National Income

advertisement

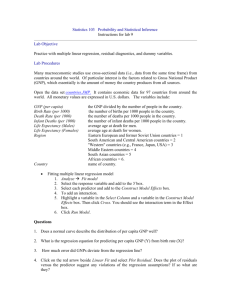

KERİMAN YILDIRIM & ASLI SEDA KURT 2001461199 2001461125 ECONOMIC GROWTH Economic growth is an increase in the total output of a nation over time. Economic growth represents the expansion of a country’s potential GNP (Gross National Product). So, economic growth is usually measured as the annual rate of increase in a nation’s real GNP. Gross Domestic Product: GDP is the total income earned domestically, including the income earned by foreign-owned factors of production; the total expenditure on domestically produced goods and services. Gross National Product: GNP is defined as the value of all final goods and services produced in a particular nation in a given period of time. This given period is usually a calendar year. It includes all the economic production in the economy in any given period. It is termed national because it refers to the productive activities of the citizens of a nation. The GNP is described as gross because it doesn’t take into account the capital goods that have been consumed or worn out during the process of production. GNP is the sum of consumption, investment, government purchases and net exports=C+I+G+X-M. Nominal GNP: Economists call the value of goods and services measured at current prices, nominal GNP. Real GNP: Economists call the value of goods and services measured at constant prices, real GNP. Real GNP provides a better measure of economic well-being than nominal GNP. The GNP Deflator: The GNP deflator measures the price of the typical unit of output relative to its price in the base year. GNP Deflator=Nominal GNP/ Real GNP Net National Product: NNP describes the net production of good and services during any given period. We can say that goods and services measured at market price, is NNP. The GNP allows no deduction for the consumption of capital. The NNP does. National Income: The national income is defined as the value of all final goods and services produced in some period, measured at the factor cost. Factor cost refers to the cost of the factors of production; labour power, capital, land and enterprise. The providers of these receive wages, interest, rent and profit. Net national product and national income are the same amount of goods and services measured at different prices. One is measured at market prices, the other at prices paid to the factors. Personal Income: Personal income is the total income received by all individuals in the economy. Disposable Income: Disposable income is the amount households and non corporate business have available to spend after satisfying their tax obligations to the government. GNP- Depreciation (the amount of the economy’s stock of plants, equipment, and residential structures that wears out during the year) = NNP NNP- Indirect Business Taxes = National Income National Income-( Corporate Profits+ Social Insurance Contributions+ Net Interest)+ Dividends+ Government Transfers to Individuals+ Personal Interest Income= Personal Income Personal Income- Personal Tax and Non tax Payments= Disposable Personal Income We can visualize economic growth as the outward shift of the PPF ( Production Possibility Frontier). Guns(thousands) I A U Butter (millions of pounds) B The frontier shows the menu of choice along which society can choose to substitute guns for butter, assuming a given state of technology and a given total of resources. Points outside the frontier, such as I, are unattainable. Any point inside the curve, such as U, indicates that resources are unemployed, or not used in the best possible way. As a result of an increase in both inputs and an improvement in a nation’s technology, the PPF shifts out. A nation can have more of all goods as its economy grows. Income distribution: It describes the distribution of national income across the individuals and factor owners, for a particular nation in a given period of time. The purpose of examining the income distribution is to find the reasons for and the results of income differentiation. Functional Income Distribution: is defined as the distribution of national income across the factor of production, in a given period of time. Individual Income Distribution : is defined as the distribution of national income across the individuals, without considering their economic activities, in a given period of time. The way of distributing the national income, across the individuals and factor owners is very important both socially and economically. Income distribution is affected by social, economical and political factors. The essential factor that forms the income distribution is ownership of production tools. Unequal distribution of the ownership of production tools causes unequal income distribution, but income distribution doesn’t only depend on the ownership of production tools. The rate of government services, fiscal policy, social and traditional relationships. They are also the important indicators of income distribution. On the other hand income distribution has so many economical and social