Foundations of Accounting Thought

Foundations of Accounting Thought

“When You Add You Subtract”

Accounting: the recording, measurement, and interpretation of financial information

Foundations of Business Thought

Accounting

Accounting is the collection, analysis, and communication of financial information.

Collection

Analysis Communication

Initial Records

• Sales invoices

• Cash receipts

• Purchases

• Credit sales

Intermediate Records

• Cash

• Accounts / receivable

• Accounts / payable

Financial Records

• Cash

• Accounts / receivable

• Accounts / payable

• Inventory

Financial Statements

• Balance sheet

• Income statement

• Statement of cash

Flow

Foundations of Business Thought

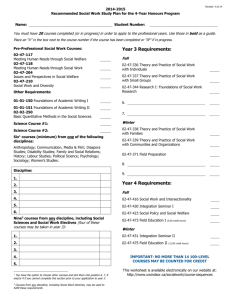

The Accounting Cycle

Transaction is recorded (a sale, salary earned, purchase goods)

Financial statements for decision makers inside and outside the company are prepared (balance sheet, income statement, statement of cash flow)

Transactions are posted to a journal as they occur

Internal reports for decision makers are prepared (sales, debt, inventory)

Journal entries are posted to ledger by type of account and balances are totaled

Foundations of Business Thought

How Accounting Information is Used

Current Investors

Potential Investors

Creditors

Managers

Unions

Government

Agencies

Evaluate income and cash flow generated by the company; evaluate management's performance.

Estimate the company’s future growth potential and the risk of investing in the company.

Evaluate prospective borrower’s ability to repay principal and interest.

Determine allocation of resources; evaluate management’s performance; compare actual results with budgeted plans.

Review company’s financial condition in order to negotiate benefits and wages.

Establish the company’s tax liability.

Foundations of Business Thought

Foundations of Business Thought

Foundations of Business Thought

“Who does nothing makes no mistakes; who makes no mistakes learns nothing.”

Pacioli, Summa De Arithmetica, Geometria,

Proportioni et Proportionalita (1494)

Foundations of Business Thought

Debit means an entry on the left side of an account. Credit means an entry on the right side of an account. … A debit or charge indicates (1) an increase in an asset, (2) a decrease in a liability, or (3) a decrease in a shareholders’ equity item. A credit indicates (1) a decrease in an asset, (2) an increase in a liability, or (3) an increase in a shareholders’ equity item.”

Stickney, Weil, & Davidson, Financial Accounting

Foundations of Business Thought

Income Statements

Sportswear International, Inc.

Income Statement

For the Year Ended December 31, 1998

Revenues:

Gross Revenue

Less: Sales returns and Allowance

Net Revenue

Cost of Sales:

Beginning Inventory

Purchases

Cost of Goods Available for Sale

Less: Ending Inventory

Cost of Sales

Gross Profit

Operating Expenses:

Selling Expense

Advertising

65,000

30,000

1,480,000

35,000

150,000

1,210,000

1,360,000

145,000

95,000

General and Administrative Expenses:

Adminstrative Salaries

Rent

Utilities

Insurance

Depreciation

Total General Expense

Total Operating Expense

Income from Operations

Interest Expense

Income Before Taxes

Income Tax Expense ( 36% )

Net Income

30,000

25,000

10,000

3,000

12,250

80,250

1,515,000

1,215,000

300,000

175,250

124,750

9,850

114,900

41,364

$ 73,536

Foundations of Business Thought

Balance Sheets

Sportswear International, Inc.

Balance Sheet

At December 31, 1998

Current Assets:

Cash

Accounts Receivable

Less: Allowance for Doubtful

Accounts

Inventory

Total Current Assets

Fixed Assets:

Store Equipment

Less Accumulated Depreciation

Assets

Furniture and Fixtures

Less Accumulated Depreciation

Total Fixed Assets

Total Assets

72,500

15,000

47,000

13,500

140,000

55,000

332,000

57,500

42,000

33,500

85,000

431,500

118,500

$550,000

Liabilities

Current Liabilities:

Accounts Payable

Long-term Liabilities:

Notes Payable in 2003

Total Liabilities

Capital Stock

Retained Earnings

Total Owner's Equity

Total Liabilities and Owner's Equity

Owner's Equity

Foundations of Business Thought

110,000

350,000

65,000

25,000

460,000

90,000

$ 550,000

The Accounting Equation

Assets

Anything of value owned by the company

=

Liabilities

+

Owner’s equity

Amounts owed by the company

Claims of owners, partners, and shareholders against the firm’s assets

Foundations of Business Thought

Objectives of Financial Reporting

Financial reporting should...

