Microsoft 2006 10-K

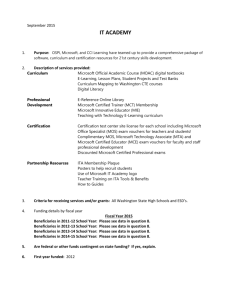

advertisement