Indonesian Tax Guide 2012

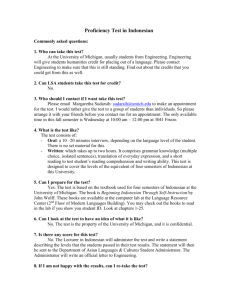

advertisement