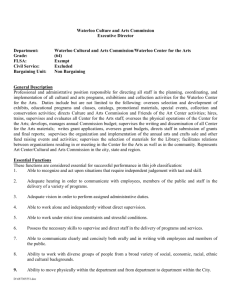

Appendix C - City of Waterloo

advertisement

Appendix C: Market Readiness Overview INTEGRATED PLANNING & PUBLIC WORKS Market Readiness Overview Contents: 1. Introduction 2. Market Readiness Factors 3. Three Residential Submarkets 4. Active Condominium Apartment Projects 5. Recently Active University Submarket Projects 6. Proposed Condominium Apartment Projects 7. Office Market Overview 8. Institutional and Industrial Market Overview 9. Market Trends and Outlook 10. Market Readiness Summary by Station Area 09/07/2014 3 4 6 10 14 17 20 23 24 34 2 1. Introduction The Market Readiness Overview report represents a second step in the LRT Station Area planning process, building upon the development of a GIS inventory of land uses and densities and best practices research. Collectively, this research establishes baseline conditions within the 6 Station Areas and allows for the development of growth forecasts based on realistic market demand expectations, as well as City, Region and Provincial demographic and land use planning policy objectives. To leverage and facilitate investment opportunities for private, public and institutional sector investment, Station Area planning is to be completed prior to operational commencement of the LRT in 2017. Future steps in this process will establish Station Area Plans, growth forecasts, a GIS-based development tracking database and identify capital infrastructure needs. A primary focus of this “Market Readiness Overview” report is to provide a higher order assessment of residential and office demand expectations as the key drivers of population and employment growth within the station areas, including an assessment of: • Market experiences and the outlook for office demand and how this might influence residential growth; • Market experiences in townhouse and condominium apartment development; and, • Anticipated future demand for housing and commercial (office/industrial) development within 800 meters of new Station Areas. These forecasts will be based on a combination of: 09/07/2014 • The locational strengths and weaknesses of local residential and office submarket areas; • The ability of the underlying land use policies to allow for a dynamic, walkable mixed-use living environment; and, • Development potential and economics, including the availability of development parcels. 3 2. Market Readiness Factors High Population Growth & Job Creation Anticipated • • While the potential supply of housing is primarily influenced by provincial and municipal planning policies, such as growth targets and the designation of land, the demand, or market, for housing is shaped by such considerations as demographics, job creation, interest rates, post-secondary enrolment growth, proximity to transit infrastructure, the overall neighbourhood context and access to day-to-day urban amenities, among many others. Below, and in the pages to follow, we explore the supply and demand characteristics influencing growth in the study area. The City of Waterloo is poised for considerable population growth and job creation: • • • • In 2013, Amendment 2 to the Greater Golden Horseshoe Growth Plan (Growth Plan) reconfirmed the Region of Waterloo’s anticipated rapid population and employment growth targets to the year 2041, indicating rapid population growth of 307,000 residents between 2011 and 2041. Similarly, the employment target anticipates substantial growth in the Region, rising from 269,000 jobs in 2011, to 321,000 jobs in 2021, and 393,000 jobs by 2041 (Table 1). Forecasts within the recently amended City of Waterloo Official Plan (Table 2) indicate a similar high level of projected population and employment growth within the City between 2006 and 2029. Table 1 Population and Employment Growth Plan Targets Region of Waterloo 2011 2031 2041 % Growth % Growth 2011-2031 2011-2041 Population 528,000 742,000 835,000 41% 58% Employment 269,000 366,000 404,000 36% 50% Source: Growth Plan for the Greater Golden Horseshoe, N. Barry Lyon Consultants Limited Table 2 Population and Employment Growth Forecast* City of Waterloo Population City of Waterloo Employment 2006 2029 % Growth 2006 2029 % Growth 101,700 137,000 35% 64,070 88,000 37% Source: City of Waterloo Official Plan, N. Barry Lyon Consultants Limited *Forecasts have been deferred by the Region of Waterloo, pending outcome of OMB appeal to Regional Official Plan. As directed by the Growth Plan, much of this growth is to be accommodated within the study area, including the Uptown Waterloo Core Urban Growth Centre, major transit station areas (within 500 metres of the LRT Stations) and along many of the study area’s arterial roads. 4 2. Market Readiness Factors LRT to Increase Residential and Office Demand • • In the past five years the Waterloo residential marketplace has shifted away from ground-oriented formats to apartment formats which now comprise well over 90% of units under construction. This trend is in large part thanks to the phenomenal success of projects geared to the student rental market, and a strong Uptown market (with nearly 1,500 units proposed or built within the last 5 years). With the ION Light Rail Transit (LRT) line opening in 2017, residents, students and workers within walking distance of LRT stations will experience a much higher degree of connectivity to the universities, technology parks, the Uptown Waterloo Core, and beyond, to Kitchener’s LRT stations, and the GTA by GO Transit. This will increase demand for both housing and office uses in proximity to LRT stations. • Strong housing demand can attract office development (and vice versa), creating opportunities for more integrated and rewarding live-work-play lifestyles, particularly in those Station Areas with mixed use policy frameworks. • In Station Areas encompassing the universities, student accommodation needs will drive housing demand. Some of these same students will continually feed a talented and growing graduate pool to support local office demand. There are also opportunities for Blackberry buildings to accommodate new employment growth within close proximity to LRT stations. • The LRT’s connectivity allows workers and residents to have greater geographic choice when choosing the location for their housing and work place, creating a more competitive market environment. • However, Station Areas that are walkable and safe, with animated streets lined with shops, restaurants and everyday amenities, and within walking distance of universities, will out-compete other less desirable locations for housing and office demand. The ION Light Rail Transit Route Streetscape Animation in Uptown Waterloo Photograph by Thomas Kolodziej 5 3. Three Residential Submarkets Waterloo Station Areas Due to the unique contextual circumstances within and around the Station Areas, three submarket overlays have been applied to assess market conditions (Figure 1). Each has its own unique strengths and weaknesses, which appeal to different market segments. The submarkets include: • The North Waterloo Submarket, which extends north from approximately three blocks north of Columbia Street; • The University Submarket, which includes the Northdale neighbourhood, extends south to Bridgeport Road and Silver Lake; and, • The Uptown Core Submarket, which extends south to the Kitchener municipal boundary. Figure 1 6 3. Station Area Residential Context North Waterloo Submarket Conestoga Mall Mall Waterloo Corporate Campus Site Plan Strengths Weaknesses Close