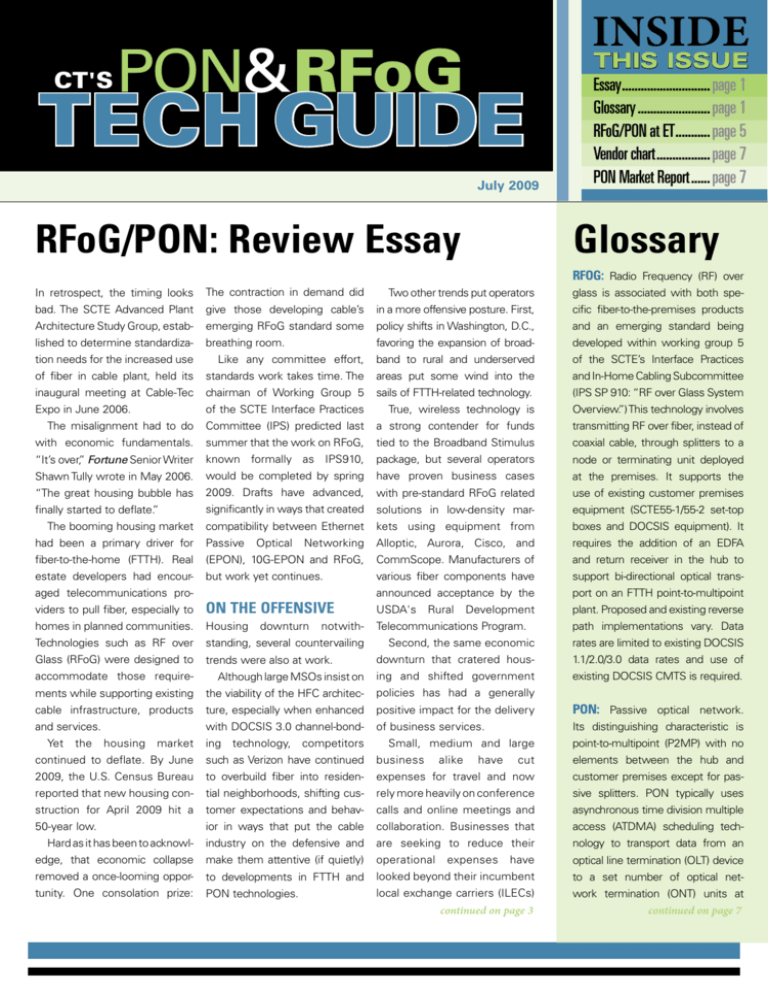

CT's

INSIDE

THIS issue

PON&RFoG

Tech Guide

July 2009

RFoG/PON: Review Essay

Essay............................. page 1

Glossary........................ page 1

RFoG/PON at ET............ page 5

Vendor chart.................. page 7

PON Market Report....... page 7

Glossary

RFOG: Radio Frequency (RF) over

In retrospect, the timing looks

The contraction in demand did

Two other trends put operators

glass is associated with both spe-

bad. The SCTE Advanced Plant

give those developing cable’s

in a more offensive posture. First,

cific fiber-to-the-premises products

Architecture Study Group, estab-

emerging RFoG standard some

policy shifts in Washington, D.C.,

and an emerging standard being

lished to determine standardiza-

breathing room.

favoring the expansion of broad-

developed within working group 5

tion needs for the increased use

Like any committee effort,

band to rural and underserved

of the SCTE’s Interface Practices

of fiber in cable plant, held its

standards work takes time. The

areas put some wind into the

and In-Home Cabling Subcommittee

inaugural meeting at Cable-Tec

chairman of Working Group 5

sails of FTTH-related technology.

(IPS SP 910: “RF over Glass System

Expo in June 2006.

of the SCTE Interface Practices

True, wireless technology is

Overview.”) This technology involves

The misalignment had to do

Committee (IPS) predicted last

a strong contender for funds

transmitting RF over fiber, instead of

with economic fundamentals.

summer that the work on RFoG,

tied to the Broadband Stimulus

coaxial cable, through splitters to a

“It’s over,” Fortune Senior Writer

known formally as IPS910,

package, but several operators

node or terminating unit deployed

Shawn Tully wrote in May 2006.

would be completed by spring

have proven business cases

at the premises. It supports the

“The great housing bubble has

2009. Drafts have advanced,

with pre-standard RFoG related

use of existing customer premises

finally started to deflate.”

