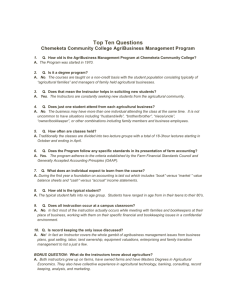

s Pricing in China --compare with traditional crop insurance

advertisement

A Fram of Weather Index Based Insurance 's Pricing in China --compare with traditional crop insurance Sun xiang yu, Wang Hong lei (Nanjing University of Information Science & Technology) Extended Abstract 1. Introduction Agriculture is one of the sectors severely affected by weather factors. It is particularly severe for Chinese agriculture, which is featured with less per capita cultivated land, more input of marginal land. According to investigation statistics, drought, flood, typhoon and pests and diseases have reduced global agriculture production by nearly 10% each year (Swiss Re, 2008). As a risk reducing and risk transferring mechanism, crop insurance has been utilized by many developed counties as an efficient risk management tool. And as a "green box" policy under the WTO framework, being allowed to provide financial support and income subsidies to farmers, in many countries, agricultural insurance also partly act as an income transfer payments policy tool. Chinese government also has been emphasizing to develop the agriculture insurance. 9 out of 10 years from 2004 through 2013, the “first document” clearly put forward to develop agricultural insurance by providing subsidies to agricultural insurance. Starting pilots from 2004 to present, agriculture insurance has covered almost all the counties in all the provinces. Currently, featured by covering only insured farmers’ cost and being subsidized by government for more than 80%, agriculture insurance in China has obvious characteristics of income transfer ( for example, although grain output is increasing stably in many provinces, local government still compensate insured farmers). Traditional agricultural insurance, or named as Indemnity-based Crop Insurance, in which the payment is calculated according to the actual yield loss of insured, is taken for as inefficient, due to serious moral hazard and high transaction costs in the process of risk diversification and income transferring (Quiggin 1994;Minranda and Glauber 1997) As traditional agriculture cover only insured farmer’s cost, the coverage amount is much lower than product value, serious moral hazard problems unlikely arise in insured farmers. Furthermore, due to the large proportion of government subsidy, the motives for farmers making an adverse selection is also very weak. Many researchers found that the major issues of agriculture insurance in China are high-cost of “damage survey and assessing”, large amount of disputes and high difficulty of claiming, causing many farmers lose their trust for agriculture insurance policy, affecting the sustainability of agricultural insurance policy, resulting in the increase of transaction costs(Sun XY,2008;Sun XY, Zhong FN, 2009;Zhu JS,2011;Gu Z,2008;He YL, Yin YF, 2009). Whereupon, high transaction costs will aggravate fiscal leakage, so weaken efficiency of income transfer. Index-based weather insurance, WIBI for short, where indemnities are paid based solely on the realized value of the underlying index, is a good way to avoid the traditional agricultural insurance problems. WIBI is more efficient on risk reduction as it can not only resolve the moral hazard, but also reduce adverse selection and operational costs (or transaction costs). Compared with traditional crop insurance (Indemnity-based Crop Insurance), WIBI can better guard against adverse selection and moral hazard , not to carry out inspections and assessment of the damage, reducing the cost of claims, and therefore the cost of management of insurance is very low (Hess, Richer and Stoppa 2005; Barnett and Coble 2001; Turvey 2001). WIBI is deemed suitable to apply in China, because of China’s vast expanses, big climate difference between each area, having more space to spread weather risk. WIBI is considered to be an inevitable trend for the agricultural risk management in the future. Nevertheless, also as a "green box" policy under the WTO framework, being allowed to provide income subsidies to farmers, WIBI is more efficient. WIBI should be used for hedging systemic risk --high correlation among farm-level yields (Stoppa and Hess 2003;Barnett and Mahul 2006). WIBI requires the insured farmer's crop loss is closely related to the underlying index; otherwise, there may be a gap between compensation and loss, resulting in unable to effectively spreading risk (so-called basis risk). Many researchers just noticed the advantages of WIBI reducing the transaction costs, moral hazard, but not yet noticed compensation cost of WIBI may be higher than that of the traditional agricultural insurance. The main reason is basis risk due to the existence of non-system risk. If the connection between the yield loss and space is not strong, i.e. the systemic risk of this area is not high, that means only part of the insured farmers are damaged by the weather disasters, but WIBI insurer has to pay all the insured farmers, while the