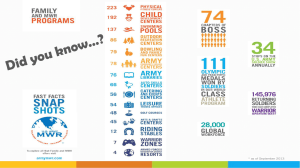

Uniform Funding and Management (UFM)

advertisement

FY 11 Uniform Funding and Management (UFM) 1. References. a. Section 335 of the 1996 National Defense Authorization Act. b. Section 323 of the “Bob Stump” National Defense Authorization Act for Fiscal Year 2003. c. Section 544 of the Ronald W. Reagan National Defense Authorization Act for Fiscal Year 2005. d. DoD Instruction 1015.15, “Procedures for Establishing, Management, and Control of Nonappropriated Fund Instrumentalities and Financial Management of Supporting Resources.” e. A complete guide to UFM may be found at www.ArmyUFM.com. 2. General. a. Uniform Funding and Management (UFM) is the merging of appropriated funds (APF) and nonappropriated funds (NAF) for the purpose of providing Morale, Welfare and Recreation (MWR) services under NAF rules and procedures. It is designed to facilitate: (1) The procurement of property and services for MWR. (2) The management of employees used to carry out the programs. b. UFM is applicable to the direct APF support MWR managers are responsible for in the budget process. This support is primarily reflected in Management Decision Evaluation Packages (MDEP) QDPC (Soldier MWR), QCYS (Child Development, and Youth Programs). Indirect APF support such as utilities and maintenance and repair will continue to be provided under current procedures. UFM is currently limited to operating support. It may not be used for Military Construction, Army (MCA) or minor MCA initiatives. c. Authority to conduct UFM is contained in Section 323: Uniform Funding and Management of MWR Programs, of the “Bob Stump” National Defense Authorization Act for Fiscal Year 2003. The DoD implementing guidance is found in Change 2, DoD Instruction 1015.15, “Procedures for Establishing, Management, and Control of Nonappropriated Fund Instrumentalities and Financial Management of Supporting Resources,” 25 May 2005. UFM is limited to MWR as defined by the DoDI. Other WellBeing programs, such as Army Community Service, may not currently benefit from UFM. d. In FY 07 all Army MWR operations completed the transition to UFM. 1 Enclosure 8 FY 11 Uniform Funding and Management (UFM) e. For the Military Academy’s cadet athletic and recreational extra-curricular programs, authority to operate under UFM is found in Section 544 of the Ronald W. Reagan National Defense Authorization Act for Fiscal Year 2005. 3. Features of the Legislation. a. Authority for UFM. Under regulations prescribed by the Secretary of Defense, funds appropriated to DoD and available for MWR may be treated as NAF and executed in accordance with laws and regulations applicable to NAF. APF shall be considered NAF for all purposes and remain available until expended. b. Conditions on Availability. The UFM process will only be utilized for MWR programs authorized to receive APF support and only in amounts and for the purpose the MWR program is authorized to receive the funds. c. Conversion of Employment Positions. The Secretary of Defense may identify MWR positions whose status may be converted from APF to NAF. (1) An employee may consent to conversion. (2) An employee who does not consent to conversion may not be removed from the position because of failure to provide consent. (3) Conversion shall be without break in service. (4) Conversion shall not entitle an employee to severance pay, back pay, or separation pay under subchapter IX of Chapter 55 of Title 5. (5) Conversion shall not be considered an involuntary separation or other adverse personnel action entitling an employee to any right or benefit under title or any other provision of law or regulation. 4. Interpretation of the Law. The Deputy Assistant Secretary of the Army (Financial Operations), in coordination with the Army General Counsel and Under Secretary of Defense (Comptroller), has interpreted the public law: a. To allow for the immediate obligation, accrual, expense and disbursement of APF prior to goods or services being acquired by the NAF Instrumentality (NAFI) supporting the eligible programs. b. To allow for the transfer of APF to NAF to be based on an established memorandum of agreement (MOA) between NAFI and Army resource managers. 2 Enclosure 8 FY 11 Uniform Funding and Management (UFM) c. The Defense Finance and Accounting Service (DFAS-IN) acknowledges the interpretation and is responsible for working with IMCOM and FMWRC on detailed instructions. 