to Retail: Conestoga Mall is a regional attraction, with a strong mix of retail, restaurant and entertainment amenities, and recent upgrades. There is also a number of large format retail uses nearby, closer to the Northfield Station (Lakeshore Plaza). There is currently a limited residential context. This is reinforced by the underlying land use policy permissions which do not permit residential uses in much of the Northfield and Research & Technology Park Station Areas. Once complete, the LRT will create short carfree commuting possible, and connect these areas to the Uptown Core and Downtown Kitchener. This submarket area is auto-oriented, with building design and streetscapes dominated by surface parking, resulting in a low quality pedestrian environment. Close to growing employment base, new office uses near the Northfield Station. Some large developable parcels (eg. Waterloo Corporate Campus) are development ready. There is currently a lack of community, recreational and public amenities. There are some stable low-rise residential areas (Lincoln Neighbourhood), potentially indicating some future demand from local endusers (move-down, empty nesters) buyers in this submarket area. The large parcel sizes, large format retail uses, single tenant office buildings, and wide arterial roads contribute to a sense of isolation, particularly for high-rise buyers who seek animated, walkable streetscapes. Beside the Conestoga Mall there is some higher density residential context (e.g. Davenport Apartments). The industrial character and associated aesthetic quality of the area lowers the attractiveness for residential development. This area has good access to highways, major arterial roads. There is traffic and car congestion, particularly near Conestoga Mall and along Northfield Dr. Development opportunity exists, with Waterloo Corporate Campus, other sites showing strong potential. The R&T Park could accommodate 5,500 more jobs (from 3,500). The availability of Blackberry buildings may delay construction of new office space in select parts of the City and Region. 3. Station Area Residential Context University Submarket Waterloo Park Conestoga Mall New Laurier School of Business Strengths Weaknesses The area is walkable to both the University of Waterloo and Wilfrid Laurier University, creating strong appeal for student housing. Easterly portions are within walking distance to the Uptown Core, which will attract additional enduser purchasers drawn to retail , entertainment and recreation amenities. Demand is dependent on continued growth at Universities and demand for new housing by an increasing number of students. This area is strategically close to key employment areas to north and northwest of the university campuses, as well as the universities themselves. LRT will improve access to universities, other employment destinations, and other station areas, once complete. Dominance of investor/student renters deters some end-user purchaser groups from buying in this area, and may deter developers from investing in alternate products. There are abundant community and recreational amenities on-campus and within the Waterloo Park area. There generally are lower quality streetscapes with a mix of dated student housing and retail strip plazas. This submarket has the opportunity to accommodate new creative start up spaces and high standard living accommodations for students and young professionals. It appears that this submarket will intensify at a rapid pace. There is a need to have direct, convenient pedestrian linkages from LRT stops to existing and future office buildings. Greater pedestrian connectivity is needed between Northdale neighbourhood, UW campus and LRT station. Blackberry owns numerous buildings in this submarket. With office consolidation, underutilized buildings will provide turnkey office space attractive to small, medium and larger companies. The availability of Blackberry buildings may delay construction of new office space in select parts of the City and Region. 8 3. Station Area Residential Context Uptown Core Submarket Strengths Weaknesses This area is the most walkable of the submarkets, with a wide range of retail, restaurants and entertainment uses, community and recreational amenities and jobs. There continues to be a surplus of surface parking , weakening the pedestrian environment. This area already possesses an established and charming mixed-use and historic context, with a recent infusion of new infill development that has further strengthened the urban fabric. This area is also close to downtown Kitchener, whether by LRT, bicycle and even by walking. The Kitchener (Victoria) Transit Hub Station will provide a convenient rail connection to Pearson International Airport and downtown Toronto, benefitting Uptown. Future LRT Station Areas overlap within the Uptown Core, creating convenient access to transit throughout. Bauer Lofts Retail Area Floodplain areas and high water table limit redevelopment potential of some sites. Some of the best redevelopment sites are City-owned lands which are constrained by parking replacement agreements which may take some time to resolve, leaving gaps in the urban fabric. The character of the area and the viability of retail and office development has been reinforced by the underlying land use planning framework, which promotes infill and intensification. The cost and difficulty of assembly due to finer parcel fabric can be a development constraint. Within Uptown, the City owns lands that are currently used for surface parking. Some of these properties can provide opportunity for new employment and mixed-use development, providing that parking commitments can be addressed. During the short term, robust incentives from the City of Kitchener will continue to attract new resident and job growth in DT Kitchener. This may dissipate over time as incentives are reduced and space becomes less available. The City is investing in the public realm, which will help maintain interest and demand for living/working in Uptown. Higher land prices and soft costs could impact small, mid-rise housing projects. 9 4. Active Condominium Apartment Projects Waterloo & Downtown Kitchener • • • • • • The Uptown Core has demonstrated itself to be a successful area for small and medium sized projects of between 50 and 150 units, while the University Submarket has featured a number of larger projects in recent years buoyed by strong student rental demand. The North Waterloo Submarket has experienced no apartment development. Residential development is limited within the two northern conceptual station areas. As of December, 2013, there were 7 condominium apartment projects in Waterloo, of which 4 are located within the Uptown Core Submarket, and 1 is located within the University Submarket (see Table 3, Figure 2 & Figure 3); the remaining 2 projects are located outside of the three submarket areas. The 5 Station Area projects comprise 739 units, of which 87% have sold. The average absorption rate of the 4 projects within the Uptown Core (cumulatively 9.4 sales per month) suggests that the remaining inventory of 132 units will be sold out in approximately 9 months time. Within the University Submarket area, there are just 9 units of unsold inventory with Sage VI which, based on the average absorption sales absorption rate of 47 units per month, should be sold out in the near future. Due to their proximity to the Uptown Core, downtown Kitchener projects were also surveyed, as they often