No. 17 of 2015 (General Serial No. 214) The Audit Results of the

advertisement

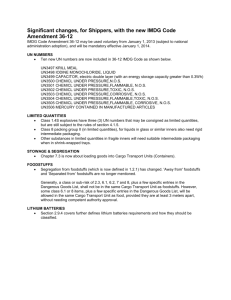

No. 17 of 2015 (General Serial No. 214): The Audit Results of the Financial Revenues and Expenditures of China Oil and Foodstuffs Corporation for the Year 2013 (June 28, 2015) In accordance with the stipulations of The Audit Law of the People’s Republic of China, in 2014 the National Audit Office conducted auditing on the situation of financial revenues and expenditures of the year 2013 of China Oil and Foodstuffs Corporation (hereinafter referred to as China Oil and Foodstuffs). The auditing work was focused on the headquarters of China Oil and Foodstuffs and eight subunits including China Foods Limited (hereinafter referred to as China Foods), COFCO Land Holdings Limited (hereinafter referred to as COFCO Land), COFCO Packaging Holdings Limited (hereinafter referred to as COFCO Packaging), and made follow-on and retroactive efforts on relevant items. I. Overview China Oil and Foodstuffs was founded in 1949, has RMB4.267 billion of registered capital by the end of 2013, possesses 569 wholly-owned or holding subsidiaries and 158 joint stock companies. The main business areas it engages in include processing of food and related packaging products, manufacturing and sales, trade of agricultural products such as grain, oil and sugar, processing, futures, logistics and relevant services, hotels, real estate development and management, native products, livestock products processing, manufacturing and sales etc.. As reflected in the consolidated financial statement of China Oil and Foodstuffs, the total assets in the end of 2013 amounted to RMB284.333 billion, the total liabilities reached RMB188.133 billion, and there was RMB96.2 billion worth of owners’ equity. The realized operating revenue of the same year was RMB189.052 billion and a net profit of RMB2.338 billion was earned. The asset-liability ratio was 66.17%, the return on equity was 2.54%, and the rate of the value maintenance and value increase of state-owned capital was 100.1%. ShineWing Accounting Firm (special general partner) audited the consolidated financial statement of 2013 of the corporation and issued a standard and unqualified auditing report. The audit results conducted by the National Audit Office indicated that China Oil and Foodstuffs, centered on the target of “building an Whole Industry Chain of Grain&Oil and Foodstuffs”, has implemented the strategy of national food security, gradually standardized the internal management of enterprises, vigorously carried out capital operation, developed the economy of mixed ownership and actively promoted transformation development. The results also demonstrated that some illegal or irregular behaviors still existed in fields such as management performance, developing potentials, and professional ethics of China Oil and Foodstuffs. II. Major Problems Found in the Audit (I) On management performance 1. On financial revenue and expenditure (1) From 2005 to 2013, the headquarters and three subunits of China Oil and Foodstuffs including Hangzhou COFCO Packaging Co. Ltd. had failed to deduct the funds for technical research and development that was withdrawn but not spent the previous fiscal year, confirm food and beverage revenue realized and fully offset internal transactions etc., which resulted in an overstatement of RMB 1013 million revenues, and an understatement of RMB2 million, and an overstatement of RMB1434 million cost expenses, which led to an understatement of RMB423 million profits in the duration of nine years among which the overstated profit of 2013 amounted to RMB5 million. (2) By the end of 2013, the subunit COFCO BVI Co. Ltd. had duplicate offset internal current accounts, which resulted in an understatement of RMB16.9726 million of assets and liabilities respectively. (3) By the end of June 2014, the headquarters had failed to include the RMB0.9614 million that was handed in by four senior executives acquired from the subsidiary companies as part-time salary. (4) From 2008 to 2011, the affiliated Shenyang Joy City Real Estate Development Co. Ltd. and three of the latter’s subsidiary units had failed to check invoices strictly, and listed and charged actual cost of advertising expense, etc. with fictitious invoices which amounted to RMB34.14 million. 2. On the enforcement and implementation of macroeconomic policies of the state, decisions and arrangements From 2005 to 2008, China Oil and Foodstuffs had invested RMB407 million to conduct an reconstruction and extension of original training center, causing problems such as the actual total investment exceeding the approved amount by RMB365 million, the actual scale of construction exceeding the approved scale by 17,700 square meters and the actual construction content of the miniature golf driving range and spas that exceeded the approved one by 265 mu etc.. Besides, the training center occupied 305.70 mu non-arable land by lease instead of requisition. 3. On internal management (1) By the end of 2013, China Oil and Foodstuffs had failed to issue relevant regulations on official reception and establish management account list on official consumption. (2) From 2006 to 2013, the subunits COFCO Land, COFCO Property ( Group ) Co. Ltd. and COFCO ( Shenzhen ) Co. Ltd. had implemented five projects including land acquisition without going through assets evaluations or obtaining evaluation results, which involved RMB767 million, among which there was RMB430 million in 2013. (3) By the end of 2012, the subunit China National Native Produce and Animal By-products Import and Export Corporation had lost RMB2.6787 million in foreign investment because of the inadequate feasibility studies. (4) From 2010 to May 2014, the subunit Baoan Shenzhen triple Co. Ltd. had leased 35,600 square meters plant at a low price. (5) From 2005 to June 2014, nine subunits of China Oil and Foodstuffs including COFCO Land had failed to conduct open tendering as required by rules in some engineering projects, which involved RMB12.911 billion, among which there was RMB0.6 billion in 2013. (6) From 2007 to 2011, China Oil and Foodstuffs and three subunits of it including Shenyang Joy City Real Estate Development Co. Ltd. had had problems such as overcharged construction costs due to laxity in verification,improper agreement with contractors on subcontracting of the main project and signing an agreement with multiple enterprises on the same project which leading to losses and wastes etc., involving RMB31.5748 million. (II) On development potential 1. From 2006 to 2012, China Oil and Foodstuffs had violated "san zhong yi da" (the decision-making system regarding decisions on major issues, appointment and removal of important administrators, assignment of significant projects, and use of large amounts of funds), conducted four share acquisition items without undergoing assets evaluations or obtaining their results, which involved RMB495 million. 2. From 2011 to 2013, COFCO had allowed some of its brands such as " Fortune" and "Great Wall" to be used free of charge by the holding company of its subsidiaries, and paid advertising costs of RMB486 million for the above-mentioned brands, including RMB289 million in 2013 . 3. By the end of May 2014, because of the inadequate deliberation on raw material supply, price trend and rising labor costs, three projects including the tomato cultivation and processing in Ningxia conducted by its affiliated COFCO Tunhe Co. Ltd. had accumulated losses of RMB582 million, among which there was RMB131 million in 2013. (III) On professional ethics 1. In December 2013, a senior executive of China Oil and Foodstuffs purchased properties developed by subunit enterprises, and handled housing transfer procedures without making a full payment according to the prescribed time in agreement. 2. In 2013 the headquarters has used 380 bottles of high-grade Chinese liquor worth RMB247,000 million which were purchased in previous fiscal year for business reception etc.. III. Audit Measures and Rectification In regard to issues discovered through auditing, the National Audit Office has submitted audit reports and released letters of audit decisions in accordance with laws, and will notify the general public of the details of straightening and rectification of China Oil and Foodstuffs. Clues related to issues in violation of laws and disciplines discovered through the audit this time have been legally transferred to departments concerned to be further investigated and dealt with.