5. Basic Steps of UFM. UFM Involves: a. Preparation of a MOA between the APF resource manager and MWR manager outlining the APF authorized MWR service to be performed by the NAFI location, the APF funding, and the up-front payment schedule. b. The MOA serves as the basis for creating the APF obligation and forwarding the money to the NAFI. c. MWR management employs NAF rules and procedures in execution of the services authorized APF and funded via the MOA. d. Expenditures authorized APF and paid in accordance with the UFM process are recorded in a specially coded departments on the NAF financial statement. e. At year-end, the MWR expenses authorized APF must equal or exceed the UFM income. Any recorded expenses excess to the amount of APF provided as a result of the MOA are termed APF shortfall. 6. Morale, Welfare and Recreation Utilization Support and Accountability. a. The predecessor to UFM is a procedure titled MWR USA. Initiated by DOD in June 1998, MWR USA laid the foundation for the development of UFM. b. Under the MWR USA, NAFIs perform MWR services authorized APF support on behalf of the Government and are then compensated for it if APF are available. The means to achieve this transaction is a MOA between the APF RM and the NAF Fund Manager. c. The differences between UFM and MWR USA include: (1) UFM APF dollars should be transferred to the NAFI up-front. Under MWR USA, payment is made after expenses are incurred by the NAF and billed to the Government. (2) UFM is based on a single system of procedures as practical as can be achieved. MWR USA continues dual APF/NAF financial, procurement, and human resource systems. 3 Enclosure 8 FY 11 Uniform Funding and Management (UFM) d. As Army garrisons implement UFM, the process of MWR USA will be curtailed in the Army. 7. Policy Clarification on APF Authorizations. The policy clarifications on APF authorizations under UFM are the same as under MWR USA, Enclosure 9. 8. Programming and Budgeting. a. Objectives. (1) Through annual NAF budget guidance, communicate to garrisons key information regarding Army MWR priorities, validated requirements, unfinanced priorities, and funding targets. (2) Through annual NAF budget development and submission, present the combined APF and NAF MWR financial plan reconciling the garrisons’ needs with Army Program Management plans. (3) Through annual UFM Budget schedules, provide supporting documentation for the successful completion of the agreement between the Government and the NAF system on levels of service to be provided for MWR. b. Procedures. (1) June 2010. - Army NAF Budget Letter of Instructions published. - Based on UFM guidance and annual Budget LOI, Garrisons begin developing NAF budgets and UFM schedules. (2) 31 August 2010. IAW Budget LOI, IMCOM Regions submit MWR NAF Region budget packages, schedules, and checklist certifications simultaneously to FMWRCfor final review. (3) 29 September 2010. FMWRC completes review, and prepares and coordinates MOA. (4) 30 September 2010. MOA is presented to FMWRC and IMCOM leadership for approval and signature. c. NAF Budgets. Procedures for the NAF budget under UFM will be similar to those established for the MWR USA process with the exceptions of: 4 Enclosure 8 FY 11 Uniform Funding and Management (UFM) (1) The operating budget will identify the IMCOM UFM and local UFM income using the separate payroll and non-payroll GLACs. (2) The operating budget will identify projected costs for reimbursement of NSPS/GS labor. (3) The cash budget will reflect increases in cash based on the expected dates of the receipt of the actual UFM funds along with similar increase in liabilities to reflect the unearned UFM income. Decreases to cash will be reflected as UFM income is earned along with similar decreases to unearned UFM income. 9. Transfer of APF to NAF. a. Objectives: (1) Document the basis for the levels of MWR service to be provided by the NAF system on behalf of the Government. (2) Facilitate, standardize, and streamline the transfer of APF to NAF. (3) Reduce the number of accounting transactions required to be made by the Government. b. Foundation. (1) Key Financial Management terms of the UFM Legislation. (a) Under regulations prescribed by the Secretary of Defense, funds appropriated to DoD and available for MWR: - May be treated as NAF and expended in accordance with laws applicable to NAF. - APF shall be considered NAF for all purposes and remain available until expended. (b) Conditions. UFM is available only if an MWR program is authorized to receive APF support and only in amounts and for the purpose the MWR program is authorized to receive the funds. (2) The Deputy Assistant Secretary of the Army (Financial Operations), in accordance with the Army General Counsel and Under Secretary of Defense (Comptroller), has interpreted the public law to allow for the: 5 Enclosure 8 FY 11 Uniform Funding and Management (UFM) (a) Immediate obligation, accrual, expense and disbursement of APF prior to goods or services being acquired