Accounting 1-2 Course Description

advertisement

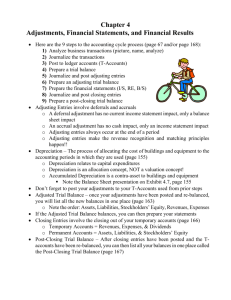

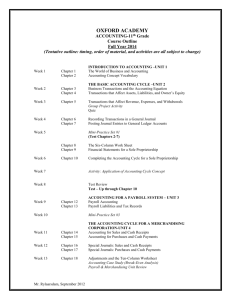

CENTENNIAL HIGH SCHOOL ACCOUNTING 1-2 COURSE DESCRIPTION Accounting 1-2 is a beginning course in learning the language of Business. Students will learn all processes involved in completing the full accounting cycle. Basic accounting documents such as Balance sheets, Journals, Income Statements, Statements of Equity, and worksheets will be taught. Students will also learn to use the computer as a tool to create these documents. The internet will also be used to enhance learning. Teacher: Mr. Gregg Holstrom E-mail: gregg_holstrom@centennial.k12.or.us Office Hours: 7:00 am – 7:30 am or 2:30 pm – 3:00 pm Accounting Concepts Accounting Concepts will be covered throughout all chapters. Performance Indicators: BAPB03.02.01.00 Understand basic financial laws and regulations as applied to financial and accounting practices. Math Concepts Math will be covered throughout all chapters. Math lessons included where appropriate. Performance Indicators: MAHSME.01 Determine the appropriate units, scales, and tools for problem situations involving measurement. MAHSAR.17 Approximate and interpret rates of change in graphical and numeric data. MAHSPS.01 Interpret the concepts of a problem-solving task and translate them into mathematics. MAHSPS.02 Choose strategies that can work and then carry out the strategies chosen. MAHSPS.05 Accurately solve problems using mathematics. Literacy Concepts Instruction will be included relating to literacy goals established for CTE students. Performance Indicators: ELHSRE.08 Understand, learn, and us new vocabulary that is introduced and taught directly through informational text, literary text, and instruction across subject areas. ELHSRE.09 Develop vocabulary by listening to and discussing both familiar and conceptually challenging selections read aloud across the subject areas. ELHSRE.10 Determine meanings of words using contextual and structural clues. ELHSRE.14 Understand technical vocabulary in subject area reading. Writing Concepts Writing instruction will be given and assessed by having students write report relating to the Accounting field. (State scoring guide used) Performance Indicators: ELHSWR.14 Produce writing that shows accurate spelling. ELHSWR.16 Understand and use proper placement of modifiers. ELHSWR.17 Demonstrate an understanding of proper English usage, including the consistent use of verb tenses and forms. ELHSWR.18 Use conventions of punctuation correctly, including semicolons, colons, ellipses, hyphens and dashes. ELHSWR.19 Use correct capitalization. ELHSWR.20 Write legibly. ELHSWR.32 Use appropriate conventions for documentation in text, notes, and works cited, following the formats in specific syle manuals. ELHSWR.34 Reflect manuscript requirements, including title page presentation, pagination, spacing and margins, and integration of source and source and support material, such as citing sources within the text, using direct quotations, and paraphrasing. Chapter 1 – Starting a proprietorship; Changes That Effect the Accounting Equation Chapter Objectives: Identify accounting concepts practices related to starting a service business organized as a proprietorship and to changes that affect the accounting equation. Classify accounts as assets, liabilities, or owner’s equity and demonstrate their relationships in the accounting equation. Analyze how transactions affect accounts in an accounting equation. Performance Indicators: BAPB05.01.01.01 Identify the parts of the accounting equation. BAPB05.01.01.02 Classify accounts as assets, liabilities, and owner’s equity. Chapter 2 – Analyzing Transactions into Debit and Credit Parts Chapter Objectives: Use T accounts to analyze transactions showing which accounts are debited or credited for each transaction. Analyze how transactions to set up a business affect accounts. Analyze how transactions affect owner’s equity accounts. Performance Indicators: BAPB05.02.01.01 Identify asset accounts. BAPB05.02.01.02 Identify liability accounts. BAPB01.01.02.03 Apply the appropriate calculation method: add, subtract, multiply, divide, compare, present value, compound values, etc. BAPB01.02.01.01 Identify the most common features of financial software. BAPB01.02.01.03 Utilize the Help feature in the financial software. Chapter 3 – Journalizing Transactions Chapter Objectives: Record transactions to set up a business in a five-column journal. Record transactions to buy insurance for cash and supplies on account in a fivecolumn journal. Record transactions that affect owner’s equity and receiving cash on account in a five-column journal. Prove and rule a five-column journal and prove cash. Performance Indicators: BAPB05.02.02.00 Record transactions. BAPB01.02.01.00 Operate appropriate financial software to generate useable data. BAPB01.02.02.03 Print a report. Chapter 4 – Posting to a General Ledger Chapter Objectives: Prepare a chart of accounts for a service business organized as a proprietorship. Post separate amounts from a journal to a general ledger. Post column totals from a journal to a general ledger. Analyze and journalize correcting entries. Performance Indicators: BAPB05.02.01.05 Open accounts payable ledger. BAPB05.02.02.02 Post from journals to ledgers. BAPB05.02.01.00 Create a chart of accounts to show the variety of accounts activity in a system. Chapter 5 – Cash Control Systems Chapter Objectives: Prepare business papers related to using a checking account. Reconcile a bank statement. Journalize dishonored checks and electronic banking transactions. Establish and replenish a petty cash fund. Performance Indicators: Chapter 6 – Work Sheet for a Service Business Chapter Objectives: Prepare a heading and