significantly in ways that created

solutions in low-density mar-

equipment (SCTE55-1/55-2 set-top

compatibility between Ethernet

kets using equipment from

boxes and DOCSIS equipment). It

had been a primary driver for

Passive

Networking

Alloptic, Aurora, Cisco, and

requires the addition of an EDFA

fiber-to-the-home (FTTH). Real

(EPON), 10G-EPON and RFoG,

CommScope. Manufacturers of

and return receiver in the hub to

estate developers had encour-

but work yet continues.

various fiber components have

support bi-directional optical trans-

announced acceptance by the

port on an FTTH point-to-multipoint

USDA's

plant. Proposed and existing reverse

The booming housing market

aged telecommunications pro-

Optical

viders to pull fiber, especially to

On the offensive

homes in planned communities.

Housing

Technologies such as RF over

standing, several countervailing

Glass (RFoG) were designed to

trends were also at work.

downturn

notwith-

Rural

Development

Telecommunications Program.

path implementations vary. Data

Second, the same economic

rates are limited to existing DOCSIS

downturn that cratered hous-

1.1/2.0/3.0 data rates and use of

accommodate those require-

Although large MSOs insist on

ing and shifted government

existing DOCSIS CMTS is required.

ments while supporting existing

the viability of the HFC architec-

policies has had a generally

cable infrastructure, products

ture, especially when enhanced

positive impact for the delivery

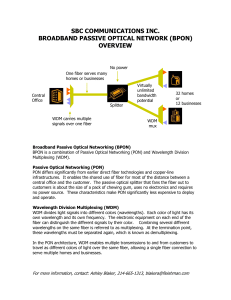

PON: Passive optical network.

and services.

with DOCSIS 3.0 channel-bond-

of business services.

Its distinguishing characteristic is

Yet

the

housing

Small, medium and large

market

ing technology, competitors

continued to deflate. By June

such as Verizon have continued

business

cut

elements between the hub and

2009, the U.S. Census Bureau

to overbuild fiber into residen-

expenses for travel and now

customer premises except for pas-

reported that new housing con-

tial neighborhoods, shifting cus-

rely more heavily on conference

sive splitters. PON typically uses

struction for April 2009 hit a

tomer expectations and behav-

calls and online meetings and

asynchronous time division multiple

50-year low.

ior in ways that put the cable

collaboration. Businesses that

access (ATDMA) scheduling tech-

Hard as it has been to acknowl-

industry on the defensive and

are seeking to reduce their

nology to transport data from an

edge, that economic collapse

make them attentive (if quietly)

operational

have

optical line termination (OLT) device

removed a once-looming oppor-

to developments in FTTH and

looked beyond their incumbent

to a set number of optical net-

tunity. One consolation prize:

PON technologies.

local exchange carriers (ILECs)

work termination (ONT) units at

continued on page 3

continued on page 7

alike

have

expenses

point-to-multipoint (P2MP) with no

Cisco Prisma D-PON

Your DOCSIS-Based Fiber-to-the-Home PON Solution

Meeting and Beating the Bandwidth Crunch

The Cisco® Prisma D-PON products offer you an industry-leading FTTH solution

specifically for DOCSIS-based service providers. The D-PON solution can provide

you with:

• Low-cost solution for master planned community (MPC) and greenfield growth

• Robust bandwidth – capable of supporting multiple DOCSIS devices and DOCSIS

3.0 channel bonding in the upstream through a 28dB link budget

• Future-flexible network – creating a low cost future upgrade path

• The advantage of leveraging existing back office infrastructure

• Industry-leading performance... it’s RFoG+

The Cisco D-PON solution enables DOCSIS 3.0 channel bonding for more

available bandwidth in the network, support of more bandwidth-intensive services

and increased data speed rates, fulfilling the consumer appetite for advanced

feature-rich entertainment and communications.

Learn more at www.cisco.com/go/dpon

RFoG/PON Review

continued from page 1

for better services and pricing.

of FTTP operations will look

DOCSIS Mediation Layer (DML)

The cable industry has been

increasingly like those they’ve

technology. In effect a middle-

The initial 10G-EPON standard

the beneficiary of much if not all

faced before with DOCSIS.

ware, it enables system vendors

will support a 10 Gbps down-

of that growth. Years of work in

This is the challenge of quickly

to run DOCSIS OSSI service

stream channel, 1 Gbps down-

the business services market—

deploying, provisioning and

interfaces,

and

stream channel (to be compatible

more than a decade for Cox

supporting services. Thus, the

PacketCable Multimedia on exist-

with existing EPON in place), and

Communications—has intensi-

still-emerging DOCSIS over

ing GigEPON and future, forth-

a shared 1 Gbps upstream chan-

fied across the board for opera-

EPON market.