by the NAF system. (b) Transfer of APF to NAF to be based on an established memorandum of agreement (MOA) between the NAF instrumentalities and Army Resource Managers. (3) The Defense Finance and Accounting Service – Indianapolis (DFAS-IN) acknowledges the interpretation and worked with IMCOM and FMWRC on detailed instructions. (4) A centralized mechanism has been established at the IMCOM HQ to accomplish the transfer of the Army’s overarching APF funding to NAF. (a) The Army Banking and Investment Fund (ABIF) is used as the conduit for transferring funds through the Garrison’s account into Region Fund’s bank account. (b) The amounts and frequency are based on a signed Memorandum of Agreement (MOA) between the IMCOM leadership and FMWRC. (5) Garrisons may develop local MOAs in order to address unfinanced requirements and administer unprogrammed funds. The same steps will be employed locally as are used for central transfer of funds. Garrison RM and location MWR manager sign the MOA. All local MOAs must be approved, in advance of execution, by DCG, IMCOM c. Features of the Memorandum of Agreement (MOA) (see Sample C and Sample D of this enclosure). (1) Establishes the basis for the Government’s upfront transfer of APF to NAF. (2) Based on Government funding targets, approved NAF budgets, identified levels of service to be provided. (3) Presents cash flow transfer schedules and “must fund” bills under CRA conditions. (4) The subparagraphs below apply to NAF used in lieu of authorized APF for IMCOM unless any one of the following occurs; new initiatives, Command approved adjustments, and/or inflation. - Equal to the Region’s share of the Army’s validated MWR requirements will result in the elimination of APF shortfall for that year. 6 Enclosure 8 FY 11 Uniform Funding and Management (UFM) - Equal to the FY 10 current level of operation will result in no increase to the APF shortfall from the FY 10 level. - Below the FY 10 current level of operation will result in an adjustment to level of APF services provided so as not to create additional APF shortfall above the FY 08 level. - Above the FY 10 current level of operation will result in a dollar for dollar reduction of the APF shortfall. d. Procedures. (1) Central MOA is approved and signed. (2) IMCOM HQ RM budget analyst for MWR prepares DD Form 2406 (Miscellaneous Obligation Document (MOD)) for each of the MDEP’s first transfer, subject to CRA instructions (see Sample E of this enclosure). (3) IMCOM emails MODs to FMWRC (IMWR-FM). (4) FMWRC (IMWR-FM) prepares Standard Form (SF) 1034 for amount of MOD and submits to the IMCOM RM for approval, certification, and submission to DFAS field site that supports IMCOM HQ. SF 1034 provides location and MDEP details (see Sample F of this enclosure). (5) DFAS Field Site electronically transfers funds to ABIF. (6) ABIF transfers funds through Garrison bank accounts to Region accounts. (7) FMWRC (IMWR-FM) notifies Region and applicable NAF accounting office of funds transferred for each MDEP by Garrison. (8) DFAS, NAF Financial Services, or applicable NAF accounting office, begins accounting for total transfer. (9) Process repeats as dollars become available under CRA conditions, process is repeated quarterly. (10) Execution of IMCOM approved local MOA execution follows same steps as above except Garrison RM, DMWR, FMD, and DFAS field site that supports Garrison are used. Local FMD is responsible for informing Region office and applicable NAF accounting office of funds transferred by MDEP. 7 Enclosure 8 FY 11 Uniform Funding and Management (UFM) (11) For the NAF location executing the local MOA, Tax ID number, DUNS number, and CAGE Code must be identified on the Standard Form 1034 to ensure a successful electronic transfer. (Electronic transfer is not required, but recommended). (12) Obtaining a CAGE Code. (Make sure you need one. Check with Garrison RM first). (a) Know your DUNS number. - Call Dun & Bradstreet at 866-705-5711 if you do not have a DUNS number. The process takes about 10 minutes and it is free of charge. (b) Go to Central Contractor Registration’s (CCR) homepage at http://www.ccr.gov. (c) Click on “Start New Registration.” (d) When prompted, enter your DUNS number. Click submit. (e) Provide all mandatory information and any applicable optional information. Mandatory information is marked in green with an * next to them. (f) Click Validate/Save when finished entering all your information on each page. (g) Your registration should become active within 24 hours of completion. Upon activation in CCR you will be assigned a CAGE Code. 10. Accounting and Reporting. a. Objectives. (1) As practical as possible in the Army: - Develop a single MWR financial accounting and