Democracy and Economic Growth:

Chapter Three:

G ROWTH

Rightly or wrongly, economic growth has come to dominate discussions of political performance. If a country’s economy is growing rapidly its government will take full credit for the achievement, and citizens are likely to reward them with another term in office (if the system is democratic). Where an economy lapses into recession, political leaders will be blamed. Academics and policymakers, likewise, look first to a country’s growth performance to judge its overall quality of governance.

Of course, one may doubt the extent to which government policy affects short-term changes in per capita GDP. One may also doubt the extent to which per capita GDP provides an accurate measure of human welfare. With these concerns in mind, the present volume adopts multiple measures of government performance.

That said, it is fair to assume that consistently poor economic performance probably has something to do with a country’s politics, broadly considered. Likewise, a consistently strong growth rate, maintained over a period of years, is a sign that something is going well in the political sphere. Additionally, it seems fair to assume that economic growth – an increase in the total size of the economic pie – is one of the factors that every government rightly aspires to achieve, even if it is not the only objective. With this modest understanding of the place of growth accounting amidst the manifold tasks of governance, we proceed.

The predominant view stemming from academic work over the past two decades is that regime-type has no causal effect on GDP growth, taking all other factors into account. Countries with authoritarian political systems are said to grow as rapidly as democracies, perhaps even faster.

To be sure, democracy probably has some positive indirect effects—for example, greater stability or more extensive property rights. The econometric evidence suggests, however, that these positive effects are balanced by negative effects such that the net effect of democracy on growth performance cross-nationally over the past five decades is negative or null.

1

A few exceptions to this general finding may be briefly noted. Papaioannou & Siourounis

(2004) and Rodrik & Wacziarg (2004) find a relationship between episodes of democratization (if sustained) and growth rates in subsequent years, though refrain from making any claims about the effect of democracy per se on growth performance. Barro (1997) finds that “growth is increasing in democracy at low levels of democracy, but the relation turns negative once a moderate amount of political freedom is attained.” A few recent studies find a positive overall relationship between democracy and growth but the authors do not report extensive robustness tests (e.g., Bhalla 1997;

Leblang 1997); perhaps as a result, these studies have not been cited extensively in the literature.

For the most part, case study approaches to the question of democracy and growth confirm the results of cross-national empirics.

2 For those focused on individual country trajectories, it is difficult to resist the fact that some of the most impressive growth performances in the postwar era have been registered by authoritarian regimes, including China, Hong Kong, Malaysia, Singapore,

1 Barro (1996), Feng (1997, 2003), Krieckhaus (2004), Kurzman, Werum, Burkhart (2002),

Przeworski, Limongi (1993, 1997), Przeworski et al. (2000), Seawright (2006).

2 E.g., Chan (2002), Woo-Cumings (1999).

South Korea, Taiwan, and Vietnam. Of course, some of these countries are now vibrant democracies; but it is nonetheless true that their postwar growth spurts were attained largely under the auspices of authoritarian rule. To East Asianists, the argument for a democratic growth dividend seems patently absurd. If anything, regionalists argue that there may be an authoritarian growth dividend. The capacity of these regimes maintain social order, to target investments on sunrise industries, to build human capital and infrastructure, to maintain cheap currencies, to maintain limited taxes and balanced budgets, and to suppress or moderate labor union demands is legendary.

Of course, different strategies were pursued by each of these countries, and these strategies changed somewhat over time. Even so, the export-led growth model engineered by the Newly Industrialized

Countries (NICs) demonstrates broad similarities across the region.

In Latin America, specialists note that phases of strong growth performance often occurred during periods of military rule, as in Brazil and Chile. By the same token, the most persistently democratic countries in the region – e.g., Costa Rica, Columbia, and Uruguay -- were not runaway economic successes. Only in Africa does the relationship between democracy and growth seem strong, although – until recently – there have been so few multi-party democracies that it is difficult to generalize. In short, although most of the rich countries in the world are democratic, the direction of causality is unclear. Case study evidence provides no clear causal story – or, to the extent that it does, it seems to suggest a negative relationship between democracy and growth.

In this chapter, we argue otherwise. On the basis of a series of crossnational regression analyses, democracy is shown to bear a positive relationship to growth when measured as a “stock” concept. We begin with a brief presentation of the anticipated causal mechanisms, and proceed to the empirics. A concluding section reflects on the actual size of the democratic growth effect, as predicted by the empirical model.

