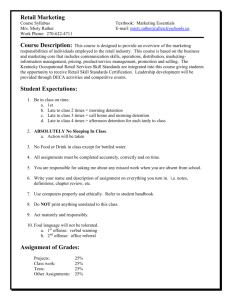

3 The number of HVR in Europe - EESC European Economic and

advertisement

The evolution of the high-volume retail sector in Europe over the past 5 years Final report Consultative Commission on Industrial Change Prepared by London Economics September 2008 The evolution of the high-volume retail sector in Europe over the past 5 years Final report Consultative Commission on Industrial Change Prepared by London Economics September 2008 Contents Page 1 Introduction 1 2 Methodology 2 3 The number of HVR in Europe 6 4 Turnover of HVR 9 5 Employment in HVR 18 6 Import penetration 27 7 Suppliers’ sales in HVR 30 8 Evolution of wholesale-retail price indices 31 9 Synoptic description of M&A 34 10 Conclusions 35 Annex 1 Firms included in the analysis (definition HVR1) 37 London Economics September 2008 i Tables & Figures Page Table 1: Data sources and definition of sectors of interest 4 Table 2: Number of HVR according to different definitions Food sector (2006) 7 Table 3: Number of HVR according to different definitions Clothing sector (2006) 8 Table 4: Top-10 European retail companies at national level (2006) 11 Table 5: HVR1 food sales 2003-2006 (EUR billion, 2006 prices) 12 Table 6: HVR1 clothing sales 2003 and 2006 (EUR billion, 2006 prices) 12 Table 7: Mergers and acquisitions in the food sector for selected countries 34 Table 8: List of firms included in the analysis (definition HVR1) Food Sector 37 Table 9: List of firms included in the analysis (definition HVR1) Textile Sector 38 Figure 1: Total food sales in selected countries 2003 and 2006 (EUR billion, 2006 prices) 9 Figure 2: Total sales of clothing in selected countries 2003 and 2006 (EUR billion, 2006 prices) 10 Figure 3: C5 for food retail sales (2003 and 2006) 14 Figure 4: C5 for clothing retail sales (2003 and 2006) 15 Figure 5: Share of turnover of HVR3 (food and department stores) 16 Figure 6: Share of turnover of HVR3 (other retail sub-sectors) 17 Figure 7: Number of employees in HVR3. Food and department stores (‘000) 18 Figure 8: Number of employees in HVR3. Other retail subsectors (‘000) 19 Figure 9: Share of employment in HVR3 (food and department stores) 20 Figure 10: Share of Employment in HVR3 (other retail subsectors) 21 London Economics September 2008 ii Tables & Figures Page Figure 11: Female employment in 2006 (in %) 22 Figure 12: Female participation (in %). Wholesale and retail sectors 23 Figure 13: Age distribution of employees Wholesale and retail sectors 24 Figure 14: Part-time employees in 2006 (in %). 25 Figure 15: Part-time employment (in %). 26 Figure 16: Imports as a percentage of domestic apparent consumption for the manufacture of food products and beverages 28 Figure 17 Imports as a percentage of domestic apparent consumption for the manufacture of wearing apparel 29 Figure 18: Suppliers' sales in HVR (as % of total production). 30 Figure 19: Ratio consumer to producer prices indices. Food (2001-2007). 32 Figure 20: Ratio consumer to producer prices indices. Clothing (2001-2007). 33 London Economics September 2008 iii Glossary Glossary Member State abbreviations CZ Czech Republic HU Hungary DE Germany PL Poland ES Spain RO Romania FR France UK United Kingdom IT Italy London Economics September 2008 iv Executive Summary Executive Summary The overarching aim of this study is to provide a complete and detailed insight of the evolution of high-volume retailers (HVR) in the food and clothing sectors in France, Germany, Italy, Poland, Romania, Spain, the UK, the Czech Republic and Hungary, over the last 5 years. The first stage of the analysis required an appropriate definition of HVR. Different definitions have been proposed and these depend on the information published by different data sources. The following definitions are being used: HVR1: HVR are firms having more than 5% of market share. HVR2: HVR are firms with turnover higher than EUR 200m. HVR3: HVR are firms which employ 250 persons or more. HVR4: HVR are the 5 largest firms (by turnover) in each retail sector of interest. Number of HVR The number of HVR has been calculated for the food and clothing sectors using different definitions and data sources. Definition HVR1 uses Mintel data and shows approximately 5 HVR per country in the food sector. The only exceptions are Poland and Romania with nil and one HVR, respectively (no comparable data is available for Hungary and the Czech Republic). The clothing sector is much more fragmented and shows only 3, 2 and 1 HVR in the UK, Germany and Italy, respectively (no data are available for Spain, the Czech Republic and Poland). Definitions HVR2 and HVR3 use Eurostat data. According to HVR2 there are 131, 55 and 52 HVR in the sector of food and department stores in Germany, Italy and the United Kingdom. There are only 2 and 8 HVR in Romania and Hungary, respectively. According to HVR3 there is a much larger number of HVR in all countries for the food and department stores. Concentration of HVR in Europe The C5 (combined market share of the top-5 firms) in the food retail market varies significantly between countries. The main findings are: London Economics September 2008 v Executive Summary Germany and the UK are the most concentrated markets with over 70% of the market controlled by the largest five firms. The French market is also comparatively concentrated, with a C5 of around 60%. In Italy, Spain and the Czech Republic, the C5 is between 30% and 45%. There have been significant increases in market concentration in the UK, the Czech Republic, Romania and Spain over the last three years. The clothing retail sector remains fragmented across the selected countries where data was available. The C5 in the UK is the highest with 35%, in Germany is second (around 25%), while in Italy and France the top-5 firms control less than 20% of the market. Employment in HVR The share of employment in HVR food and department stores is very different across Europe, according to definition HVR3. In the UK and Germany, HVR employ respectively more than 75% and 60% of workers in food and department stores. In Poland they employ about 20% and in Romania less than 5%. The proportion of employees working for HVR has increased in Spain, the UK and Eastern European countries. Import penetration in the retail sectors The proportion of imported food is generally higher in the Western countries, which show percentages around 20% for 2006 (24% is the highest in Germany and 18% the lowest in Spain). However, the proportion of imports in food consumption is rising quickly in Eastern European countries, especially in Hungary and the Czech Republic. Western countries show a very high import penetration in the clothing sector. The highest import penetration is observed in France and Germany, while the percentages for Spain and