coming 10G-EPON systems.

nel for both existing 1GigEPON

PacketCable

should follow.

tors and vendors alike. Several

In CT’s first RFoG/PON tech

This development at the chip

ONUs and new 10/1GigEPON

indicators would be the distance

guide, published last October,

level is likely to drive the pro-

ONUs. The 10Gbps capability

learning, telehealth and telep-

there was a single entry in

duction of additional products

opens the door for even more

resence exhibits seen in various

this

Hitachi

based on the same technol-

substantial and larger business.

venues at The Cable Show in

Communications’ Salira Systems

ogy, as it facilitates the entry

The standard also positions

April this year.

group. In April this year, two

of any systems vendor into the

10G-EPON as the most suitable

category

from

So while FTTH has been

months after Motorola became

MSO market. Dozens of ven-

and scalable access technol-

put on the back burner, fiber

the exclusive distributor for

dors already are supplying tens

ogy for 4G cell tower backhaul

to the premises (FTTP)—or to

its RFoG products, Alloptic

of millions of ports in Japan,

services. EPON is already in

outposts of business prem-

announced the availability of its

Korea, and now China. (See

use for 2.5G and 3G cell tower

ises, even competitive ones,

DOCSIS PON Controller (DPC)

sidebar, page 7.)

backhaul in the United States

and abroad. With the shift to

“Several operators have proven business

cases with pre-standard RFoG... in

low-density markets.”

4G and focus on mobile broadband, the demand for backhaul

will push beyond the singledigit Gbps barriers of EPON,

GPON, and SONET.

Which technology will be

able to support the need for

hundreds of Mbps for multiple

sites on a single strand of glass?

such as cell towers—is grow-

software, designed to enable

At least some of the largest

ing significantly. As it happens,

DOCSIS provisioning and control

suppliers are likely to develop

it was in business services

of its EPON system.

those some products, with some

As mentioned, SCTE’s IPS

software accommodations, for

WG 5 continues its work on

the U.S. MSO market.

RFoG. The sustained appeal of

Possibly the only candidate for

that role is 10G-EPON.

that EPON first emerged as

In May, two months after

a solution in cable. For servic-

entering the RFoG market with

es beyond the capabilities of

its FTTMax 1000 optical network

DOCSIS 3.0 and RFoG, MSOs

unit (ONU), ARRIS launched an

Standards: IEEE, SCTE

are now looking to EPON as

EPON optical line terminal (OLT)

Meanwhile, the 10G-EPON stan-

by operating gateways at both

a way to serve those same

and EPON ONU as extensions

dard, IEEE P802.3av, is progress-

the hub and customer prem-

business customers.

to its CHP Max 5000 chassis.

ing as expected. The task force

ises site that would support

DOCSIS over EPON

Adding validity—and generat-

should complete its work early

existing forward and reverse

ing buzz at The Cable Show—was

this fall. Once the standard is

optical systems at the hub

As MSOs scale their busi-

an announcement at the event

approved, product announce-

site and coaxial-based devices,

ness services, the challenges

by chipset vendor Teknovus of a

ments and products themselves

including both unidirectional

editorial

editor Jonathan Tombes

(301) 354-1795, jtombes@accessintel.com

managing editor Ron Hendrickson

(303) 422-3373, rhendrickson@accessintel.com

contributing analyst Victor Blake

RFoG is the proposed capability to support FTTP or FTTH

design/production

senior art director Tzaddi Andoque (301) 354-1677

senior production manager John Blaylock-Cooke

(212) 621-4655

Access Intelligence

4 Choke Cherry Road, 2nd Floor, Rockville, Maryland 20850

3

and bidirectional set-top boxes

In a rural development with,

multi-access optical network.

the probability of a collision

and DOCSIS devices, at the

for example, a dozen or so

Unlike PONs, most RFoG tech-

(not in RF but) in the optical

customer premises.

homes in a 20 km span, RFoG

nology (including the proposed

domain is significantly higher.

could offer both a lower cost and,

RFoG standards) does not use

If that were not enough, the

with DOCSIS, more than enough

a scheduler.

variations in DOCSIS 3.0 con-

RFoG applications

In the potential greenfield mar-

bandwidth for 12 subscribers.

