comments & best answers to old exam questions

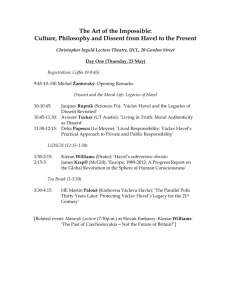

advertisement