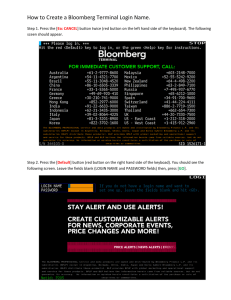

Euro Tops USD 1 35 First Time Since 2011 as Metals Advance

advertisement

Euro Tops USD 1 35 First Time Since 2011 as Metals Advance By Stephen Kirkland & Lukanyo Mnyanda – Jan 30, 2013 7:31 PM GMT+0700 http://www.bloomberg.com/news/2013-01-30/asian-stocks-rise-for-second-day-as-wonstrengthens-oil-falls.html Tomohiro Ohsumi/Bloomberg A man counts euro notes in this arranged photograph in Tokyo, Japan. The euro strengthened above $1.35 for the first time since 2011, metals gained and Treasuries fell as the Federal Reserve meets and European economic confidence rose more than estimated this month. European stocks declined from a 23-month high. Enlarge image The euro advanced for a second day against the dollar, reaching $1.3563, the highest level since November 2011. Photographer: Alessia Pierdomenico/Bloomberg 6:45 Jan. 30 (Bloomberg) -- Neil Jones, head of European hedge-fund sales at Mizuho Corporate Bank Ltd., discusses the euro, yen and potential impact of tighter Federal Reserve monetary policy on currency markets. He talks with Mark Barton and Caroline Hyde on Bloomberg Television's "On the Move." (Source: Bloomberg) 5:22 Jan. 30 (Bloomberg) -- Nick Nelson, a strategist at UBS AG, discusses his stock recommendations and the outlook for U.S. and European banks. He speaks with Francine Lacqua on Bloomberg Television's "On the Move." (Source: Bloomberg) The euro appreciated 0.4 percent to $1.3543 at 7:25 a.m. in New York, while the yen declined against all but one of its 16 major peers. Nickel advanced 2.1 percent and zinc climbed 2.3 percent, leading commodities to a three-month high. The Treasury 10-year yield increased two basis points to 2.02 percent. The Stoxx Europe 600 Index slipped 0.3 percent, while Standard & Poor’s 500 Index futures swung between gains and losses. Amazon.com Inc. jumped 9.2 percent after reporting gains in sales and North American operating margins. The Fed’s latest round of bond buying will reach $1.14 trillion before it ends the program in the first quarter of 2014, economists forecast in a Bloomberg survey. The U.S. will report fourth-quarter economic growth today before monthly payroll data on Feb. 1. An index of executive and consumer sentiment rose to 89.2, surpassing the 88.2 reading forecast in a Bloomberg survey, the European Commission said today. “The world is shifting from fear to hunt for opportunity,” said Neil Jones, head of European head of hedge- fund sales at Mizuho Corporate Bank Ltd. in London. “Slowly but surely, economic data in the euro zone is going in the right direction and the numbers today were encouraging. The euro is leading the way today.” Euro Gains The euro advanced for a second day against the dollar, reaching $1.3563, the highest level since November 2011. It appreciated to as high as 86.07 British pence, the strongest since Dec. 7, 2011, before trading at 85.85. Against the yen, Europe’s shared currency rose 1 percent. The yen weakened 0.7 percent to 91.33 per dollar, taking its January loss to 5 percent. That would be a fourth monthly decline, the longest losing streak since 2008. It reached 91.41 yen per dollar today, the weakest level since June 2010. South Korea’s won retreated 0.3 percent against the dollar after Deputy Finance Minister Choi Jong Ku said taxes on currency trading and bonds should be considered to help limit “speculative” inflows. U.S. Treasuries dropped for a fifth day, the longest run of declines since August. Singapore bonds also fell, pushing 10- year yields nine basis points higher to 1.48 percent. The yield on Italy’s 10-year note rose seven basis points to 4.24 percent as government sold 3 billion euros ($4.1 billion) of 2017 notes and 3.5 billion euros of bonds due in 2022. Metals Climb The S&P GSCI gauge of 24 commodities climbed 0.7 percent to the highest since Oct. 11. Zinc, nickel, aluminum and copper rose at least 1.5 percent. Oil rose 0.5 percent to $98.06 a barrel. Palladium rose to a 16-month high. U.S. natural gas increased 0.9 percent, the first advance for the most-active contract in seven sessions. The Stoxx 600 retreated as oil-services companies tumbled after Italy’s Saipem SpA (SPM) cut its profit forecast. Saipem lost 32 percent. Petrofac Ltd. sank 6.2 percent in London trading, Technip SA retreated 6.6 percent in Paris and Subsea 7 SA declined 5.8 percent in Oslo. Imperial Tobacco Group Plc sank 4.8 percent as Europe’s second-biggest tobacco company said earnings will drop because of worsening conditions in Europe. Swedbank AB jumped 8.6 percent after raising its dividend payout ratio to 75 percent of profit as fourthquarter net income more than quadrupled. Best Start The S&P 500 extended its best start to a year since 1989 as profit beat the average analyst estimate at 76 percent of the 180 companies in the index that posted results so far this reporting season. The gauge, which has rallied 5.7 percent in 2013, is less than 4 percent below its record of 1,565.15 set in October 2007, while the Dow Jones Industrial Average is less than 2 percent from its all-time high. Amazon gained as the world’s largest Internet retailer said fourth-quarter sales climbed 22 percent to $21.3 billion. Operating margin in North America widened to 5 percent from 2.9 percent a year earlier. Data today is forecast to show U.S. economic growth slowed to 1.1 percent on an annualized basis in the fourth quarter, according to the median estimate in a Bloomberg survey. Expansion was 3.1 percent in the three months ended Sept. 30. Employers added 161,000 workers to payrolls in January after a 155,000 December increase, according to the median estimate of economists in a Bloomberg survey before the Feb. 1 Labor Department report. Emerging Markets The MSCI Emerging Markets Index (MXEF) gained 0.2 percent, heading for its longest stretch of monthly gains in three years. The Shanghai Composite Index added 1 percent, extending its bull market. Taiwan’s Taiex index advanced 0.4 percent as securities regulator said the island will double the limit on mainland Chinese institutions’ securities investments. Egyptian stocks rebounded from a one-month low and Russia’s Micex Index gained 0.2 percent as commodities rose. Israelis stocks fell for a second day after Stanley Fischer said yesterday he will step down as central bank chief in June. Poland’s WIG20 Index slipped 0.5 percent as Bank Pekao SA tumbled the most since November 2011 after UniCredit SpA said it was selling as much as 9.1 percent of its Polish unit to free capital and increase earnings. Hellenic Telecommunications Organization SA, the Greek phone company known as OTE, is marketing a benchmark issue of five-year junk bonds that will be priced to yield 8 percent to 8.25 percent. The notes will be the lowest-rated securities from a peripheral European issuer in at least seven years. The deal comes as the cost of insuring against default on junk bonds climbed, with the Markit iTraxx Crossover index of credit-default swaps on 50 mostly high-yield companies rising six basis points to 438 basis points. To contact the reporters on this story: Stephen Kirkland in London at skirkland@bloomberg.net; Lukanyo Mnyanda in Edinburgh at lmnyanda@bloomberg.net To contact the editor responsible for this story: Stuart Wallace at swallace6@bloomberg.net