To keep costs down, most

figurations make it ever more

ket, RFoG is appealing because

Yet a combination of challeng-

RFoG systems on the mar-

of its light touch: In theory,

es continues to add on the com-

ket simply turn on (burst) an

Take DOCSIS 3.0 upstream

nothing in the system would

plexity to RFoG. Operators have

upstream laser whenever they

channel configurations, which

need to be changed except for

been surprised to find some

sense the beginning of an

allow for 3.2 MHz, 6.4 MHz,

the construction to the premis-

RFoG systems are only compat-

upstream DOCSIS or DAVIC

or 12.8 MHz wide channels

es. As discussed at the outset,

ible with DSG and DOCSIS and

transmission. These systems

in any variation adding up to a

however, greenfields have all

not DAVIC. Other RFoG systems

rely on the low data rates of

minimum of 12.8 MHz of com-

but dried up.

support DAVIC and DOCSIS 1.0,

DAVIC and DOCSIS and count

bined upstream channel band-

1.1, and 2.0, but do not support

on a statistically low chance

width. Vendors and operators

DOCSIS 3.0.

(improbability) of the simulta-

developing

neous transmission (collision)

must struggle with the bal-

of two devices.

ance between keeping RFoG

While that has left RFoG

without its largest expected

is

While economically proven

potentially useful for opera-

in certain cases, a solution with

tors that might want to offer

FTTH using RFoG does requires

In DOCSIS, this is a reason-

video services to fiber-based

expense, yet with no increase

able assumption because the

Ethernet customers. When the

in available bandwidth. Limiting

DOCSIS system itself manag-

market,

the

technology

challenging.

the

technology

cost low and the need for

forward compatibility.

An RFoG product not com-

bandwidth demands justify it,

DOCSIS over EPON is likely

to supplant RFoG as the FTTH

strategy of choice.

Yet RFoG will continue to be

useful for operators for as long

as there is an inventory of nonDOCSIS (DAVIC)-based set-top

boxes. With inventories in the

tens of millions, many of which

are new HD and HD-DVR systems, the technology will have

“When that transition (to IP) occurs is a

big question. One near-term appeal of

RFoG is its link to the installed base of

millions of non-DOCSIS set-tops.”

some shelf life.

An equally important application of RFoG is the use of

the future potential of such

es each of the clients to avoid

patible

FTTH in more rural develop-

a network by not supporting

a simultaneous transmission.

defeats one of the principal

ments. (See above.) As homes-

DOCSIS 3.0 is a difficult strat-

In the case of an actual colli-

goals of the initiative. If these

passed density drops, the cost

egy to support.

DOCSIS

3.0

sion, all of the data protocols

challenges can’t be met cost

of traditional HFC plant rises,

DOCSIS 3.0 having arrived,

allow for network level retrans-

effectively, RFoG may be rel-

as the number of amplifiers

some RFoG solutions are now

mission. DOCSIS 3.0 channel

egated to “video duty” for

and length of coax copper plant

outdated. Solutions being explored

bonding allows for the inde-

EPON and long-reach low-den-

rises. With the rising price of

could potentially support DOCSIS

pendent and possible simulta-

sity rural applications.

copper and falling fiber costs,

3.0, but with added cost.

neous transmission of multiple

most new rural development is

4

with

more cost-effective with fiber.

DOCSIS dilemma

Once the cost of active plant

upstream channels.

Conclusion

DOCSIS 3.0 is different

Long-term, DOCSIS over EPON

PONs typically employ some

from DOCSIS 1.1 and 2.0 in

appears to have cost-structure

powering and supporting oper-

type of scheduler to manage

that clients in a (shared) serv-

advantages. Even today, an

ational costs are considered,

the transmission and recep-

ing group can transmit at the

EPON ONU costs less than

passive fiber solutions become

tion from multiple transmitters

same time (albeit on differ-

an RFoG gateway (or R-ONU).

even more attractive.

and receivers on a shared or

ent channels). As a result,

continued on page 7

RFoG and PON at ET

Fiber continues to be a news

Management of Ethernet PON

layer to translate DOCSIS man-

RFoG

item. Passive optical network-

Infrastructure," and Oleh Sniezko,

agement into language the fiber

Sniezko's paper treats RFoG as

ing (PON) in particular is hot. A

CTO of Aurora Networks, present-

network can understand, thus

a hedge against competition. It's

late May report by the Dell'Oro

ed "RFoG—How to Make It Work

preserving the cable operator's

essentially transitional technol-

Group indicates that worldwide

and How to Expand It." Both deal

DOCSIS

ogy designed to facilitate moving

PON equipment revenues grew

with evolutionary approaches to

expanding bandwidth.