results. Firstly savings, investments and growth are closely connected to the income distribution. The recipients of income can decide to spend their income on consumer goods or save it, this decision is totally theirs, and because of this, the way of income distribution and the policies that influence it also will affect the economic growth. The social effects of income disrtibution are very important just like the economic effects are. A society in which income is distributed inefficiently suffers from low level of education, a low culture level, an inadequate health care system, and poverty. There will be both rich and poor people in the society but the majority will be poor, because of this it would be difficult to provide social equality in that society. İf there is no social equality in a society it will be difficult to obtain economic growth. The studies about income distribution suggest economic policies which provide equalization in distribution help to create social equality within the society. There are various ways to measure unequal income distribution; the most popular are Lorenz Curve and Gini Coefficient. Lorenz Curve & Gini Coefficient Gini Index of Income Inequality:A summary measure of the extent to which the actual distribution of income, consumption expenditure, or a related variable, differs from a hypothetical distribution in which each person receives an identical share. The Gini Index provides a measure of income or resource inequality within a population. It is the most popular measure of income inequality. This indicator is particularly relevant to the equity component of sustainable development. Income or resource distribution has direct consequences on the poverty rate of a country or region. Broadly speaking, average material welfare can be defined by the per capita Gross Domestic Product (GDP). However, statistical averages can mask the diversity that exists within any country. Therefore, from a sustainable development perspective, it is informative to examine income and wealth distribution throughout a population. A country can, for example, have a high per capita GDP figure, but its income distribution so skewed that the majority of people are poor. This indicator is useful both to measure changes in income inequality over time and for international comparisons. In the "Lorenz diagram" the straight line above the area "A" would be generated by an absolutely equal distribution of wealth. In such a case it would not be possible to order segments of the population by wealth per household. This defines the maximum of "disorder". Maximum entropy would have been achieved. With the sampled data, however, it is possible to define and order groups by wealth in a way that generates the curve above the area ""B". The more "distinct" the ordering, the lower is the entropy. The more "distinct" the ordering, the lower is the entropy. proportional income LORENZ CURVE Gini Coefficient = A/A+B A B Proportional population The Lorenz curve is used to calculate the Gini coefficient directly from the areas "A" and "B". (A/ A+B)= Gini Coefficient. What is the significance of the Gini coefficient? As explained, this measure is a ratio of areas. The area A+B represents the wealth, which would be available equalizing redistribution in case of maximum inequality. The area A represents the wealth, which is available for equalizing redistribution for a given inequality. A/(A+B) respectively 1-B/(A+B) then is related to the degree of inequality. The drawback of the gini index is that societies that have similar average income and gini coefficients can have very different income distributions. The gini index can only be used as a comparative figure if the distribution curve of one country or point of observation lies wholly within the distribution curve of the other country of point of observation. Furthermore, the gini coefficient is more responsive to changes in distribution among the middle classes and is not as sensitive at the extremes. Fortunately, there are other, albeit less common, measures of inequality that behave in different ways. For example, the coefficient of variation focuses on the inequality between the top and middle of the income distribution, while the Atkinson measure emphasizes either the high or the low end of distribution but should always be used instead of the Gini index if the Lorenz curves of two countries or time frames intersect. A fourth measure of inequality is the Theil index, which focuses on group differences and if one is comparing groups, it is the appropriate index. Case Study- Income Distribution In Turkey Regional income distribution in Turkey When we examine Regional Income Distribution In Turkey, we’ll find that the poorest region is East Anatolia; except this region, the income percentages, and household percentages are nearly the same. The comparisation between the household sahares and the annual disposable income shows that in Turkey 33 cities are developed and 48 cities are undeveloped. Sectoral Income Distribution Income of household→%100(according to 