ACCOUNTING UNIT 1 Suggested course outline and timeline for

advertisement

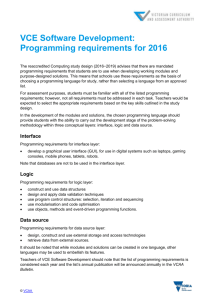

ACCOUNTING UNIT 1 Suggested course outline and timeline for Accounting Unit 1 for 2014 Mark Mansfield St Albans Secondary College The following suggested week-by-week VCE Accounting Unit 1 course outline/timeline for 2014 provides recommended time allocations for the areas of study in Unit 1 and suggestions for assessment based on the VCE Accounting Study Design. The Accounting Study Design (accreditation period 2013–2016) was revised during 2012 and replaces the previous Accounting study design (accreditation period 2012–2016). Further information can be found at: http://www.vcaa.vic.edu.au/Pages/vce/studies/account/accountindex.aspx. Note that at least two of the assessment tasks for Unit 1 should be ICT based and approximately 15 hours of scheduled classroom time should be allocated to these tasks. Also, ICT must be used during the inputting, processing and outputting stages of the accounting process. Week Area of study/key knowledge Assessment Term 1 Area of Study 1: ‘Going into business’ Week 1 29–31 Jan. Reasons for establishing a small business Alternatives to establishing a small business Week 2 Factors that lead to the success or failure of a small business 3–7 Feb. Resources required to establish a small business The role of professionals, such as accountants, business advisors and professional organisations, in providing advice to achieve business success Week 3 10–14 Feb. Internal and external sources of finance, including features, advantages and disadvantages Week 4 Time to work on Assessment task 1 17–21 Feb. Week 5 24–28 Feb. © VCTA Assessment task 1 (Outcome 1): Small business assignment (covers Weeks 1 to 3) Area of Study 2: ‘Recording financial data and reporting accounting information’ Applicable accounting principles and qualitative characteristics of accounting information The definition of the accounting elements: assets, liabilities, owner’s equity, revenue and expenses Published October 2013 page 1 ACCOUNTING UNIT 1 Week Area of study/key knowledge Week 6 3–7 Mar. The accounting equation Classification of current and non-current items in the Balance Sheet The twofold effect of transactions on the Balance Sheet Week 7 11–14 Mar. Source and business documents for a service business, including cash receipts, cheque butts, memos, bank statements Special journals: cash receipts and cash payments Week 8 Special journals: cash receipts and cash payments (continued) Internal control procedures, including cash control procedures and the bank reconciliation process 17–21 Mar. Week 9 24–28 Mar. Assessment Assessment task 2 (Outcome 2): Test (covers Weeks 5 and 6) Internal control procedures, including cash control procedures and the bank reconciliation process (continued) Accounting reports (financial statements): Statement of Receipts and Payments, Income Statement, Balance Sheet Week 10 31 Mar. – 4 Apr. Accounting reports (continued) 5–21 Apr. Mid-semester break Term 2 Time to work on Assessment task 3 (folio of exercises) Week 11 22–24 Apr. Week 12 28 Apr. – 2 May Budgeting for cash and profit: role and benefits of cash and profit budgeting in planning and control; budgeted reports for cash and profit; budget variance reports for cash and profit Assessment task 3 (Outcome 2): Folio of exercises Covers Weeks 7 to 10) Week 13 Budgeting for cash and profit (continued) 5–9 May Week 14 Graphical representations of accounting information Assessment task 4 (Outcome 2): Test (covers Weeks 12 and 13) Time to work on Assessment task 5 Assessment task 5 (Outcome 2): Case study (covers Week 14) 12–16 May Week 15 19–23 May Week 16 Exam revision 26–30 May Week 17 Exam revision 2–6 June Week 18 Year 11 exams 10–13 June Week 19 Begin Unit 2 16–20 June Week 20 Unit 2 continued 23–27 June © VCTA Published October 2013 page 2 ACCOUNTING UNIT 1 Note: Remember to consult your individual school planner for information about examination timetables and possible non-assessment weeks. ICT must be used during the inputting, processing and outputting stages of the accounting process. As a guide, 15 hours of scheduled class time involving ICT should be allocated and at least two of the selected assessment tasks for Unit 1 must be ICT based. Disclaimer: This timeline has been updated by Mark Mansfield for teachers of VCE Accounting. This does not imply that it has been endorsed by the Victorian Curriculum and Assessment Authority (VCAA). While every care is taken, we accept no responsibility for the accuracy of information or advice contained in Compak. Teachers are advised to preview and evaluate all Compak classroom resources before using them or distributing them to students. © VCTA Published October 2013 page 3