reporting process. (2) Reduce the number of Government financial transactions. (3) Provide clear audit trail on uses of APF supporting MWR under UFM. b. Appropriated Fund Accounting and Reporting (to be used centrally or locally). (1) Under UFM, the Government’s accounting transactions for MWR MDEPs are completed with the periodic transfer of APF to NAF. 8 Enclosure 8 FY 11 Uniform Funding and Management (UFM) (2) Indirect APF support (i.e., utilities, SRM, communications) is to continue to be provided with no change to the APF accounting and reporting procedures. (3) AMSCODEs and Element of Resource (EOR) to be used by the Government: - QDPC – MDEP 96LJ (Community Support). - QCYS – MDEP 19.25 (Child Development (CCS/CYS Base). - Other – Use MDEP MWR Program Element (i.e., QMIS). - EOR – 25FC (UFM Transfer). UPDATE: New AMSCODES are being staffed to help track APF resources provided through local MOAs. There will be one additional AMSCODE per MDEP and should be reflected in 37-100-08. (4) Under UFM, the dollar value of on-board NSPS/GS MWR personnel is included in the MOA and APF to NAF transfers. (5) An automatic reimbursement process will be established to ensure employees are paid and the NAF location is appropriately billed. (6) Steps: (a) The FMD issues a DD Form 448 (Military Interdepartmental Purchase Request) to the local budget office that is responsible for oversight of the MWR APF dollars to pay NSPS/GS/WG payroll for the fiscal year. (b) A DD Form 448-2 Acceptance of MIPR is prepared by the local budget office that has responsibility for the MWR APF dollars. (c) Once the initial MIPR is accepted, a request is sent to the DRM office to request a customer number that will be associated with the MIPR. DFAS Field Site issues form that is required to be used. (d) The Director of Resource Management (DRM) assigns a customer number and notifies FMD budget analyst. Customer number must be established as a FAC 8 customer as it is 100% reimbursable. This precludes having to do manual earnings calculation. At year-end, the orders will need to be adjusted to the obligations in STANFINS, SOMARDS, etc., as the customer number is not closed out until all of the pay has obligated for that fiscal year. (e) IMCOM Online can be used to establish Customer Number for FAC 8 APCs. This is at the discretion of each Garrison. 9 Enclosure 8 FY 11 Uniform Funding and Management (UFM) (f) If the AMS related to the MIPR has multiple program directors (PD), a customer number must be established for each PD. (g) The pay will be obligated to the FAC 8 APC’s assigned to each MWR NSPS/GS/WG employee which causes the APF accounting system to process/create the earnings to the customer number. At month end, the DFAS Field Site initiates the billing cycle to create an invoice. This automatic billing process will only occur if the APC’s are set up as FAC 8, which precludes the need for a manual billing. This invoice, DA Form 4445-R (Voucher for Transfer Between Appropriations and/or Funds) is sent to the billing address provided on the Appropriated Reimbursement Order Document which should be the address of the FMD office. It is sent to the FMD where it is verified against the internal pay records that are kept each pay period. If correct, it is signed by the Fund Administrator and sent on a payable TL to applicable NAF accounting office for payment against the accrued payable account. (h) Once the DD Form 448-2 is accepted and the customer number is assigned, the budget analyst for the APF would prepare an Appropriated Reimbursement Order Document, which is a local form. This form provides the APC, customer number and dollar amount of the MIPR. The Appropriated Reimbursement Order Document is prepared each time the MIPR is changed to increase/decrease the amount of funding. The YTD figure on the Appropriated Reimbursement Order Document should always balance to the total funding on the MIPR. (i) Each time an Appropriated Reimbursement Order Document is prepared the accounting information is input into STANFINS, SOMARDS, etc., by the budget analyst. A copy of the DD Form 448, DD Form 448-2, and Appropriated Reimbursement Order Document is faxed to the DFAS Field Site Accounting System. (Confirmation will need to be made with the other DFAS Field Sites to ensure they allow the faxing of the above documents.) c. Nonappropriated Fund Accounting and Reporting. The following departments and general ledger account codes (GLACs) are provided for use of MWR programs utilizing the UFM/USA execution process, however they do not include any special accounting procedures associated with the Army Family Covenant which are issued at the time funding transfers occur: APF Support Departments Code DESCRIPTION