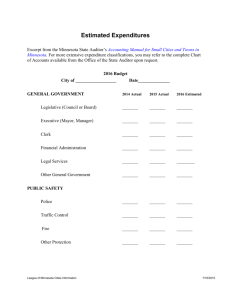

Uniform Chart of Accounts - Office of the State Auditor

advertisement