Italy are much lower. Suppliers’ sales in HVR The percentage of suppliers’ sales achieved through HVR has increased in every country but Germany and France, where it has remained almost constant. There are significant differences between countries: HVR share of suppliers’ sales ranges from 10% in Romania to 64% in Germany, in 2006. London Economics September 2008 vi Executive Summary Conclusions The main conclusions from the analysis are the following. The number of HVR (firms with more than 5% market share) in the food sector is around 5 in each country. Using other definitions, the number of HVR is the highest in Germany. The number of HVR in the clothing sector is the highest in the United Kingdom using several definitions. Indicators of market concentration show that the United Kingdom is the most concentrated market in both food and clothing sectors. In the food sector, market concentration has increased in recent years in every country but France and Germany, where it remains constant. In the clothing sector, market concentration has increased between 2003 and 2006 in Germany and Italy but has decreased in France and the United Kingdom. The number of employees working for HVR is by far the highest in the United Kingdom in food and department stores and in the other retail sub-sectors. In every country, the proportion of employees working for HVR is higher in the food sector than in other sectors (except in Romania). Female employment is generally higher (France is an exception) in the wholesale and retail sectors than in the economy as a whole. Female employment has stayed constant in recent years in all countries except in Germany where it has decreased. Part-time employment is more important in the wholesale and retail sectors in the UK and Germany, but not in the rest of countries. Recent trends show that part-time employment is increasing in Western Europe (except Germany where it has decreased) and stay constant in Eastern Europe. Import penetration is more important in the clothing sector than in the food sector. In both sectors, import penetration has generally increased over the recent years. Between 2001 and 2007 the margin between consumer and producer food prices widened in the Czech Republic, Spain, and Hungary, and narrowed in Romania. The margin between consumer and producer prices in the clothing sector narrowed mainly in the Czech Republic, the UK and Romania. London Economics September 2008 vii Section 1 Introduction 1 Introduction The overarching aim of this study is to provide a complete and detailed insight of the evolution of high-volume retailers (HVR) in Europe over the last 5 years. To this end, the study provides a synoptic analysis by compiling and cross-referencing the various existing data (including statistics, specialised literature and other sources) so as to describe the evolution of HVR in Europe. With this aim, the study starts with a definition of HVR, describes its time evolution, and investigates how HVR are impacting consumers and other suppliers and companies (e.g. small and medium enterprises). The original scope of the report was the European Union, with special focus on the largest Member States: France, Germany, Italy, Poland, Romania, Spain and UK. At request from CCMI we included two additional countries (Czech Republic and Hungary) to account for the recent growth of the Eastern European market. In this report we provide: Tables and figures for all the data collected across relevant subdivisions; An synoptic analysis of the data, presented according to the breakdown criteria given in the terms of reference; and Conclusions. The structure of the report is as follows: In section 2, we present the methodology and the various definitions of HVR used. In section 3, we show the number of HVR according to each definition. In the next two sections, we study the evolution of turnover and employment over recent years. In section 6, we analyse recent trends on imports of goods in Europe and in section 7, we analyse the proportion of suppliers’ sales achieved in HVR. In section 8, we discuss the evolution of wholesale-retail prices. In section 9, we report main merger and acquisition activity during the last four years in the relevant sectors. In the last section, we conclude by summarising the main findings of the report. London Economics September 2008 1 Section 2 Methodology 2 Methodology The first stage of the analysis requires the appropriate identification of HVR from secondary data sources as a basis for further analysis. Given the range of questions we are attempting to answer, we made use of a number of different data sources. Initially we sourced indicators from AMADEUS database, which is a comprehensive pan-European database containing financial information on over 8 million public and private companies in 38 European countries, including the 27 EU Member States.1 After analysing the data we found that the consolidated accounts for some of the major players were missing in different countries. We initially resolved this problem by aggregating the data of the different identified subsidiaries; however, it remained impossible to get meaningful data for some companies and especially for those operating under voluntary groups2, cooperatives, or franchises. In such cases data were not recorded in the AMADEUS database. Our second source of information has been the European Retail Book published by Mintel. We have been able to source data from 2004, 2005, 2006 and 2007 reports and have complemented our analysis with data from Eurostat. In particular we used the Structural Business Statistics (SBS), the Labour Force Survey, the harmonised indices of consumer prices, and Prodcom. The two sectors of interest, as defined by CCMI, are food and clothing. Unfortunately, the various data sources do not have a consistent definition for these sectors. However, to ensure the greatest degree of comparability, we made sure that for each data source the most appropriate sectoral definition was used. Data from Mintel uses “food, drink and tobacco” and “clothing, textiles and footwear” for reporting the sales of major retailers. Data from Eurostat is provided by sectors classified according to NACE. Hence, for food products we use “52.11: Retail sale in non-specialized stores with food, beverages or tobacco predominating”, and “52.2: Retail sale of food, beverages or tobacco in specialized stores”. For clothing we use “52.42: Retail sale of clothing”. 1 Bureau Van Dijk assembles data from a number of regional information providers and compiles them into a single database, which provides information in a standardised format that is comparable across countries. 