Chapter3

advertisement

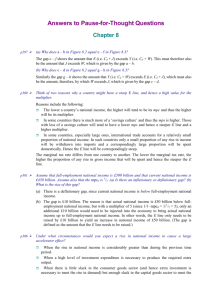

Answers to Questions for Chapter 3 1. Why is the demand for goods and services, denoted by Z in chapter 3, always equal to Gross Domestic Product? Does this mean that supply and demand are always equal? In the National Income and Product Accounts (NIPA), the Flow of demand Z is defined to include, as part of its second component (Investment), any change in the aggregate Stock of inventories. Aggregate Sales (the actual aggregate flow demand for goods and services) is not always equal to the aggregate flow supply of goods and services. The overall stock of inventories changes to absorb the difference. In particular, the stock of inventories increases when aggregate supply (Y) exceeds actual aggregate demand (Z) or sales; it decreases when total final sales (Z) exceeds aggregate supply (Y). Only if actual Investment is defined to include the actual change in inventories (whether planned to occur or not) will total demand equal GDP by definition. 2. Planned Investment is the sum of: (1) planned expenditure by firms on currently produced capital goods and services (including software); (2) intentional changes to inventories of finished and unfinished goods; (3) expenditure by households on new houses and apartment buildings. The purchase of an existing house is not included if it was produced a prior period, because it is not part of this period’s GDP. The total planned Investment is denoted I , where the over-bar indicates that this type of spending is “exogenous” to the model. That just means it is not explained within the model. What else should therefore have an over-bar? The only part of expenditure that is explained in this model is Consumption and not all of consumption is explained! Therefore, almost everything is unexplained or “exogenous”. In particular, c0 should have an over-bar along with G , X , M . Likewise, the only parameter of the model is the marginal propensity to consume, which is also just given. To emphasize this, it too could have an over-bar, c1 . So why did just I get the special designation? Because the unplanned change in inventories, denoted inv , is included in actual investment without the over-bar, the following definition is implied: I I inv . All unplanned changes in inventories (whether they be unsold consumption goods, unsold capital goods including unsold houses, or goods produced in expectation of being sold to federal, state, and local governments or to foreigners, but not sold) are tossed into one category inv . For this reason the distinction between I and I has a special significance and justifies the notation, even though other categories of demand in addition to planned investment are exogenous. 3. The constant in the consumption function c0 is interpreted as the level of consumption spending by people with zero incomes. Is a more reasonable and more general interpretation implied? Yes. The constant can be interpreted as that part of consumption expenditure which is explained by wealth (a stock) rather than income (a flow). When wealth increases, households at any level of income can either liquidate assets in order to increase consumption or borrow against wealth (using it as collateral for loans) in order to increase consumption. Decreases in wealth can have the opposite effect, resulting in lower consumption for people affected by the wealth reduction, regardless of their income. Changes in wealth have effects on consumption of people at all levels of income, not just those with no income. 4. When the identity Z C I G is replaced by equation (3.5), what is the required interpretation of I I ? It follows that the uses of Z prior to (3.5) are potentially confusing. What symbol would have been a better choice? See above: the difference between actual investment and planned investment is the unexpected change in inventories. A better choice would have been the symbol for actual GDP. In short, Y C I G as opposed to Z C I G . 5. The marginal propensity to consume is the simplest possible example of “additional spending per dollar increase in total output” : z1 Z1 / Y . Express the multiplier in terms of this ratio. The multiplier for any ratio of the change in endogenous spending to the change in total income is: 1 1 . In chapter 3, 1 z1 1 (Z1 / Y ) z1 c1 , although even this simplest case is made a bit more realistic in a question at the end of the chapter where z1 c1 (1 t1 ) . A positive tax rate reduces the effect of any change in income on total expenditure and therefore reduces the multiplier. Subsequent models incorporate further effects into z1 Z1 / Y by taking account of the effect of changes in GDP on interest rates and therefore on those types of expenditures which are sensitive to interest rates. 