compete for end-user purchasers. Kitchener’s downtown has seen stronger investor (i.e. rental) demand and not surprisingly, has experienced much higher sales volumes than that of the Uptown Core, at over 36 cumulative sales per month. These projects cater to the downtown’s young workforce employed in its financial and civic institutions and technology firms. Kitchener has robust incentives that offer competitive advantages for new construction. As Kitchener’s downtown submarket matures further, and remaining sites are developed, NBLC anticipates some demand could overspill into Waterloo’s Uptown Core. Red Condominiums (Uptown Core) City Centre Living Condominiums (Downtown Kitchener) 10 4. Active Condominium Apartment Projects Waterloo & Downtown Kitchener Table 3: Actively Marketing (New) Condominium Apartment Projects in Waterloo & Downtown Kitchener As of December 12, 2013 (Unless noted otherwise) Map Project Name / Developer No. Address Open Status Storeys # Units # Sold % Sold Date * Size Range Price Range Avg. $PSF Overall Abs. Rate** Surveyed Waterloo Projects Uptown Core Submarket Projects 144 Park Uptown Waterloo Mady Corporation Westmount Grand Luxury Condominiums A2 Kingsley Development Red Condominiums A3 Momentum Develpoments One Fifty Five Uptown Waterloo*** A4 Mady Corporation Totals / Averages / Ranges: 4 Projects A1 141, 145 and 155 Caroline St./ 156 Park St. Oct-09 UC 19 149 148 99% 1,835 - 1,835 $647,990 - 223 Erb Street West Dec-09 SI 12 77 68 88% 1,040 - 2,491 $400,000 119 King Street North Sep-11 SI 6 63 57 90% 958 - 1,833 141, 145 and 155 Caroline St./ 156 Park St. Jan-12 PRE 19 140 70 50% 601 14 429 343 80% University Submarket Projects A5 Sage VI Condominiums IN8 Developments $353 - $353 2.9 - $1,200,000 $385 - $482 1.4 $372,900 - $699,900 $382 - $389 2.1 - 1,157 $239,900 - $431,900 $373 - $399 3.0 601 - 2,491 $239,900 - $1,200,000 $353 - $482 2.3 $647,990 251 Hemlock Street Jun-13 PRE 12 310 301 97% 559 - 1,126 $209,900 - $380,900 $338 - $375 47.2 776 Laurelwood Drive Sep-10 SI 7 91 90 99% 791 - $239,500 - $239,500 $303 - $303 2.3 778 Laurelwood Drive Jun-11 UC 7 91 46 50% 678 - 1,032 $199,900 - $295,000 $286 - $295 1.5 7 12 182 921 136 780 74% 85% 678 559 - 1,032 - 2,491 $199,900 $199,900 - $295,000 - $1,200,000 $286 $286 - $303 $482 2.0 3.5 North Waterloo Projects Reflections at Laurelwood - Building 1 Activa Reflections at Laurelwood - Building 2 A7 Activa Totals / Averages / Ranges: 2 Projects A6 Waterloo Summary (7 Projects) 791 Surveyed Downtown Kitchener Projects (As of January 13, 2014 for A8, A10 & A12) City Centre Condominiums Andrin Homes Arrow Lofts A9 Auburn Homes Victoria Common Condos - Phase 1 Claridge A10 Queensgate Homes One Victoria Condominiums A11 Momentum Developments Victoria Common Condos - Phase 2 Trafalgar A12 Queensgate Homes Kitchener Summary (5 Projects) A8 120 King Street West Oct-10 UC 17 203 156 77% 510 - 1,150 $178,490 - $421,940 $350 - $367 4.0 112 Benton Street Jul-11 SI 8 136 109 80% 732 - 2,051 $237,900 - $695,000 $325 - $339 3.6 1 Adam Street Jun-12 UC 4 77 67 87% 490 - $179,900 - $274,900 $309 - $367 3.5 1 Victoria Street South Feb-13 UC 19 204 184 90% 517 - 1,945 $209,900 - $899,900 $406 - $463 16.2 1 Adam Street Nov-13 PRE 4 77 19 25% 490 - $189,900 - $285,900 $321 - $388 8.8 10 697 535 77% 490 - 2,051 $178,490 - $899,900 $309 - $463 5.2 890 890 *Status: "Pre" = pre construction, "UC" = under construction, "SI" = standing inventory; **The overall absorption rate is calculated from a project's opening date until December 12th, 2013 for Waterloo Projects, and is calculated from a project's opening date until January 13th, 2014 for City Centre Condominiums and Victoria Common Condos (Phases I & II). ***Excludes penthouse and podium units at 155 Uptown. These units are to be released early 2014. Source: Sales and Marketing Materials, Sales Agents, and N. Barry Lyon Consultants Limited 4. Active Condominium Apartment Projects Waterloo Station Areas Actively Marketing Station Area Projects: A1 – 144 Park Uptowns (149 units, 19-storeys) A3 – Red Condominiums (6-storeys, 49 units) A5 – Sage VI Condominiums (12-storeys, 310 units) LRT Stations - - - - 800 Metre Distance from Future LRT Station A2 – Westmount Grand (77 units, 12-storeys) A4 – One Fifty Five Uptown (19-storeys, 140 units) Figure 2 12 4. Active Condominium Apartment Projects Downtown Kitchener Actively Marketing Downtown Kitchener Projects: A8 – City Centre Condos (203 units, 17 storeys) A9 – Arrow Lofts (136 units, 8 storeys) A10 – Victoria Common – Phase 1 (Claridge) (77 units, 4 storeys) A11– One Victoria (204 units, 19 storeys) A12 – Victoria Common – Phase 2 (77 units, 4 storeys) LRT Stations - - - - - 800 Metre Distance from Future LRT Station Figure 3 13 5. Recently Active University Submarket Projects Sage Condominium Phases • In order to better understand the depth of investor purchaser (student rental) demand for condominium apartments in the University Submarket, NBLC reconstructed historical sales experienced in earlier phases of Sage, by IN8 Developments, now marketing its sixth project in just two years (see Table 4 & Figure 5, to follow). • With sales offices in both downtown Toronto and Waterloo, Sage I sold out in just four days in January of 2012. The project features 58 three- and five-bedroom luxury condo units, which were sold for between $359,900 (for an 1,800 square foot unit) and $599,900. Sales of subsequent phases have been equally impressive, with the next three phases now sold out and the current apartment phase (Sage VI) now 97% sold in just 6 months since its launch back in June of 2013. This represents a very high sales absorption rate of over 47 units per month. • Collectively, all 5 Sage condominium apartment phases have sold 821 of a possible 830 units in just 2 years, representing a very impressive sales absorption rate of 410 units per year (Table 4 & Figure 5). Sage Condos Source: Marketing Materials Sage II Source: Marketing Materials Sage VI Source: Marketing Materials 14 5. Recently Active University Submarket Projects Sage Condominium Phases The Forty-Two Source: Marketing Materials Table 4 Sage Condominiums Sales Summary - IN8 Developments As of January 20, 2014 Map No. Project Name / Developer Address Open Date Status* Storeys # Units # Sold % Sold S1 Sage 8 Hickory Street Jan-12 SI 12 58 58 100% S2 Sage II 318 Spruce Street Sep-12 UC 23 198 198 100% Size Range - - 527 - 957 Price Range - - Avg. $PSF - - - - $189,900 - $320,000 $334 - $360 Overall Abs. Rate** 25.9 172.1 S3 Sage III 62 Balsam Street Jan-13 UC 6 98 98 100% 777 - 1,731 $249,900 - $419,900 $243 - $322 99.4 S5 Sage V 280 Lester Street Mar-13 PRE 6 167 167 100% 424 - 1,163 $184,900 - $389,900 $335 - $436 112.9 266 266 100% 559 - 1,126 $209,900 - $380,900 $338 - $375 238.0 44 35 80% 534 - 1,134 $199,900 - $242,900 $214 - $374 16.9 68 899 44 866 65% 96% 725 - 1,383 424 - 1,731 $269,900 $184,900 - $419,900 $419,900 $304 - $372 $214 - $436 44.0 86.2 S6 Sage VI Release 1 251 Hemlock Street Jun-13 PRE Sage VI Release 2 (Soft Launch) 251 Hemlock Street Nov-13 PRE 253 Albert Street Jan-14 PRE SIV Ivy Towns (Soft Launch) Sage Condominiums Summary (6 Projects): 12 4 11 *Status: "Pre" = pre construction, "UC" = under construction, "SI" = standing inventory; **The overall absorption rate is calculated from a project's opening date until January 20th for actively selling projects, and the project's closing date for sold out projects. Source: Sales and Marketing Materials, Sales Agents, and