1 - Policy Forum

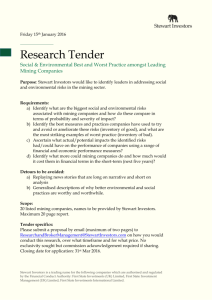

advertisement