2 A voluntary group is a wholesaler-sponsored group of independent retailers. A complete range of services is offered to retail members including centralized advertising and promotion, store location and store layout, training, financing, and accounting. London Economics September 2008 2 Section 2 Methodology Data from SBS for different company-size bands is only available at a very aggregated level. As a proxy for food, we use “G521: Retail sale in nonspecialized stores” and “G522: Retail sale of food, beverages, tobacco in specialized stores” (thereafter called “Food and department stores”). As an approximation for clothing, we use “G524: Other retail sale of new goods in specialized stores” (thereafter called “Other retail sub-sectors”). Consumer prices provided by Eurostat are available for “FOOD: Food including alcohol and tobacco” and “CP031: Clothing” and domestic producer prices are provided for “manufacture of food products; beverages and tobacco” and “manufacture of wearing apparel; dressing; dyeing of fur”. We use “Manufacture of food products and beverages” and “Manufacture of wearing apparel; dressing and dying of fur” for the data from the Prodcom database. A list of the data sources and sector definition is provided in Table 1. London Economics September 2008 3 Section 2 Methodology Table 1: Data sources and definition of sectors of interest Data source Food Clothing Mintel Food, drink and tobacco Clothing, textiles and footwear Eurostat “52.11: Retail sale in nonspecialized stores with food, beverages or tobacco predominating”, “52.42: Retail sale of clothing” “52.2: Retail sale of food, beverages or tobacco in specialized stores” SBS “G521 Retail sale in nonspecialized stores”, “G524 Other retail sale of new goods in specialized stores” “G522 Retail sale of food, beverages, tobacco in specialized stores” Prodcom Manufacture of food products and beverages Manufacture of wearing apparel; dressing and dying of fur CPI Eurostat FOOD: Food including alcohol and tobacco CP031: Clothing PPI Eurostat DA: Manufacture of food products; beverages and tobacco DB18: Manufacture of wearing apparel; dressing; dyeing of fur Definition of high-volume retailers Initially, we proposed several definitions to define HVR. Some of the definitions were based on turnover, number of employees or the annual balance sheet of the company. For example, one definition identified as HVR those firms with more than 250 employees. Another definition was based on the structure of the enterprise and considered as HVR firms that are not a small and medium enterprise (SME).3 3 Recommendation 2003/361/EC defines SME in the following way: “The category of micro, small and medium-sized enterprises (SMEs) is made up of enterprises which employ fewer than 250 persons and which have an annual turnover not exceeding 50 million euro, and/or an annual balance sheet total not exceeding 43 million euro.” Extract of Article 2 of the Annex of Recommendation 2003/361/EC. London Economics September 2008 4 Section 2 Methodology One problem with both definitions is that data on the number of employees and annual balance sheets are not available for a number of significant players in different countries. This is especially the case for buying or voluntary groups, cooperatives, and for players organised under franchises.4 Therefore, the proposed definitions are heavily conditioned by the way the different data sources publish the data. With this in mind, we have proposed the following definitions: HVR1: HVR are firms having more than 5% of market share. In some sources, data is available according to a breakdown that can be used to describe the HVR sector. For example, Eurostat provides data on employment based on different bands of turnover and employment. For the analysis of these data it is convenient to use the following two definitions: HVR2: HVR are firms with turnover higher than EUR 200m.5 HVR3: HVR are firms which employ 250 persons or more. In addition, in some cases it can be useful to analyse the top 5 firms in each market. The following definition is proposed. HVR4: HVR are the 5 largest firms (by turnover) in each retail sector of interest. 4 For example data was not available for E. Leclerc and Intermarché (France); Edeka/AVA Gruppe and Schwarz Gruppe (Germany); and Co-op Italia and Interdis (Italy). Data is also difficult to obtain for Eastern European countries. 5 In the analysis it was found that data is missing for many years in the UK and therefore the definition has not been used for the analysis of trends. London Economics September 2008 5 Section 3 The number of HVR in Europe 3 The number of HVR in Europe The number of HVR can be calculated according to different definitions for the food and clothing sectors. We use Mintel data as the basis of the analysis in relation for definition HVR1, and Eurostat data for HVR2 and HVR3. Eurostat does not provide a more refined breakdown by sector and we use food and department stores as a proxy for the food sector, and other retail sub-sectors as an approximation of the clothing sector. The distribution of the number of HVR in each country varies depending on the definition used (Table 2). According to HVR2 and HVR3, Germany has the largest number of HVR. Definition HVR1 uses 5% of market share and shows approximately 5 HVR per country. The only exceptions are Poland6 and Romania with nil and one HVR respectively (no comparable information is available in the Czech Republic and Hungary). A list of all firms used in definition HVR1 is in Annex 1. HVR2 uses turnover greater than EUR 200m as a threshold to classify HVR firms. There are many large companies in Germany, Italy and the United Kingdom and there appear 131, 55 and 52 HVR in these countries, respectively. There are only 2 and 8 HVR in Romania and Hungary, respectively. The HVR3 definition shows a larger number of HVR in all countries. 6 This means that no retailer has more than 5% of market share in the Polish market. London Economics September 2008 6 Section 3 The number of HVR in Europe Table 2: Number of HVR according to different definitions Food sector (2006) Country CZ DE ES FR IT HU PL RO UK Total HVR1 n.a.+ 6 4 6 5 n.a.