Maybank - EGM Presentation

advertisement

Presentation to the Shareholders of Maybank

Extraordinary General Meeting

23 March 2009

Maybank – In A Position of Strength

The Dominant Malaysian bank…

9

9

9

9

9

9

9

9

9

No. 1 Bank in Malaysia in assets

and reach

No. 1 Islamic Bank in Malaysia in

assets

Leading bank in most business

segments

Superior multi-channel

distribution network

Comprehensive portfolio of

products and services

Proactive and conservative

approach to capital management

One of the most recognized

brand names

Strong shareholder support and

ratings

Strong dividend track record

… and A Talent and Execution

Focused Company

… An Emerging Regional Leader…

9

Diversified Pan-Asia platform

9

A leadership pool and talent

pipeline to realise our aspirations

9

Presence in the highest growth

markets

9

Highly effective performance and

talent management processes

Leadership in fast-growing

Islamic banking

9

A Group-wide performance culture

9

9

Continued momentum and robust

performance amidst current

environment

9

Solid financial strength

Aspire to be The Undisputed Malaysian Leader

and A Top 5 Bank in South and South East Asia

2

Implementation of LEAP 30

Wave 1 (Sep 2008 – Dec 2009)

Initial 20 initiatives

Initiatives

Consumer

Enterprise

• Launch tactical sales stimulation

Objective

• Enhance consumer sales with tangible sales

uplift captured in the first year of launch

• Deepen share of Corporate

• Enhance customer penetration with improved

customers’ wallet

• Create a domestic Insurance

• Reduce procurement costs

• New tiered system for agency and full product

range

• Detailed spend analysis and quick win

•

•

Cost

Optimisation

Recent Progress

• Launched pilot at 8 branches

• Target RM11 mil PBT uplift by this FY

• Launched 4 of 8 rounds of tactical account

wallet share

champion

Insurance

Operation

Wave 2 (Jan 2010 – Dec 2011)

Remaining 10 initiatives

identification

Category mapping of group spend

Defining governance model and structuring

central procurement unit

planning. Target RM26.9 mil PBT uplift by this

FY

•

•

•

•

Increase in premiums to Etiqa

Target RM 989 mil by this FY

Increase commission/fees to Maybank

Target RM58 mil by this FY

• Capex cost reduction/avoidance of RM60 million

in this FY

• Cost reduction/avoidance of RM85 million in

• IT Projects Reprioritisation

• Ensure IT projects resources are focused on

• MIS enhancement

• Upgrade management information system

• Reprioritise to enhance performance

• Credit Collections

• Tighten prevention mechanisms in deteriorating

• Pilot specific performance improvement

delivering benefits

this FY

management dashboards

economic conditions

Credit

measures targeted at prevention

• Pilot Collections centre operationalise by end

June 09

People

•

•

•

•

•

•

Upgrade performance management

Launch talent management

Enhance leadership development

Ramp-up external recruitment engine

Embed core values in the way we work

Launch PMO (completed)

• Build a pipeline of talent and leaders to achieve

•

Maybank’s aspiration to be a talent and execution

–based company

And be among the top quartile employer of talent

in each of Maybank’s markets

• Group Talent Review Committee and Sectoral

Review Committees formed

• Achieved ratio of 1:2 succession plan coverage

for Level 1 positions

• Intensive improvement programme for

Performance Management launched

• Centralised Recruitment set up

• Annual Talent Management calendar introduced

3

Strategic Transformation Plan

RM6.0 billion rights issue is an integral part of Maybank’s strategy to become one of the top 5 banks in

South and South East Asia by size and performance by 2015

Strategic Transformation Plan

1

Strengthening core business

and franchise

⎯

Achieve globally-benchmarked

operating metrics

⎯

Achieve leadership across all

key segments of business

⎯

Capture value from

new investments

⎯

Improve synergies across the

Maybank Group

Implementation of LEAP 30

initiatives underway

2

Further strengthen capital

base via rights issue

⎯

Pre-emptive capital to

strengthen Maybank’s

capital base

⎯

Widen Maybank’s

competitive positioning

3

Putting in place an

organisational and corporate

structure that provides greater

strategic, financial, and

operational flexibility across

the group

⎯

Adopt a financial holding

company structure, subject to

regulatory and tax

considerations and a final

implementation plan

Rights Issue

4

Summary of Rights Issue

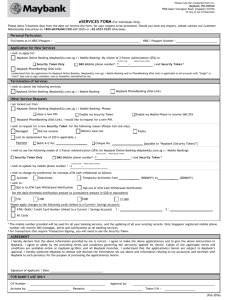

Offer Type: Renounceable, fully underwritten rights issue

Size: Approximately RM6.0 billion (US$1.6 billion)

