International Trade Fund

advertisement

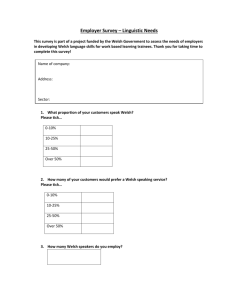

Overseas Business Development Visit Support Application Guidelines Before completing the application for funding form please read through guidelines below The aim of the Overseas Business Development Visit Support is to provide support and assistance to companies to carry out international trade development activities and projects. You should provide evidence in your application that your activities form part of a strategic plan to develop your business. Applications will only be considered from companies that: have never exported, or have been exporting for less than 2 years, or are targeting export markets that are new to the company, or new business in an existing market. This support is not to support your current export activity, such as meeting existing agents or clients. The Overseas Business Development Visit Support is discretionary and every application is judged on its own merits and the quality of the information that is provided. Retrospective applications will not be considered for reimbursement. A retrospective application is a project in relation to which activity (which includes expenditure or commitment) has commenced prior to either the application being submitted or approval being granted (offer letter issued). This means that any expenditure and/or any activity associated with the project that pre dates either the initial application or the offer letter will mean that your application is refused or, if approval has already been given, that the entire application will be considered retrospective and that all of the Overseas Business Development Visit support will be ineligible and therefore withheld on that basis. The Welsh Government reserves the right to decide whether an application is retrospective. No support will be paid for VAT, insurance, domestic (UK) travel and accommodation, petrol overseas, and will only be paid for economy travel. All costs in the application will be tested to ensure that they are reasonable and provide value for money. The maximum amount payable by the Welsh Government is 50% of the total eligible costs of a project up to a maximum of £10,000. E.g. for a project that costs a total of £23,000, the Welsh Government support will be capped at £10,000. The Overseas Business Development Visit Support can only support activities that cannot be supported by other sources of public money (e.g. trade missions, delegations to exhibitions). You should investigate alternative sources of funding prior to making your application, and detail these in your supporting documentation. Applicants should note that the assistance provided by this funding constitutes de minimus state aid as defined by the European Commission. Awards of de minimus aid, from all public sources, must not exceed 200,000 euros within any 3-year fiscal period. Please ensure that your Company has not received de minimus state aid of more than 200,000 euros within the 3year fiscal period before the date of this application. If the company exceeds the limit then they are responsible for any action as a result, including repayment of the support they have received Support under this programme is subject to Welsh Government approval and budget availability 1 Cost Eligibility The following costs are eligible for support: International flights or ferry costs (economy only) Accommodation on standard B&B basis only Exhibition space cost Shipment of stand & equipment for exhibitions Exhibition registration fees If you are visiting a market or an event/exhibition but not exhibiting then one person can be supported, however if you are exhibiting at an event/exhibition then two people can be supported. Please note that the costs of UK travel and accommodation cannot be subsidised, nor can attendance at UK events/ exhibitions. After the business development visit All activity as detailed in the project must be completed prior to submitting a claim. Interim payments for partially completed projects will under no circumstance be considered. If a claim is submitted without all elements of the project being completed, an explanation must be provided. In order to process a claim, we will require a report detailing the outcome of the project – this should focus on successes and experience gained. If new business has been secured, profit benefit received and/or jobs have been safeguarded/created you will be required to complete a ‘business secured form’ You will be required to submit original invoices / receipts as proof of expenditure. You will also need to provide proof of payment from your account. Please note electronic bank statements cannot be accepted and originals must be provided. Cash payments cannot be reimbursed for any expenditure incurred for the project. Claims must be submitted within 4 weeks of completion of the project date set out in your application. The Welsh Government will contact you 6 and 12 months after your claim has been paid to ensure that we capture any further outputs and to provide assistance where applicable. Again any further new business secured, profit benefit received or jobs have been safeguarded/created will require completion of a ‘business secured form’ 2