Status of Wisconsin Agriculture 2003

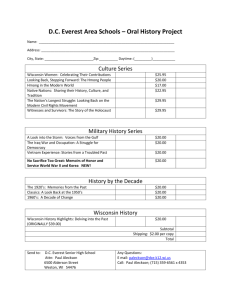

advertisement