Metering and Retail Pricing - Pennsylvania Office of the Consumer

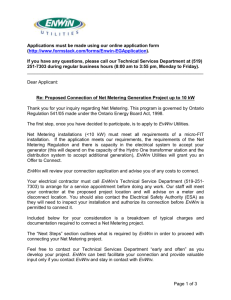

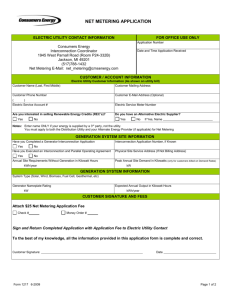

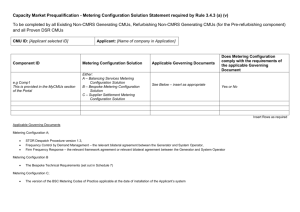

advertisement