Special journal

advertisement

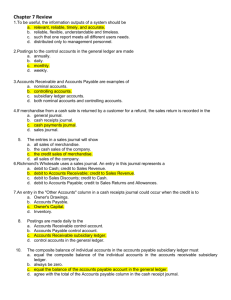

1 Chapter 7 Special Journals and Subsidiary Ledgers 2 Learning objectives 1. Explain the purpose of special journals 2. Explain the purpose of control accounts and subsidiary ledgers 3. Journalize transactions using special journals – Sales journal – Cash receipts journal – Purchases journal – Cash payments journal 3 Learning objectives 4. Post transactions from the special journals to general and subsidiary ledger accounts 5. Prepare schedules of accounts receivable and payable 6. Explain how special journals affect the general journal 4 Learning objective 1 Explain the purpose of special journals 5 The purpose of special journals Special journal: ▪ A record in which similar transactions are journalized ▪ Exact types and format used varies from business to business Advantages: ▪ More efficient way to journalize transactions – Each transaction entered on one line – Time saved by posting column totals 6 Learning objective 2 Explain the purpose of control accounts and subsidiary ledgers 7 Control accounts and subsidiary ledgers Control account: ▪ An account in the general ledger that summarizes the information contained in its related subsidiary ledger Subsidiary ledger: ▪ An accounting record that stores the details summarized in the related control account ▪ Not part of the general ledger 8 Control accounts and subsidiary ledgers Examples: Control account Subsidiary ledger Accounts Receivable Accounts Receivable Subsidiary Ledger Accounts Payable Accounts Payable Subsidiary Ledger Inventory Inventory Cards 9 Control accounts and subsidiary ledgers ▪ At the end of the accounting period: Control Account: Ending Balance Subsidiary Ledger: $600 = Account 1 Account 2 Account 3 Total $ 100 200 300 $600 10 Control accounts and subsidiary ledgers Advantages: ▪ Minimizes detail in the general ledger accounts ▪ Provides up-to-date details on the balances of each subsidiary account ▪ Internal control – Assist in detecting and preventing errors in the accounts – Allows separation of duties 11 Learning objective 3 Journalize transactions using special journals Sales journal Cash receipts journal Purchases journal Cash payments journal 12 Types of journals Journal: Transaction type: Sales journal Credit sales of inventory Cash receipts journal Cash inflows to the business Purchases journal Credit purchases (including inventory) Cash payments journal Cash outflows from the business General journal Any transaction that is not able to be recorded in a special journal, including: • Correcting entries • Adjusting entries • Closing entries 13 Sales journal ▪ Used to record sales of inventory on credit ▪ Perpetual inventory system – last two columns used for each sale 14 Sales journal ▪ Post entries to customers’ accounts in the accounts receivable subsidiary ledger daily 15 Sales journal ▪ Post totals to all relevant general ledger accounts at the end of the accounting period 16 Cash receipts journal ▪ Used to record transactions involving a receipt of cash 17 Cash receipts journal ▪ Post entries to customers’ accounts in the accounts receivable subsidiary ledger daily ▪ Post to other accounts in the general ledger daily 18 Cash receipts journal ▪ Post totals to all relevant general ledger accounts at the end of the accounting period 19 Purchases journal ▪ Used to record credit purchases 20 Purchases journal ▪ Post entries to suppliers’ accounts in the accounts payable subsidiary ledger daily ▪ Post to other accounts in the general ledger daily 21 Purchases journal ▪ Post totals to all relevant general ledger accounts at the end of the accounting period 22 Cash payments journal ▪ Used to record transactions involving a payment of cash 23 Cash payments journal ▪ Post to suppliers’ accounts in the accounts payable subsidiary ledger daily ▪ Post to other accounts in the general ledger daily 24 Cash payments journal ▪ Post totals to all relevant general ledger accounts at the end of the accounting period 25 Learning objective 4 Post transactions from the special journals to general and subsidiary ledger accounts 26 Posting transactions Remember to post: ▪ Entry to subsidiary ledger on a daily basis ▪ Entry recorded in an ‘Other Accounts’ column on a daily basis ▪ Totals of each column (except the ‘Other Accounts’ column) at the end of the accounting period 27 Learning objective 5 Prepare schedules of accounts receivable and payable 28 Schedules of accounts Schedule of accounts receivable: ▪ Verifies that the sum of the customer balances recorded in the accounts receivable subsidiary ledger is equal to the balance of the Accounts Receivable control account in the general ledger. 29 Schedules of accounts Schedule of accounts payable: ▪ Verifies that the sum of the supplier balances recorded in the accounts payable subsidiary ledger is equal to the balance of the Accounts Payable control account in the general ledger. 30 Learning objective 6 Explain how special journals affect the general journal 31 Special journals and the general journal ▪ Not all transactions can be entered into special journals e.g. – Correcting entries – Adjusting entries – Closing entries ▪ These are entered into the general journal 32 Special journals and the general journal ▪ If a transaction recorded in the general journal involves both a control account and a subsidiary account: ▪ Journalizing: Both the control and subsidiary account must be identified in the general journal entry ▪ Posting: The amount must be posted to both the control account and the subsidiary ledger account 33