Offer

No. of rights shares: Up to 2,212 million rights shares

Structure

Issue Price: RM2.74 representing a discount of 34.4% to the theoretical ex-rights price of the Share

Rights Ratio: 9 rights share for 20 existing shares

Substantial Shareholder Commitment

Shareholder

Support

⎯

Written irrevocable undertaking to fully subscribe for its pro-rata entitlements by Permodalan

Nasional Berhad and its managed funds of a combined stake of 55.7%, plus 20% excess shares

commitment, and written undertaking by Employees’ Provident Fund of its entitlement stake of

13.7%1, which represents a significant combined shareholder support of approximately 89.4%.

Maybank Investment Bank: Financial Advisor, Joint Global Coordinator and Joint Lead Manager

Issue

Managers MIDF Amanah Investment Bank and RHB Investment Bank: Joint Lead Underwriters

Goldman Sachs & Credit Suisse: Joint Global Coordinators and Joint International Lead Managers

Financial

Impact

Pro forma consolidated Core Equity2 ratio of up to 8.1% and Tier I ratio of up to 11.0% after the

rights issue (vs. consolidated Core Equity1 ratio of 5.2% and Tier I ratio of 8.1%), as at Dec

20083

Support Strategic Transformation Plan

Rationale Enhance balance sheet and capital ratios

Strengthen franchise and accelerate organic growth

(1) Subject to share price not falling below RM2.74 per share

(2) Core Equity capital refers to Tier 1 capital less qualifying preferred and hybrid instruments

(3) Based on unaudited December 2008 financials

5

Strengthening Balance Sheet and Capital Ratios

Capital Ratio Benchmarking1

Recent Fund Raising Exercise

Rights Issue

RM 6.0 bn

16.4%

15.3%

15.1%

14.9%

Total Capital

Raised

RM 15.1 bn

Subdebt

RM 3.1 bn

11.0%

10.9%

10.1%

13.9%

12.4%

8.1%

11.0%

9.0%

8.1%

8.0%

8.1%

8.5%

7.1%

5.2%

Aug 2008

Nov 2008

Mar 2009

MBB

Total

2

UOB

OCBC

Core Tier 1 Capital

13.5%

10.8%

Non-Innovative

Tier I

RM 3.5 bn

Jun 2008

13.7%

8.3%

RM 9.1 bn

already

raised

Hybrid Tier I

RM 2.5 bn

14.0%

Pre-emptive capital raising exercise

DBS

CIMB

Public

3

Tier 1 Capital

MBB

RHB

Total Capital

Maybank’s capital ratios will be best-in-class post rights

issue, which strongly positions Maybank to capture

market share and business opportunities

(1) Based on latest available public data of 3Q08, except for Maybank, Public Bank, CIMB, RHB, and the Singapore Banks, which are based on Dec 2008 data. Maybank

Dec 2008 financials are unaudited

(2) Pro forma capital ratios based on net proceeds under the minimum scenario and do not take into account impact on RWA from new proceeds

(3) Core Tier 1 capital refers to Tier 1 capital less qualifying preferred and hybrid instruments

6

Rights Issue to Strengthen Franchise and Accelerate Growth

Comprehensive one-time capital raise to provide sufficient capital to implement the

Bank’s key strategic initiatives for the next 2-3 years

Financial Centres

Country Presence

Shanghai

Malaysia

Hong Kong

Singapore

Bahrain

Indonesia

London

Philippines

New York

Vietnam

Cambodia

Brunei Darussalam

Papua New Guinea

1 Domestic Franchise

Focus on organic growth to establish undisputed leadership in

Malaysia across all high margin products and segments:

⎯

⎯

⎯

⎯

#1 in consumer, SME and corporate banking business

#1 in Islamic banking

Top 2 in investment banking

Top 2 in insurance, Takaful and asset management

Continually strengthen the Bank’s “anytime, anywhere”

distribution capability

Achieve superior operating metrics through productivity

improvements and cost management

2 Regional Franchise

Pakistan

Completed major strategic acquisitions

Strong presence in Singapore, Philippines and Vietnam

Strengthening leadership position in Islamic Banking

Strengthening regional presence by capturing value from BII

and MCB through participating in the Bank’s management and

operations. Recent progress includes:

⎯

⎯

Strengthening key management positions at BII (CEO, COO,

CFO)

Leveraging BII and MCB franchise to develop fee-based

business such as investment banking

7

Effects Of The Rights Issue (Based on Minimum Scenario)

Share Capital

4,881.12 million shares

Up to 7,077.63 million shares

Net Assets

RM3.90 per share

RM3.54 per share

Gearing

0.77 times

0.58 times

No material effect on earnings for FYE 30 June 2009. However, the EPS will be reduced as

a result of the increase in the number of shares post completion of the Proposed Rights

Issue.

