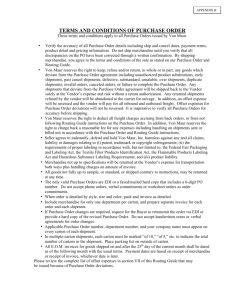

STATE NAME SALES TAX FORMS REQUIRED OCTROI STATE

advertisement

SALES TAX FORMS REQUIRED STATE NAME ANDHRA PRADESH ARUNACHAL PRADESH ASSAM BIHAR CHHATISGARH DELHI GUJARAT GOA HARYANA JAMMU AND KASHMIR INBOUND FORM FORM 10 NA FORM 61 FORM 19D FORM 59A OCTROI NO NO NO NO NO STATE ENTRY TAX REMARKS NO Tin no of consignee is must on invoices, Invoice must have APST NO; Form X & Form 600 both are same Sales tax Form. YES CST / TIN and LST number is required must YES All commercial shipments irrespective of value require form 61 for entry in to state of Assam. NO Form 19D is mandatory for all inbound shipments in to state of Bihar. This form is also called as Road Permit of Bihar state. NO Form 59A is mandatory for all inbound shipments in to the state of Chattisghar. NA NO NO NO SPECIFIC SALES TAX FORM APPLICABLE. AUTHENTIC COMMERCIAL INVOICE HAVE TO ACCOMPANY THE CONSIGNMENT FORM 403 YES NO Form 403 is mandatory for all inbound shipments to state of Gujarat. NO NO SPECIFIC SALES TAX FORM APPLICABLE. AUTHENTIC COMMERCIAL INVOICE HAVE TO ACCOMPANY THE CONSIGNMENT NO Form 38 is mandatory for all inbound shipments to the state of Haryana whose value is Rs. 25,000/- and above. YES Form 65 is mandatory for all inbound shipments in to the state of Jammu and Kashmir whose value is Rs. 5000/- and above. NA FORM 38 FORM 65 NO NO NO JHARKHAND KARNATAKA KERALA MEGHALAYA MAHARASHTRA FORM 65 NA FORM 8FA FORM 14 NA NO NO NO NO YES YES 1. Road Permit issued by the concerned authorities is mandatory for all inbound shipments in to the state of Jharkhand. This is issued to all registered dealers of goods. 2. Jharkhand Road permit is mandatory for all shipment outbound from the state of Jharkhand. How ever for goods which are received within the state and for delivery within the state the road permit is required only for consignments whose value is Rs, 50,000/- and above. YES 1.TIN /CST number of the consignee is mandatory on the invoice. All consignments of commercial value have to necessarily be accompanied by Invoice. 2. For all commercial shipments moving as stock transfer form 505/515 has to be provided YES 1. Kerala state sales tax number is to be mandatorily provided on the invoice /document for all inbound shipments in to the state of Kerala NO Form 14 (Road permit) is mandatory for all shipments inbound in to the state of Manipur. The form has to be collected from the consignee NO 1. All inbound shipments should be accompanied by Invoices and the Tin/CST number of the consignee should be clearly marked on them. 2. Octroi is applicable in Maharashtra. There are zones within Maharashtra where the octroi is applicable. 3. Octroi in the respective zones is applicable if brought in to the zone by various modes like Sea, Air , Rail and Road MADHYA PRADESH MANIPUR MIZORAM NAGALAND FORM 49/50 FORM 52 FORM 33 FORM 34 NO NO NO NO YES For all commercial shipments inbound in to the state of Madhya Pradesh Form 49(earlier Form No 88) is mandatory and for all non commercial/personal shipments, Form 50(earlier Form No 89) is to be provided. NO Form 52 (Road permit) is mandatory for all shipments inbound in to the state of Manipur. The form has to be collected from the consignee from the concerned NO Form 33 (Road permit) is mandatory for all shipments inbound in to the state of Mizoram. NO Form 34 (Road permit) is mandatory for all shipments inbound in to the state of Nagaland. ORISSA FORM 32 NO YES Form 32 (Waybill / Road permit) is mandatory for all shipments inbound in to the state of Orissa. PUNJAB FORM 25 YES NO TIN number is must and all inbound shipments must carry invoices.. NO NO SPECIFIC SALES TAX FORM APPLICABLE. AUTHENTIC COMMERCIAL INVOICE HAVE TO ACCOMPANY THE CONSIGNMENT NO Form 18A is mandatory for select list of shipments inbound in to the state of Rajasthan. NO Form 20 (Road permit) is mandatory for all shipments inbound in to the state of SIKKIM. NO TIN/CST/LST number is a must and all inbound shipments must carry invoices... PONDICHERY RAJASTHAN SIKKIM TAMIL NADU NA FORM 18A FORM 20 NA NO NO NO NO TRIPURA FORM 24 NO NO Form 24 (Road permit) is mandatory for all shipments inbound in to the state of TRIPURA. UTTAR PRADESH Form 38 & 39 NO NO Form 38 for Commercial shipments, Form 39 for Non-Commercial shipments UTTARANCHAL WEST BENGAL NO FORM 50 NO NO Form 16 for Commercial shipments, Form 17 for Non-Commercial shipments YES Inbound shipments must carry Form 50A ( I & II).