REPLACEMENT PROBLEM WITH MACRS

advertisement

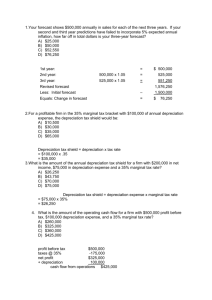

REPLACEMENT PROBLEM WITH MACRS Bradley Corp. purchased a computer two years ago for $120,000. The asset is being depreciated under the five-year MACRS schedule. The old computer can be sold for $37,600. A new computer will cost $180,000 and will also be written off using the five-year MACRS schedule. The new computer will provide cost savings and operating benefits over the old computer of $42,000 per year for the next 6 years. The firm has a 35 percent tax rate and a 10 percent cost of capital. Should Bradley Corp. replace its computer? Use NPV method. NET COST Year Percentage Depreciation Depreciation Annual Base (see MACRS) Depreciation 1.. 2.. $120,000 120,000 .200 .320 $24,000 38,400 Total depreciation to date $62,400 Purchase price $120,000 Total depreciation to date 62,400 Book value $ 57,600 Book value $57,600 Sales price 37,600 Tax loss on sale$20,000 Tax loss on sale$20,000 Tax rate 35% Tax benefit $ 7,000 Sale price of old computer$37,600 Tax benefit from sale $ 7,000 Cash inflow from sale of old computer $44,600 Price of new computer $180,000 - Cash flow from sale of old computer 44,600 Net cost of new computer$135,400 NET BENEFIT The annual depreciation on the new computer will be: YearDepreciation Percentage Annual .............. Base DepreciationDepreciation 1 2 3 4 5 6 $180,000 180,000 180,000 180,000 180,000 180,000 .200$36,000 .320 57,600 .192 34,560 .115 20,700 .115 20,700 .058 10,440 $180,000 The annual depreciation on the old computer for the remaining four years would be: Year 1. 2 3 4 Dep. Base $120,000 120,000 120,000 120,000 Percentage Annual Depreciation Depreciation .192 $23,040 .115 13,800 .115 13,800 .058 6,960 Note:: The next four years represent the last four years for the old computer, which is already two years old. ' Calculate the tax shield benefit of the incremental depreciation: (2) (3) (4) (5) (1) Depreciation on Depreciation onIncremental Year Now ComputerOld ComputerDepreciationRate 1 2 3 4 $36,000 57,600 34,560 20,700 $23,040 13,800 13,800 6,960 $12,960 43,800 20,760 13,740 (6) Tax Benefit .35 $ 4,536 .35 15,330 .35 7,266 .35 4,809 Tax Shield 5 6 20,700 10,440 20,700 10,440 .35 .35 7,245 3,654 Calculate the aftertax cost savings: (1) (2) Year Cost Savings 1 2 3 4 5 6 $42,000 42,000 42,000 42,000 42,000 42,000 (3) (4) Aftertax I - Tax Rate Savings .65 .65 .65 .65 .65 .65 $27,300 27,300 27,300 27,300 27,300 27,300 PRESENT VALUE OF BENEFITS (1) (2) (3) Tax Shield Benefits Aftartax Cost from Depreciation Savings Year 1 2 3 4 5 6 $ 4,536 15,330 7,266 4,809 7,245 3,654 (4) (5) total AnnualPresent Value Benefits Factor (10%) $27,300 $31,836 27,300 42,630 27,300 34,566 27,300. 32,109 27,300 34,545 27,300 30,954 (6) Present Value .909$28,939 .82635,212. .75125,959 .68321,930. .62121,452 .56417,458 Present value of incremental benefits Present value of incremental benefits Net cost of new computer NPV $150,950 135,400 $ 15,550 Therefore, Bradley Corp. should accept the project. $150,950