GF APF Support – Expanded Operations GH APF Support – Security GJ APF Support – Emergency Essential Civilian 10 Enclosure 8 FY 11 Uniform Funding and Management (UFM) GL GLAC 249 252 264 265 508* 526* 561* 562* 563* 564* 648 649 803* APF Support – Normal Operations APF General Ledger Accounts DESCRIPTION APF US Reimbursed Payroll Payable APF Foreign National Reimbursed Payroll Payable Unearned Income – IMCOM/Central – UFM Unearned Income – Local MOA – UFM UFM Income – IMCOM/Central – Payroll UFM Income – IMCOM/Central – Non-payroll UFM/USA Income – Local MOA – Payroll UFM/USA Income – Local MOA – Non-payroll UFM Income – Special – Payroll UFM Income – Special – Non - Payroll APF Foreign National Reimbursed Payroll APF US Reimbursed Payroll Gain on or Loss on Disposal of Other Fund-Owned Property *The Income accounts noted in the preceding table are the only income accounts authorized in the APF Support Departments. In addition, income accounts 563 and 564 may only be used in conjunction with funds received under the Army Family Covenant. (1) The expenses within the APF Support Departments must equal or exceed the UFM income. (2) ALL NAF costs for APF authorized expenses (reference AR 215-1, Appendix D, APF Authorizations for Elements of Expense, Table D-1) are to be recorded under one of the APF Support Departments, regardless of whether there are funds remaining in GLAC 264 or 265. (3) Upon notification of the UFM transfer to the NAF bank account, the servicing accounting office will record the receipt as cash with a contra entry to GLAC 264. Receipt of UFM funds from local agreements will be recorded as cash with contra entry to GLAC 265. For Army Family Covenant funding the contra entry will be to GLAC 276. (4) UFM Employees. (a) As personnel costs are incurred for reimbursable UFM employees, they will be reported using the normal GLACs currently in use for NAF personnel within one of the four APF Support Department Codes. 11 Enclosure 8 FY 11 Uniform Funding and Management (UFM) (b) As costs are recognized, an equal amount of income is to be transferred from the applicable unearned income account to GLAC 508 or 561, as applicable. Note all NAF costs for APF authorized payroll accounts are to be recorded in one of the APF Support Departments, regardless of whether there are funds remaining in GLAC 264 or 265. (5) APF/NSPS/GS Personnel. (a) The NAF cost associated with repayment to the government for APF/NSPS/GS personnel is to be recorded in one of the APF Support Departments, using GLAC 649 (APF US Reimbursed Payroll) or GLAC 648 (APF Foreign National Reimbursed Payroll) with a contra entry to GLAC 249 (APF US Reimbursed Payroll Payable) or GLAC 252 (APF Foreign National Reimbursed Payroll Payable). Simultaneously with this entry funds are to be transferred from GLAC 264 (Unearned Income – IMCOM/Central – UFM) or GLAC 265 (Unearned Income – Local MOA – UFM) or GLAC 526 (UFM Income – IMCOM/Central – Non-payroll) or GLAC 562 (UFM/USA Income – Local MOA – Non-payroll), as applicable. (b) Note that NAF uses an accrual system for accounting so this reimbursable cost must be accrued and accounted for in the period the APF US or foreign national reimbursed payroll is performed. (6) Other Items: (a) All other NAF expenditures for items, authorized APF, are to be reported using the normal NAF GLACs within one of the APF Support Departments. As these costs are recognized, an equal amount of income is to be transferred from the applicable unearned income account to GLAC 526 or 562. (7) Capital Expenditures. Any NAF capital expenditure which is authorized APF will be recorded using one of the following methods: (a) If funded through either IMCOM UFM or local UFM, it is to be recorded in one of the APF Support Departments using GLAC 742 (Capital Items - UFM) and an equal amount of income is to be transferred from GLAC 264 or 265 to 526 or 562, as applicable. Any property purchased in this method must be recorded on the NAF sensitive item inventory and insured as applicable. It must be disposed of IAW Army Regulation 215-1 and any funds received from the disposal should be recorded using GLAC 803 (Gain or Loss on Disposal of Other Fund-Owned Property) within the department/program code it was initially recorded as an expense. Should it occur that the recording of this income would cause the department to reflect a net income before depreciation (NIBD) greater than zero, and then these funds must be recorded in the following order so this situation would not occur: 12 Enclosure 8 FY 11 Uniform Funding and Management (UFM) - Under a different APF Support Department (GF/GH/GJ/GL) within the original program code where the expense was recorded. - Under an APF Support Department