Austin Housing Finance Corporation

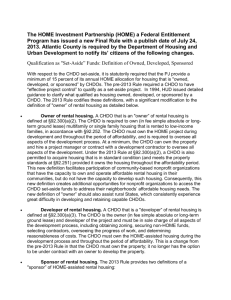

advertisement