Course for Graduate International Students

advertisement

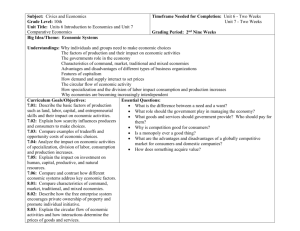

Institutional and Evolutionary Approaches to Economic Transformation Dimiter Ialnazov, Assistant Professor (Course for Graduate International Students) Graduate School of Economics, Kyoto University e-mail: ialnazov@econ.kyoto-u.ac.jp. Course language: English or Japanese Spring semester I. Introduction II. Various explanations of economic growth and development 1. physical capital, human capital, and social capital 2. dependency theory 3. policies (monetary and fiscal policies, openness to trade and foreign investment, industrial policies, market-augmenting policies, etc.) 4. institutions (legal systems, nature and capacity of the government, social norms, habits, routines, etc.) III. Some institutional and evolutionary theories 1. "old" institutional economics (Veblen, Commons) 2. the Coase theorem 3. the property rights literature (Alchian, Demsetz, Buchanan) 4. the theory of collective action (Olson) 5. "new" institutional economics (North, Williamson) 6. evolutionary economic theories (Hodgson, Chavance and Magnin) 7. other evolutionary theories (Hayek, Schumpeter) IV. Institutional change 1. how do institutions evolve? The concepts of path dependence and institutional lock-in (North). Institutional complementarity (Aoki). 2. how are institutions constructed? What types of political systems (autocracy, democracy, etc.) may produce sound institutions and how (Olson)? "Marketaugmenting" type of government. 3. the concept of emergent properties (Hodgson) V. Summary of the material studied during the spring semester Readings 1. C. Claque, ed., Institutions and Economic Development, The John Hopkins University Press, 1997 2. H. De Soto, The Mystery of Capital: Why Capitalism Triumphs in the West and Fails Everywhere Else, Bantam Press, 2000 3. H. Engerer, Privatization and its Limits in Central and Eastern Europe: Property Rights in Transition, Palgrave, 2001 4. G. Hodgson, “The Approach of Institutional Economics”, Journal of Economic Literature, Vol. XXXVI (March 1998), pp. 166-192 5. C. Menard, Institutions, Contracts and Organizations: Perspectives from New Institutional Economics, Edward Elgar, 2000 6. D. North, Institutions, Institutional Change and Economic Performance, Cambridge University Press, 1990 7. M. Olson, Power and Prosperity: Outgrowing Communist and Capitalist Dictatorships, Basic Books, 2000 8. T. Yeager, Institutions, Transition Economies, and Economic Development, Westview Press, 1999 Autumn semester Application of the above institutional and evolutionary approaches to transition economies 1. The centrally-planned system in former socialist countries (Central and Eastern Europe, former USSR, China) 2. The collapse of the centrally-planned system and transition to capitalism in the 1990s (Central and Eastern Europe, former USSR, China) 1. various explanations for the collapse of the centrally-planned system (initial conditions, economic reform progress, type of political system) 2. initial conditions and path dependence 3. external factors (the Washington consensus, the role of IMF, integration in the EU and the WTO) 4. macroeconomic reforms 5. legal reforms and corruption 6. privatization and property rights 7. corporate governance 8. the financial system 9. government incentives 10. microeconomic actor incentives 11. the political economy of transition 3. The importance of institutions. Indicators of institutional quality in former socialist countries (Central and Eastern Europe, former USSR, China) 4. The emergence of capitalism in former socialist countries (Central and Eastern Europe, former USSR, China). What type of capitalism or market economy? 5. Summary of the material studied during the autumn semester Readings 1. M. Aoki, Information, Corporate Governance, and Institutional Diversity, Oxford University Press, 2000 2. S. Braguinsky and G. Yavlinsky, Incentives and Institutions: The Transition to a Market Economy in Russia, Princeton University Press, 2000 3. B. Chavance and E. Magnin, “The Emergence of Various Path-dependent Mixed Economies in Post-Socialist Central Europe”, EMERGO, Vol. 2, No. 4, Autumn 1995, pp. 55-75 4. H. Engerer, Privatization and its Limits in Central and Eastern Europe: Property Rights in Transition, Palgrave, 2001 5. D. Guthrie, Dragon in a Three-piece Suit: The Emergence of Capitalism in China, Princeton University Press, 1999 6. M. Lavigne, The Economics of Transition: From Socialist Economy to Market Economy, Macmillan Press, 1999 7. M. Olson, Power and Prosperity: Outgrowing Communist and Capitalist Dictatorships, Basic Books, 2000 8. Y. Qian, The Institutional Foundations of China’s Market Transition, Paper presented at the World Bank’s Annual Conference on Development Economics, Washington, D.C., 28-30 April, 1999 9. D. Stark and L. Bruszt, Postsocialist Pathways: Transforming Politics and Property in East Central Europe, Cambridge University Press, 1998 10. T. Yeager, Institutions, Transition Economies, and Economic Development, Westview Press, 1999 Students will be evaluated according to the following criteria: 1. class participation (presentations, as well as participation in discussions during classes): maximum 30 points 2. the results of two mid-term tests (one in spring, and one in autumn): maximum 20 points 3. the quality of a research paper (to be submitted by the end of the autumn semester): maximum 50 points To earn the credits, you need to obtain a total score of at least 70 points from the above a), b) and c).