+ 0 1 4 39 HVR2* 11 131 33 46 55 8 n.a. 2 52 338 HVR3* 55 251 105** 184 129 36** 102 22 171 1055 HVR4 5 5 5 5 5 5 5 5 5 45 Note: * Food and Department stores and Other retail sub-sectors. Data for HVR3 refer to 2005; ** Department stores only. + The number of HVR in Hungary and Czech Republic is 9 and 4, respectively, but these numbers may be overestimated as the sales figures include department stores and food stores. HVR1: HVR are firms having more than 5% of market share. HVR2: HVR are firms with turnover higher than EUR 200m. HVR3: HVR are firms which employ 250 persons or more. HVR4: HVR are the 5 largest firms (by turnover) in each retail sector of interest. Source: London Economics using Eurostat and Mintel. Table 3 shows the number of HVR in the clothing sector using different definitions. The UK has the largest number of HVR according to HVR2 and HVR3 with 81 and 314 respectively, followed closely by Germany with 45 and 278, respectively. New Member States have the lowest number of HVR by any definition: using definition HVR2, there are at most 1 HVR (no data is available for Poland) and with the exception of Poland (with 43) the remaining countries have less than 25 HVR according to HVR3. Notably, very few firms were identified as HVR according to the HVR1 definition, indicating that the clothing market tends to be more fragmented. A list of all firms used in definition HVR1 is in Annex 1. London Economics September 2008 7 Section 3 The number of HVR in Europe Table 3: Number of HVR according to different definitions Clothing sector (2006) Country CZ DE ES FR IT HU PL RO UK Total HVR1 n.a.+ 2 n.a.+ 0 1 0 n.a.+ 0 3 6 HVR2* 0 45 19 52 17 0 n.a. 1 81 215 HVR3* 23 278 77 169 64 15 43 19 314 1002 HVR4 5 5 5 5 5 5 5 5 5 45 Note: * Food and Department stores and Other retail sub-sectors. Data for HVR3 refer to 2005. ** Department stores only. +No information available regarding the size of the clothing market, and so it is not possible to calculate HVR1. HVR1: HVR are firms having more than 5% of market share. HVR2: HVR are firms with turnover higher than EUR 200m. HVR3: HVR are firms which employ 250 persons or more. HVR4: HVR are the 5 largest firms (by turnover) in each retail sector of interest. Source: London Economics using Eurostat and Mintel London Economics September 2008 8 Section 4 Turnover of HVR 4 Turnover of HVR Retail sales of food in the countries of the study amounted to EUR 754 billion in 2006, representing an increase of 3.4% in real terms from 2003. It can be seen that France, the UK, and Germany account for more than 65% of the total 2006 sales, with Italy, Spain and Poland accounting for a further 30%. Less than 5% of the total spending occurred in Romania, Hungary and the Czech Republic combined. Figure 1: Total food sales in selected countries 2003 and 2006 (EUR billion, 2006 prices) 800 700 600 500 400 300 200 100 0 2003 DE 2006 ES FR IT UK CZ HU PL RO Note: For Poland and Czech Republic, sales include all of Nace code 52.1 and 52.2. 2006 data for Czech Republic estimated based on total retail sales growth. Source: Mintel. Data for retail sales of clothing is more difficult to obtain. In addition, in the Czech Republic, Poland and Spain data for overall sales is not available from the Mintel reports. In the remaining countries of the study, retail amounted to EUR 120 billion in 2006, having grown by 2.5% in real terms since 2003. Almost all retail sales occurred in the UK, Germany, France and Italy, although this may be a reflection of the limited data availability in the New Member States. London Economics September 2008 9 Section 4 Turnover of HVR Figure 2: Total sales of clothing in selected countries 2003 and 2006 (EUR billion, 2006 prices) 140 120 100 80 60 40 20 0 2003 2006 DE FR IT UK HU RO Source: Mintel. The largest players in Europe The 10 companies with largest turnover at national level in the countries and sectors of interest are shown in Table 4. All the largest players operate in the food sector. Tesco is the largest operator in the UK and is significantly ahead of its main rivals: in 2006 national sales were EUR10 billion higher than the French operator Carrefour, in second place. When comparing food and clothing retailers the largest clothing firm (Marks and Spencer) appears only in 25th place. Unsurprisingly, all the largest firms are based in Western Europe in the three largest markets of Germany (4), the UK (3) and France (3) (although some have operations in Eastern Europe). London Economics September 2008 10 Section 4 Turnover of HVR Table 4: Top-10 European retail companies at national level (2006) Company Country Operation National market sales (EURm) Tesco UK Multiple grocer 47,928 Carrefour FR Food multiple 37,200 Edeka/AVA Gruppe DE Voluntary group 30,200 E. Leclerc FR Voluntary group 27,500 J Sainsbury UK Multiple grocer 24,738 Rewe Gruppe DE Food group 24,400 Asda (Wal-Mart) UK Multiple grocer 23,048 Intermarché (ITM) FR Voluntary group 22,000 Schwarz Gruppe DE Discount food stores & hypermarkets 22,000 Aldi DE Discount food stores 21,100 Source: Mintel. Presence of HVR in Europe Over the last four years, food sales of HVR (according to HVR1 definition) have remained relatively constant in the two largest markets (France and Germany). In the UK, sales of HVR have increased by almost 10%, which is primarily due to the growth of Tesco. There has been an increase by more than 25% in sales of HVR in the food sector in both Italy and Spain, since 2003. HVR in Czech Republic and Romania also experienced a significant growth (albeit Romania started from an extremely low base). Sales of HVR in Hungary also grew but at a lower pace. No HVR operated in Poland (under the HVR1 definition during the period). London Economics September 2008 11 Section 4 Turnover of HVR Table 5: HVR1 food sales 2003-2006 (EUR billion, 2006 prices) Country CZ DE ES FR IT HU PL RO UK Total 2003 3.5 112.3 28.1 135.0 28.6 9.0 0.0 0.1 103.8 420.4 2006 4.6 115.2 35.7 137.1 38.8 9.4 0.0 1.1 114.0 455.9 % change 33.3% 2.5% 26.9% 1.6% 35.5% 4.5% n.a. n.m. 9.8% 8.4% Note: UK 2003 value includes sales of Safeway, which was later acquired by Wm Morrison. Source: Mintel. As seen, the clothing sector is much less concentrated and HVR (according to definition HVR1) are only present in three of the nine markets in the study. HVR in both Germany and the UK experienced steady sales growth (of 5% and 3% respectively). The one HVR in Italy however (the Benetton Group) saw a decline in sales in real terms between 2003 and 2006. Table 6: HVR1 clothing sales 2003 and 2006 (EUR billion, 2006 prices) Country CZ DE ES FR IT HU PL RO UK Total 2003 2006 n.a. n.a. % change n.a. 4.1 4.3 5.3% n.a. n.a. n.a. 0.0 0.0 n.a. 1.3 1.3 -5.2% 0.0 0.0 n.a. n.a. n.a. n.a. 0.0 0.0 n.a. 10.9 11.2 2.5% 16.3 16.7 2.6% Note: No information on market size in Czech Republic, Poland and Spain. No HVR identified in France, Hungary or Romania. Clothing sales separated from footwear sales based on sales per store in the case of two French companies. Source: Mintel. London Economics September 2008 12 Section 4 Turnover of HVR Analysis of market concentration over time We analyse market concentration by looking at the evolution of C5 (the combined market share of the top-5 firms) in the food and clothing sectors in each of the selected countries.7 Concentration in the food retail market varies significantly between countries. Germany, the UK and Hungary are the most concentrated markets with over 70% of the market controlled by the largest five firms.8 The French market is also comparatively concentrated, with a C5 of around 60%. In Italy, Spain and the Czech Republic, the C5 is between 30% and 45%, while the market is much less concentrated in Romania and Poland (with the top-5 companies controlling less than 20% of the market). As Figure 3 indicates, there have been significant increases in market concentration in food retail over the last three years in several countries, including the UK, the Czech Republic, Romania and Spain. 