N. Barry Lyon Consultants Limited 15 5. Recently Active University Submarket Projects Sage Condominium Phases Sage Phases Marketing Between 2012 and 2014 1) S1 – Sage S5 – Sage V S2 – Sage II S6 – Sage VI Condominiums S3 – Sage III SIT – Ivy Towns LRT Stations - - - - - 800 Metre Distance from Future LRT Station Figure 5 16 6. Proposed Condominium Apartment Projects Condominium & Rental Apartment Projects • • • • • The proposed (planned and approved) residential apartment supply provides an indication of the anticipated demand for housing and the level of competition in each of the submarket Station Areas. Currently, there are 10 planning approval applications in proximity to the Station Areas, proposing 3,283 condominium apartment units (Table 4, Figure 4). Approximately 40% of the units are within the Uptown Core, with the remaining 1,965 units in the University Submarket. The anticipated Uptown Core condominium apartment units represent an approximate 9.8 years of supply, while the University Submarket units represent 3.5 years of supply, based on current sales absorption rates, and assuming that all units are sold and not immediately allocated to a rental management pool. In 2012 and 2013, another 1,346 rental apartment units, comprising 3,546 bedrooms, have been proposed and site plan approved, primarily in the University Submarket. These projects will compete directly with private rental projects in that area as they constructed. Table 5: Condominium & Rental Apartment Development Applications - City of Waterloo As of December 20, 2013 Ref. No./ Address Date Applicant Submarket # Storeys # Units Area Uptown Core Submarket Projects Comments Includes hotel, office , rental and condominium apartments. 178 condominium and 220 rental units are under construction, but have not come to market. P1 104-106 Erb Street (The Barrel Yards) 2009 Auburn Developments Uptown Waterloo 25-12 1,036 P2 110 Union at Moore 2011 Lexington Park Real Estate Uptown Waterloo 6 43 P3 220, 222 and 226 King St. S (The Cortes on King) Dec-12 KGR Holdings Uptown Waterloo 6 49 6-storey, mixed-use building with approximately 300 square metres of commercial space at grade and49 units in 5storeys. P4 31 Alexandra Avenue Feb-13 Auburn Developments Uptown Waterloo 14 152 Residential building with townhouse units atgrade. P5 14 Princess Street Marsland Centre Ltd. Uptown Waterloo 7 38 Demolition complete and site remediation underway. 2013 University Submarket Projects P6 256 Philip Street 2011 JD Investment Group University 20-24 451 Marketed as luxury student rental, with 1,807 bedrooms. 330 Philip Street (Icon 330) 2010 Rise Real Estate Inc. University 25, 25 624 O.M.B. Approved in July of 2013. Phase I includes 867 bedrooms within 624 units. Based on density permissions, another 470 bedrooms may be developed. May-12 2208254 Ontario Inc. University 20 110 110 units to contain 199 bedrooms. P7 128-138 King St. N. &6 Elgin St. P8 158 and 150 King Street Oct-13 North (K2 Condominiums) GSP Group Inc. University 11 & 21 180 P9 124 and 130 Columbia St. Nov-13 W. and 365 Albert St. Prica Group University 7 & 13 600 17 3,283 Totals / Averages : 10 Projects Source: N. Barry Lyon Consultants, City of Waterloo 2-storey podium, two condominium apartment towers, and 250 square metres of commercial space. 2,500 sq. m. of commercial GFA, and 7 and 13-storey residential buildings to be marketed to “young professionals”. 17 6. Proposed Condominium Apartment Projects Condominium & Rental Apartment Projects Proposed High Rise Projects: P1 – 104-106 Erb St. (The Barrel Yards) P2 – 110 Union & Moore St. P3 – 220, 222 & 226 King St. S (The Cortes on King) P4 – 31 Alexandra St. P5 – 14 Princess St. LRT Stations - - - - 800 Metre Distance from Future LRT Station P6 – P7 – P8 – P9 – 256 Philip St. 128-138 King St. N & 6 Elgin St. 158 King St. N (K2 Condominium) 124 and 130 Columbia St. W. Figure 4 18 6. Proposed Condominium Apartment Projects Barrel Yards & K2 • The largest proposed project is the Barrel Yards master planned community, by Auburn Developments, with approximately 1,036 approved apartment units, of which: • 178 condominium apartment units are under construction; • 356 condominium apartment units are under an active building permit; • 220 purpose-built rental units are under construction, and lease commitments are being taken now; • 440 purpose-built rental units are under an active building permit; • 202 unit hotel is under construction; and, One office block with two towers and a podium are permitted. This block has been postponed. Other upcoming projects of note include the 600 unit K2 Condominiums, by U.I.D. Development Inc., located two blocks south of the Laurier King Street North Campus and Icon330, by Rise Real Estate, a 624-unit building, at the intersection of Philip Street and Columbia Street, east of the University of Waterloo. Both projects are in the University Submarket, and will be catering to investor purchasers as luxury student rental projects. Although we understand that soft marketing campaigns are under way, sales to the public are anticipated to occur early in 2014, providing a good bellwether of current investor demand in the University Submarket. Barrel Yards Master Plan • • • K2 Rendering Source: Marketing Materials 19 7. Office Market Overview To understand the level of demand for office and industrial uses in the Station Areas, as well as residential demand in proximity to these areas, NBLC has reviewed the prospects for employment generating uses in these areas. • The City of Waterloo remains the office prestige space leader in the Region, with other markets capturing lower cost class B/C space. • Low and falling Q3 2013 vacancy rates in the City of Waterloo have not resulted in increases in net rental rates as of yet. However, the Uptown Waterloo Core’s traditionally and comparatively low vacancy rates have resulted in net asking rents that have now surpassed the City average as a whole in the third quarter of 2013. • This pent up demand is resulting in conversions to new Class 'A' space and further tightening of the sublet market. • Although office demand is high in the Uptown Waterloo Core and improving in the business parks to the north, higher rents in the range of $25 per square foot of net leasable space are needed to support replacement costs, and to result in new office development. • To date, downsizing BlackBerry has had minimal impact on new space demand, recognizing that they have just formally put their lands on the market. However, demand should weaken, and vacancy rates should rise, as BlackBerry begins to sell its remaining landholdings in the City of Waterloo, totaling almost 70 acres of vacant land in the Northfield and University Campuses, along with over 1.6 million square feet of office space (650,000 square feet and just under 1,000,000 square feet respectively in the Northfield and University Campuses). Table 6: Office Submarket Summary Quarter/ Municipality 2012 Q1 2012 Q2 2012 Q3 2013 Q1 2013 Q2 2013 Q3 2012 Q1 2012 Q2 2012 Q3 2013 Q1 2013 Q2 2013 Q3 2012 Q1 2012 Q2 2012 Q3 2013 Q1 2013 Q2 2013 Q3 Region of Waterloo City of Waterloo Office Inventory (sq. ft.)* 10,665,728 5,776,115 10,892,883 5,955,420 10,909,382 5,870,463 11,137,947 6,031,783 11,141,216 6,031,783 11,142,442 6,031,783 Vacancy Rate 11.8% 9.4% 12.5% 8.9% 12.1% 7.6% 11.6% 8.5% 11.5% 8.4% 11.0% 8.1% Net Rents $12.57 $14.82 $12.76 $14.61 $12.84 $15.24 $12.92 $15.30 $13.25 $15.28 $11.85 $13.21 Uptown Waterloo 1,272,168 1,272,168 1,272,168 1,272,168 1,272,168 1,272,168 2.5% 2.6% 2.3% 1.6% 1.9% 2.1% $11.66 $13.40 $13.35 $12.93 $12.99 $13.52 Excludes government offices and buildings with less than 10,000 sq. ft. Source: Colliers, NBLC 20 7. Office Market Overview BlackBerry Properties to be Sold (continued): • . 