a trial balance on a work sheet. Plan adjustments for supplies and prepaid insurance. Complete a work sheet for a service business organized as a proprietorship. Identify selected procedures for finding and correcting errors in accounting records. Performance Indicators: BAPB01.02.02.00 Operate electronic spreadsheet software to create formulas and reports. BAPB05.02.02.03 Prepare a trial balance. BAPB01.02.02.01 Create formulas for mathematical computations. Chapter 7 – Financial Statements Chapter Objectives: Prepare an income statement for a service business organized as a proprietorship and analyze an income statement using component percentages. Prepare a balance sheet for a service business organized as a proprietorship. Performance Indicators: BAPB05.03.01.01 Prepare a balance sheet. BAPB05.03.01.02 Prepare an income statement. BAPB01.01.02.03 Apply the appropriate calculation method: add, subtract, multiply, divide, compare, present value, compound values, etc. BAPB04.01.01.00 Understand the purpose of financial statements. BAPB04.01.01.02 Explain the purpose of a financial statement. BAPB04.01.01.01 Describe the different types of financial statements. BAPB04.01.01.03 Compare the differences in financial statements. Chapter 8 – Adjusting and Closing Entries for a Service Business Chapter Objectives: Record adjusting entries for a service business organized as a proprietorship. Record closing entries for a service business organized as a proprietorship. Prepare a pos-closing trial balance for a service business organized as a proprietorship. Performance Indicators: BAPB05.02.02.04 Journalize and post adjusting and closing entries. BAPB05.02.02.05 Close the general ledger. Chapter 9 – Journalizing Purchases and Cash Payments Chapter Objectives: Journalize purchases of merchandise using a purchases journal. Journalize cash payments and cash discounts using a cash payments journal. Prepare a petty cash report and journalize the reimbursement of the petty cash fund. Total, prove, and rule a cash payments journal and start a new cash payments journal page. Journalize purchases returns and allowances and other transactions using a general journal. Performance Indicators: BAPB05.02.02.01 Journalize transactions in appropriate journals. Chapter 10 – Journalizing Sales and Cash Receipts Using Special Journals Chapter Objectives: Journalize sales on account using a sales journal. Journalize cash receipts using a cash receipts journal. Record sales returns and allowances using a general journal. Performance Indicators: BAPB05.02.02.01 Journalize transactions in appropriate journals. Chapter 11 – Posting to General and Subsidiary Ledgers Chapter Objective: Post separate items from a purchases, cash payments, and general journal to an accounts payable ledger.. Post separate items from a sales, cash receipts, and general journal to an accounts receivable ledger.. Post separate items from a cash payments and general journal to a general ledger. Journalize and post correcting entries affecting customer accounts. Performance Indicators: BAPB05.02.01.04 Open accounts receivable ledger. BAPB05.02.01.05 Open accounts payable ledger. Chapter 12 – Preparing Payroll Records Chapter Objectives: Complete a payroll time card. Calculate payroll taxes. Complete a payroll register and an employee earnings record. Prepare payroll checks. Performance Indicators: BAPB01.01.02.03 Apply the appropriate calculation method: add, subtract, multiply, divide, compare, present value, compound values, etc. Chapter 13 – Payroll Accounting, Taxes, and Reports Chapter Objectives: Analyze payroll transactions and record a payroll. Record employer payroll taxes. Prepare selected payroll tax reports. Ray and record withholding and payroll taxes. Performance Indicators: BAPB01.02.02.03 Print a report. Chapter 14 – Distributing Dividends and Preparing a Work Sheet Chapter Objectives: Journalize the declaration and payment of a dividend. Begin a work sheet for a merchandising business. Plan work sheet adjustments for merchandise inventory, supplies, prepaid expenses, uncollectible accounts, and depreciation. Calculate federal income tax and plan the work sheet adjustment for federal income tax. Complete a work sheet for a merchandising business. Performance Indicators: Chapter 15 – Financial Statements for a Corporation Chapter Objectives: Prepare an Income Statement for a merchandising business organized as a corporation. Prepare a Balance Sheet for a merchandising business organized as a corporation. Analyze an income statement using component percentages and financial ratios. Comparing financial ratios with acceptable industry standards. Prepare a statement of stockholders equity for a merchandising business organized as a corporation. Performance Indicators: BAPB04.01.01.03 Compare the differences in financial statements. BAPB05.03.01.01 Prepare a balance sheet. BAPB05.03.01.02 Prepare an income statement. BAPB01.01.02.03 Apply the appropriate calculation method: add, subtract, multiply, divide, compare, present value, compound values, etc. BAPB04.01.01.00 Understand the purpose of financial statements. BAPB04.01.01.02 Explain the purpose of a financial statement. BAPB04.01.01.01 Describe the different types of financial statements. Chapter 16 – Recording Adjusting and Closing Entries for a Corporation Chapter Objectives: Record adjusting entries for a business organized as a corporation. Record closing entries for income statement accounts for a business organized as a corporation. Record closing entries for dividends for a business organized as a corporation. Prepare a trial balance for a business organized as a corporation. Performance Indicators: BAPB05.02.02.04 Journalize and post adjusting and closing entries. BAPB05.02.02.05 Close the general ledger.