traditional agricultural insurance compensate insured farmers according to their actual loss, resulting in WIBI higher compensation cost due to basis risk. There are two potential sources of basis risk. First, losses may be caused by factors other than the weather variable on which the index is based. Unless the index is based on a weather variable that is the dominant cause of loss in the regions, basis risk will be unacceptably high. Second, the weather variable being used as the index may not be highly spatially covariant (i.e. the systemic risk is not high enough). The measure of the weather variable at the farm or household may be quite different than the measure at the weather station. And the basis risk may cause the claim payoff of the WIBI is higher than the traditional crop insurance. According to the fair premium principle, the higher prices as a consequence thereof. Moreover, it is worth mentioning that the scaled production of agriculture has raised new demands for risk management. With the outflow of rural surplus labor, the circulation and concentration of rural land, farmers’ roles begin to differentiate from previous “trinity”--land owners, workers, owners of capital to the emergency of the large grower and family farm. This big trend in China due to rural surplus labor transfer is irreversible. The larger growers with business ideas will become the main force of China's future agricultural production. They have stronger risk awareness, also higher risk concentration. Food production of large growers and family farms plays an important role in the country's food security, so it will set more demands for risk management and also need more focus on the efficiency of risk management. It will be more critical to choose cautiously between traditional agriculture insurance and WIBI. To sum up, although traditional agriculture insurance is heavily criticized, but, whether the reduction of WIBI transaction costs can offset its higher compensation due to basis risk? We will answer this question by an empirical study in our research. This study is to establish an analytical framework comparing the premium rate of Indemnity-based Crop Insurance (i.e. traditional agriculture insurance) and WIBI. 2. Literature Review In recent decades, many countries have been paying close attention to the adjustment and progress in the agricultural insurance policy which is an inevitable part of the agricultural policy (Stoppa and Hess 2003). Agricultural insurance policy has been put under discussion as a significant issue since 2004 after China’s several attempts and failures in exploring it. The centre government began providing financial subsidies for pilot provinces since 2007, marking the official implement of policy oriented agricultural insurance in China. As the third largest type of insurance, policy oriented agricultural insurance is developing with a great momentum, which has made our country the largest market for agricultural insurance second only to America (Feng Wenli 2011). Additionally, the number of the market operators has risen from 2 (Life Insurance and China United) to 20 or so, which shows the strong support from the market and the government. However, the sustainability of agricultural insurance is still faced with great challenges. The promotion of agricultural insurance mainly rely on administrative power because of the low satisfaction and awareness of the local farmers, which results in the extremely high transaction costs(Sun Xiangyu,2008).From the academic perspective, the problem of asymmetric information was a chief topic when discussing the agricultural insurance before 1997, which holds that the moral hazard and adverse selection caused the agricultural insurance business failure(Quiggin 1994).In the mean while, an article published by Minranda and Glauber points out that the systemic risk is the main problem in agricultural insurance system failure. Systemic risk results from adverse weather events at geographically broad, which shows its significant correlation with farmers’ yield. And the indivisibility of yield will destroy the insurance’s function as a risk pool, leading to the higher risks and costs for insurance companies. With the help of a continuous interval, this paper points out the corresponding management tools for the risks. As is shown in the illustration below, the agricultural insurance is between the two extremes. That is to say, agricultural insurance is related with yield, but the correlation is not complete. Also, the illustration demonstrates that the insurance market and the futures market alone can not alone provide farmers with sufficient insurance for yield without the support from the government. The paper holds that the reinsurance (a future contract put forward by the government) in one area will be the solution to the systemic risk. Paper by Minranda and Glauber (1997) lays foundation for the research on weather derivatives in the later part. Weather index insurance or derivatives is considered to be