ACCT 2010 Intermediate Accounting Former Course(s)

advertisement

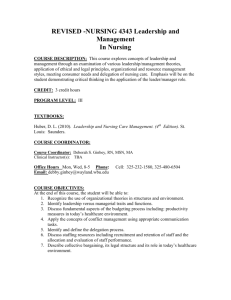

Date Revised: August 2013 COURSE SYLLABUS Syllabus for: ACCT 2010 Intermediate Accounting Former Course(s): ACT 2510, ACT 251 and ACT 252 (quarter courses) Catalog Description: This course is a study of fundamentals of accounting, including statement of changes in financial position, present value, cash and receivables, inventories, depreciation, amortization, and current and long-term liabilities. Credit Hours: 3 Contact Hours: 3 Lab Hours: 0 Prerequisite(s): ACCT 1020 Principles of Accounting II Required Text(s): Intermediate Accounting, ACT 2510 Motlow State, 19th edition, Stice and Stice, Cengage Learning, 2014. ISBN-13: 978-1-285-88247-5. ISBN-10: 1-28588247-4. Required Supplies/Material(s): Working Papers Recommended Supplementary Material(s): None Student Group for Whom Course is Required/Intended: This course is intended for students pursuing the following degree(s) and program(s) of study: Associate of Applied Science, Business Technology Major: Concentration in Accounting. Student Learning Outcomes: Upon completion of the course, students will demonstrate the ability to: 1. Explain the financial reporting to users of accounting information. 2. Describe the role of the FASB and various governmental and professional organizations in the development of accounting standards. 3. Explain the importance of a conceptual framework. 4. Describe the traditional assumptions of the accounting model. 5. Describe the accounting process. 6. Prepare a cash flow statement. 7. Explain earnings management and its application to the accounting process. 8. Explain the composition of cash and petty cash and the recognition and valuation of accounts and notes receivables and their relationship to revenue recognition. 9. Describe the cost allocation and valuation of inventories. 10. Name the components of the acquisition of noncurrent operating assets. BUS 2010 Intermediate Accounting Course Syllabus, Page 2 Suggested Evaluation Plan: Task Exam 1 (Chapters 1-4) Exam 2 (Chapters 5-6) Exam 3 (Chapters 7-8) Exam 4 (Chapters 9-11) Homework Total Weight 22.5% 22.5% 22.5% 22.5% 10% 100% Student Learning Outcomes 1-5 6-7 8 9-10 1-10 Final Grading Plan: The grading scale for all examinations, assignments, and the final course grade will be based on the following percentages: A = 90-100% B = 80-89% C = 70-79% D = 60-69% F = Below 60% Instructional Schedule: Week 1 Student Learning Outcomes 1-2 2 3-5 3 3-5 4 3-5 5 3-5 6 6 7 8 6 7 9 10 7 6-7 8 Content to Be Covered Chapter 1, "Financial Reporting" Chapter 2, “A Review of the Accounting Cycle" Chapter 3, “The Balance Sheet and Notes to the Financial Statements" Chapter 3 (Continued) Chapter 4, "The Income Statement" Student Assignments/ Supplementary Material(s) Read Chapter 1. Cases 11, 12, 14, 18, 19. Read Chapter 2. Cases 45-46. Exercises 21, 25, 30. Read Chapter 3. Questions 15 and 21. Exercises 23-28, and 32. Read Chapter 4. Questions 13, 14. Cases 55-57 Exercises 24-31. Problems 43-46. Chapter 4 (Continued) Exam 1—Chapters 1-4 Chapter 5, “Statement of Cash Flows and Articulation” Chapter 5 (Continued) Chapter 6, “Earnings Management” Chapter 6 (Continued) Exam 2 (Chapters 5-6) Chapter 7, "The Revenue/Receivables/ Cash Cycle" Read Chapter 5. Cases 62-64. Exercises 24-30. Read Chapter 6. Exercises 1-10. Read Chapter 7. Question 8. Cases 64-66. Exercises 25-32, 36, 41, 42. Problem 56. BUS 2010 Intermediate Accounting Course Syllabus, Page 3 11 8 Chapter 8, “Revenue Recognition” 12 8 Exam 3 (Chapters 7-8) 9 Chapter 9, “Inventory and Cost of Goods Sold” Chapter 10— "Investments in Noncurrent Operating Assets—Acquisition" Chapter 11, “Investments in Noncurrent Operating Assets—Utilization and Retirement” Exam 4 (Chapters 9-11) 13 10 14 10 15 9-10 Read Chapter 8. Questions 4, 7. Cases 43-47. Exercises 19-22, 30. Problem 32. Read Chapter 9. Questions 7-12. Exercises 26-29, 35, 37-38, Problems 67, 74, 80. Read Chapter 10. Cases 65, 68, 69. Exercises 21-23, 36 Problems 45-47, 58, 61 Read Chapter 11. Exercise 26, 29, 34, 40. Problem 50, 51, 58.