9 percent sequentially in the first

fiber, working with existing cable

Chen writes that DEPON can

same RF signals appearing at

quarter of this year. (For more,

infrastructure rather than doing

scale up available bandwidth

customer outlets as in HFC net-

see sidebar, page 7.)

a prohibitively expensive whole-

beyond the capabilities of current

works. RF signals are carried via

sale rip-and-replace.

DOCSIS 3.0 implementations

fiber to the premises, where they

and is cost effective. He also

transition to coax.

RF over Glass (RFoG) also

generated news, with several

investments

while

from HFC to FTTH, with the

vendors announcing products

DEPON

argues that the same concepts

Sniezko describes RFoG's

designed to support it. (For more

Chen's

a

can be extended to include simi-

current status, compares it

on RFoG vendors, see page 6.)

paper

advocates

DOCSIS over EPON (DEPON)

lar functionality for PacketCable

with HFC, analyzes ways to

Despite all that, there was

architecture designed to enable

1.5, PacketCable 2.0, PacketCable

make RFoG more appealing

relatively little emphasis on fiber

EPON fiber access networks

Multimedia, L2VPN, Business

to cable operators, and pres-

optics at the SCTE's Conference

to be managed by existing

Services over DOCSIS (BSoD),

ents some technical and archi-

on Emerging Technologies this

DOCSIS infrastructure and oper-

DOCSIS Set-top Gateway (DSG),

tectural solutions intended to

year. James Chen, CTO of Salira

ations support systems (OSSs).

and other operations built on the

improve RFoG’s performance

Systems, presented "DOCSIS

DEPON provides a middleware

DOCSIS foundation.

and ease of operation.

the FTTH solution

that fits perfectly

with existing HFC

Network

Interface

Device

(NID)

Back-Up

Power Supply

Network Interface

Unit (NIU)

Optical

Tap

Fiber Drop

Armored

Cable

Fiber Flat

Drop Cable

in Conduit

FTTH made simple!

TM

BrightPath is a simple approach to FTTH, employing reliable technology and

standard cable installation practices to allow cable operators to deploy FTTH in

new build areas without altering existing infrastructure.

®

- This cost effective RFoG system can be installed as needed within an HFC network

- The total system cost is highly competitive with advanced HFC systems,

especially in low density and rural areas

- Another innovation from a business partner

you already trust

©2009, CommScope, Inc. All Rights Reserved.

AB

®

800.982.1708

5

SubScribe for free to

Communications Technology is

a global resource that provides

broadband engineers, executives and

managers with reliable information

on technology trends, strategy,

implementation and best practices.

Sign up for a free SubScription

today by viSiting

www.omeda.com/ct

introducing

digital delivery of

Communications Technology is now available digitally!

Enjoy the ease and convenience of receiving and reading

each issue on your computer. The digital version delivers

the same look and feel of the print magazine and includes

all of the same information. In addition, you’ll enjoy the

following benefits:

❖ No software needed

❖ Clickable table of contents

❖ Easy keyword search

❖ Clickable links to advertisers

❖ Best of all, it’s FREE!

GO DIGITAL! Eliminate clutter in your mailbox and enjoy the interactive capabilities

only available online. You can even download each issue to your laptop!

to SubScribe for free, Simply viSit

www.omeda.com/ct

15161

Vendor Name

RFoG Only

EPON

DPON

(DOCSIS +

EPON) + RFoG

EPON

Aurora Networks

Cisco Systems

Commscope

RFoG

DPON

x

x

x

Report: PON Market Shines

The Dell'Oro Group's "Access Quarterly

Report" issued in May 2009 indicates

that worldwide PON equipment rev-

ECI Telecom

Huawei

ZTE

Pacific Broadband

Networks

Enablence

x

x

x

x

x

x

x

Hitachi Telecomm (Salira

Systems)

Arris Corporation

Alloptic Networks

x

x

x

x

x

x

enues grew 9 percent sequentially in

the first quarter of this year, despite a

weak global economy. The report indicates that both GPON and EPON had

robust sequential growth.

x

x

x

In a statement, Tam Dell'Oro, president of the Dell'Oro Group, said, "PON

revenue growth in the first quarter was

higher than what we had expected due

Note:

This list does not include EPON vendors that do not offer products for sale in the US. There are a

number of vendors that sell EPON products in Japan that do not offer them for sale in the US and do

not want to sell or support those products in the US.

to rapidly increasing EPON buildouts in

China, strong GPON ONT shipments

for Verizon's FiOS service, and continued strong EPON demand in Japan."