...provide information useful for making rational investment and credit decisions.

...provide information to help investors and creditors assess the amount, timing, and uncertainty of cash flows.

...provide information about the economic resources of a firm and the claims on those resources.

...provide information about a firm’s operating performance during a period.

...provide information about how an enterprise obtains and uses cash.

...provide information about how management has discharged its stewardship responsibility to owners.

...include explanations and interpretations to help users understand the financial information provided.

Stickney, Weil & Davidson, Financial Accounting

Foundations of Business Thought

Financial Ratios

Liquidity ratios - ability to pay short-term debts

Current ratio

Quick ratio

Current assets

Current liabilities

Cash + Accounts receivable

Current liabilities

2:1 ratio considered favorable

1:1 ratio considered adequate

Activity ratios - how efficiently assets are used

Accounts receivable turnover

Inventory turnover

Net sales

Average net A/R

Cost of goods sold

Average inventory per period

Varies with payment terms

Varies by industry

Foundations of Business Thought

Financial Ratios Continued

Profitability ratios - overall operating success

Return on sales

Return on

Equity

Net income

Net sales

Net income

Equity

Varies by industry

Varies by industry

Debt ratios - ability to pay long-term debts

Debt to total assets

Total liabilities

Total Assets

The lower the better for lenders

Times interest earned

Income before interest

& taxes

Interest + Expense

The higher the better for lenders

Foundations of Business Thought

Financial Accounting

“A firm’s financial accounting system is concerned with EXTERNAL users of information - consumer groups, unions, stockholders, and government.”

Managerial Accounting

“Managerial accounting serves

INTERNAL users of a company’s financial information.”

Ronald Ebert & Ricky Griffin, Business Essentials 2nd Edition (1998)

Foundations of Business Thought

Business Benefits of Budgeting

Budgets…

…provide standards from which performance can be measured.

…inform and often motivate employees.

…can force managers to be future oriented.

…allow top managers to get a better overall perspective.

…allow managers to recognize and anticipate problems.

…facilitate communication among departments.

Source: UNDERSTANDING BUSINESS , 3/e by Nickels, McHugh, and McHugh

Foundations of Business Thought

Management Information Systems MIS

Transactions

Procedures

Processes

Computers Decision

Making

Foundations of Business Thought

Accounting Information Model

Management Process

Goal

Accounting Process

Information Needs

Strategy Inputs

Tactics Storage / Processing

(Models)

Activities

Information Needs

Evaluate

Reports

Evaluate

Improve

Foundations of Business Thought

Improve

Manufacturing and Information Systems

Input

Raw Materials

Processing

Manufacturing

Process

Output

Finished Goods

Data Input

Process Data into

Information with

Information Systems

Information

Foundations of Business Thought

Input

Data Input

Data versus Information

Processing Output

Information

Process Data into Information

• alphanumeric

• audio

• video

• text

• calculating

• updating

• adding

• sorting

• reports

• displays

• documents

Foundations of Business Thought

Trends in M.I.S.

+

• Increased access to information

• Increased reliance on technology

• Increased speed

• Decreased size

• Increased portability

_

• Increase in computer crime

• Increased pace

• Decrease in privacy

Foundations of Business Thought

Poet’s Point/Counterpoint about Accounting

Point

“Double-entry bookkeeping is one of the most beautiful discoveries of the human spirit…It came from the same spirit which produced the systems of Galileo and Newton and the subject matter of modern physics and chemistry. By the same means, it organizes perceptions into a system, and one can characterize it as the first Cosmos constructed purely on the basis of mechanistic thought…Without too much difficulty, we can recognize in double-entry bookkeeping the ideas of gravitation, or the circulation of the blood and the conservations of matter.”

Counterpoint

Juann Wolfgagn von Goethe, 1796.

Reprinted in the Wall Street Journal,

3/17/93 (Editorial Page)

The Hardship of Accounting

Never ask of money spent

Where the spender thinks it went.

Nobody was ever meant

To remember or invent

What he did with every cent

Robert Frost, 1936

A Further Range

Foundations of Business Thought