a tool to solve the systemic risk (Stopp a and Hess 2003;Barnett and Mahul 2006). It is necessary to clarify the relationship between weather index insurance and weather derivatives. The former is closer to the financial derivatives, which is equivalent to weather options. Banks,Corbally & Phuoc Dang, (2011)think the difference between the two mainly lies in the adjustability and the accounting and legal aspects. What should be paid attention to is that the equivalence they emphasize only exist in the non-disaster market. As is determined by the market, the application of weather index insurance to agriculture in practice is mainly intended for catastrophic risk such as drought, flood and frost and et cetera. Because of farmers’ limited ability in managing risks and the backwardness of the futures and options market, weather index insurance rather than weather derivatives(futures or options) play a role in developing countries in risk management (Barnett and Mahul 2006). The creative products of agricultural insurance include two large divisions, one is regional production index insurance(which is based on established regional average product as compensation trigger point, if actual regional average product is under trigger point then start the compensation ), the other one is weather index insurance(which is based on one or several weather variables as compensation trigger point, if actual weather achieves to index trigger point then start the compensation)(Wenner&Arias,2003). Weather index insurance has been seen as an effective style of management for developing countries by more and more scholars and is the development direction of agriculture insurance in those countries (Chantarat etal. 2007;Barnett etal. 2008), using objective weather conditions as the insurance object since it can avoid adverse selection and ethical risk effectively(Skees 1999) and it can also reduce the transaction cost(Hess, Richer and Stoppa 2005;Barnett and Coble 2001;Turvey 2001;). Weather index insurance is greatly supported by international groups like the World Bank and many national governments and it has already spread in India、Mexico、Malawi、Ethiopia、the USA、Canada、etc.(Xiaojun Chu、Jie Cao 2011;Wuhan Sun 2013;Pen Sun 2012). There are still many other opinions besides avoidance of moral hazard, adverse selection and reduction of trade cost about weather index insurance, for example, its standard contrast and mobility makes it easier to disperse risk through reinsurance (Hayes, Lence and Mason 2004;Turvey,Nayak and Sparling 1999;). Woodard and Carcia (2007) analyzed the effects of reinsurance as the tool of weather risk management. The central contribution of the article is that it proved that the more spatial distribution of weather derivative/insurance provide, the more effective the diversification of risk is. In the other word, totaling the tools of weather risk in a larger space scale (not in a weather station) can make it easier to disperse the non-system risks. The main method is comparing the efficiency of single station (CRD, standard region of risk management) with the efficiency of total stations (state level is upon the state).Using RMSL(loss of the square root) and ES(loss of expectation) to measure the efficiency. Weather index insurance is not perfect, and one of its main problems is basis risk. Norton, Osgood and Turvey (2010) suggested that even if the technology allows, basis risk remai ns a major problem. Basis risk is defined as the corresponding risk that risk protection to ols fail to protect, and the payment is not consistent with the actual loss. Collier, Skees and Barnett (2005) pointed out that the basis risk occurs because of the var iation in space and the differences in management, land quality or crop of weather risk,th erefore, careful design can reduce but not eliminate the basis risk. Barnett and Mahul thou ght the basis risk has two origins: one is the loss may be caused by the weather, unless t his factor is closely related to the weather, otherwise basis risk will be very high. Another is the index variables used in the index is not highly space-related, the weather v ariables tested in meteorological stations and large farms might possibly exist wide differe nce. If the basis risk is very large, the significance of weather index insurance as a tool t o smooth the risk does not exist, and farmers are unwilling to buy the weather index insu rance. And there are many ways to solve the basis risk: one is using spatial analysis tech niques with time series data of each site(Paulson and Hart 2006); another is the data us ed to analysis have an equal height(Richards, Manfrodo and Sanders 2004). Also has some scholars combined the personal insurance with the personal credit, and pro posed gathering the weather index insurance contracts through a centralized financial organ to make an average of basis risk(Miranda et a12010,Woodard and Carcia 2008). Norto n, Osgood and Turvey(2010) attempt to understand better the characteristics of the