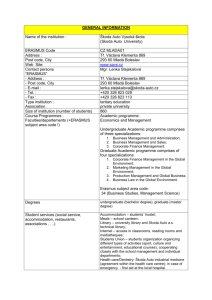

ŠKODA Annual Report

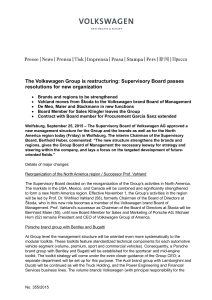

advertisement