tyco international - Corporate-ir

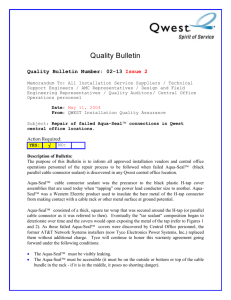

advertisement