spatial distribution of risk by using spatial analysis techniques—it’s greatly important for weather index insurance. In addition, Che Mohd Imran Che Tai and Fred Espen Benth (2012) pointed out tha t weather index insurance compared traditional agricultural insurance,is riskier,and has hig her prices. This could be another issue of weather index insurance. The article considered the profit / loss distribution of insurance companies when pricing weather derivatives, and considered that only weather index insurance requests a higher solvency, and the premiu ms plus additional capital costs except for fair rates can ensure the insurance companies d o not go bankrupt. But the premium also makes the insurance contract unattractive. Accor dingly weather index insurance's fluctuations in payment is larger, costs is higher and risks is higher. 3. Conceptual Frame The insurance payment insurance premium is a gross rate, and attaches the tariff constitution by the pure tariff. According to fair tariff principle, The premium rate arranges the basic principle is Expected indemnity= insurance income, According to the World Bank’s Clark ect (2012) proposed a formula of a weather index box premium rates: Premium rate =(PPR+CL)*(Administrative load) PPR represents pure premium rates, CL represents a catastrophic risk loss ratio, Administrative load on behalf of the administrative costs (Management costs, transaction costs, etc.). The formula for determining the rate of traditional agricultural insurance also applies. We will going to further decomposition of this formula: Premium rate =(PPR+CL)*(1+FCP+VCP) Further decomposing the Operating costs, we follow the fixed costs (FC) and variable costs (VC) to be divided, and the fixed costs of expenses primarily include personnel office and administrative expenses, the cost of liquidity costs primarily reconnaissance loss costs and the cost of compensation. FCP represent fixed costs account for the proportion of premium income, VCF represents the variable cost accounts for the insurance premium income the proportion. Here are comparing premiums constitute two insurance, Catastrophe risk of loss rate burn cost represents the annual compensation, sum insured represents the total amount of insurance, HBR represents the arithmetic average of the cost of burning, namely compensation cost。a representative of the cost of capital。Here we can think catastrophe risk loss ratio as the cost that insurance company funds to be able to pay the full amount of the payment. Apparently,ability to weather risk diversification index compared to traditional agricultural insurance company is even worse, Affected by systemic risk, the function of each risk pool is almost no use, Only can depend on in the wide range the risk unit to gather carries on the region the risk disperser, for example, each village or town as one risk unit, so above the county level may going to risk diversification, But to the traditional agricultural insurance, each villages or town interior also may carry on the risk to be dispersible. In other words, the risk of weather index insurance decentralized "pixels" bigger, it needs greater scope carries on. Therefore, it requires more risk reserve. Determination of the pure premium rates The index insurance payment occurs when pays damages the complete senate to guarantee the peasant household, but the traditional agricultural insurance is only a peasant household which pays damages the part, according to fair tariff principle, insurance premium income = payment disbursement, therefore we thought the weather index the payment is high, its pure tariff can be higher than the tradition agricultural insurance. Given an extremely example: A farmer owned two land, bought both Indemnity-based insurance and weather index -based insurance, the land only has one disaster risk- drought during a growth period. No adverse risk and no adverse selection. The clause of the two insurance showed in table1 Table 1 the simplified insurance contract Indemity-based Index-based Liability Drought and other peril nature disaster Accumulative (API) Duration A growth period A growth period Deductible 30% API<h, 30%y=y(h) Amount 300 300 Claim rate w Y(w) Precipitation index The definition is based on the simplifying assumptions : y= f(API), y denoted crop yield , API is accumulative precipitation index . So we can calculated if yield loss 30%, the relevant API=h, and claim rate are also relevant.On this situation, the insurance indemnity are same, so the pure premium also are the same.But, if the crop loss are not only caused by precipitation, or the rain fall only caused one land loss not the whole land loss, the traditional insurance only need to pay a certain percentage indemnity, and the weather index insurance will pay all the indemnity, so the pure premium of traditional insurance will be lower than weather index insurance. Of course the ideal assumptions are easily be broken: firstly,the yield depend on not only weather factors but also other economic