1 Absolute Advantage and Exchange Rates (comments) Let us

advertisement

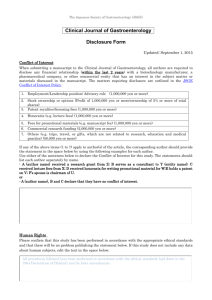

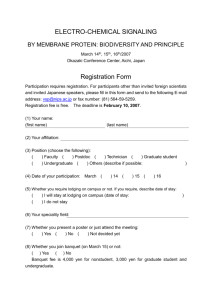

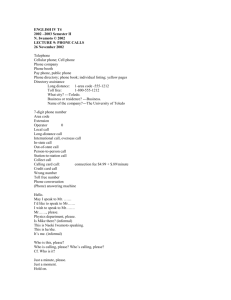

Absolute Advantage and Exchange Rates (comments) Let us suppose that the Japanese yen has depreciated substantially against the Vietnamese dong, raising the yen price of Vietnamese rice from PV to PV’ yen. The absolute advantage has now switched from Vietnam to Japan, and rice is exported from Japan to Vietnam. Let us also suppose that similar changes have happened to a number of other goods, tipping the trade balance between the two countries into Japan’s surplus. Figure 1 Absolute advantage and the exchange rate Vietnam Japan P P V S’ S J V P’ V S J P P V D’ D D Q Q This exchange rate-induced trade imbalance is unlikely to remain indefinitely, however. Why this is so can be understood by considering what will happen subsequently in the foreign exchange market. While the foreign exchange market is a market for money rather than goods and services, it can be analyzed using the same demand-supply diagram. Panel (a) of Figure 2 depicts Japan’s market for apples. The vertical axis plots the yen price of one apple, whereas the horizontal axis measures the number of apples traded. Panel (b) depicts the exchange market for yen and dong. Here the vertical axis plots the yen price of one dong, which is nothing but the yen/dong 1 exchange rate, while the horizontal line measures the amount (value) of dong to be exchanged for yen. Figure 2 Markets for goods and money (b) The Dong Market (a) The Apple Market E P S S Excess supply P’ E’ P E D’ D D Q (apple) Q (dong) Excess supply For ordinary goods like rice and apples, it is natural to assume that the demand curve is downward-sloping while the supply curve is upward-sloping. These properties are likely to hold in the foreign exchange market as well. Japanese firms importing goods from Vietnam exchange yen into dong and send this dong to their trade partners in Vietnam.1 Similarly, Vietnamese firms importing goods from Japan purchase yen in the exchange market and use this yen to settle their accounts. As the yen becomes more depreciated (i.e., as E increases in panel (b)), Vietnamese goods become more expensive in yen, increasing Japan’s exports while reducing its imports. It is thus likely that the demand and supply curves for dong are also downward-sloping and upward-sloping, respectively.2 Let us suppose that PV and PV’ in Figure 1 correspond to E and E’ in Figure 2(b), respectively. At the exchange rate of 1 dong = E’ yen, the supply of dong far exceeds the demand for it, 1 Although Vietnamese firms may agree to be paid in yen, these firms will then have to convert yen into dong. Therefore, whether trade is settled in yen or dong will only change who will participate in the foreign exchange market and will not alter the positions of the demand and supply curves. 2 In foreign exchange market, there is a possibility that the supply curve becomes downward-sloping, a possibility that is related to a phenomenon called J-curve effect. However, this is only a transitory phenomenon and does not affect the analysis that follows. 2 reflecting the fact that Japan now exports to Vietnam much more than it imports from Vietnam. In the market for ordinary goods, an excess supply will be eliminated by a falling price, perhaps after a certain period of time. In the foreign exchange market, in contrast, this process is likely to take place quickly because individual transactions are completed instantaneously. As the exchange rate reverts to the original level, so does the yen price of Vietnamese rice. The above analysis suggests that in the long run, a country cannot have an absolute advantage in everything. In countries whose currency is floated in the exchange market, the exchange rate will adjust to a level at which these countries possess an absolute advantage in some goods and an absolute disadvantage in other goods, so that their exports and imports remain roughly in balance. What will happen if the Japanese government refuses to let the exchange rate adjust from S’ to S? In Figure 2, the exchange rate of 1 dong = S’ yen can be sustained only if the Japanese monetary authorities buy up all excess supply of dong, that is, if the Japanese authorities pushes the demand curve from D to D’. This implies that the monetary authorities can keep the domestic currency more depreciated than its equilibrium value only by issuing domestic currency continuously. If the Japanese government succeeds in keeping the exchange rate at 1 dong = E’ yen, however, Japanese firms will have to raise their output to meet increasing demand. These firms will then start employing more factors of production such as labor and capital, bidding up their prices. This upward pressure on factor prices is strengthened by the fact that the Japanese monetary authorities are now expanding the supply of yen. In due course, then, the Japanese firms will start raising the price of their output, so as to cover their increased costs. In Figure 3, this process is depicted as an upward shift of the supply curve. The demand curve is likely to shift up, too, since the average Japanese worker now earns more income because of his/her higher wage rate. These processes are likely to continue until the Japanese price rises to a level comparable to PV’.3 3 Although in Figure 3 Japan’s demand and supply schedules shift up by the same proportion, this is not necessarily the case. 3 Figure 3 Adjustment of domestic prices Vietnam Japan P P V S’ S’ J S J V P’ J P P V D’ D’ D Q Q The above analysis suggests that even if a country maintains a fixed exchange rate, an imbalance in its external trade will be corrected eventually by natural economic force. As is explained in Chapter 3 of the textbook, what individual countries export and import in the long run are determined not by their absolute advantage but by their comparative advantage. It should be noted, however, that the adjustment of the domestic prices of goods and production factors is likely to be much slower than that of the exchange rate. This is why the United States (and other countries) often demand their trade partners to float or revalue their currencies, rather than wait quietly until inflation in the latter countries erodes their price competitiveness. 4