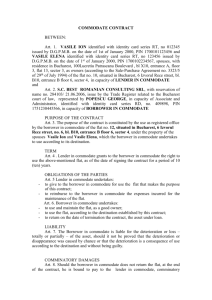

TERM PROMISSORY NOTE

advertisement

TERM PROMISSORY NOTE July 1, 2011 Amount: Interest: Maturity: $650,000.00 Variable rate at 1.00% over the Prime Rate and subject to the Rate Restriction mentioned below. June 30, 2014 FOR VALUE RECEIVED, the undersigned, Griffin Leased Housing Associates I, Limited Partnership, a Minnesota limited partnership ("Borrower"), promises to pay to the order of Drake Bank, a Minnesota banking corporation ("Lender"), at St. Paul, Minnesota, or such other place as the Lender or any other holder of this note may designate in writing, on or before June 30, 2014 ("Maturity"), the principal sum of Six Hundred Fifty Thousand and 00/100 Dollars ($650,000.00), together with interest on any and all amounts remaining unpaid thereon from time to time from the date hereof (computed on the basis of actual days elapsed in a year of 360 days) at a variable rate equal to one percent (1.00%) in excess of the Prime Rate and subject to the Rate Restriction, as those terms are hereinafter defined. "Prime Rate" for the purposes hereof shall mean the Prime Rate as published from time to time in the Wall Street Journal, under "Money Rates". All changes in the interest rate caused by a fluctuation in the Prime Rate shall become effective automatically on the same date that the change in the Prime Rate became effective; provided, however, the rate of interest hereon shall never exceed the highest rate permitted by law. In the event the Wall Street Journal ceases to publish the Prime Rate, Prime Rate for the purposes hereof shall mean the prime rate of interest quoted in the Federal Reserve Statistical Release H.15, under "Selected Interest Rates". Notwithstanding the foregoing, the rate of interest hereon shall never be less than six percent (6.00%) and shall never be more than eight percent (8.00%) at any time during the term of this note ("Rate Restriction"). Accordingly, the applicable interest rate of this note on the date hereof is six percent (6.00%). Monthly principal and interest payments in the amount of Twelve Thousand Five Hundred Fifty Six and 00/100 Dollars ($12,556.00) shall be made commencing on July 31,2011, and continuing on the last day of each and every month thereafter until May 31, 2014 ("Monthly Installment"). The entire unpaid principal, accrued but unpaid interest and any other charges due hereon shall be fully due and payable on the Maturity date. The Monthly Installment is calculated and based upon an assumed amortization of sixty (60) months. The Lender reserves the right to adjust the amount of the Monthly Installment based upon a fluctuation in the Prime Rate, and subject to the Rate Restriction, to that amount (rounded up to the nearest whole dollar) which would completely amortize the unpaid principal balance of this note as of the date of said adjustment based upon an assumed amortization of sixty (60) months, less the number of months that have elapsed from the date hereof. Contemporaneously with the execution of this note, the Borrower shall pay to the Lender an origination fee in the amount of Six Thousand Five Hundred and 00/100 Dollars ($6,500.00), together with all other costs associated with this note and the Mortgage described below due Lender and third parties at closing. This note is the Note referred to in and is secured, in part, by that certain Georgia deed to secure debt, security agreement and assignment of rents of even date herewith, executed by the Borrower, in favor of the Lender ("Mortgage"). Unless otherwise defined herein, all capitalized terms used in this note shall have the same meanings as defined in the Mortgage. If the Lender, or any other holder of this note, has not received the full amount of any Monthly Installment provided for in this note, by the end often (10) calendar days after the date it is due, Borrower shall pay a late charge fee to the Lender, or any other holder of this note. The amount of the late charge fee shall be five percent (5.00%) of the overdue Monthly Installment. The Borrower shall pay this late charge fee on demand, however, collection of the late charge fee shall not be deemed a waiver of the Lender’s right to declare an Event of Default and exercise its rights and remedies as provided for in the Mortgage. Each Monthly Installment and other payments made under this note shall be applied as follows, (i) first, to be applied against and pay interest which has accrued and remains unpaid on the date the payment is received, then (ii) to be applied against and pay unpaid late charges and any other charges, including attorneys’ fees and protective advances, and then (iii) all remaining amounts, if any, shall be applied against and reduce the then outstanding principal balance of this note. If an Event of Default shall occur under the Mortgage and any cure period provided for in the Mortgage has expired, the Borrower agrees to pay a default rate of interest equal to three percent (3.00%) in excess of the applicable interest rate set forth herein until such Event of Default is cured, and the entire principal amount outstanding, accrued interest and any other charges due hereon shall at once become due and payable at the option of the Lender or the holder hereof. Any failure of the Lender to exercise such option to accelerate this note at any time shall not constitute a waiver of the right to exercise the same right to accelerate at any subsequent time. The Borrower may prepay the principal under this note at any time and from time to time, in whole or in part, without premium or penalty. No partial prepayment shall postpone the due date of any Monthly Installment or reduce the amount of any such Monthly Installment unless the Lender agrees otherwise in writing. All sums payable to the Lender under this note shall be paid in immediately available funds. The Borrower promises to pay all costs in connection with the preparation, interpretation or enforcement of this note, including but not limited to, those costs, expenses and attorneys’ fees of Lender whether or not suit is filed with respect thereto and whether or not such cost or expense is paid or incurred or to be paid or incurred prior to or after the entry ofjudgrnent or for the pursuance of, or defense of, any litigation, appellate, bankruptcy or insolvency proceeding. Presentment, notice of dishonor and protest are hereby waived by all makers, sureties, guarantors and endorsers hereof. This note shall be the joint and several obligation of all makers, sureties, guarantors and endorsers and shall be binding upon them, their heirs, personal 2 representatives, successors and assigns. This note shall be governed by and be construed under the laws of the State of Minnesota, without regard to principles of conflicts of law. IN WITNESS WHEREOF, the undersigned has caused this note to be executed as of the day and year first above written. Griffin Leased Housing Associates I, Limited Partnership (a Minnesota limited partnership) By: Griffin Leased Housing Associates I, LLC (a Minnesota limited liability company) Its: General Partner Name: Paul Title: STATE OF MN R. Sween Vice President .) ) SSo COUNTY OF Hennepin The foregoing instrument was acknowledged before me this 29th day of June , 2011, by Paul R. Sween ., the Vice president of Griffin Leased Housing Associates I, LLC, a Minnesota limited liability company, the General Partner of Griffin Leased Housing Associates I, Limited Partnership, a Minnesota limited partnership, on behalf of the limited partnership. ~l.~l;~ ~ NOTARY PUBLIC MINNESOTA ......... This is the signature and notary page to that certain Term Promisso~ Note dated 2011.