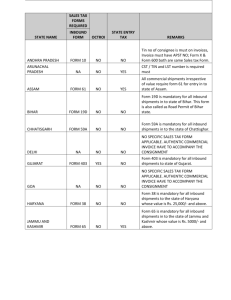

India - State wise Regulatory Requirements

advertisement

India - State wise Regulatory Requirements Sl No State/ Union Territory State Statutory requirement Forms Required for Value Equal to or ALL Entry Tax/ Octroi http://www.and.nic.in/ Required Sales Tax or VAT form No ( Imports only) 1 Andaman & Nicobar No extra paperwork requirement 2 Arunachal Pradesh Invoice must have APST No. on the Invoice ( Auranchal Pradesh Sales Tax No) 3 Andhra Pradesh Invoice must bear TIN No. of consignee Invoice must have APST Nos. (Andhra Pradesh Sales Tax #) Form X / ALL 600 is required. No https://www.apct.gov.in/apportal/ 4 Assam Taxable goods for resale / Form 61. Road permit / Form ALL 62. Tax Free goods / Form 60. Transit Form / Form 64. Yes Form 61 http://www.tax.assam.gov.in/Assa Form 62 mTimsInfo/index.html 5 Bihar Form D-IX (if value>INR 10K, bearing signature of Shipper, consignee and State Sales Tax Authorities. Consignee declaration for shipments for personal use e-Waybill with shipping detail and vehicle registration number is required. E- transit pass at shipment level is required INR 10000 Yes www.biharcommercialtax.gov.in/ 6 Chandigarh No extra paperwork requirement TIN No. is required for commercial shipments and for Individual shipments declaration is mandatory ALL No http://chandigarh.gov.in/welcome. NIL asp 7 Chhattisgarh TIN # of shipper and consignee required on invoice for all commercial shipments ALL Yes http://comtax.cg.nic.in/ TIN No 8 Dadra & Nagar Haveli No extra paperwork requirement ALL No http://www.dnhctd.gov.in/ NIL 9 Daman & Diu No extra paperwork requirement ALL No http://www.daman.nic.in/ NIL 10 Delhi Form T2 ,T-2 is applicable ONLY for goods purchased by Delhi registered dealer ALL No http://dvat.gov.in/website/home.ht Form T2 ml ALL No Sales Tax website No (Yes, applicable if TIN http://arun-taxexcise.nic.in/ /APST No. is missing) NIL APST No TIN No & Form X/ 600 Form D-IX Sl No State/ Union Territory State Statutory requirement Forms Required for Value Equal to or Entry Tax/ Octroi Sales Tax website Required Sales Tax or VAT form No ( Imports only) 11 Goa No extra paperwork requirement ALL No http://goacomtax.gov.in/ 12 Gujarat For outbound form no 402; for inbound form no. 403 and for transit form no. 404. Consignee declaration for shipment for personal use ALL No http://commercialtax.gujarat.gov.i Form 403 n/vatwebsite/index.jsp Form 404 13 Haryana No extra paperwork requirement ALL No http://www.haryanatax.com/ NIL Himachal Pradesh Only TIN no. on commercial invoice required for any inbound and outbound shipment For Non Commercial Shipments only Declaration/Affidavit is required. Entry tax can be charged in case the shipment is assessed to be commercial by sales tax. ALL No https://hptax.gov.in/HPPortal/ CST / TIN No Form 26 for Entry Jammu & Kashmir VAT Form 65 for all shipment INR 5,000 and above and for non commercial Declaration is required clearly mentioning value and stating items are for personal use. INR 5000 In case of mis-declaration, shipments are subject to tax and penalty. Yes https://jkcomtax.gov.in/JKPortal/ Form 65 Jharkhand For Inbound -Form JVAT 504G. For Outbound - Form 504 B For persons other than dealer’s application in ALL Form JVAT 502 and permit in JVAT 503. Transit pass in Form JVAT 508 No http://jharkhandcomtax.gov.in/co mmercialtax/ Karnataka For both inbound and outbound shipments, Tax Invoice & TIN # of consignor & consignee mandatory. All kinds of Automobile Parts & Accessories /Electrical Goods & Appliances of commercial in nature, should have Tax Invoice attached with e-Sugam Form. All kinds of shipments which are moved as Stock Transfer goods , e- ALL Sugam Form along with delivery challan is must.