6. Rewrite equation (3.9) as Z Z 0 z1Y . On the right side, where do we put all types of “exogenous” demand and what are some examples? What is a general name for anything in the second term? All types of expenditure not explained by current income are included in Z 0 . In this model, that includes consumption explained by wealth, capital spending by firms (including purchases of new residences by households), government spending, and expenditure by foreigners net of our imports). A general name for the second term is “endogenous” demand, which here means demand explained by current income. 7. If output Y and expenditure Z are equal before and after some change in any component of Z 0 , what is the relationship between Y and Z 0 . What special case would yield the result Y Z 0 ? Subtract one equilibrium equation (for the change) from the other (after the change): Y new Z 0new z1Y new Y old Z 0old z1Y old Y Z 0 z1Y In the simplest case, z1 c1 . Therefore: Y (1 c1 ) Z 0 Y 1 1 if Z 0 1 c1 0 c1 1 Y Z 0 if their ratio is unity, i.e. if z1 c1 0 . 8. Justify the geometric series form of the multiplier algebraically. As long as the re-spending ratio z1 is a positive fraction, the multiplier is approximated by a finite number of terms of a geometric series: 1 1 z1 z12 z13 z14 1 z1 1 (1 z1 )(1 z1 z12 z13 z14 ) 1 (1 z1 ) ( z1 z12 ) ( z12 z13 ) ( z13 z14 ) ( z14 z15 ) 1 1 z15 9. In Figure 3-3, production and demand are both measured on the vertical axis. Does that mean they are always equal? Explain. There are two lines in the diagram. The 45º line identifies production on the vertical axis with income on the horizontal axis, as in the national income and product accounts where production includes any unplanned change in inventories. The expenditure line as a function of income includes only planned expenditures. Therefore, a vertical line cuts both lines at distinct points when the aggregate level of inventories is increasing or decreasing at an unexpected rate. When there is no such unexpected change in overall inventories, aggregate supply and demand are in balance. The aggregate nature of macroeconomic models allows for offsetting change in inventories across individual firms and industries when the structure of the economy is changing. 10. Copy or redraw Figure 3-2 and place directly below it a new diagram where savings- plus-taxes is measured on the vertical axis and total income on the horizontal axis as in Figure 3-2. What is the intercept and what is the slope of this new savings-plus-taxes line? In the new diagram, draw a horizontal line cutting the vertical axis at I G . Where does this line cross the savings plus taxes line? What do you conclude about the verbal description of equilibrium in this chapter’s model? C, Z , Y Expenditure function Consumption function Y Savings function O I G X M Y In the top half, both the consumption function and the parallel, higher expenditure line are drawn. The intersection of the consumption function with the 45º line occurs at a level of income on the horizontal axis where saving is zero. Therefore, the saving line in the bottom part cuts the horizontal axis at zero at that level of income. The total expenditure line (parallel to the consumption function) in the top diagram cuts the 45º line at the equilibrium level of income. In the bottom diagram, the same point corresponds to an intersection between the savings line and a horizontal line that measures all sources of exogenous demand except c0 . At this level of income, savings is positive. The two diagrams show the same thing because of the way in which the flow of savings is defined. The level of income where savings is zero is, in the top diagram: Y C c0 c1Y Y c0 1 c1 In the bottom diagram: S Y C Y c0 c1Y S 0 Y C Y c0 c1Y 0 Y c0 1 c1 The level of income where the aggregate level of inventories is not changing unexpectedly is, in the top diagram: Y C I G X M c0 c1Y I G X M Z 0 c1Y Y Z0 1 c1 Z 0 c0 I G X M In the bottom diagram: S Y C Y c0 c1Y c0 (1 c1 )Y c0 s1Y S I G X M c0 s1Y I G X M Y c0 I G X M Z 0 Z 0 s1 s1 1 c1 The pictures and the equations tell the same story in different ways. In this model, the multiplier is the reciprocal of the marginal propensity to save, defined as one minus the marginal propensity to consume: two ways of thinking about the multiplier. The condition for equilibrium (no unexpected change in overall inventories) can also be restated as equality between planned saving (unspent income overall) and the sum of planned investment plus all other sources of exogenous demand, namely, government spending and net exports. Note that because an excess of imports over exports means that foreigners are lending us purchasing, the trade deficit is just another name for foreign savings. Therefore: S I G X M S (M X ) I G S domestic S foreign I G In general, savings from all sources finances domestic exogenous demand, here stated as the sum of private planned investment and government spending.