CHAPTER 3

advertisement

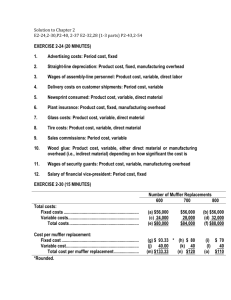

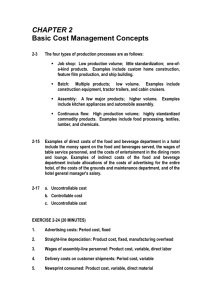

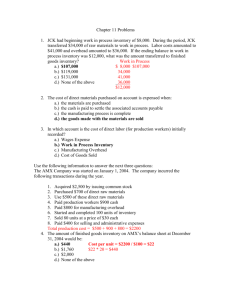

CHAPTER 3 Product Costing and Cost Accumulation in a Batch Production Environment 3-2 In a job-order costing system, costs are assigned to batches or job orders of production. Job-order costing systems are used by firms that produce relatively small numbers of dissimilar products. In a process-costing system, production costs are averaged over a large number of product units. Process-costing systems are used by firms that produce large numbers of nearly identical products. 3-4 a. Material requisition form: A document upon which the production department supervisor requests the release of raw materials for production. b. Labor time record: A document upon which employees record the time they spend working on each production job or batch. c. Job-cost record: A document on which the costs of direct material, direct labor, and manufacturing overhead are recorded for a particular production job or batch. The job-cost sheet is a subsidiary ledger account for the Work-in-Process Inventory account in the general ledger. 3-9 The difference between actual and normal costing systems involves the procedure for applying manufacturing overhead to Work-in-Process Inventory. Under actual costing, applied overhead is the product of the actual overhead rate (computed at the end of the period) and the actual amount of the cost driver used. Under normal costing, applied overhead is the product of the predetermined overhead rate (computed at the beginning of the period) and the actual amount of the cost driver used. 3-16 When direct material, direct labor, and manufacturing-overhead costs are incurred, they are applied to Work-in-Process Inventory by debiting the account. When goods are finished, the costs are removed from that account with a credit, and they are transferred to Finished-Goods Inventory by debiting that account. Subsequently, when the goods are sold, Finished-Goods Inventory is credited, and the costs are added to Cost of Goods Sold with a debit. EXERCISE 3-23 (10 MINUTES) 1. Process 2. Job-order 3. Job-order (contracts or projects) 4. Process 5. Process 6. Job-order 7. Process 8. Job-order (contracts or projects) 9. Process 10. Job-order EXERCISE 3-25 (25 MINUTES) JOB-COST RECORD Job Number TB78 Description Date Started 8/11 Date Completed teddy bears 8/20 Number of Units Completed Direct Material Requisition Number Quantity 201 500 208 600 Date 8/11 8/12 Unit Price $.90 .40 Cost $450 240 Rate $14 Cost $7,700 Direct Labor Hours 550 Date 8/15 Time Card Number 82 Date 8/15 Manufacturing Overhead Activity Base Quantity direct-labor hours 550 1,000 Application Rate $3 Cost $1,650 Cost Summary Cost Item Total Direct Material Total Direct Labor Total Manufacturing Overhead Total Cost Unit Cost Date 8/30 Amount $ 690 7,700 1,650 $10,040 $ 10.04 Shipping Summary Units Remaining Units Shipped In Inventory 800 200 Cost Balance $2,008* *200 units remaining in inventory$10.04 = $2,008 EXERCISE 3-26 (15 MINUTES) 1. Applied manufacturing overhead = total manufacturing costs 30% = $1,250,000 30% = $375,000 Applied manufacturing overhead = direct-labor cost 80% Direct-labor cost = applied manufacturing overhead 80% = $375,000 .8 = $468,750 2. Direct-material used = total manufacturing cost – direct labor cost – applied manufacturing overhead = $1,250,000 – $468,750 – $375,000 = $406,250 3. Let X denote work-in-process inventory on December 31. Total manufacturing cost $1,250,000 work-in-process + inventory, – Jan. 1 + .75X – work-in-process inventory, Dec. 31 X = cost of goods manufactured = $1,212,500 .25X = $1,250,000 – $1,212,500 X = $150,000 Work-in-process inventory on December 31 amounted to $150,000. EXERCISE 3-31 (20 MINUTES) 1. Raw material: Beginning inventory .................................................................................. Add: Purchases ......................................................................................... Deduct: Raw material used ....................................................................... Ending inventory ....................................................................................... $142,000 ? 652,000 $162,000 Therefore, purchases for the year were ................................................... $672,000 2. Direct labor: Total manufacturing cost .......................................................................... Deduct: Direct material ............................................................................. Direct labor and manufacturing overhead ............................................... 