130612 syllabus - ssf lse summer

advertisement

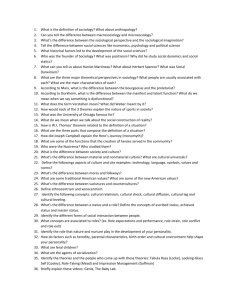

FINAL SYLLABUS MG301: Firms, Markets and Crises: Foundations of the Social Studies of Finance The London School of Economics and Political Science Department of Management, Summer School 2013 Dr. Daniel Beunza (Course Leader, Management, LSE) Professor Yuval Millo (U. of Leicester) Dr. Juan Pablo Pardo-Guerra (Sociology, LSE) Session: One Prerequisites: A university level introductory course in sociology, anthropology, psychology, political science, management or economics. Lecture Time: 10.00 am – 1.00 pm Class Teacher: Chris Moos Speaker Liason: Nina Andreeva Class Time: 2.00 pm – 3.00 pm This course focuses on the financial sector and financial markets. It discusses current research in the social sciences on how this sector has emerged and operates with an emphasis on sociology. It also sheds light on the recent financial crisis, including mortgage derivatives and the sovereign debt crisis. In each lecture, faculty will discuss a major aspect of or issue in the financial sector. The classes will use readings or cases to explore these matters in greater depth. The course offers novel alternatives to orthodox economics and behavioral finance. This includes a social network/ embeddedness perspective that examines the role of financial intermediaries such as financial analysts. This is complemented by an institutionalist / cultural perspective on financial markets. The third primary perspective offered in the course centers of the recent research on financial markets by sociologists of science and technology, and the concept of performativity. The framework covers key analysis components such as: • • • • Market formation Financial markets and society in a historical-organizational perspective Hedge funds and social networks The performativity of economic theory The framework is then applied to: • • • Promises and pitfalls of financial models Managing traders in a world of bias Socially responsible investment 1 FINAL SYLLABUS This course should hence appeal to students interested in corporate finance, equity search, fund management, and strategy consulting. Text: MacKenzie, D. Material Markets. How Economic Agents Are Constructed by, Oxford University Press, 2009 Lectures: 36 hours Classes: 12 hours Assessment: One written examinations Dr. Daniel Beunza 4.21 New Academic Building Tel. 020 7106 1146 d.beunza@lse.ac.uk Office hours: Tuesdays 3:00 pm to 4:00 pm and by appointment. For more details, see: http://www2.lse.ac.uk/study/summerSchools/summerSchool/courses/management/MG30 1.aspx 1. What is the social studies of finance I? Market Devices (Beunza, July 8th) Beunza, D. and David Stark. 2004. “Tools of the trade: the socio-technology of arbitrage in a Wall Street trading room.” Industrial and Corporate Change, 13(2): 369-400 Knorr Cetina, K. 2003. “From Pipes to Scopes: The Flow Architecture of Financial Markets.” Distinktion. 7: 7-23 Case: Long Term Capital Management. Read: Lewis, Michael. 1999. How the eggheads cracked. New York Times Magazine (January 24): 24-31, 42, 67, 71, 77. 2. What is the social studies of finance II? Performativity (Millo, July 9th) MacKenzie, Donald and Yuval Millo 2003. Constructing a market, performing theory: the historical sociology of a financial derivatives exchange. American Journal of Sociology. 109 (1): 107-145 Callon, M. 1998. “Introduction: the Embeddedness of Economic Markets in Economics.” Pp. 1-57 in The Laws of the Markets. Edited by Michel Callon. Oxford: Blackwell. Case: Porsche-Audi 3. What is the social studies of finance III? Controversies (Beunza, July 10th) 2 FINAL SYLLABUS Beunza, Daniel and Garud, Raghu 2007. Calculators, lemmings or frame-makers? the intermediary role of securities analysts. The sociological review. 55 (s2) pp. 13-39. ISSN 0038-0261 Zuckerman, E. W. 2004. “Structural Incoherence and Stock Market Activity.” American Sociological Review. 69:405-32. Case: Barings collapse (A): Breakdowns in Organizational Culture & Management IMD-1-0155 Hamilton, Stewart; Marchand, Donald A., Bernard, Alicia 4. Social networks in finance (Beunza, July 11th) Baker, Wayne. 1984. The Social Structure of a National Securities Market. American Journal of Sociology 89: 775-811 Uzzi, Brian. 