No effect on the shareholdings of the Company's substantial shareholders except for the

proportionate increase in the number of shares held following the Proposed Rights Issue.

Depends, amongst others, on the profitability and cash flow position of the Maybank Group.

Earnings

Substantial

Shareholdings

Dividends

Capital Adequacy

Ratio

Going forward, commitment to the long term dividend payout ratio of 40% to 60% of profit

attributable to shareholders, subject to approval by Bank Negara Malaysia.

Core capital

Risk weighted capital

8.1%

13.5%

Core capital

11.0%

Risk weighted capital

16.4%

8

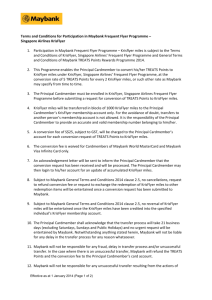

Recent Rights Issues Of Financial Institutions

Financial

Institutions

Date

launched

Date of

listing

Issue size

Ratio

USD’billion

Issue

price

Price

before

announce

ment

Discount

to last

price

TERP

Discount

to TERP

USD

USD

%

USD

%

Maybank

27-Feb-09

Ongoing

1.65

9 for 20

0.75(1)

1.32(2)

43.2%

1.14(3)

34.4%

HSBC Holdings

02-Mar-09

Ongoing

17.70

5 for 12

3.66

6.98

47.5%

6.00

39.0%

Bank Danamon

Indonesia

18-Feb-09

Ongoing

0.34

68 for 100

0.10

0.19

46.7%

0.15

34.2%

Shinhan Financial

Group

02-Feb-09

Ongoing

1.13

0.145 for 1

11.90

20.18

41.1%

15.86

25.0%

DBS Group

Holdings

22-Dec-08

02-Feb-09

2.64

1 for 2

3.58

6.50

45.0%

5.53

35.2%

Standard

Chartered

10-Nov-08

23-Dec-08

2.70

30 for 91

5.62

10.94

48.7%

9.62

41.6%

Banco Santander

10-Nov-08

04-Dec-08

9.76

1 for 4

6.10

11.31

46.0%

10.26

40.6%

For comparison, all local currencies are translated into USD based on the following rates as at 20 March 2009:

Ringgit Malaysia

USD1:RM3.645

Indonesian Rupiah

USD1:IDR11,815.00

Korean Won

USD1:KRW1,412.25

Singapore Dollar

USD1:SGD1.5147

Euro

USD1:EUR0.7377 (8.15pm)

British Pound Sterling USD1:GBP0.694 (8.15pm)

Notes:

(1) RM2.74

(2) RM4.82

(3) RM4.17

9

Rights Issue Discount

12,000

7.0

6.0

Last

High

Low

Average

4.36

5.70

3.98

5.11

Date of Announcement

27-Feb-2009

10,000

5.0

8,000

4.0

37.2%

Discount

6,000

3.0

Issue Price = RM2.74

Volume ('000)

Closing Price (MYR)

Last Close (20-Mar-09) = RM4.36

4,000

2.0

2,000

1.0

0.0

02-Jan-09

0

20-Jan-09

11-Feb-09

27-Feb-09

18-Mar-09

Daily from 02-Jan-2009 to 20-Mar-2009

Volume

Maybank

The Rights Issue price of RM2.74 still represents a sizeable discount of 37.2% to the last closing price of

RM4.36 as at 20 March 2008.