7 In several countries, this is very similar to the firms identified under the HVR1 definition. 8 The estimates for Hungary and the Czech Republic should be treated with caution as the sales data include some outlets selling non-food items. London Economics September 2008 13 Section 4 Turnover of HVR Figure 3: C5 for food retail sales (2003 and 2006) 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% DE ES FR IT UK 2003 CZ HU RO PL 2006 Note: Sales include other goods beside food in Hungary and Czech Republic. Source: Mintel. The clothing retail sector remains fragmented across the selected countries where data was available. The C5 in the UK is the highest with 35%, in Germany is second (around 25%), while in Italy and France the top-5 firms control less than 20% of the market. London Economics September 2008 14 Section 4 Turnover of HVR Figure 4: C5 for clothing retail sales (2003 and 2006) 40% 35% 30% 25% 20% 15% 10% 5% 0% DE FR IT 2003 UK 2006 Note: No information on market size in Czech Republic, Poland and Spain. Insufficient sales data available for Romania and Hungary. Clothing sales separated from footwear using sales per store in the case of two French companies. Source: Mintel. We now analyse the evolution of concentration according to the HVR3 definition and using Eurostat data. Results are presented for two broad sectors: food and department stores, and other retail sub-sectors. The share of turnover according to the HVR3 definition in food and department stores is shown in Figure 5 for several years. HVR account for more than 50% of turnover in the UK, Germany, Spain, France, Hungary and the Czech Republic. Overall, the UK is the most concentrated market and Romania the least. It is noticeable that the market concentration in the Czech Republic and Hungary is roughly the same than in France and Italy. The recent evolution shows that the market concentration has increased in most countries. It has decreased in Germany and stayed approximately constant in France. The main conclusions are consistent with the findings of Figure 3. London Economics September 2008 15 Section 4 Turnover of HVR Figure 5: Share of turnover of HVR3 (food and department stores) 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% DE ES FR IT 2002 UK 2003 CZ 2004 HU PL RO 2005 Source: Eurostat The share of turnover according to the HVR3 definition in the other retail sub-sectors is shown in Figure 6 for several years. The UK is again the most concentrated market and is the only country where HVR have more than 50% market share. Market concentration has increased in most countries (especially in Romania) but has remained constant in Germany and Hungary. London Economics September 2008 16 Section 4 Turnover of HVR Figure 6: Share of turnover of HVR3 (other retail sub-sectors) 70% 60% 50% 40% 30% 20% 10% 0% DE ES FR IT 2002 UK 2003 CZ 2004 HU PL RO 2005 Source: Eurostat London Economics September 2008 17 Section 5 Employment in HVR 5 Employment in HVR In this section we analyse employment data using HVR3 definition. All the data are sourced from Eurostat. Results are presented for two broad sectors: food and department stores, and other retail sub-sectors. Number of employees in HVR Overall 3 million people are employed in HVR in the food and department stores in the countries of interest in 2005. Of these, around 1.2 million people are employed in HVR in the food sector in the UK. The remaining countries employ much less, but overall HVR in Western European countries employ a higher number of workers than Eastern European countries. The number of employees has increased since 2003 in every country except in France and the Czech Republic where it has remained constant (Figure 7). Figure 7: Number of employees in HVR3. Food and department stores (‘000) 1,400 1,200 1,000 800 600 400 200 0 DE ES FR IT 2002 UK 2003 CZ 2004 HU PL RO 2005 Source: Eurostat London Economics September 2008 18 Section 5 Employment in HVR A similar picture can be observed in the other retail sub-sectors. As before, HVR in the UK employ the highest number of workers. However, the number of employees has steadily increased in all the countries except in the UK where it increased in 2003 and has reduced since. Overall, 1.5 million people are employed in HVR in other retail sub-sectors in 2005, in the countries studied. Figure 8: Number of employees in HVR3. Other retail sub-sectors (‘000) 900 800 700 600 500 400 300 200 100 0 DE ES FR IT 2002 UK 2003 CZ 2004 HU PL RO 2005 Source: Eurostat Evolution of the proportion of employees working in HVR The share of employment in HVR is very different across Europe. In the UK and Germany, HVR employ respectively more than 75% and 60% of workers in food and department stores whereas in Poland they employ about 20% and in Romania less than 5% (Figure 9). The proportion of employees working for HVR has increased in Spain, the UK and Eastern European countries; has stayed almost constant in Germany and France and has increased only slightly in Italy. London Economics September 2008 19 Section 5 Employment in HVR Figure 9: Share of employment in HVR3 (food and department stores) 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% DE ES FR IT 2002 UK 2003 CZ 2004 HU PL RO 2005 Source: Eurostat HVR in the UK employ about 60% of the workforce of the other retail subsectors. In Spain, Italy, the Czech Republic, Hungary, Poland and Romania HVR employ about 10% or less; and in Germany and France about 30%. The proportion of employees working for HVR has increased steadily in all countries except in Germany and the UK: in Germany the proportion reduced in 2003 and increased steadily thereafter, and in the UK it first increased and decreased steadily from 2003 (Figure 10). London Economics September 2008 20 Section 5 Employment in HVR Figure 10: Share of Employment in HVR3 (other retail sub-sectors) 70% 60% 50% 40% 30% 20% 10% 0% DE ES FR IT 2002 UK 2003 CZ 2004 HU PL RO 2005 Source: Eurostat London Economics September 2008 21 Section 5 Employment in HVR Female participation in the retail market Overall, female participation in the wholesale and retail sectors is higher than in the entire workforce across Europe but such difference is much higher in the 10 New Member States that in the EU15 (Figure 11). The only exception is France that shows a lower share of women in the wholesale