1999. Embeddedness in the Making of Financial Capital: How Social Relations and Networks Benefit Firms Seeking Capital. American Sociological Review. 64(4): 481-505. Case: Leading the Josie Esquivel Franchise (A) by Boris Groysberg, Laura Morgan Roberts Source: Harvard Business School. 21 pages. Publication Date: Nov 21, 2003. Prod. #: 404054-PDF-ENG (No lecture on July 12th) 5. Promises and pitfalls of financial models (Beunza, July 15th) Beunza, D. and Stark, D. (2012). From Dissonance to Resonance: Cognitive Interdependence in Quantitative. Economy and Society, 41 (3): 383-417. Donald MacKenzie and Taylor Spears, 2012. 'The Formula That Killed Wall Street'? The Gaussian Copula and the Material Cultures of Modelling. Willman, P., Fenton O’Creevy, M. Nicholson, N. and Soane, E. 2002. Traders, Management Behaviour and Loss Aversion in Investment Banking; A Field Study, Accounting, Organisations and Society. 27: 85-98 Case: PBS “Frontline: Inside the Meltdown” http://www.pbs.org/wgbh/pages/frontline/meltdown/view/ 6. Market automation (Pardo-Guerra, July 16th) Pardo-Guerra, J.P. 2010. Creating flows of interpersonal bits: the automation of the London Stock Exchange, c. 1955-90. Economy and Society, 39 (1): 84-109. ISSN 14695766 3 FINAL SYLLABUS MacKenzie, D. and Pardo-Guerra, J.P. 2013. Insurgent capitalism: Island, bricolage and the re-making of finance. Forthcoming in Economy and Society. Case: International Securities Exchange (Harvard Business School 9-203-063) 7. Understanding the credit crisis (Beunza, July 17th) MacKenzie, D. 2011. The Credit Crisis as a Problem in the Sociology of Knowledge, American Journal of Sociology 116: 1778-1841. Poon, M. 2009. From New Deal Institutions to Capital Markets: Commercial Consumer Risk Scores and the Making of Subprime Mortgage Finance. Accounting, Organizations and Society 34: 661-2. Case: Bear Stearns (Harvard Business School Case UV1065). 8. Socially responsible investment (Beunza, July 18th) Ferraro F. and D. Beunza. 2013. Understanding Voice: Mechanisms of Influence in Shareholder Engagement. Manuscript. London School of Economics, February 2013. Bartley, Tim. 2007. Institutional Emergence in an Era of Globalization: The Rise of Transnational Private Regulation of Labor and Environmental Conditions." American Journal of Sociology 113(2):297-351 (2007). Case: “Driving Sustainability at Bloomberg L.P.” Harvard Business School Case. Prod. #: 411025-PDF-ENG. 9. Culture (Beunza, July 19th) Ho, Karen. 2005. Situating Global Capitalisms: A View from Wall Street Investment Banks. Cultural Anthropology 20(1): 68-96. Zaloom, Caitlin 2003. Ambiguous numbers: Trading technologies and interpretation in financial markets. American Ethnologist 30: 258–272. Case: Rob Parsons at Morgan Stanley A. Harvard Business School Case 9-498-054 10. SSF and public policy (Beunza, July 22nd) Beunza, D. and Millo, Y. 2013. “Folding: Integrating Algorithms into the Floor of the NYSE.” Manuscript 4 FINAL SYLLABUS Beunza, D. Millo, Y. MacKenzie, D. and Pardo-Guerra JP. 2010. Impersonal efficiency and the dangers of a fully automated securities exchange. Foresight driver review, DR11. Foresight, London, UK. Case: Karen Leary A. Harvard Business School Case 9-487-020 11. Looking ahead (Beunza, July 23rd) Callon, M. 2007. “What does it mean to say that economics is performative?” in D. MacKenzie et al., Do Economists Make Markets? Pp. 311–357. Zuckerman, Ezra W. 2012. “A Sociological Approach to Market Efficiency.” in K. Knorr-Cetina and A. Preda eds., The Oxford Handbook of the Sociology of Finance. Case: The performativity debate: Teppo Felin, “mackenzie seminar – theory or just-so stories?” Available at http://orgtheory.wordpress.com/2006/11/13/why-should-economicsociologists-care-about-performativity/ and Brayden King, “mackenzie seminar – why should economic sociologists care about performativity?” http://orgtheory.wordpress.com/2006/11/13/why-should-economic-sociologists-careabout-performativity/ 12. Review (Beunza, July 24th) Preda, Alex. 2001. Sense and Sensibilty, or How Should the Social Studies of Finance Behave. Economic Sociology European Electronic Newsletter 2 Case: Revision. (No lecture on July 25th) Final Exam: July 26th 5