10

Update on the regulatory approvals required

Securities

Commission

To implement the Rights Issue

For a waiver from providing the underwriting arrangement in

respect of the Employee Provident Fund Board’s entitlement of

the Rights Issue

For a waiver from the requirement for Maybank IB to act as an

underwriter

To allow Maybank to announce the book closure date for the

Rights Issue prior to the EGM

Obtained on

6 March 2009

Obtained on

6 March 2009

Bursa Malaysia

Securities Berhad

The listing of and quotation for the Rights Shares

Bank Negara

Malaysia

To increase Maybank’s issued and paid-up capital of Maybank

pursuant to the Rights Issue

Shareholders of

Maybank

To implement the Rights Issue

Obtained on

12 March 2009

Obtained on

18 March 2009

Pending approval from

shareholders

11

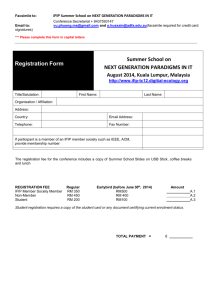

Targeted Timeline of Rights Issue

27 February 09

Announcement of rights issue

6 March 09

Despatch of circular

19 March 09

Announcement of books closure date

23 March 09

EGM

2 April 09

7 April 09

14 April 09

21 April 09

30 April 09

Books closure date

Despatch of abridged prospectus

Commencement of Rights Trading period

Cessation of Rights Trading

Closing date of applications

Receipt of application monies

Listing of rights shares

12

Conclusion

Strategic Transformation Plan to strengthen our Malaysian leadership and become a top 5

bank in South and South East Asia

Successful Implementation of LEAP 30 is the first step of the Strategic Plan

Pre-emptive rights issue is the next step towards achieving the Strategic Plan

⎯ Further strengthen our franchise and core business

⎯ Allow focus on capturing market share and business opportunities

⎯ Enhance our balance sheet and capital ratios

The Rights Issue will place us in an even stronger position for long-term growth

The Board is of the opinion that the Rights Issue is in the best interest of Maybank

and the shareholders.

Hence, the Board recommends that you vote in favour of the Rights Issue.

13

Questions raised by Minority Shareholder Watchdog Group

14

Q1:

Why the potential BII impairment losses have not been accounted

for to date?

Reply

Maybank is committed to completing this process by FYE June 2009.

Impairment based on FRS 136: Impairment of Assets.

Value-In-Use will be based on future long term cash flows, discounted at

long term rates and not referenced to the stock market price of BII.

Computation will involve:

- stabilisation of earnings potential

- cashflow projections

- stabilisation of the interest rate term structure

New management team for BII has been appointed at its EGM on 20 March

2009.

Impairment charge is non-cash and does not affect the capital position of

Maybank.

Our cash and liquid reserves remain robust.

15

Q2:

How much capital commitment is expected to be involved in the

outstanding proposals pending completion?

Reply

Proposal

Current status

Capital commitment

Acquisition of additional charter capital of An

Binh Bank

Pending approval from the

Vietnam’s authorities

VND400 million or

RM84 million

MOU between Maybank and ICD

Pending implementation

Maybank has not

committed any

capital

Family Takaful business in Pakistan

Pending completion

PKR150 million or

RM7 million

Subordinated bonds issuance of up to

USD1.0 billion and/or its equivalent

Deferred. Approval from the

SC has lapsed

Maybank has not

committed any

capital

The total capital commitment highlighted is approximately RM91 million.

16

Q3:

With the undertakings from substantial shareholders, what would

be the likely free float in the public spread post Rights Issue?

Reply

Assuming 89.4% of the rights shares will be taken up by:

i)

Permodalan Nasional Berhad (“PNB”);

ii) units trust schemes managed by Amanah Saham Nasional Berhad (“Schemes”); and

iii) Employees Provident Fund Board (“EPF”).

As at 25.02.2009

After the Proposed Rights Issue

(%)

No of

shares

(million)

Market Value

(RM million)(b)

(%)

No of

shares

(million)

Market Value

(RM million)(c)

Public spread(a)

44.3

2,162

8,821

38.1

2,696

9,873

Free float

30.6

1,494

6,096

24.4

1,727

6,323

Domestic retail free float

10.7

522

2,130

8.5

602

2,203

The free float in number of shares will be higher post Rights Issue

(a)

(b)

(c)

Includes EPF as permitted under the Listing Requirements of Bursa Securities but excludes PNB and the Scheme

Based on the closing price of Maybank shares as at 18.3.2009 of RM4.08 per share

Assuming market capitalisation of approximately 25,914 million (after taking into account the RM6.0 bil to be raised)

17

Q4:

Please clarify the Group’s gearing position as it would increase

from 0.44 times to 0.58 times.

Reply

As at 30 June 2008

After raising funds

totalling RM9.1 billion

After completion of

Rights Issue

0.44 times

0.77 times

0.58 times

The CAR reflects strength of financial institutions; not the conventional

gearing computation.

Post Rights, Maybank’s core capital and risk weighted capital ratios

increase to 11.0% and 16.4% respectively.

Maybank’s capital position will be the best-in-class post rights, allowing it

to capture growth opportunities.

18

Q&A

19

THANK YOU

20