21 7. Office Market Overview • Although BlackBerry will continue to lease back space, should they continue to downsize, this could put downward pressure on rents and lower the prospects for redevelopment in Station Areas. We note that in situations where sunken land costs are low, office development has been feasible within the Northfield, Research & Technology Park and University Station Areas, as is evidenced by smaller office projects now under construction at 139 Northfield Drive (40,000 sf) & 435 Phillip Street (10,700 sf). • Office demand should improve in each of the residential submarket Station Areas due to the construction of the LRT and the start-up of two-way GO Transit service to Guelph and Toronto from the LRT’s Transit Hub station in downtown Kitchener. • Not only will this allow for car-free commuting for those living within walking distance of planned transit stations, but the new Toronto-Guelph connection should allow the City’s many technology, insurance and start-up companies to compete for top talent within the GTA. The success of these firms should spur new office demand in Station Areas. • Table 7: Summary of Office Construction by Submarket Area (sf) As of December, 2013 Year North Waterloo University Uptown Core Overall 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Yearly Avg.: Total: 110,945 209,979 66,154 75,102 123,132 7,351 177,578 201,868 732 65,876 10,720 95,403 1,049,437 0 0 0 0 0 54,260 0 193 0 0 0 4,950 54,453 2,792 152,051 77,719 71,900 3,359 0 64,484 11,657 0 14,697 0 36,242 398,658 113,737 362,030 143,873 147,002 126,491 61,611 242,062 213,718 732 80,573 10,720 136,595 1,502,548 Note: Office construction includes the following categories of building permit data: office, commercial office, industrial malls, government administrative buildings, municipal buildings, mercantile & utility buildings, wholesale stores, bus./personal service offices.. Source: City of Waterloo, NBLC These areas already have a sizeable and growing pool of talented young employees residing within their boundaries, which should attract future office development and increase achievable rental rates. 139 Northfield Drive Northfield Station/Office Development 22 8. Institutional and Industrial Market Overview • The institutional marketplace is difficult to forecast as it is influenced by many factors, some of which relate to demographic characteristics, while others relate to philanthropy or politics; the latter particularly relating to university-based institutional growth. • On the municipal governmental side, the City’s rapid population growth suggests that demand for institutional office space will be increasing throughout the study period timeframe of 2031. We note that in 2012 & 2013, building permits for institutional space were issued for: • Over 210,000 square feet within the Seagram Station Area; • Almost 195,000 square feet within the University Station Area; and, • Just under 20,000 square feet within the R & T Park Station Area. • Demand for university classroom and administrative space is shaped more by student enrolment growth. The 2011 Student Accommodation Study Monitoring Report suggests that the aggregate student enrolment for both universities should continue to increase by approximately 1,000 students per year to 2017 and then increase by 1.5% per year thereafter. This bodes well for the need for additional space in the decades ahead, as was evidenced by the recent purchase of 300,000 square feet of space from BlackBerry by the University of Waterloo. • Industrial growth has been slower in the Station Areas, and in the City of Waterloo in general, with flat rents in 2013 and just under 9,000 square feet under construction based on building permits issued in 2013. BlackBerry’s plans to sell 126,000 square feet of warehousing space at 451 Philip Street (Figure 5) should lessen demand for new development resulting from firms entering the marketplace in the short term. However, as evidenced by minor additions at 55 Bathurst Drive and 35 Northland Drive over the past couple of years, the economics are favourable for existing landowners with additional land to expand their existing footprint. New Science Teaching Complex BlackBerry’s Warehouse at 451 Philip Street Figure 5 23 9. Market Trends & Outlook General • High-rise residential market, institutional and office trends are pointing in the right direction. Over the 18 year time horizon to 2031, demand for these uses will continue to grow and intensify, particularly: within the Uptown Core; in proximity to the universities; in those portions of business parks within Station Areas; and areas where the City has established a mixed use planning framework to promote more efficient lifestyles. • As Station Areas within the University and Uptown Core Submarkets are built out, residential market demand in peripheral areas, such as the King Street corridor around Conestoga Mall should emerge, particularly on lands that can demonstrate a compelling mixed use master/block plan vision with a high degree of pedestrian, cycling and transit connectivity. • Community designs consisting of a finer grain and animated street and pedestrian connections, with on-site amenities and recreational spaces, nearby shopping and entertainment will be necessary to attract larger scale development in the North Waterloo Submarket Station Areas. • To stem the loss of employees to more amenity-rich urban settings, suburban employers are attempting to create new mixed-use districts with restaurant, entertainment and retail uses to improve the worker experience and save them time. Station Areas will have the added benefit of a car-free commute and rail connections to the GTA, creating competitive advantages for attracting new office development of all types. Figure 6 Official Plan Land Use Designation/Station Study Area Overlay (North Waterloo) Note: The information contained on this map is for discussion purposes only and is not an Official Plan Schedule. Source: Integrated Planning and Public Works, City of Waterloo 24 9. Market Trends & Outlook North Waterloo Station Areas • • • • There are currently no condominium apartment projects within any of the North Waterloo Submarket Station Areas. The only project in North Waterloo – Laurelwood, by Activa - is located near the City’s rural/urban fringe. The 7-storey, two-building (two-phase) project has appealed to end-users, including seniors, empty nesters and young professionals, capitalizing on its suburban setting and averaging a respectable 2.0 sales per building, per month (4.0 sales combined). To be successful, near-term projects within the Station Areas will need to be mindful of construction costs due to the lower pricing potential of the North Waterloo Submarket, suggesting that smaller-scale wood-frame apartment, stacked townhouse and townhouse projects will be the most viable. Development designs that serve to break down and transition the suburban character of the area to a more urban character, consistent with the Uptown Core, are necessary to encourage a more intensified residential development form. These include quality architectural detailing and the implementation of pedestrian-oriented designs to establish quality