and social factors; secondly, the weather risk may be very complicate which can not be measured by weather index; third, farmers can take action on disaster,like irrigating, which can reduce the risk, but also farmer will have moral hazard behavior; finely, crop can recover and regrow after diaster, thus weather risk are not lead to yield lost. Fixed cost ratio FCP No matter what kind of insurance, the necessary working conditions and management costs should be a fixed expense. Weather index insurance fixed costs in product design will be more, but with the improvement of the market, the promotion of products is getting lower. However, the traditional agricultural insurance fixed cost on the management expense will be higher (because works will do are more).Because this part of expense mainly is supports the work and the overhead charge, so our supposition that the differences between them are not obvious. Variable cost ratio The variable cost mainly due to each disaster will bring the cost of reconnaissance and determination about the damage and the compensation. This is a tradition agricultural insurance disbursement quite high factor. Because the investigation and determination about the damage, it not merely the insurance company and government's related personnel participation, but also must invite some agricultural technology expert, needs investments and so on vehicles fuel consumption, moreover each principle compensates all has a very big file expense, these all are the variable cost, along with disaster number of times different, disaster area and benevolent difference, the cost is changed. But this is precise cost which the weather index insurance may save. Therefore, comparing the rate of weather index insurance with the rate of traditional agriculture insurance, both the pure rate and the catastrophe risk loss rate are higher, but the main drop is the cost of the loss of investigation and settlement of claims among transaction cost. And the contrast of these two costs needs empirical test. This also means that the weather index insurance should possess where the possibility of diversification is in the high systematic risk and in large space(the catastrophe risk loss rate would reduce),also, the investigation of loss functions and the settlement of claims’ cost of the traditional agriculture insurance develops in a large region. Table 2. comparison between premium rate of WIBI and traditional agriculture insurance Rate constitute explanation WIBI Traditional agriculture insurance PPR Pure rate, according to insurance income=the fair rate of compensation pay calculation high low CL Catastrophe risk loss rate, it refers to the capital cost of insurance reserve fund in fact high low FCP Fixed cost, refers to secure fixed management cost, work cost and etc. equal equal VCR Fluctuant cost rate, mainly refers to the loss of investigation functions and the cost of settlement of claims Very low high References: [1] Jerry R. Skees. Challenges for Use of Index-based Weather Insurance in Lower IncomeCountries. Agricultural Finance Review, Vol. 68 ISS: 1 pp. 197-217. [2] Collier B, Skees J, Barnett B. Weather index insurance and climate change: opportunitiesand challenges in lower income countries[J]. The Geneva Papers on Risk andInsurance-Issues and Practice, 2009, 34(3): 401-424.[11]Binswanger-Mkhi7e H P. Is there too much hype about index-based agriculturalinsurance?[J]. Journal of Development Studies, 2012, 48(2): 187-200. [3] Skees J R, Black J R, Barnett B J. Designing and rating an area yield crop insurance contract. American Journal of Agricultural Economics, 1997, 79: 430-438. [4] Vedenov,D.V. and B.J. Barnett. Efficiency of Weather Derivatives for Agricultural RiskManagement. Journal of Agricultural and Resource Economics 29(2004):387–403. [5] Varangis P, Skees J, Barnett B. Weather indexes for developing countries// Dischel R S.Climate Risk and the Weather Market. World Bank, University of Kentucky and Universityof Georgia, 2005. [6] Skees J R, Varangis P, Larson D, Siegel P. Can financial markets be tapped tohelp poorpeople cope with weather risks?//World Bank Policy Research Working Paper Series.Washington, D C, 2002. [7] Skees,J.R.and A.J.Leiva.“Analysis of Risk Instruments in an Irrigation Sub-Sector inMexico.”[R]. Report prepared for the Inter-American Development Bank TechnicalCooperation Program and IDB-Netherlands Water Partnership Program, June 30, 2005. [8] Barnett,B.J.,J.R.Black,Y. Hu,and J.R.Skees. “Is Area Yield Insurance Competitive withFarm Yield Insurance?” Journal of Agricultural and Resource Economics 30(2005):285–301. [9] Mahul, Olivier and Jerry Skees, Piloting Index-Based Livestock Insurance inMongolia[R] Access Finance, March 2006, Issue 10. [10] Miranda M, Vedenov D V. Innovations in agricultural and natural disaster insurance. American Journal of Agricultural Economics. 