and retail sector compared to the economy as a whole. Figure 11: Female employment in 2006 (in %) 60% 50% 40% 30% 20% 10% 0% EU15 NMS10 UK FR RO All sectors HU DE PL CZ ES IT Wholesale and Retail sectors Source: Eurostat. Female participation in the wholesale and retail sectors remained fairly constant between 2002 and 2006 in most countries (Figure 12). Germany is the only exception to this, showing a decline in each year from between 2002 and 2006. There is also some evidence of a sustained increase in participation in both Spain and Italy over the period. London Economics September 2008 22 Section 5 Employment in HVR Figure 12: Female participation (in %). Wholesale and retail sectors 60% 50% 40% 30% 20% 10% 0% DE ES FR IT 2002 UK 2003 2004 CZ 2005 HU PL RO 2006 Source: London Economics using Eurostat data. Age distribution of employees The age distribution of employees in the wholesale and retail sectors shows that the workforce is dominated by employees below the age of 50, who account for between 75% and 85% of the workforce (Figure 13). Further, these sectors have very few employees (under 5% of the total workforce) over the age of 65. There are some interesting differences in the age distribution between Member States. The UK, for example has a much higher proportion of young workers (aged under 25) than anywhere else, but also a higher proportion of workers older than 65 (although still a very small amount). Italy and Germany also have a small but noticeable proportion of workers older than 65. Italy, the Czech Republic and Hungary have a lower number of young workers but have a higher proportion of workers aged 25-49. Notably, there are no clear differences between the EU15 countries and the New Member States in the graph. London Economics September 2008 23 Section 5 Employment in HVR Figure 13: Age distribution of employees Wholesale and retail sectors 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% DE ES FR IT 15-24 UK 25-49 50-64 CZ HU PL RO Over 65 Source: Eurostat. Part-time employment Around 5.15 million people are working part-time in the retail and wholesale sectors in the countries of interest (6.59 million people in the EU27). Part-time work is higher in the wholesale and retail sectors than in the entire European economy, although there are important differences across countries, and also between the EU15 and NMS10 (Figure 14). Part-time work is more common across the EU15 than in the NMS10 (around 20% compared to 8%), and this is reflected in the wholesale and retail sectors. Across the EU15, part-time work was more common in wholesale and retail than the economy as a whole (around 25% compared to 20%), whereas in the NMS10, the proportion was approximately the same. However, the result for the EU15 appears to be driven by the countries with the highest proportion of part-time workers (Germany and the UK). In these countries, part-time work exceeds 25% across all sectors, and 30% in retail and wholesale. In the other EU15 countries, the overall proportions are much lower, and also there is little difference between the wholesale and retail sectors and the rest of the London Economics September 2008 24 Section 5 Employment in HVR economy. A similar pattern is seen in the New Member States, with the exception of Romania (where part-time employment is much higher overall than in the wholesale and retail sectors). Figure 14: Part-time employees in 2006 (in %). Wholesale and retail sectors 45% 40% 35% 30% 25% 20% 15% 10% 5% 0% EU15 NMS10 DE UK FR All sectors UT ES PL RO CZ HU Wholesale and Retail sectors Source: London Economics using Eurostat data. The evolution of part-time employment shows a different pattern for Western and Eastern countries (Figure 12). In all Western countries, part-time employment has increased recently except in the UK. The increase in Germany, Italy and Spain can possibly be attributed to labour market reforms. In Eastern Europe, the proportion of part-time employees has stayed roughly constant, except in Hungary that has increased recently. London Economics September 2008 25 Section 5 Employment in HVR Figure 15: Part-time employment (in %). Wholesale and retail sectors 45% 40% 35% 30% 25% 20% 15% 10% 5% 0% DE ES FR IT 2002 2003 UK 2004 CZ 2005 HU PL RO 2006 Source: London Economics using Eurostat data. London Economics September 2008 26 Section 6 Import penetration 6 Import penetration In this section we analyse the evolution of import penetration in Europe. Import penetration is calculated as imports divided by domestic apparent consumption. Domestic apparent consumption is calculated as the value of production plus the value of imports less the value of exports. Data on imports, exports and production are obtained from Eurostat’s Prodcom database.9 Data are provided for very large product, each with an eight digit product code. To calculate indicators for a whole sector it is necessary to aggregate the data across all the relevant eight digit product codes. This creates some complications because data is missing for imports, exports or production for some years and product codes. In order to be consistent, we excluded from the analysis the product groups with at least one missing value (in imports, exports or production) for the sample period. For years prior to 2003 there are a lot of missing data. The analysis is therefore undertaken for the years 2003 to 2006 inclusive. For the food sector10, generally the percentage of imports in domestic apparent consumption is increasing in the countries of interest (Figure 16). The only exception is Spain, where overall it has stayed roughly the same over the four-year period (it has increase in the last three years but fallen by 0.3% in total). The proportion of imported food is generally higher in the Western countries, which show percentages around 20% for 2006 (24% is the highest in Germany and 18% the lowest in Spain). The proportion of imports in food consumption is rising quickly in Eastern European countries. This is especially true for Hungary which in 2003 imported less food as a percentage of total consumption than any of the western countries, but by 2006 has the highest percentage of imported food. The Czech Republic shows a similar pattern. Finally, Poland and Romania import a noticeably smaller percentage of their food consumption than the other countries. 