The report says that Mitsubishi

remained the leader in the overall

continued from page 4

PON market, benefiting significantly

With multiple suppliers and now off-the-

millions of non-DOCSIS set-tops. Or, at

from being the primary EPON sup-

shelf chipset and middleware solutions,

least, all RFoG products should be able to

plier to NTT, Japan's largest service

the economics of DOCSIS over EPON as

serve the base, as that is a major point the

provider. Alcatel-Lucent recaptured

a solution for 1Gbps now and 10Gbps later

of initiative.

the No. 2 position with higher GPON

looks even better.

Perhaps the most significant develop-

ONT shipments to Verizon. Huawei's

The key for DOCSIS over EPON suc-

ment during the last year has been the

revenue share nearly doubled from

cess will be a transition to DOCSIS based

effort to create compatibility for both

last quarter, and the company vaulted

set top boxes (Docsis Set-top Gateway) or

EPON and RFoG. Neither standards is yet

to the No.3 spot because of strong

ultimately a transition to IP-based video

complete, current drafts would allow for

EPON shipments to China, as well as

distribution. When that transition occurs

the operation of both in parallel on the

higher GPON shipments to custom-

is big question. One near-term appeal of

same fiber serving the same or different

ers in Europe and the Middle East.

RFoG is its link to the installed base of

customers.

Glossary

continued from page 1

the premises. Upstream signals

at 2.488 Gbps downstream and

(sometimes called GE-PON) to

ages a cable operator’s DOCSIS

are combined using a multiple

1.244 Gbps upstream. Verizon

support 1 Gbps symmetrical,

networks and operational sup-

access protocol. It is contrasted

began deploying GPON in late

with dual-speed EPONs capable

port systems (OSSs). While

with more capital-intensive point-

2007 and standardized on GPON

of 2.5 Gbps/1 Gbps. The IEEE

RFoG relies on a CMTS and RF

to-point (P2P) architectures.

for all new deployments in early

10 Gbps EPON study group

transport (over optical), DPON

2008. ITU-T SG15 (Study Group

(P802.3av) is completing work

moves the compatibility back

GPON: Gigabit PON (ITU-T 15) has adopted IEEE 10GigEPON on the first 10G/1G standard, to the OSS interfaces, making

G.984); the successor to BPON.

(P802.3av) as the foundation for

with chipsets expected in 2009.

an EPON OLT look and act like

It provides for transport of asyn-

Next Generation (NG) PON.

A number of cable operators

a CMTS. While eliminating the

already have deployed EPON to

need for the DOCSIS CMTS, it

chronous transfer mode (ATM),

time division multiplexing (TDM)

EPON: Ethernet PON (IEEE serve business customers.

offers compatibility for provision-

and Ethernet, but has shifted

802.3ah). EPON initially support-

ing and operations. Unlike RFoG,

over several years to primarily

ed 100 Mbps symmetric and

DPON OR DEPON: DOCIS over it will support EPON data rates

an Ethernet standard, operating

has evolved as Gigabit Ethernet

EPON. A combination that lever-

up to 10Gbps/1Gbps.

7

Convergence Enabled.

MISSION: To maintain an operationally efficient and cost effective infrastructure when adding new voice, video and

data services, and expanding the existing subscriber base.

SOLUTION: ARRIS network technologies and product platforms for all architectures, including

Supported architectures:

•

•

•

•

Hybrid Fiber Coax

Fiber to the premise

Extended Reach

Fiber Deep (Node + x)

Leading technologies:

•

•

•

CORWave and CORWave II multi wavelength plans for more services over as few as one fiber

RFoG and EPON solutions that co-exist over the same fiber

Variable output transmitters that allow output powers to be configured by the customer rather

than pre-ordered from the factory

Product platforms:

•

•

•

•

•

CHP Max headend optics - Indoor optical/RF conversion platform and components

Opti Max nodes - Outdoor optical/RF conversion platform and components

Flex Max Amplifiers - Outdoor RF amplification

FTTMax – Fiber to the premise RFoG and EPON platforms

Trans Max- Outdoor Optical long haul transmission platform and components

With over 50 years of commitment to the cable industry, ARRIS is a trusted partner and solution provider to

cable operators worldwide.

www.arrisi.com

Expect More from Your Network.