3. 4. $1,372,000 652,000 $ 720,000 Direct labor + manufacturing overhead Direct labor + (60%) (direct labor) (160%) (direct labor) = = = $720,000 $720,000 $720,000 Direct labor = $720,000 1.6 Direct labor = $450,000 Cost of goods manufactured: Work in process, beginning inventory .................................................. Add: Total manufacturing costs ............................................................ Deduct: Cost of goods manufactured ................................................... Work in process, ending inventory ....................................................... $ 160,000 1,372,000 ? $ 60,000 Therefore, cost of goods manufactured was ....................................... $1,472,000 Cost of goods sold: Finished goods, beginning inventory ...................................................... Add: Cost of goods manufactured ........................................................... Deduct: Cost of goods sold ...................................................................... Finished goods, ending inventory ........................................................... $ 180,000 1,472,000 ? $ 220,000 Therefore, cost of goods sold was ........................................................... $1,432,000 EXERCISE 3-33 (20 MINUTES) NOTE: Budgeted sales revenue, although given in the exercise, is irrelevant to the solution. 1. Predetermined overhead rate = budgetedmanufacturing overhead budgetedlevel of cost driver (a) $650,000 = $32.50 per machine hour 20,000 machine hours (b) $650,000 = $26.00 per direct-labor hour 25,000 direct - labor hours (c) $650,000 $325,000 * = $2.00 per direct-labor dollar or 200% of direct-labor cost *Budgeted direct-labor cost = 25,000$13 2. Actual manufacturing overhead – applied manufacturing overhead = overapplied or underapplied overhead (a) $690,000 – (22,000)($32.50) = $25,000 overapplied overhead (b) $690,000 – (26,000)($26.00) = $14,000 underapplied overhead (c) $690,000 – ($364,000†)(200%) = $38,000 overapplied overhead †Actual direct-labor cost = 26,000$14 EXERCISE 3-34 (5 MINUTES) 1. 2. Work-in-Process Inventory ...................................................... Manufacturing Overhead ............................................... 690,000 Work-in-Process Inventory ...................................................... Manufacturing Overhead ............................................... 715,000* 690,000 715,000 *Applied manufacturing overhead = $715,000 = 22,000 hours x $32.50 per machine hour EXERCISE 3-35 (15 MINUTES) 1. Predetermined overhead rate = $1,040,000 / 80,000 hours = $13.00 per hour 2. To compute actual manufacturing overhead: Depreciation ............................................................................................... Property taxes............................................................................................ Indirect labor .............................................................................................. Supervisory salaries ................................................................................. Utilities ....................................................................................................... Insurance ................................................................................................... Rental of space .......................................................................................... Indirect material: Beginning inventory, January 1 ........................................................ $ 48,000 Add: Purchases .................................................................................. 102,000 Indirect material available for use ..................................................... $150,000 Deduct: Ending inventory, December 31 .......................................... 70,000 Indirect material used ........................................................................ Actual manufacturing overhead ............................................................... Overapplied overhead = actual manufacturing overhead – applied manufacturing overhead $250,000 21,000 82,000 220,000 61,000 34,000 310,000 80,000 $1,058,000 = $1,058,000 – ($13.0083,000*) = $21,000 *Actual direct-labor hours. 3. Manufacturing Overhead ........................................................... Cost of Goods Sold .......................................................... 4. 