9 10 This database classifies products using the first four digits of Nace Rev. 1 and digits five and six of the CPA (Classification of products by activity). The food sector is defined as all products in the ‘manufacture of food products and beverages’ category. London Economics September 2008 27 Section 6 Import penetration Figure 16: Imports as a percentage of domestic apparent consumption for the manufacture of food products and beverages 35% 30% 25% 20% 15% 10% 5% 0% DE ES FR IT 2003 UK 2004 CZ 2005 HU PL RO 2006 Source: Prodcom database. Western countries show a very high import penetration in the clothing sector.11 In many cases the percentage is greater than 100% (Figure 17). This is because the total value of exports is greater than the total value of production, meaning that some goods are imported and then re-exported. The highest percentages in France and Germany (where they reach 170% and 146% by 2006, respectively) reflect their low domestic production and high volumes of imports and exports. Over the last two decades, French retailers and clothing and footwear manufacturers have moved their production facilities to lowcost counties or decided to concentrate on design and marketing activities, purchasing items abroad. The German textile and clothing sector has also gone through major structural changes that have led the industry to reduce and outsource some of its inland production and cover its local demand for 11 The clothing sector is defined as all products with in ‘manufacture of wearing apparel; dressing and dying of fur’. London Economics September 2008 28 Section 6 Import penetration textiles and clothing largely by importing from other countries. Conversely the import shares for Spain and Italy are well under 100% (85% and 80% in 2006 respectively). For most of the Western countries imports as a percentage of consumption rise over the period. The only exception is the UK where the ratio remained at around 100%. The results for Eastern European countries are very unreliable due to poor data and have not been reported. Figure 17 Imports as a percentage of domestic apparent consumption for the manufacture of wearing apparel 180% 160% 140% 120% 100% 80% 60% 40% 20% 0% DE ES FR 2003 2004 IT 2005 UK 2006 Source: Prodcom database London Economics September 2008 29 Section 7 Suppliers’ sales in HVR 7 Suppliers’ sales in HVR In this section we analyse HVR share of suppliers’ sales and how this has been changing over time. For this section, we use definition HVR1. Total suppliers’ sales sold by HVR are calculated using the share of HVR suppliers’ sales times total domestic sales. We use total production minus exports (from Prodcom data) as total domestic sales. Since we do not have the share of suppliers’ domestic sales achieved by HVR we use the total market shares of HVR. Finally, we express the HVR domestic sales as a share of total production. In the food sector, we see that more than 50% of the national food production is sold by HVR in Germany and the UK (Figure 18). The percentage of suppliers’ sales achieved through HVR has increased in every country but Germany and France, where it has remained almost constant. There are significant differences between countries: HVR share of suppliers’ sales ranges from 10% in Romania to 64% in Germany, in 2006. Figure 18: Suppliers' sales in HVR (as % of total production). Food 70% 60% 50% 40% 30% 20% 10% 0% DE ES FR 2003 IT 2004 UK 2005 CZ RO 2006 Source: Prodcom database London Economics September 2008 30 Section 8 Evolution of wholesale-retail price indices 8 Evolution of wholesale-retail price indices In this section we present the evolution of consumer and producer prices. The analysis uses the ratio of consumer price index and domestic producer price index12 for the food and clothing sectors. Hence, the different charts presented below show the changes (increases, decreases) of consumer prices in relative terms, i.e. compared to producer prices. A chart with an increasing ratio represents a situation where consumer prices have been increasing more rapidly than producer prices. A decreasing ratio means that consumer prices have been increasing less rapidly than producer prices. In the first case it means that the margin in absolute terms has been widening, in the second, narrowing. One should be cautious on the type of conclusions drawn from this analysis. The differences in the evolution of prices do not necessarily reflect changes in the profit margins for producers and retailers. This is because prices are affected by many other variables. For example, changes in Value Added Taxes,13 wages, import prices or technical improvements could explain a drop of consumer prices and this could be unrelated with the prices producers receive. The results of the analysis are shown in Figure 19 and Figure 20. Between 2001 and 2007 consumer food prices have increased more rapidly than producer prices in the Czech Republic, Spain, and Hungary (Figure 19). This implies that for these countries, the margin has been widening. In Romania consumer prices increased significantly less rapidly than producer prices. In the other countries there are only small differences between the growth rates of producer and consumer prices. 12 The domestic producer price index (or domestic output price index) for an economic activity measures the average price development of all goods and related services resulting from that activity and sold on the domestic market. 13 “The prices measured are those actually faced by consumers, so for example they include sales taxes on products, such as Value Added Tax, and they reflect end-of-season sales prices”, Harmonized Indices of Consumer Prices (HICPs) A Short Guide for Users, Eurostat, March 2004 London Economics September 2008 31 Section 8 Evolution of wholesale-retail price indices Figure 19: Ratio consumer to producer prices indices. Food (2001-2007). DE ES EU FR HU IT PL .8 .9 1 1.1 .8 .9 1 1.1 CZ 2000 2002 2004 2006 2008 2000 2002 2004 2006 2008 UK .8 .9 1 1.1 RO 2000 2002 2004 2006 2008 2000 2002 2004 2006 2008 Time Graphs by Country Note: Consumer prices include VAT so any change in VAT has an effect on the indices. Source: Eurostat. Between 2001 and 2007 consumer prices have been increasing less rapidly than producer prices prices in EU27 as a consequence of imports from abroad (Figure 20). This is particularly noticeably in the Czech Republic, the UK and Romania. This means that the margin between consumer and producer prices narrowed. London Economics September 2008 32 Section 8 Evolution of wholesale-retail price indices Figure 20: Ratio consumer to producer prices indices. Clothing (2001-2007). DE ES EU FR HU IT PL .6 .8 1 1.2 .6 .8 1 1.2 CZ 2000 2002 2004 2006 2008 2000 2002 2004 2006 2008 UK .6 .8 1 1.2 RO 2000 2002 2004 2006 2008 2000 2002 2004 2006 2008 Time Graphs by Country Note: Consumer prices include VAT so any change in VAT has an effect on the indices. Source: Eurostat. London Economics September 2008 33 Section 9 Synoptic description of M&A 9 Synoptic description of M&A In this section we provide a synoptic description of the main operations of merger and acquisitions in the relevant countries for the past four years. Information has been obtained from Mintel reports. Table 