residential living environments and better pedestrian and cycling connectivity within Station Areas and to the LRT stations themselves. Accelerated sales and a deeper and more varied residential marketplace can be cultivated by also providing a more walkable mix of commercial, recreational, community and open space uses. Building 1 – Reflections at Laurelwood 25 9. Market Trends & Outlook North Waterloo Station Areas • • • Residential demand in proximity to Northfield Station should increase as proposed office and retail commercial projects in the Waterloo Corporate Centre (580-590 Weber Street North, 150 Northfield Drive West) and at 139 Northfield Drive are constructed. The first phase of the Waterloo Corporate Centre is planned to include over 175,000 square feet of office space and over 21,000 square feet of restaurant space. Northfield Station, now under construction, includes approximately 40,000 square feet of leasable office space. In proximity to Conestoga Mall Station, there is a medium to long term opportunity for the City to work collaboratively with Ivanhoe Cambridge to establish a redevelopment and phasing plan for the surface parking lots surrounding Conestoga Mall. Such plans should work to establish a finer grain pattern of development blocks, streets and public spaces, with interior block structured parking garages lined by animated street uses. As an example, Oxford Properties and the City of Mississauga are currently working on a development phasing plan for Square One Shopping Centre (Downtown 21 Master Plan), which will involve the establishment of an outdoor main street-style shopping district with a synergistic mix of office, residential and park uses. 139 Northfield Drive Northfield Station/Office Development Waterloo Corporate Centre Concept Plan 26 9. Market Trends & Outlook University Submarket Station Areas Demand for housing in this area is heavily influenced by student enrolment, and therefore, performance in this market is dependent on continued student body growth at the two universities. The past five years has seen a dramatic increase in the scale of student rental projects, as the supply of housing has tried to keep pace with enrolment growth. In 2013 alone, seven new privately-owned student rental apartment buildings, containing approximately 200 units and 1,000 bedrooms, were completed in the City of Waterloo (Figure 7). Below, we have summarized key observations and projections from several demandrelated information sources, including the Northdale Final Report, university planning documents, the 2011 Student Accommodation Study prepared in 2011 and the associated “Student Accommodation Monitoring Report” (“Monitoring Report”). • The University of Waterloo’s full-time equivalent student enrolment (including graduate and undergraduate students) has grown by about 950 students per year since 2005 to a total enrolment of 31,600 students in 2013. This leaves them just 400 students shy of achieving their 2017 “Sixth Decade Plan” projection of 32,000 students. • Laurier’s 2012 Waterloo campus full-time student enrolment of 12,550 is anticipated to grow by around 2,450 students by 2023 (approximately 225 students annually over the next decade). • As such, it appears that demand for student housing will continue to grow at a moderate pace in the short term but the market may be nearing a saturation point in the decade to come, particularly with the new LRT line providing more accessible accommodation options outside the submarket. Figure 7: New Student Rental Supply 27 9. Market Trends & Outlook University Submarket Station Areas • • • • Through the Northdale land use study the universities indicated that they could not estimate specific long-term enrolment, and are generally not comfortable projecting out more than 3 years. We know from recent experience that the universities have not grown in a linear fashion, but instead, have grown in spurts. Future student enrolment is therefore difficult to gauge as it is dependent upon a number of interrelated variables, including university participation rates, international demographics, and associated participation rates, and changes in technological advances that could shift learning away from the classroom environment, as well as provincial funding. The Ministry of Finance, in a Presentation by the Ministry of Training, Colleges and Universities in May of 2012, projects that the key student cohort of 18 to 24 years of age is expected to decline, beginning in 2013, from approximately 1.32 million to approximately 1.23 million in 2021, and then rise to approximately 1.44 million by 2036. However, university participation rates are steadily rising and are anticipated to continue this trend, thereby offsetting short term declines in the student cohort population. The Ministry of Training, Colleges and Universities projects that the 2011 undergraduate participation rate of 27.5% could rise to 35% by 2031. To offset declines in cohort population to the year 2021, the participation rate would only be required to increase to 29.5% to maintain current student enrolment levels. The graduate portion of the student population is also an important component of rental demand within condominium projects. The Council of Ontario Universities (COU) anticipates • • that graduate student enrolment will grow by 6% annually to the year 2020, suggesting growing demand for condominium rental accommodation. These slightly older and more mature students often desire smaller and more intimate housing accommodation than is typically offered in student rental projects, where the majority of units feature 4 or 5 bedrooms. The relatively smaller one- and two-bedroom units offered within condominium apartment projects offer these students the necessary conditions to conduct their studies. The Region of Waterloo, the universities in Waterloo (UW and WLU) and the City’s Northdale consultant (MMM Group) are not in agreement regarding the pace of future enrollment. The Region and the universities believe that enrollment will generally be stagnant until at least 2029, whereas MMM had projected that enrollment growth would continue based on increasing participation rates, increasing graduate enrollment and increased enrollment from international students. This study has assumed that student enrolment at the two universities combined will continue to increase at a rate of 1,000 students per year to the year 2017. After 2017 UW growth is assumed at 1.5% annually, with WLU assumed at 1% annually. Assuming that 85% will require housing in proximity to the universities, this translates into the need for 850 bedrooms per year, or approximately 280 student rental units per year up to 2017, based on an average of 3 bedrooms per unit. Growth rates after 2017 would see the addition of approximately 570 students in 2018, escalating up to nearly 680 students in 2031. 