2001, 83(3): 650-655. [11] Mario J. Miranda, Joseph W. Clauber. Systemic Risk, Reinsurance, and the Failure ofCrop Insurance Markets. American Journal of Agricultural Economics, Vol. 79, No. 1. (Feb.,1997), pp. 206-215. [12] Barnett B J. Agricultural index insurance products: Strengths and limitations//The 2004USDA Agricultural Outlook Forum. Arlington, Virginia, 2004. [13] Barnett B J, Mahul 0. Weather index insurance for agriculture and rural areas inlower-income countries[J]. American Journal of Agricultural Economics, 2007, 89(5):1241-1247 [14] Xiaohui Deng, Barry J. Barnett, Gerrit Hoogenboom. Alternative Crop Insurance Indexes.Journal of Agricultural and Applied Economics, April 2008:223–237.[56]Casey Brown and James W. Hansen.Agricultural Water Management and ClimateRisk[R].Report to the Bill and Melinda Gates Foundation, 2008. [15] Turvey, C. G.,: Weather derivatives for specific event risk inagriculture. Rev. Agric. Econ., 2001, 23, 333–351. [16] Barry J B, Olivier M. Weather index insurance for agriculture and rural areas inlower-income countries. American Journal of Agricultural Economics, 2007, 89(5):1241-1247. [17] Che Taib, Che Mohd Imran; Benth, Fred Espen. Pricing of temperature index insurance. Review of Development Finance 2012;2(1):22-31 [18] Erik Banks, 2002: Weather risk management: markets, products and applications, Element Re Capital Products, Inc. [19] Stanley A. Changnon, David Changnon etc . Effects of Recent Weather Extremes on the Insurance Industry:Major Implications for the Atmospheric Sciences Bulletin of the American Meteorological Society Vol. 78, No. 3, March 1997,p426-435 [20]Stoppa, A., and U. Hess., “Design and Use of Weather Derivatives in Agricultural Policies: the Case of Rainfall Index Insurance in Morocco”, Contributed Paper Presented at the International Conference “Agricultural Policy Reform and the WTO: Where are We Heading?” Capri (Italy), June 23–26, 2003. [21]Mahul,0."Optimal Insurance Against Climatic Experience." Amer. J. Agr. Econ. 83(2001):593-604. [22]Manfredo, M. R., and R. M. Leuthold. "Value-at-Risk Analysis: A Review and the Potential for Agricultural Applications." Rev. Agr. Econ. 21(1999):99-111. [23]Bokusheva R., Measuring dependence in joint distributions of yield and weather variables[J], Agricultural Finance Review 2011,71: 120-141 [24]Woodard, J. and P. Garcia, Basis Risk and Weather Hedging Effectiveness[J], Agricultural Finance Review 2008, 68: 111-124. [25]Musshoff, O., Odening, M. and Xu, W., Management of climate risks in agriculture – will weather derivatives permeate[J], Applied Economics 2005, 43: 1-11, [26]Deng, X., B.J. Barnett, D.V. Vedenov, and J.W. West. Hedging Dairy Production Losses Using Weather-based Index Insurance[J], Agricultural Economics 2007.36:271–280. [27]Breustedt, Bokusheva and Heidelbach, The potential of index insurance schemes to reduce farmers’ yield risk in an arid region[J]. Journal of Agricultural Economics 2008, 59: 312–328. [28]Mude A,Chantarat S, Barrett C, et a]. Index-based Livestock Insurance for NorthernKenya' s Arid and Semi Arid Lands: The Marsabit Pi lot [J]. Nairobi, Kenya: Projectdocument, ILRI, 2009: 14. [29]Chen S L Modeling Temperature Dynamics for Aquacu]turc Index Insurance In Taiwan: ANonlinear Quantile Approach[C]//2011 Annual Meeting, July 24-26’ 2011, Pittsburgh, Pennsylvania. Agricultural and Applied Fconomics Association, 2011 (104229). [30]Dercon S, Hill R, Clarke D, et al. Offering rainfall insurance to informal insurancegroups: evidence from a field experiment in Ethiopia[J]. Available at SSRN, 2012.、 [31] Raphael N K, Holly H W, Douglas L Y. Weather-based crop insurance contracts for africancountries// International Association of Agricultural Economists Conference. Gold Coast,Australia, 2006. [32] Muller.A,and M.Grandi.“Weather Derivatives:A Risk ManagementTool for Weather-Sensitive Industries.”Geneva Papers on Risk and Insurance 8025(2000):273–287 [33] Hess U, Syroka J. Weather-based insurance in Southern Africa: The case of Malawi//Agriculture and Rural Development Discussion Paper 13. the World Bank,Washington, D C, 2005. [34] Chantarat C, Barrett C B, Mude A G, Turvey C G. Using weather index insurance toimprove drought response for famine prevention. American Journal of AgriculturalEconomics, 2007, 89(5): 1262-1268. [35] Glauber J W. Crop insurance reconsidered. American Journal of Agricultural Economics,2004, 86(5): 1179-1195. [36]Angus J F, V an Herw aarden A F. Increasingwater use and water use efficiency indryland wheat[J]. A Gronomy Journal, 2001, 93 (2) : 290-298. [37]Shadreck Mapfumo. Weather Index Insurance The Case for South Africa. MircoInsurance Agency.2007(09):1-24. [38]World Bank. 2007.China: Innovations in Agricultural Insurance, Promoting Access to Agricultural Insurance for Small Farmers. [39]Zhang,Q., and K. Wang. 2010. Evaluating production risks for wheat producers in Beijing. China Agricultural Economic Review, 2(2):200-211 [40]Zhang, Q.,K.Wang,and X.Zhang. 2010. Study on the assessment approach for crop loss risk, Agricultural and Agricultural Science Procedia,1,pp.219-225.Available at:http://linkinghub.elsevier.com/retieve/pii/S2210784310000288