21,000 21,000 In the electronic version of the solutions manual, press the CTRL key and click on the following link: 10E - BUILD A SPREADSHEET 03-35.XLS NOTE: Budgeted selling and administrative expense, although given in the exercise, is irrelevant to the solution. PROBLEM 3-43 (35 MINUTES) 1. Predetermined overhead rate = budgeted overhead ÷ budgeted directlabor cost = $2,730,000 ÷ $2,100,000 = 130% of direct labor cost 2. Additions (debits) total $7,802,500 [$2,800,000 + $2,175,000 + ($2,175,000 x 130%)]. 3. The finished-goods inventory consisted of job no. 3154, which cost $175,750 [$78,000 + $42,500 + ($42,500 x 130%)]. 4. Since there is no work in process at year-end, all amounts in the Work-inProcess account must be transferred to Finished-Goods Inventory. Thus: Finished-Goods Inventory .......................................7,880,900* Work-in-Process Inventory .......................... ....................................................................................7,880,900 *Beginning balance in Work-in-Process Inventory + additions to the account: $78,400 + $7,802,500 = $7,880,900 5. BBBC’s applied overhead totals 130% of direct-labor cost, or $2,827,500 ($2,175,000 x 130%). Actual overhead was $2,777,000, itemized as follows, resulting in overapplied overhead of $50,500. Indirect materials used ........................................... $ 32,500 Indirect labor ........................................................... 1,430,000 Factory depreciation ............................................... 870,000 Factory insurance ................................................... 29,500 Factory utilities ....................................................... 415,000 Total.................................................................... $2,777,000 6. Manufacturing Overhead ...................................................... Cost of Goods Sold .................................................. The company’s cost of goods sold totals $7,654,650: Finished-goods inventory, Jan. 1……………. $ 50,500 50,500 0 Add: Cost of goods manufactured………….. 7,880,900 Cost of goods available for sale……………... $ 7,880,900 Less: Finished-goods inventory, Dec. 31….. 175,750 Unadjusted cost of goods sold………………. $ 7,705,150 Less: Overapplied overhead…………………. 50,500 Cost of goods sold……………………………... $ 7,654,650 7. No, selling and administrative expenses are operating expenses of the firm and are treated as period costs rather than product costs. Such costs are unrelated to manufacturing overhead and cost of goods sold. PROBLEM 3-46 (35 MINUTES) 1. Predetermined overhead rate = budgeted overhead ÷ budgeted machine hours = $1,925,000 ÷ 35,000 = $55.00 per machine hour 2. (a) Work-in-Process Inventory ...................................... 170,000* Raw-Material Inventory ..................... 170,000 Work-in-Process Inventory ...................................... 288,200** Wages Payable .............................................. 288,200 * $45,000 + $90,000 + $33,000 = $170,000 ** $80,000 + $49,000 + $140,000 + $19,200 = $288,200 (b) Manufacturing Overhead ...................................................... 520,000 Accumulated Depreciation ....................................... 72,000 Wages Payable .......................................................... 140,000 Manufacturing Supplies Inventory .......................... 15,000 Miscellaneous Accounts .......................................... 293,000 (c) Work-in-Process Inventory .................................................. 605,000* Manufacturing Overhead .......................................... 605,000 * (2,500 + 1,500 + 5,000 + 2,000) x $55.00 = $605,000 (d) Finished-Goods Inventory ....................................... 692,000* Work-in-Process Inventory ...................................... 692,000 * Job 101: $182,000 + $45,000 + $80,000 + (2,500 x $55.00) = $444,500 Job 102: $116,000 + $49,000 + (1,500 x $55.00) = $247,500 $692,000 = $444,500 + $247,500 (e) Accounts Receivable ................................................ 319,800* Sales Revenue .............................................. 319,800 * $247,500 + $72,300 = $319,800 Cost of Goods Sold .................................................. 247,500 Finished-Goods Inventory ........................... 247,500 3. Job no. 103 and no. 104 are in production as of March 31: Job 103: $92,000 + $140,000 + (5,000 x $55.00) ..................$507,000 Job 104: $33,000 + $19,200 + (2,000 x $55.00) .................... 162,200 Total ...........................................................................$669,200 4. Finished-goods inventory increased by $444,500 ($692,000 - $247,500). 5. The company’s actual overhead amounted to $520,000, whereas applied overhead totaled $605,000. Thus, overhead was overapplied by $85,000.