28 9. Market Trends & Outlook University Submarket Station Areas • • • • • • Market demand for high and medium density apartment uses should accelerate and evolve in the University submarket as the completion date for the LRT nears, and additional retail and office uses are developed in response to the area’s rising population and student enrolment. Recent development patterns for student-oriented apartments has been outpacing enrolment growth. Should this pattern continue, it is possible that market demand for high and medium density apartment uses will slow in the medium and long-term. Under such a scenario, development could be lower than the projections in Table 9 for the University Submarket area. There has been “flight to quality” in the market place, as purchasers and renters alike look to upgrade their units with more contemporary on-site amenities, more efficient layouts and higher quality finishes and appliances. Successful condominium rental projects catering to more mature students often feature a greater mix of one- and two-bedroom suites (i.e. lower bedroom counts), with split bedroom designs to further separate tenants through the use of intervening living space. In addition to student accommodation demand, end-user purchaser demand should also increase throughout the study time horizon, particularly from young professionals, first-time homebuyers, empty nesters and divorcees. Investor purchasers will be comprised of parents of students and traditional investors from the local area and Greater Toronto Area, while renters will also include a mix of professionals (in addition to students). The expansion of the two universities should continue to drive institutional and research office growth and faculty expansion within the University Station Areas (Seagram & University of Waterloo), with population-related retail and service commercial demand to follow suit. It is reasonable to expect institutional space growth in the order of 100,000 to 200,000 square feet per year for the full spectrum of office and academic uses, although this will vary considerably throughout the study time period. Areas such as the easterly portions of the University Submarket should have a competitive advantage over the traditional automobile-oriented business parks. This is primarily due to their walkable mix of everyday amenities, restaurants and shops, which create more interesting atwork and post-work urban lifestyles. SageSage II Condominiums II Condominiums Amenities, Amenities, Interior Interior Finishes Finishes and and Features Features Source: Source: Marketing Marketing materials materials /Buzz/Buzz Buzz Buzz Home Home 29 9. Market Trends & Outlook Uptown Core Residential Submarket: Station Areas • • • • • Earlier planning initiatives, such as the Uptown Vision 2025 and the recently adopted Official Plan policies for the Uptown Core/Urban Growth Centre are working to promote a higher density mixed use environment. By far, the Uptown Core is the most mature and successful submarket area in Waterloo, as it has all of the necessary elements in place (e.g. walkable retail, entertainment and community amenities, animated streetscapes and transit accessibility) to encourage a high quality intensified community for a broad range of end users, including most notably, empty nesters, as well as some first-time homebuyers and young professionals. Projects that opened after the 2009 recession utilized VIP broker events, selling up to 50% of their units prior to public openings. Notwithstanding higher average pricing ($420 per foot), the pace of sales is a reasonably healthy 2.3 sales per project, per month, or 9.2 sales per month combined. This current market environment allows for small to medium sized projects to succeed. For a project to be feasible, it is critical to be able to sell about 70% of the units within a reasonable time period, ideally 18 to 24 months. As the development period stretches outward, the value of the project declines. The current marketplace would allow for one large project or three smaller projects to succeed, marketing simultaneously (Table 8). 144 Park & One Fifty Five Uptown Source: Marketing Materials Red Condos Table 8: Sustainable Condominium Apartment Project Sizes in Current Uptown Core Market Environment No. of Marketing Projects 1 Project 2 Projects 3 Projects Months to 70% Sales Sales Per Month 70% Sales Project Size (Units) 24 24 24 9.2 4.6 3.1 221 110 74 315 158 105 Source: N. Barry Lyon Consultants Limited Source: Marketing Materials 30 9. Market Trends & Outlook Uptown Core Residential Submarket: Station Areas • • • • Market demand for high and medium density apartment uses in the Uptown Core is expected to accelerate and evolve as the completion date for the LRT nears, and additional retail and office uses are developed, creating greater live-work-play synergies. We anticipate that Uptown Core should be able to attract some new office development in the near and medium terms (next 10 years), particularly on sites where land costs are low, or the City provides subsidies or inducements. The City will play a key role in this continued supply of both residential apartment and office/institutional sites with its significant land holdings in the Uptown (Figure 8). However, many of these sites are complicated by long-term parking agreements which may delay the pace of build-out until suitable development agreements are reached between the relevant parties. In the longer term, the gap between achievable net (office) rents and required economic (replacement) rents should continue to shrink, or disappear entirely, opening up additional development opportunities. Figure 8 City-Owned Parcels in the Uptown Core 31 9. Market Trends & Outlook Growth Expectations • • • The near term (0-5 year), medium term (6-10 year) and long term (1120 year) outlooks for combined rental and condominium high-rise apartment demand in the Station Area submarkets are described in Table 9 and Table 10. From a residential perspective, NBLC anticipates that condominium apartment sales absorptions will increase slowly in the near and medium terms, but should accelerate in the coming decades due to the presence of the LRT, job growth, student enrolment growth and the continued infilling of the urban fabric to create more animated/ interesting, amenity-rich and walkable environments. In the 11 to 20 year timeframe, despite improving contextual conditions, we anticipate that unit sales in the University and Uptown Waterloo Core Submarkets will start to become restricted by emerging supply constraints as redevelopment parcels become more scarce and costly to assemble and unit prices appreciate and start to become less affordable to first-time homebuyers. • This should benefit the North Waterloo Submarket as a more affordable alternative, although it is conceivable that a compelling master plan design may accelerate market demand in those areas in the medium term. • Across Station Areas, the projected residential demand estimates given above represent annual sales in the order of 372 to 552 units, or between 56% to 83% of the annual average unit growth experienced between 2004 and 2011 of 663 units. Note that the 2012 Development Charges Study forecasts an average annual household growth between 2012 and 2022 of 607 units. Table 9: Projected Residential Market Demand by Submarket Timeframe Uptown Core University North Waterloo Sales Per Month 20 to 25 1 to 3 Totals (All Station Areas) 0 to 5 yrs 10 to 12 31 to 40 5 to 10 yrs 12 to 14 20 to 25 3 to 5 35 to 44 11 to 20 yrs 12 to 14 20 to 25 5 to 7 38 to 47 Sales Per Year 0 to 5 yrs 120 to 144 240 to 300 12 to 36 372 to 480 5 to 10 yrs 144 to 168 240 to 300 36 to 60 420 to 528 11 to 20 yrs 144 to 168 240 to 300 60 to 84 444 to 552 Source: NBLC 32 9. Market Trends & Outlook Growth Expectations Except as noted otherwise within this report, NBLC shares the market readiness expectations and sentiments of Colliers as expressed within the Region of Waterloo Community Building Strategy (2013). While it is beyond the scope of this market readiness report to provide more detailed demand