Hospital Business Interruption Insurance Worksheet

advertisement

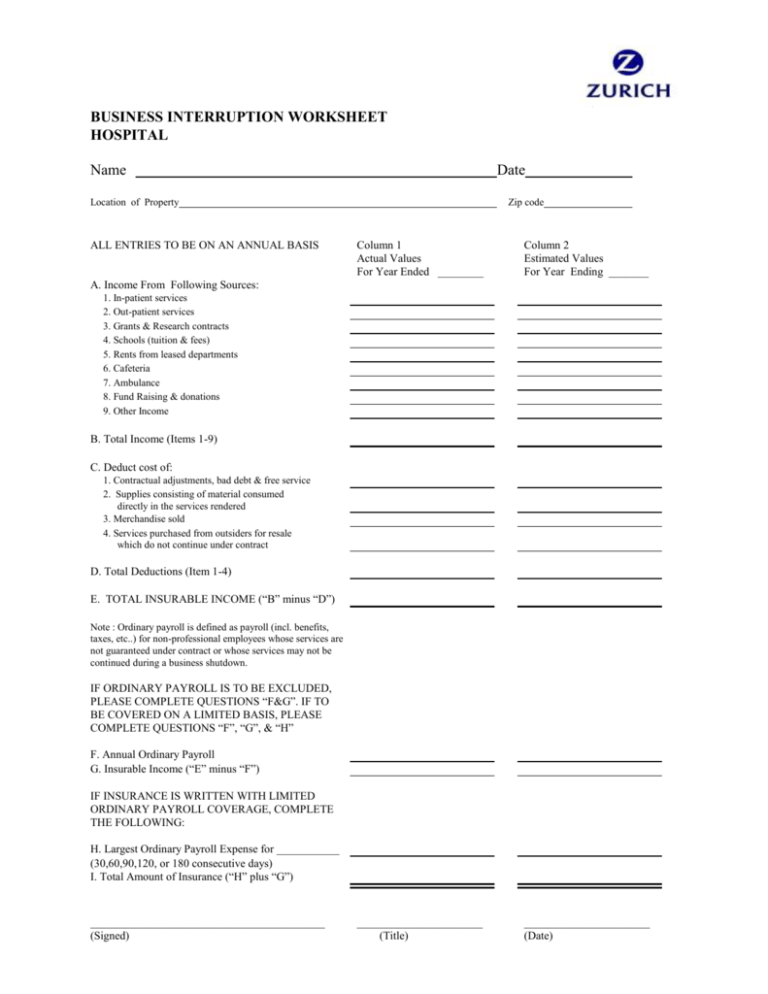

BUSINESS INTERRUPTION WORKSHEET HOSPITAL Name Date Location of Property ALL ENTRIES TO BE ON AN ANNUAL BASIS Zip code Column 1 Actual Values For Year Ended ________ Column 2 Estimated Values For Year Ending _______ ______________________ (Title) ______________________ (Date) A. Income From Following Sources: 1. In-patient services 2. Out-patient services 3. Grants & Research contracts 4. Schools (tuition & fees) 5. Rents from leased departments 6. Cafeteria 7. Ambulance 8. Fund Raising & donations 9. Other Income B. Total Income (Items 1-9) C. Deduct cost of: 1. Contractual adjustments, bad debt & free service 2. Supplies consisting of material consumed directly in the services rendered 3. Merchandise sold 4. Services purchased from outsiders for resale which do not continue under contract D. Total Deductions (Item 1-4) E. TOTAL INSURABLE INCOME (“B” minus “D”) Note : Ordinary payroll is defined as payroll (incl. benefits, taxes, etc..) for non-professional employees whose services are not guaranteed under contract or whose services may not be continued during a business shutdown. IF ORDINARY PAYROLL IS TO BE EXCLUDED, PLEASE COMPLETE QUESTIONS “F&G”. IF TO BE COVERED ON A LIMITED BASIS, PLEASE COMPLETE QUESTIONS “F”, “G”, & “H” F. Annual Ordinary Payroll G. Insurable Income (“E” minus “F”) IF INSURANCE IS WRITTEN WITH LIMITED ORDINARY PAYROLL COVERAGE, COMPLETE THE FOLLOWING: H. Largest Ordinary Payroll Expense for ___________ (30,60,90,120, or 180 consecutive days) I. Total Amount of Insurance (“H” plus “G”) _________________________________________ (Signed) Explanatory Notes: A. Items 1 through 9 are possible revenue streams for the hospital. They will add up to the total income for the hospital. B. Is the total income of items 1thru 9 in item A. C. Items 1 through 4 are deductions from the total income. 1. Contractual adjustments are discounts on contracts in place. (example HMO plans) Bad debts would be unpaid bills by patients that are written off, and not reimbursed by government programs. Free Service would care that is given to patients that are unable to pay, and not reimbursed paid by government programs. 2. Supplies would consist of disposable goods used to provide services. (examples, gowns, BandAids, syringes) 3. Merchandise sold by the hospital. This would be crutches, splints, etc…. 4. Service provided by outsiders, which is resold to patients, These services contracted out by the hospital. An example, contracting diagnostic service by an outside company. Ambulance service by an outside company. A. Item D is the total of all deductions in item C. (These items would be non-continuing costs) B. Item E is total insurable income or gross earnings. ( Item B minus Item D) Stop here if the Hospital desires full coverage for loss of income. The Hospital does have the option to exclude ordinary payroll, or limit the ordinary payroll to a specific time period. The option to complete this starts in Item F. An ordinary payroll expense means payroll expenses for all employees except; Officers Executives Department Managers Employees under contracts Ordinary payroll expenses include the following; Payroll Employee Benefits, if directly related to payroll FICA payments the hospital pays Union dues the hospital pays Workers compensation premiums A. Item F is the total annual Ordinary Payroll expense. B. Item G. is the insurable income or gross earnings after excluding ordinary payroll. ( Item E minus Item F) C. Item H. is an option for the hospital to cover a limited amount of ordinary payroll expenses. It is usually purchased in thirty-day increments. (example: 30 days = $5,000,000 ordinary payroll) D. Item I is Item H plus Item G.