C

AUSAL

M

ECHANISMS

Because growth is the end-product of many contributing factors, it is exceedingly difficult to present a unified model to account for changes in per capita GDP. (Such are the shortcomings of general theory that the once-thriving field of macroeconomics is now moribund.) Macroeconomic models, while essential, are highly reductionist. Our task is simplified to the extent that our theoretical focus is narrowly focused on a country’s regime-type. However, since a country’s political institutions may affect virtually all other factors that contribute to growth this scarcely restricts our theoretical field of vision. Indeed, current shift in macroeconomic theory away from an exclusive focus on physical capital and towards factors such as human capital, social capital, and

“good institutions”, which might be referred to as political capital reinforces this conclusion. Since government policy directly affects these factors, it stands to reason that regime-type might have important effects on aggregate growth. One implication of “endogenous growth” theory is to emphasize the primacy of politics.

But what, precisely, are the causal mechanisms? Most of the topics discussed in later chapters might be regarded as mediating factors in the regime/growth relationship. Insofar as the accumulation of experience under democratic rule causes improvements in economic policy (chapter four), infrastructure (chapter five), policy continuity (chapter six), education (chapter eight), public health (chapter nine), and gender equality (chapter ten), these improvements should contribute to improved growth performance. Since these factors are discussed at length in later chapters, we leave them in abeyance.

2

A NALYSIS

The relationship between democracy and growth may be tested in many ways. We take as our point of departure the cross-country regression format. Yet, this scarcely limits the methodological field since any of the multitudinous approaches employed in current growth regressions might also be applied to this particular question.

3 The researcher faces choices about which time intervals to consider, how to correct for serial and spatial autocorrelation, and how to resolve issues of specification, simultaneity, and endogeneity, among other matters. Fortunately, there is agreement about how to measure the dependent variable, economic growth, which is generally understood as the percentage change in

GDP per capita.

4

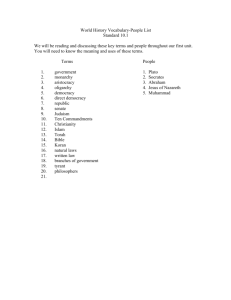

In Table 3.1, growth is regressed against two measures of democracy – a contemporary measure (“democracy level”) and a stock measure, along with various controls. The results shown in models 1 and 2 confirm the standard finding. If democracy is understood as having a contemporaneous or short-term relationship with growth (lagged by only one time-period), it has no statistically significant effect on economic performance. This nonrelationship is robust across a wide range of democracy indicators and model specifications (not shown). It matters not how one measures the level of democracy in a given year; it still has no effect on subsequent economic performance.

In the remaining models we investigate democracy as a stock variable. Model 2 shows level and stock measures of democracy side by side. [Comment on the results.] Model 3 presents what we regard as our benchmark model, with only one generally recognized control variable, GDP per capita (to account for convergence effects). Model 4 drops that control variable, demonstrating that democracy stock enhances growth performance even when convergence effects are ignored. Model

5 includes a small set of additional control variables chosen by virtue of their theoretical significance

(in the growth literature) and/or their robust performance in this specification (see chapter appendix for variable definitions). Note that because some of these factors may be endogenous to a country’s regime-type, their inclusion may pose identification problems. Model 6, a “kitchen sink” specification, adds another set of control variables that are available for a large sample of countries over the postwar period and are suggested by the literature.

5 endogeneity (vis-à-vis democracy stock) are even greater.

Here, problems of potential

Although these various specifications affect the coefficient and standard error of democracy stock, the variable remains statistically significant. When measured as a stock variable, democracy appears to have a strong positive relationship to growth performance regardless of the specification

3 For a recent review, see Temple (1999).

4 We employ the World Development Indicators growth variable, measured in constant dollars (WDI

2003). Additional data for the 1950s is imputed using the Penn World Tables ( PWT ) 6.1 data set (Chain index, constant dollars; Summers & Heston 1991). Our choice of the WDI data set as the primary data source for indicators of country growth is motivated by two concerns. First, WDI country coverage is considerably larger than offered by the PWT data set. Second, for various reasons explored by Nuxoll and Temple, the WDI indicator is probably the best measure of growth performance. See Nuxoll (1994) and Temple (1999: 118–

19).

