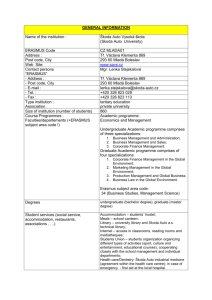

ŠKODA Annual Report

advertisement