7: Mergers and acquisitions in the food sector for selected countries Country Description FR Carrefour purchased Rewe’s Penny Market stores in June 2005 Intermarché sold Spar Handels and Netto to Edeka in April 2005 Metro acquired Wal-Mart Germany in July 2006 DE Spar AG sold its 50% stake in Netto to Intermarché at the end of 2004 Rewe acquired the Swiss food retail and catering group Bon Appetit in 2003 IT Coop Italia and Conad signed a partnership agreement in 2001 Caprabo purchased Alcosto in 2003 ES Ahold exited the market and sold its business to private equity firm Permira in October 2004 Laurus exited the Spanish market in 2003 Morrison’s acquired Safeway in March 2004. The acquisition was approved by the High Court in March 2004, with the requirement that 53 of the acquired stores be divested J Sainsbury acquired the Bells stores, Jackson’s stores and JB Beaumont convenience store chains in 2004 Cellar 5 (previously Parisa Group) entered administration in December 2002, before being UK acquired by Maryland Securities in March 2003 Tesco acquired 45 convenience stores from Adminstore in January 2004 United Co-op acquired Yorkshire Co-op in 2003 Irish Musgrave acquired the Londis chain in June 2004 Delvita sold to Rewe in May 2007 CZ Tesco bought Carrefour’s business in 2005, and most of Edeka’s stores in early 2006 Casino withdrew from the market selling its Geant hypermarkets to METRO-owned Real, and its Leader Price chain to Tesco in 2006 Ahold sold its Polish businesses to Carrefour in December 2006. (Competition comission’s approval in June 2007) PO Ahold reduced its stake in Poland, it sold its 13 Hypernova-branded hypermarkets to IC Company in 2005 Edeka sold its Polish operation to local group Rojal Markety in March 2003 Metro and Spar own jointly the buying group Metspa since 1995 HU Spar acquired 14 Billa stores from Rewe in 2002, and 22 Kaiser’s stores from Tengelmann in September 2003 Cora opened its second hypermarket in the country in October 2005 Delhaize Group acquired a majority share of Mega Image in March 2000 Tengelmann opened its first Plus discount store in Romania in October 2005 Schwarz Group launched its first two Kaufland discount hypermarkets in the second half of RO 2005 Metro Group launched its Real supermarket chain in March 2006 Carrefour opened a store in Bucharest in July 2001 in a joint venture with one of its major franchisees Hyparlo Source: Mintel London Economics September 2008 34 Section 10 Conclusions 10 Conclusions Some conclusions arise from the analysis undertaken in this report. The number of HVR (firms with more than 5% market share) in the food sector is around 5 in each country. Using other definitions, the number of HVR is the highest in Germany. The number of HVR in the clothing sector is the highest in the United Kingdom using several definitions. Indicators of market concentration show that the United Kingdom is the most concentrated market in both food and clothing sectors. In the food sector, market concentration has increased in recent years in every country but France and Germany, where it remains constant. In the clothing sector, market concentration has increased between 2003 and 2006 in Germany and Italy but has decreased in France and the United Kingdom. The number of employees working for HVR is by far the highest in the United Kingdom in food and department stores and in the other retail sub-sectors. In every country, the proportion of employees working for HVR is higher in the food sector than in other sectors (except in Romania). Female employment is generally higher (France is an exception) in the wholesale and retail sectors than in the economy as a whole. Female employment has stayed constant in recent years in all countries except in Germany where it has decreased. Part-time employment is more important in the wholesale and retail sectors in the UK and Germany, but not in the rest of countries. Recent trends show that part-time employment is increasing in Western Europe (except Germany where it has decreased) and stay constant in Eastern Europe. Import penetration is more important in the clothing sector than in the food sector. In both sectors, import penetration has generally increased over the recent years. According to definition HVR1, HVR achieve more than 50% of domestic suppliers’ sales in Germany and the United Kingdom. London Economics September 2008 35 Section 10 Conclusions Between 2001 and 2007 the margin between consumer and producer food prices widened in the Czech Republic, Spain, and Hungary, and narrowed in Romania. The margin between consumer and producer prices in the clothing sector narrowed mainly in the Czech Republic, the UK and Romania. London Economics September 2008 36 Section 10 Conclusions Annex 1 Firms included (definition HVR1) in the analysis Table 8: List of firms included in the analysis (definition HVR1) Food Sector Country Retailer Operation(s) Sales (EURm) 2006 Market share 2006 FR Carrefour Food multiple 37,200 17.9% FR E. Leclerc Voluntary Group 27,500 13.3% FR Intermarché (ITM) Voluntary Group 22,000 10.6% FR Auchan Food multiple 18,600 9.0% FR Casino Food multiple 17,600 8.5% FR Système U Food buying group 14,200 6.8% DE Edeka/AVA Gruppe Voluntary group 30,200 22.5% DE Rewe Gruppe Food group 24,400 18.2% DE Schwarz Gruppe Discount food stores & hypermarkets 22,000 16.4% DE Aldi Discount food stores 21,100 15.7% DE Real (METRO) Hypermarkets & superstores 9,100 6.8% DE Tengelmann Food group 8,400 6.3% IT Co-op Italia Co-operative group 11,800 12.0% IT Conad-Rewe (Coopernic) Buying group 7,796 7.9% IT Interdis Voluntary group 7,098 7.2% IT Carrefour (France) Hypermarkets, supermarkets, cash&carry 6,397 6.5% IT Auchan (France) Hyper/supermarkets 5,700 5.8% ES Carrefour (France) Grocery multiple 12,354 15.5% ES Mercadona Large supermarkets 12,158 15.2% ES Grupo Eroski Retail/co-operative group 6,415 8.0% ES El Corte Inglés Hypermarkets/ supermarkets 4,735 5.9% UK Tesco Multiple grocer 47,928 30.6% UK Sainsbury's (J Sainsbury) Multiple grocer 24,738 15.8% UK Asda (Wal-Mart, USA) Multiple grocer 23,048 14.7% UK Wm Morrison Supermarkets Multiple grocer 18,285 11.7% RO Rewe (Germany) Groceries 1,050 10.1% Source: Own elaboration and Mintel. London Economics September 2008 37 Section 10 Conclusions Table 9: List of firms included in the analysis (definition HVR1) Textile Sector Country Retailer Operation(s) Sales (EURm) 2006 Market share 2006 DE C&A General clothing 2,422 8.9% DE H&M (Sweden) Men’s, women’s, childrenswear 1,880 6.9% IT Benetton Group General clothing 1,250 6.3% UK Marks & Spencer (non-food) Adult and children’s clothing 5,241 12.6% UK Next Retail Adult and children’s clothing 3,309 8.0% UK Arcadia Group Adult clothing 2,643 6.4% Source: Own elaboration and Mintel. London Economics September 2008 38