( as saleable goods company to company ). Additionally for inbound shipments if e-Sugam form is not available eSugam Form number must be mentioned on the Tax Invoice with consignee TIN#. Form JVAT 504G Form JVAT 502 Form JVAT 503 Form JVAT 508( Transit Pass) No http://ctax.kar.nic.in/ TIN No Form E-Sugam 14 15 16 17 NIL Sl No State/ Union Territory State Statutory requirement Kerala TIN/CST # of consignee required on invoice for all commercial shipments. Form 16 with consignee signature for shipments with value <=INR 5,000. Sales tax authorities’ signature for over INR 5,000 Govt. Departments self declared Form 16 with copy of PO. Transporter to carry Form 8F for shipment value >INR 5,000 while transporting goods within or across the state. Madhya Pradesh Form 49 for Commercial Shipments. VAT Form 60 is required in case goods are imported rail. Form 50 for Non Commercial Shipments 20 Maharashtra 21 Manipur 18 19 Forms Required for Value Equal to or Sales Tax website Required Sales Tax or VAT form No ( Imports only) Form 16 Form 8F ( Transporter) Form 8 No http://www.keralataxes.gov.in/ ALL No Form 49 (Air / https://mptax.mp.gov.in/mpvatweb Surface) / Form 60( Railways) Form 50 ( Individual) Octroi payment based on applicability by city and paid at the entry gate into the city. Recoverable from the consignee or shipper. N Form for transiting shipments. ALL Personal luggage exempted. LBT is applicable (Except Mumbai where Octroi is applicable) Yes http://mahavat.gov.in/Mahavat/inde CST / TIN No x.jsp No http://www.manipurvat.gov.in/ ST-27 ST 28 For Inbound commercial shipments- Form 27; For Outbound commercial shipments- Form 28 , INR 5000 Entry Tax/ Octroi ALL Meghalaya 4 copies of invoice and For Inbound - Form 40; For Outbound - Form 37 for taxable goods outside state. Form 35 for non taxable outside state; Form 35 is for non taxable goods & Form 40 is for taxable goods Transit pass in Form 38 4 copies of invoice and For Inbound - Form 33 , Form 34; For Outbound – N.A. ; Declaration & Form in form 32 & 33 and way bill in Form 34 ALL No http://megvat.nic.in/ Form 40 Form 37 Form 35 Form 38 Form 32 Form 33 Form 34 23 Mizoram All commercial shipments for Mizoram must have Form 33. Sales tax department issues this form to the registered dealers in Mizoram For Personal Shipment Form 34 is required. ALL No http://zotax.nic.in/ Form 33 / 34 24 Lakshadweep NIL NIL No http://lakshadweep.nic.in/welcome NIL .htm 25 Nagaland All commercial shipments for Nagaland must have Form 23. Sales tax department issues this form to the ALL registered dealers in Nagaland. No http://nagalandtax.nic.in/ 22 Form 23 Form 24 Sl No State/ Union Territory State Statutory requirement Forms Required for Value Equal to or Entry Tax/ Octroi Sales Tax website Required Sales Tax or VAT form No ( Imports only) 26 Orissa VAT Form 402 Invoice must bear TIN/CST# of registered dealer For Non Commercial VAT From 402A & Invoice ALL Yes https://odishatax.gov.in/ CST / TIN No Form 402 27 Pondicherry No extra paperwork requirement NIL No http://gst.puducherry.gov.in/ NIL 28 Punjab Invoice with Consignee TIN #. Carrier to provide Form 25 for transiting shipments. VAT 36 required for INR 10000 shipment value >=INR10,000 No https://www.pextax.com/PEXWA From 25 ( R/appmanager/pexportal/PunjabEx Transporter) cise Form 36 29 Rajasthan Form 47 for Commercial Shipments, Consignee declaration for shipments for personal use ALL Yes http://rajtax.gov.in/vatweb/ Form 47 30 Sikkim For both inbound and outbound - Form 25, Form 26, Form 34; Form 25 is for registered dealer Form 26 for any other person ALL No http://www.sikkimtax.gov.in/ Form 25 31 Tamil Nadu Invoice with Consignee CST# / TIN #. Transit pass in Form LL. form KK by CNF agent. ALL No http://www.tnvat.gov.in/ 32 Tripura For inbound- Form XXIV / XXVI; for outbound XXVII; Transporter/ carrier declaration in Form ALL No http://taxes.tripura.gov.in/ Form XXVI 33 Telengana Invoice must bear TIN No. of consignee Invoice must have APST Nos. (Andhra Pradesh Sales Tax #) Form X / ALL 600 is required. No https://www.apct.gov.in/apportal/ TIN No & Form X/ 600 34 Uttar Pradesh Form 38 with State Tax Dept Signature/Stamp , For non ALL commercial Form 39 Required No http://comtax.up.nic.in/main.htm Form 38 Form 39 35 Uttaranchal For inbound- Form 16/17; Trip Sheet in Form 18. Form ALL 16 is for registered dealer. No http://comtax.uk.gov.in/ Form 16 Form 17 36 West Bengal Form 50 / Form 50 A Yes ALL CST / TIN No Form 50 ( http://wbcomtax.nic.in/welcome.a Manual)Form 50A ( sp Electronic Generated)