5 We interpolate missing values for illiteracy, life expectancy, and population growth in order to maintain a consistent sample (failing to do so would have significantly reduced the sample size and perhaps biased our results).

3

of the growth equation.

6 chapter fourteen.

Further specification tests are included in the chapter appendix and in

6 In additional analyses (not shown), we introduce these control variables seriatim into the benchmark equation to make sure that their individual effects do not impair the performance of the key variable of interest, democracy stock. (They do not.)

4

Table 3.1:

Democracy and Growth

Democracy stock

Democracy stock, t-10

Democracy stock, t-20

Democracy level

GDP pc (ln)

Inflation (ln)

1

-0.028

(0.021)

2 3 4 5 6

X 0.006*** 0.002* 0.009*** 0.007***

(0.001) (0.001) (0.002) (0.002)

X

-2.597*** X -2.961***

(0.452) (0.488)

-4.805*** -4.655***

(0.519) (0.668)

-0.450*** -0.389***

(0.082) (0.091)

Investment ( PWT )

Instability (Banks)

Trade openness (

PWT

)

Life expectancy ( WDI )

Oil shock (dummy)

Growth pc

(trade-weighted)

Population growth

(

WDI

Trend

)

Years independent

Regime durability

(Polity IV)

Social conflict

(Marshall)

Govt consumption

(

PWT

)

Illiteracy (ln)

Annual Dummies

Constant

Observations

Countries

Sample Period

R squared (within)

Prob > F

0.023

(0.023)

(0.021)

0.002

(0.024)

-0.099*** -0.113***

(0.023)

0.041*** 0.047***

(0.007) (0.008)

0.134*** 0.194***

(0.037) (0.058)

-1.338*** 0.124

(0.318) (17.053)

0.468***

(0.117)

13.472

(17.259)

-0.166

(0.280)

0.003

(0.010)

-0.503

(0.645)

0.001

(0.025)

0.640

(0.707)

0.136

(0.281)

YES

21.145*** 23.885*** 1.771*** 28.654*** 31.125

(3.387)

6264

180

0.0000

(3.670)

6264

180

0.0000

(0.085)

6430

187

0.0673

(3.576)

3721

149

1950-00 1950-00 1950-00 1961-99

0.03 0.03 0.00 0.08

0.0000

(0.000)

3296

129

1961-98

0.13

0.0000

Fixed effect regressions with AR(1) disturbance. Units of analysis: country-year. Dependent variable: annual per capita growth rate. All predictors lagged one year. Newey-West standard errors in parentheses. (two-tailed tests) Variables and procedures defined in the text. Variables not indicated by source are constructed by the authors. *** p<.01 ** p<.05 *p<.10

Notes for the next iteration: Exclude the following variables: regime durability (which will be dealt with in chapter 14), years independent (which is picked up by country fixed effects), trend (picked up by annual dummies). Substitute the new conflict variables for this conflict variable (drawn from Marshall).

5

T

HE

D

EMOCRATIC

G

ROWTH

E

FFECT

We have shown thus far that the relationship between democratic stock and growth is robust in a variety of plausible specifications and operationalizations. (Further tests are relegated to the appendix.) We turn now to the question of its practical significance. Is the democratic growth effect significant in real (policy) terms?

Let us consider the results of model 5 in Table 3.1, in which we control for a range of other possible causal factors. We regard this model as offering a conservative estimate of causal effects since many of the variables introduced as controls in this model may be endogenous to democracy, and hence might be suppressing democracy’s true causal effect on growth. (Note that the coefficient for democracy is virtually unchanged from the reduced-form equation in model 2, so it hardly matters which model one chooses to base this estimate on.)

Within the parameters of this model, a country with no existing stock of democratic capital

(for example, Botswana in 1966) experiences the following democratic growth effect: for each full decade of high-quality democracy (Polity2=10), democracy stock increases by approximately 100 points. To estimate the predicted effect of this change on growth, we simply multiply this change by the coefficient on democracy stock, 0.007. So from model 5 in Table 3.1, the predicted growth impact of a decade of high quality democracy is approximately 0.7 percent. Given the well-known cumulative effects of small increases in the growth rate, these changes are significant. For instance, an increase in the annual growth rate from 2 percent to 2.7 percent reduces the time needed to achieve a doubling of incomes from thirty-five to twenty-six years; an increase to 3.4 percent further reduces the doubling period to 20.7 years.

