7 DEADLY MISTAKES PROPERTY DEVELOPERS MUST AVOID

advertisement

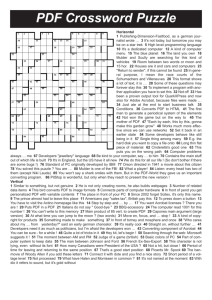

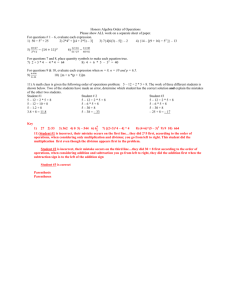

7 DEADLY MISTAKES PROPERTY DEVELOPERS MUST AVOID 7 DEADLY MISTAKES PROPERTY DEVELOPERS MUST AVOID REPORT N0.1-2014 Jim CastagnetPROPERTY DEVELOPMENT WORKSHOPS4/1/2014 According to the Collins English dictionary property development is: “thebusiness of buying land and buildings and then making improvements to them so that their selling price exceeds the price paid for them”. Sounds simple enough! So why do so many get it so wrong! Read on….. Page 2 7 DEADLY MISTAKES PROPERTY DEVELOPERS MUST AVOID 7 DEADLY MISTAKES PROPERTY DEVELOPERS MUST AVOID REPORT N0.1-2014 Property Developers by nature are entrepreneurs and risk takers. They are enthusiastic and passionate individuals who are generally very successful at what they do. However, those very characteristics that make them successful can often cause them to make unnecessary and often very costly mistakes. During the 16 years I have been teaching and doing property development, I have found these to be the 7 most common mistakes that Property Developers are “guilty” of in their haste to make things happen. MISTAKE N0.1 LACK OF DUE DILIGENCE A thorough due diligence process is an absolute must if you are to reduce your risks as a property developer. This process can be exhaustive depending on the complexity of your particular project. Rookie developers will often do the very bare minimum of what is necessary. They will often commit to purchase on the word of a third party. Often an unqualified third party. I would recommend that if you’re unsure of what is necessary, to commission a qualified consultant(s) to do this for you. It will save you thousands from costly mistakes &/or hidden pitfalls MISTAKE N0.2 MASSAGING THE FINANCIAL FEASIBILITY ANALYSIS The Feasibility Analysis is the most critical part of your due diligence. If you get this wrong you will probably end up overpaying for the land or walking away from a perfectly viable Project. The Feasibility is the basis for everything that you do. It will allow you to determine residual value of land, and therefore how much you should pay. Ideally this will be below the residual value. The problem that I see over and over is that developers tend to overestimate the sales of their projects and underestimate the construction costs. It is too easy to play with the figures to make it look like what youwish as opposed to the reality. What often happens then is that the developer goes ahead and purchases the site, spends loads of money to get a DA only to find that the Project does not stack up and therefore not fundable by the Bank. Hence why there are so many sites on the market that are not viable. MISTAKE N0.3 UNDERESTIMATING THE POWER OF NEIGHBOURS Neighboursshould be on your list of stakeholders who are affected by your development. Very often lots of angst is created unnecessarily, because the developer has surprised the neighbour with their proposed development. The developer has failed to communicate their intentions to the neighbour prior to lodging the development approval. Remember that the less objections you get the easier it will be to get your DA. Neighbours are also constituents who vote for their local Councilors. Therefore they do carry a lot of weight when Council is considering your application. They can hold up your application Page 3 7 DEADLY MISTAKES PROPERTY DEVELOPERS MUST AVOID indefinitely and worse still force you to take the matter to the Land Environment Court where there will be even more costly delays and court costs. MISTAKE N0.4 SELECTING THE WRONG BUILDER There is nothing more heartbreaking than having the Builder go broke halfway through your Project. It is very costly to replace a builder and your budget may not be sufficient to do so without further injection of funds. Builder selection is a critical part of the property development process and too often a builder is selected on the basis of a recommendation from a “mate” or on the cheapest price. Depending on the size of your Project, it is wise to use the services of a Quantity Surveyor who will be able to provide the costs estimates for your Project when assessing the Builder’s tender. They will also advise on the performance of particular builders as they are often processing monthly progress payments on the Bank’s behalf. They know the builders who perform on time and on budget. MISTAKE N0.5 SHODDY LEGAL DOCUMENTATION This is an issue that is often overlooked by even the most experienced developers. Indeed I have been guilty of getting this wrong myself and it has been very costly. There are some obvious reasons why you should ensure that your legals, i.e. Option Agreements, JV’s, Structures, NonDisclosure Agreements, Building Contracts, PreLease Agreementsand a host of others depending on your situation, are up to scratch. These include minimizing your liabilities, protecting your assets and ensuring that you get Page 4 to keep your profits at the end. You must engage a qualified property development Solicitor and Accountant who can advise in this regard or risk being exposed before, during and after the completion of your Project. MISTAKE N0. 6 NOT SELECTING THE RIGHT CONSULTANTS You may have heard the term “pay peanuts and get monkeys”. To succeed in property development you need to surround yourself with the right team. I mean Architect, Solicitor, Accountant, Town Planner, QS etc. Too often developers go for the cheapest consultants. Unfortunately, inevitably, this ends up costing them more in the long run because of mistakes resulting in variations, an ordinary end product and at the end of the day not achieving the highest and best use. This of course results in much less profit if not a loss. MISTAKE N0. 7 BUYING THE WRONG SITE This the most common mistake that I see developers do. There are many reasons for this. Some of them I covered above including lack of due diligence, incorrect or incomplete (back of the envelope) feasibilities etc. The reality is that often it’s a combination of lack of knowledge and understanding of the property development process including buildability issues, property development funding, planning framework and the target market.The risk with Property Development is most often not the Project itself but the Property Developer. Self-education in property development is a critical part of a developer’s due diligence. www.propertydevelopmentworkshops.com.au