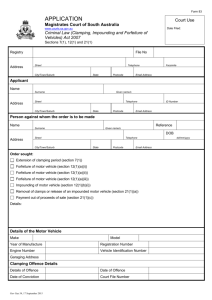

Motor Vehicle (Third Party Insurance) Act 1943 - 11-00-00

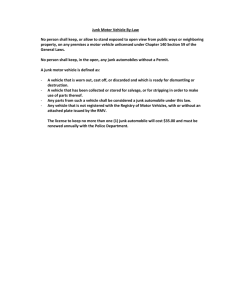

advertisement