7

7 The number of years that a country growing at rate g takes to double its income is given by ln 2/ln

(1+g).

6

M ETHODOLOGICAL A PPENDIX

Specification problems pervade all cross-country growth regressions.

8 While the fixed-effect format handles the problem of invariant controls, it does nothing to control for factors that might vary over time. To control for convergence effects we include

GDP

/capita (natural logarithm) as part of the benchmark model. (Thus, we measure the effect of democracy on a country’s growth rate given its current level of economic wealth.)

Other controls are less obvious by virtue of their possibly endogenous relationship to democracy, their lack of robustness, or their theoretical status. At the same time, it is vital that we test as comprehensive a set of alternative controls as possible. These controls must encompass not only those identified by the prodigious literature on economic growth but also those factors that might affect the simultaneity problem discussed above.

However, for a variety of reasons, we do not maintain these controls in most of the tests shown above (Table 3.1) and below (Table 3.2). First, there is a substantial loss in degrees of freedom when the equation is expanded to include the full set of controls. Second, there is serious question about the theoretical justification (not to mention the empirical robustness) of all of these controls. Third, there is the danger of overspecifying causal relationships: note that democracy stock may affect any and all of these control variables. Indeed, the coefficient for democracy stock

increases in the full models shown in Table 3.1, a result that seems dubious if one’s principal objective is to measure the independent effect of democracy stock. For all these reasons, it seems safer to work with a smaller benchmark equation, including only

GDP per capita. This is the only control that can claim some degree of theoretical consensus, is empirically robust, and is—with respect to the causal question at hand—exogenous. (A recent reevaluation of cross-country growth empirics concludes that the log of GDP per capita is the only variable that is robust across all models [Bleaney

& Nishiyama 2002: 45].)

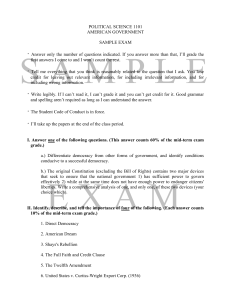

Results shown in Table 3.1 are based on annual data, fixed effects, and an AR1 correction for serial autocorrelation. We now attempt to show that our results are robust even when various elements of this methodology are altered: fixed effects versus random effects, annual versus fiveyear increments of data, the possible influence of OECD cases (tested this time in a random-effects format), a lagged-dependent-variable approach to modeling serial autocorrelation, the possible peculiarities of the democracy stock variable, and a wide variety of static (time-invariant) control variables, as displayed in Table 3.2.

For each model with annual data we have followed our usual approach of measuring all independent variables in the year prior to the dependent variable. For each model with five-year increments we have maintained the same approach, this time measuring the independent variables in the first year of the period under study. The dependent variable in this case is a five-year average of growth performance during the subsequent period. So in both cases the dependent variable is forward lagged one time-period.

The standard method of correcting for autocorrelation is employed where annual data is used (AR1 error correction), but not when five-year increments are used. (By virtue of the fact that we are dealing with five-year increments, it should be less of a problem.) No correction for serial autocorrelation is usually necessary when a lagged dependent variable is included, as in models 8 and

9, and none is employed.

Model 1 is a fixed-effects model with one control ( GDP pc) and growth data aggregated across five-year periods. Model 2 is a random-effects model with annual data and the same all-

8 Levine & Renelt (1992); Sala-i-Martin (1997); Temple (1999).

7

purpose control. Model 3 is a non-fixed-effects model with annual data that includes all large-N controls employed previously (see Table 2), plus some additional static controls, intended to model spatial heterogeneity. These include English legal origin (dummy), Muslims (as percentage of the population), ethnic fractionalization (the likelihood that two persons chosen randomly from a population will share the same ethnicity), East Asia (dummy), Middle East (dummy), Latin America

(dummy), and latitude (logarithm of the absolute value of the distance of a country’s capital city from the equator).