forecasts (they will be provided in the next stage of analysis), we believe the following guidelines, as augmented by Tables 8 and 9 on the next page, are useful considerations for future phases of demand analysis within the Station Areas: • • Industrial space will continue to be a minor component of growth within the North Waterloo Station Areas, in the order of 5,000 square feet to 15,000 square feet per year, combined, on average; Office demand within the North Waterloo and University Station Areas should increase in the medium and long term following several years of slower growth due to the readjustment of the marketplace to BlackBerry’s disposition of its lands. Market conditions for industrial space conversions and some purposebuilt uses are favourable and should continue that way through the study time horizon. • The unique context of the Uptown Core should afford it some protection from the office and industrial restructuring to the north, with demand for space remaining strong , and increasing, throughout the time horizon of the study. • Cumulatively, office additions, as well as purpose-built office buildings in the North Waterloo and University Station Areas could add between 50,000 to 150,000 square feet of new space per year, in the near term, and increase to between 100,000 sf to 200,000 square feet annually thereafter; • Demand for office space in the Uptown Core Station Areas will continue to be high, but limited in the near and medium terms by development economics of expansions and additions, likely adding between of 5,000 to 15,000 square feet per year, on average. Larger projects, in the order of 100,000 square feet to 200,000 square feet, are most likely to be developed in the longer term timeframe; • Institutional space demand will be highly concentrated within the University of Waterloo, Seagram and R&T Park Station Areas, likely averaging between 100,000 and 200,000 square feet of space combined across the three Station Areas over the study time horizon, based on recent building permit activity and enrolment growth expectations. The majority of added space will be academic related in those areas, although the expansion of governmental offices in the Uptown Core may be needed to administer the City’s growth; and, • Commercial (retail/service commercial) space demand within Station Areas will undoubtedly grow, on pace with population and workforce growth. As well, the regional drawing capacity of Conestoga Mall and the Uptown Core will strengthen over the study time horizon, as their prominence grows in the regional context, appealing to a broader spectrum of national and international brands. 33 10. Market Readiness Summary by Station Area Table 10: Market Readiness Summary & Outlook Station Area Near Term (0-5 years) Medium Term (6-10 years) Long Term (11-20 years) Conestoga Mall & Northfield Office/Industrial: Ready for conversions, expansions to existing footprints and purpose-built office/industrial buildings for sole users Institutional: Ready for purpose-built office and industrial space conversion Residential: Ready for townhouse/stacked townhouse (woodframe construction) Office/Industrial: Ready for conversions, expansions to existing footprints and purpose-built office/ industrial buildings for sole users Institutional: Ready for purpose-built office and industrial space conversion Residential: Ready for townhouse/stacked townhouse and smaller condominium apartment projects (<60 units) Office/Industrial: Ready for conversions, expansions to existing footprints and purpose-built office / industrial buildings for sole users. Shift to Class ‘A’ office Institutional: Ready for purpose-built office and industrial space conversion Residential: Ready for townhouse/stacked townhouse and medium-sized condominium apartment projects (<100 units) within master planned communities, including Conestoga Mall’s surface parking lots Research & Technology Park Office/Industrial: Ready for conversions, expansions to existing footprints and purpose-built office/industrial buildings for sole users Institutional: Ready for office and academic space associated with UW expansion Residential: Ready for townhouse, stacked townhouse and student rental housing (purpose-built/condominium apartment) Office/Industrial: Ready for conversions , expansions to existing footprints and purpose-built office/industrial buildings for sole users Institutional: Ready for office and academic space associated with UW expansion Residential: Ready for townhouse, stacked townhouse and student rental housing (purpose-built/condominium apartment) Office/Industrial: Ready for conversions, expansions to existing footprints and purpose-built office/industrial buildings for sole users. Shift to Class ‘A’ space. Institutional: Ready for office and academic space associated with UW expansion Residential: Ready for townhouse, stacked townhouse and student rental housing (purpose-built/condominium apartment) University of Waterloo & Seagram Office: Ready for conversions, expansions to existing footprints and purpose-built office buildings for sole users Institutional: Ready for purpose-built office & university (academic ) expansion space Residential: Ready for townhouse, stacked townhouse and high density student rental housing (purpose-built/condominium apartment) and small/medium scale condominium apartment projects geared to end users (<80 units) Office: Ready for conversions, expansions to existing footprints and purpose-built office buildings for sole users. and Class ‘A’ office space. Institutional: Ready for purpose-built office & university (academic) expansion space Residential: Ready for townhouse, stacked townhouse and high density student rental housing (purpose-built/condominium apartment) and medium scale condominium apartment projects geared to end users (<100 units) Office: Ready for conversions, expansions to existing footprints and purpose-built office buildings for sole users and Class ‘A’ office space. Institutional: Ready for purpose-built office & university (academic) expansion space Residential: Ready for townhouse, stacked townhouse and high density student rental housing (purpose-built/condominium apartment) and medium scale condominium apartment projects geared to end users (<100 units) Uptown Core Stations (Allen/Willis Way/ Town Square) Office: Ready for conversions, expansions to existing footprints and purpose-built office buildings for sole users, including Class ‘A’ space on low cost sites Institutional: Ready for purpose-built office & university (academic ) satellite expansion space Residential: Ready for all forms and tenures of housing, including one to two medium/ large-scale projects per year (<200 units) Office: Ready for conversions, expansions to existing footprints and purpose-built office buildings for sole users, including Class ‘A’ space on low cost sites Institutional: Ready for purpose-built office & university (academic ) satellite expansion space Residential: Ready for all forms and tenures of housing, including one to two medium/ large-scale projects per year (150 -250 units) Office: Ready for conversions, expansions to existing footprints and purpose-built office buildings for sole users, including Class ‘A’ space on assembled sites Institutional: Ready for purpose-built office & university (academic ) satellite expansion space Residential: Ready for all forms and tenures of housing, including one to two medium/ large-scale projects per year (150-250 units) Source: NBLC 34