within another program code which is reporting a net loss before depreciation greater than the funds received in association with the disposal. (b) If insufficient funds are available within GLAC 264 (Unearned Income – IMCOM/Central – UFM) or 265 (Unearned Income – Local MOA – UFM) to cover the entire capital expenditure, it must be recorded using GLAC 181 (APF Authorized Fixed Assets). (8) Fees collected which were previously deposited in the U.S. Treasury. Fees, such as patron late fees for library books, which were deposited, prior to UFM implementation, in the U.S. Treasury whether the books were purchased through the MWR USA process or directly from APF sources, are to be deposited in the garrison MWR bank account. The accounting for these fees is to follow the same procedure as described in c (7) a. This treatment only applies to MWR programs operating under the UFM process. (9) Fiscal Year End. (a) At the beginning of September of each fiscal year the garrison FM in concert with IMCOM Region FM and the servicing accounting office, must review the balance in GLAC 264 to determine if the funds will be exhausted prior to the end of the fiscal year. Any funds which may remain at the end of the fiscal year may remain with the garrison or re-directed by the IMCOM Region. Should funds be re-directed, request this headquarters be notified in order to enable the re-direction. (b) If funds are allowed to remain within the Garrison, there should be no shortfall reported. However, in certain circumstances this may legitimately occur with a Garrison reporting a balance in the unearned income accounts and a balance or no balance in the shortfall accounts. In this instance, the Garrison should be prepared to provide explanations for this occurrence. (10) Classification of Expenses. In UFM reporting, as in all NAF reporting, it is incumbent upon the Garrison FM to ensure all documents provided to the servicing accounting office clearly identify the Garrison Standard NAFI Number (SNN), program code, location code, department code, and GLAC. Care must be taken to ensure that all UFM transactions are properly identified to either the IMCOM Central or local agreements. 13 Enclosure 8 FY 11 Uniform Funding and Management (UFM) 11. Manpower Tracking. a. Objective: To create a tracking system that may evolve into a total MWR manpower database, providing a reliable and consistent source. Supports visibility of former APF authorizations as they are converted under UFM. b. Information Management Enterprise Tracking System (IMETS): Automated system used to track MWR manpower/workforce and conversions under UFM. Refer to the Army Implementation Guidance for UFM for more information on IMETS. c. The Director of Force Management (DAMO) issued a memorandum, subject: Documentation of Spaces Converted from APF to NAF, 23 December 2005, describing the documentation and process. (1) UFM documentation will occur during POM 08-13 with the FMWRC identifying the number of current NAF spaces paid by APF. UFM positions will be recorded in SAMAS using the following codes to allow for tracking and affordability analysis: (a) Civilian Type (CTYPE): 999 (b) Resource Code (RC): - Requirements: QNAF - Authorizations: CNAF (2) Commands with MWR employees will submit: (a) A Schedule 8 as part of their POM 08-13 submission to turn-in manpower requirements and authorizations of APF positions that are no longer filled by APF personnel. MACOMs will not move a requirement or authorization to a non-MWR function program. (b) Line level of detail information for the APF positions converted to NAF positions to remove those positions from the TAADS Documents. Converted positions will not be documented on the TAADS Document but will be managed through the MWR manpower program. (3) Actions listed in paragraphs (1) and (2) above will be the basis for establishing and maintaining UFM MWR manpower accounting. 12. Summary. 14 Enclosure 8 FY 11 Uniform Funding and Management (UFM) a. Uniform Funding and Management does not result in increases or decreases to the Army’s level of funding MWR. It is a new way of executing the MWR service. The authorizations for APF support for MWR are not altered as a result of implementing UFM. Further, the DoD will continue to require the reporting of APF support for MWR in the current level of detail. b. For more information on UFM regarding the Human Resource plan, Procurement guidance, IMETS, and the Marketing Communications Plan, please see the Army UFM Implementation Guidance. 13. Points of Contact FMWRC (IMWR-FM) Karen Strunk Jim Phillips Christine French Jim Keene Karen.m.strunk@us.army.mil James.H.Phillips@us.army.mil Christine.French@us.army.mil Jim.Keene1@us.army.mil 15 Enclosure 8