Model 4 is a non-fixed-effects model with five-year data increments and the same set of controls. Model 5 is a fixed-effects model with five-year increments and all relevant (varying) controls. Models 6 and 7 replicate models 3 and 4, this time excluding OECD cases. Models 8 and

9 test the lagged-dependent variable approach to

TSCS

analysis, discussed previously. In model 10 we test the benchmark specification in an Arellano-Bond format. This procedure combines firstdifferencing with a series of lags—equivalent to the total number of prior observations in the dataset—for each variable in the model.

9 (Simple first-difference models, without lagged instruments, show results similar to those in model 12.)

In each of these various tests we find that the democracy stock variable retains statistical significance, usually at the .01 level (two-tailed tests).

9 Arellano & Bond (1991).

8

AR correction

Frequency

Sample:

Country fixed effects:

1

AR(0)

5 years

All

Yes

Democracy stock 0.009***

(1900-)

Growth pc

(lagged dep var)

GDP pc (ln)

(WDI)

Inflation (ln)

(WDI)

Investment

(PWT)

Govt consumption

(0.002)

-4.581***

(0.864)

(PWT)

Trade openness

(PWT)

Population growth

(WDI)

Instability

(Banks)

Social conflict

(Marshall)

Years independent

Regime durability

(Polity IV)

Life expectancy

(WDI)

Illiteracy (ln)

(WDI)

Trend

Oil shock

(dummy)

English legal origin

(La Porta)

Muslims (% pop)

Ethnic fractionaliz.

(Alesina)

East Asia

(dummy)

Middle East

(dummy)

2

AR (1)

1 year

All

No

0.002***

(0.000)

0.096

(0.077)

(0.013)

0.010***

(0.003)

-24.731

(15.804)

-0.078***

(0.021)

0.045

(0.435)

0.000

(0.002)

-0.013**

(0.006)

0.092***

(0.024)

0.312**

3

AR (1)

1 year

All

No

0.002**

(0.001)

-0.544**

(0.212)

-0.250***

(0.085)

0.004

(0.015)

-0.037***

(0.146)

-0.016

(0.016)

-1.387***

(0.370)

0.161

(0.230)

-0.014***

(0.005)

-0.761

(0.499)

2.624***

(0.409)

1.305***

(0.488)

Table 3.2:

Alternative Estimators and Models

(0.014)

0.010***

(0.003)

-46.596***

(15.445)

-0.001

(0.021)

0.217

(0.464)

-0.000

(0.002)

-0.013**

(0.006)

0.093***

(0.025)

0.091

4

AR (0)

5 years

All

No

0.002**

(0.001)

-0.632***

(0.230)

0.006

(0.080)

-0.013

(0.015)

-0.030**

(0.150)

-0.026

(0.019)

-1.171***

(0.432)

0.131

(0.265)

-0.009

(0.006)

-0.547

(0.562)

2.919***

(0.477)

1.181**

(0.565)

(0.024)

0.021**

(0.009)

-33.207*

(18.896)

-0.007

(0.023)

-0.177

(0.607)

0.103

(0.097)

-0.013

(0.010)

0.145***

(0.051)

0.545

5

AR (0)

5 years

All

Yes

0.012***

(0.002)

-4.592***

(0.662)

-0.185*

(0.101)

-0.008

(0.023)

-0.006

(0.531)

-0.117

(0.102)

-0.464

(0.388)

(0.221)

-0.010

(0.021)

-1.186**

(0.493)

0.143

(0.317)

-0.014**

(0.006)

-0.546

(0.705)

2.862***

(0.600)

1.653***

(0.565)

(0.015)

0.009***

(0.004)

-20.794

(17.533)

-0.101***

(0.027)

0.042

(0.499)

0.001

(0.003)

-0.016*

(0.009)

0.074***

(0.029)

0.177

6

AR (1)

1 year nonOECD

No

0.003***

(0.001)

-0.556**

(0.241)

-0.230**

(0.099)

0.001

(0.018)

-0.035**

(0.218)

-0.026

(0.025)

-0.995*

(0.598)

0.025

(0.359)

-0.007

(0.007)

-0.661

(0.785)

3.111***

(0.688)

1.395**

(0.659)

(0.016)

0.007*

(0.004)

-44.483**

(18.894)

-0.007

(0.026)

0.047

(0.541)

0.001

(0.003)

-0.019**

(0.009)

0.075**

(0.030)

-0.174

7

AR (1)

