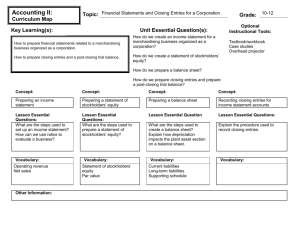

Chapter 10:Completing the Accounting Cycle for a Sole

advertisement

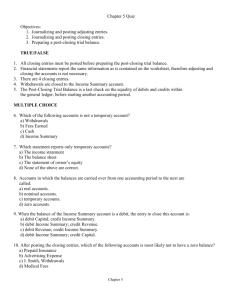

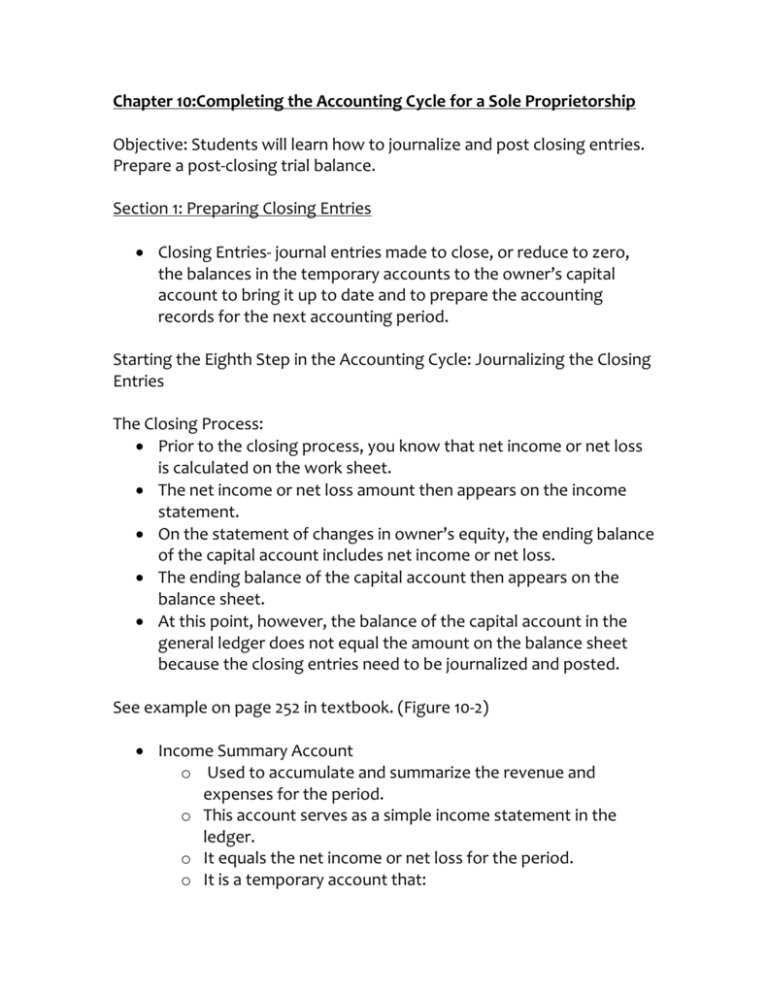

Chapter 10:Completing the Accounting Cycle for a Sole Proprietorship Objective: Students will learn how to journalize and post closing entries. Prepare a post-closing trial balance. Section 1: Preparing Closing Entries Closing Entries- journal entries made to close, or reduce to zero, the balances in the temporary accounts to the owner’s capital account to bring it up to date and to prepare the accounting records for the next accounting period. Starting the Eighth Step in the Accounting Cycle: Journalizing the Closing Entries The Closing Process: Prior to the closing process, you know that net income or net loss is calculated on the work sheet. The net income or net loss amount then appears on the income statement. On the statement of changes in owner’s equity, the ending balance of the capital account includes net income or net loss. The ending balance of the capital account then appears on the balance sheet. At this point, however, the balance of the capital account in the general ledger does not equal the amount on the balance sheet because the closing entries need to be journalized and posted. See example on page 252 in textbook. (Figure 10-2) Income Summary Account o Used to accumulate and summarize the revenue and expenses for the period. o This account serves as a simple income statement in the ledger. o It equals the net income or net loss for the period. o It is a temporary account that: Is used only at the end of the accounting period to summarize revenue and expenses balances. Does not have a normal balance. Has a zero balance before and after the closing. Does not appear on any financial statement. Closing Revenue to Income Summary o Enter Closing Entries in the Description Column. o Enter the last day of the accounting period. o Enter the name(s) and the amount(s) of the account(s) to be debited. o Enter Income Summary as the name of the account to be credited and the amount to be credited. Closing Expenses to Income Summary o The balances of the expense accounts are found in the Income Statement section of the worksheet. o Compound Entry- a journal entry with two or more debits or two or more credits. o Enter the Income Summary as the name of the account to be debited and the amount to be debited. o Enter the name(s) and the amount(s) of the account(s) to be credited. Closing Income Summary to Capital o Enter the Income Summary as the name of the account to be debited and the amount to be debited. o Enter the Owner’s Equity account and the amount to be credited. o If there is a Net Loss, the Owner’s Equity amount should be debited and the Income Summary should be credited. Closing Withdrawals to Capital o Enter the Owner’s Equity account and the amount to be debited. o Enter the Owner’s Withdrawal account and the amount to be credited. Section2: Posting Closing Entries and Preparing a Post-Closing Trial Balance The Ninth Step in the Accounting Cycle: Preparing a Post-Closing Trial Balance: Post-Closing Trial Balance- the final step in the accounting cycle. It is prepared after closing entries are posted in order to verify total debits equal total credits.