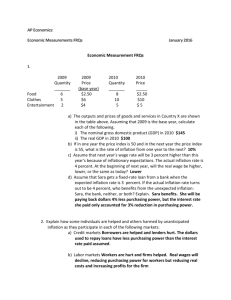

3. Inflation is the Real Risk

advertisement

3. Inflation is the Real Risk “Successful Retirement” - a lifestyle-sustaining income and a legacy for those you love Do you know your Successful Retirement Number? Successful Retirement Concepts: 1. We are Living Longer than We Think 2. Inflation is the Real Risk 3. Rising Income Investments are the Solution 4. Appropriate Investing Behaviour is Key Loss of Purchasing Power The biggest challenge to a 30 year retirement is inflation or the rising cost-of-living. This results in the loss of purchasing power because our dollar is able to buy less and less. As the red line in the chart shows, the purchasing power of $1 in the U.S. in the year 2000 had eroded to $0.79 by 2010, a loss of 21% over a 10 year period. Stocks are NOT Risky Over the Long Term Despite the previous fact, many of us worry about keeping our principal (investment capital) safe instead of keeping our purchasing power safe. We make the mistake of believing that “stocks are too risky” for retirement and that bonds or fixed income are “safe”. In the short-term, we do have a higher chance of losing our principal when investing in stocks. However, in the long term, the risk of losing principal from a broadly diversified portfolio of equities (stocks) actually reduces to zero. (And remember, we have much longer time horizons than we think!) Simply stated, it means that over a long period of time, the risk of losing capital from owning a portfolio of well-diversified equities is negligible. This interesting phenomenon is shown in the graph below by Morningstar. Between 1926 and 2013, the US stock market, with dividends reinvested, did not produce a negative return when averaged over any 15 year period. The data suggest that if we hold quality, well-diversified equities for 15 or more years, we will likely not suffer a loss. Therefore, the risk of losing capital over the long term when holding stocks, reduces to zero. This can be illustrated by the following graph where the orange dot on the RISK axis shows stocks can be highly risky in very short timeframes (days, weeks, months), but over long periods of time (decades), the risk decreases to zero, as shown by the orange dot on the TIME axis. Inflation is the Real Risk Meanwhile, the risk of losing purchasing power due to inflation, represented by the red dot at the bottom left hand corner of the graph below, is extremely low in the first year of retirement. Yet over time, the risk of inflation (rising cost-of-living) increases and it has no finite limit! RISK Risk of Losing Principal “Principal Risk” Risk of Inflation “Purchasing Power Risk” TIME According to Morningstar, the long-term inflation rate in the United States for the past 86 years (19262012) has been 3%. This means that to sustain a lifestyle which requires $60,000 income today, $93,000 would be needed in 15 years and $145,000 in 30 years. (assuming a 3% inflation rate) Conclusion When we realize we may be retired for 30+ years, it becomes easier to understand the real risk to a lifestyle-sustaining income is Inflation, and not the risk of Losing Principal (investment capital) because it reduces to zero over long periods of time, as the above graph shows. So in summary: 1. our everyday cost-of-living will never stop rising 2. over a long period of time, the risk of losing money from a broadly diversified portfolio of equities reduces to zero 3. inflation, not stock volatility, is the real threat to our long-term purchasing power Yet, many of us spend too much time and energy worrying about the volatility of our investment portfolios with the mistaken belief that volatility means losing our principal. It’s only when we realize that the real risk is losing our purchasing power through inflation that we can start making truly great investment portfolio decisions. Read about the solution to inflation in the next article of this series. Capital Concepts Group at HollisWealth is committed to helping you achieve your Successful Retirement. Call us. Suite 1030 – 4720 Kingsway, Metrotower 2, Burnaby, BC V5H-4N2, (604) 432-7743, info@capitalconceptsgroup.ca This article was prepared solely by Chad Ekren who is a registered representative of HollisWealthTM (a division of Scotia Capital Inc., a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada). The views and opinions, including any recommendations, expressed in this article are those of Chad Ekren alone and not those of HollisWealth. Capital Concepts and Capital Concepts Group are personal trade names of Chad Ekren. TM Trademark of The Bank of Nova Scotia, used under license.