5 years nonOECD

No

0.003**

(0.001)

-0.690***

(0.266)

-0.001

(0.088)

-0.006

(0.019)

-0.029*

8

AR (0)

1 year

All

Yes

0.006***

(0.001)

0.272***

(0.027)

-3.053***

(0.423)

10

AR (1)

1 year

All

No

0.034***

(0.002)

0.107***

(0.011)

-20.960***

(0.421)

(0.024)

0.042***

(0.007)

15.296

(16.500)

-0.083***

(0.020)

-0.520

(0.607)

-0.071

(0.229)

0.004

(0.010)

0.167***

(0.053)

0.634

9

AR (0)

1 year

All

Yes

0.008***

(0.002)

0.151***

(0.031)

-4.473***

(0.591)

-0.339***

(0.086)

-0.021

(0.025)

0.013

(0.604)

0.062

(0.230)

-0.973***

(0.350)

9

Latin America

(dummy)

Latitude (ln)

Constant

Observations

Countries

Sample Period

R squared (within)

Prob > F

Sargan test (prob)

35.797***

(6.457)

1082

179

1960-95

0.18

0.0000

1.073*

(0.583)

6264

180

1950-00

0.01

0.0000

-0.409

(0.333)

0.248

(0.168)

2.854

(1.937)

3231

128

1961-98

0.11

0.0000

-0.565

(0.362)

0.143

(0.195)

3.522

(2.157)

601

119

1965-95

0.28

0.0000

21.313***

(8.061)

615

121

1965-95

0.24

0.0000

-0.330

(0.493)

0.211

(0.191)

3.697

(2.654)

2335

101

1961-98

0.09

0.0000

-0.783

(0.518)

0.073

(0.234)

6.038**

(2.921)

435

92

1965-95

0.25

0.0000

24.082***

(3.171)

6136

180

1951-00

0.11

0.0000

27.400**

(13.951)

3302

130

1961-98

0.11

0.0000

0.298***

(0.010)

5954

178

1950-00

0.0000

All regressions are OLS (Newey-West standard errors in parentheses) except for model 12 which is estimated using the Arellano-Bond estimator. Corrections for autocorrelation in the residual and inclusion of country fixed effects are included as noted. Dependent variable: growth rates, either annually or in five-year increments (mean). All predictors lagged one year.

Variables and procedures defined in the text. Where no source is listed, the variable is constructed by the authors. *** p<.01 ** p<.05 *p<.10 (two-tailed tests)

10

Variable Definitions

English legal origin: dummy variable ( La Porta et al. 1999).

Ethnic fractionalization: the likelihood that two persons chosen randomly from a population will share the same ethnicity (Alesina et al. 2003).

GDP per capita: from the World Development Indicators (WDI 2003), with a small number of missing cases from the 1950s imputed from the Penn World Tables (

PWT

6.1) dataset ( Summers &

Heston 1991).

Government consumption: government share of real

GDP

per capita (

PWT

6.1).

Growth per capita, trade-weighted: Each country is assigned the mean value of the growth rate of all other countries in the world in that year, weighted by their bilateral trade with the country in question).

Illiteracy: percent of population who cannot read and write a sentence in their native tongue (World

Bank 2003), natural logarithm.

Inflation: annual percent change in consumer prices (natural logarithm; World Bank 2003).

Instability: includes assassinations, general strikes, guerilla warfare, government crises, purges, riots, revolutions, and anti-government demonstrations, all from the Banks dataset. Each is added together to form a composite index (construction of index by the authors).

Investment: the share of real GDP comprised by investment ( PWT 6.1).

Latitude: logarithm of the absolute value of the distance of a country’s capital city from the equator

(calculated by authors).

Life expectancy: life expectancy at birth (World Bank 2003)

Muslims: percentage of total population

Oil shock: dummy variable: 1950–1973=0, 1974–2000=1).

Population growth: (World Bank 2003).

Regime durability: the number of years since the last three-point change in the composite Polity2 score (Polity IV).

Regional dummies: East Asia, Middle East, Latin America.

Social conflict: includes civil violence, civil war, ethnic violence and ethnic war.

Trade openness: imports and exports as a share of GDP ( PWT 6.1)

Years independent: the number of years a country has been sovereign (coded by the authors).

11