1994 data) it includes; Share of Agricutural sector →%23.3 Share of industrial sector→%19.3 Share of commerce sector→%17.8 Hizmet sektörü→%26.9 Konut sektörü→%14 MUSTAFA GÖKDEMİR & LEVENT YILMAZ Economic Growth • The term economic growth refers to any situation in which national output increases. Suppose that an economy starts out at full employment and utilizes its resources, efficiently. In this situation the first condition for growth is that the economy’s productive capacity has to increase. One way in which the economy’s productive resources may increase is through a rise in the supply of natural resources. Today, however increases in natural resources are more often tied up with advances in technology. The other condition for economic growth is growth of population. The growth of population creates the possibility of economic growth in the sense that it provides more workers. It also provides us with more consumers. If the increase in the population is not accompanied by the increase in a nation’s capital stock, each additional worker who enters the labour force will have less and less plant and equipment to work with. • • • In the assumption that full employment and using resources efficiently; increasing the GNP of country shows us economic growth of this country in given period of time. • Gross National Product: GNP measures both the income of everyone in the economy and the total expenditure on the economy’s output of goods and services. GNP is the sum of four categories of expenditure: consumption, investments, government purchases, and net exports. Nominal GNP values goods and services at current prices, and real GNP values goods and services at constant price. Thus, Reel GNP rises only when the amount of goods and services has increased, whereas nominal GNP can rise either because output has increased or because prices have increased. • • The GNP Deflator: From nominal GNP and reel GNP we can compute a third important statistics the GNP deflator. Its, also called the implicit price deflator for GNP, is defined as: • Nominal GNP GNP Deflator=----------------------- Thus the GNP deflator is the ratio of nominal GNP to reel GNP Reel GNP Gross Domestic Product: GDP is the value of all final goods and services produced in a particular domestic in a given period of time. For Example: The foreign firm’s economic activities are contributed to the Turkısh GDP. The economic activities of Mercedes-Benz in Turkey is apart of Turkish GDP and these part of Germany’s GNP. • Net National Product: The GNP allows no deduction for the consumption of capital, but the NNP does. NNP is the net production of goods and services during any given period. • G NP ( GDP ) - Amortization NNP = ( ND P ) National Income • The national income is defined as the net value all final goods and services • • produced in some period, measured at the factor costs. For in the GNP, as in the NNP, the value of goods services is measured at the market prices. These prices include excise and sales taxes levied by the government. Factor cost refers to the cost of the factors of production; labor power, capital, land and enterprise. (The total value of all earnings of people and in the country.) Total Personal Income • Personal income is the total income received by all individuals in the economy. First, people pay their personal taxes. What people have left we call total disposable income. Most of this they spend on consumption and the rest they save. Personal Income=National Income (NNPf.p.)+transfers payments-(Firm Taxes+Undistributed Profits +Social Security) Income per Person =Personal Income/Population Disposable Personal Income=Personal Income - Personal Direct Taxes(Income Taxes) Max Lorenz&Corrado Gini • Consideration of the concentration ratio begins with the joint cumulative distribution function of total income and recipient units. This function is known in English-speaking countries as the Lorenz Curve, and in Latin countries as the Gini Curve. • The cumulative percentage of income receivers is plotted on the horizantal axis and the cumulative percentage of total income receivers is plotted on the vertical axis. When the relevant observations have been connected, the result is called a Lorenz or a Gini Curve. • Among this curve’s interesting mathematical properties is that its slope at every point is thre • • ratio of the corresponding income to the mean income. If the distribution plotted entirely equal, the Lorenz Curve will be a 45-degree line through the points (0,0)and(100,100).(Line of Equality) At the opposite extreme, if all the income goes to one recipient, the Lorenz curve will degenerate into a pair of perpendicular straight lines. Income Distribution if we divide the population in five equal pieces each year. We see that in 1987 initial income receivers are taking %5,2,in 1994 this ratio is decrease to %4,9.Final income receivers are taking in 1987 %49,9,in 1994 this ratio is increase to %54,9.The changes in the Gini ratio (1987-0,44;1994-0,49)is the reason of negative changes income distribution in Turkey.