475 Lecture Notes

advertisement

570 Notes, Pds/Mtds,16-1

570 Lecture Notes

Ch. 16 - Accounting Periods and Methods

IRC Subchapter E (§441-483)

I.

Accounting Periods (§441-444)

A.

Potential Periods (all are basically 12-month periods)

1. Calendar year

2. Fiscal year

3. 52-53 week year

B.

Returns for Periods of Less than 12 Months

1. Short year can occur in 1st tax year, last tax year, or when there is a change in

tax year.

2. Taxpayers changing from one accounting period to another must annualize their

taxable income. Generally, IRS approval is required.

II.

Ptr.

A

Periods for Specific Entities

A.

Individuals

B.

Partnerships

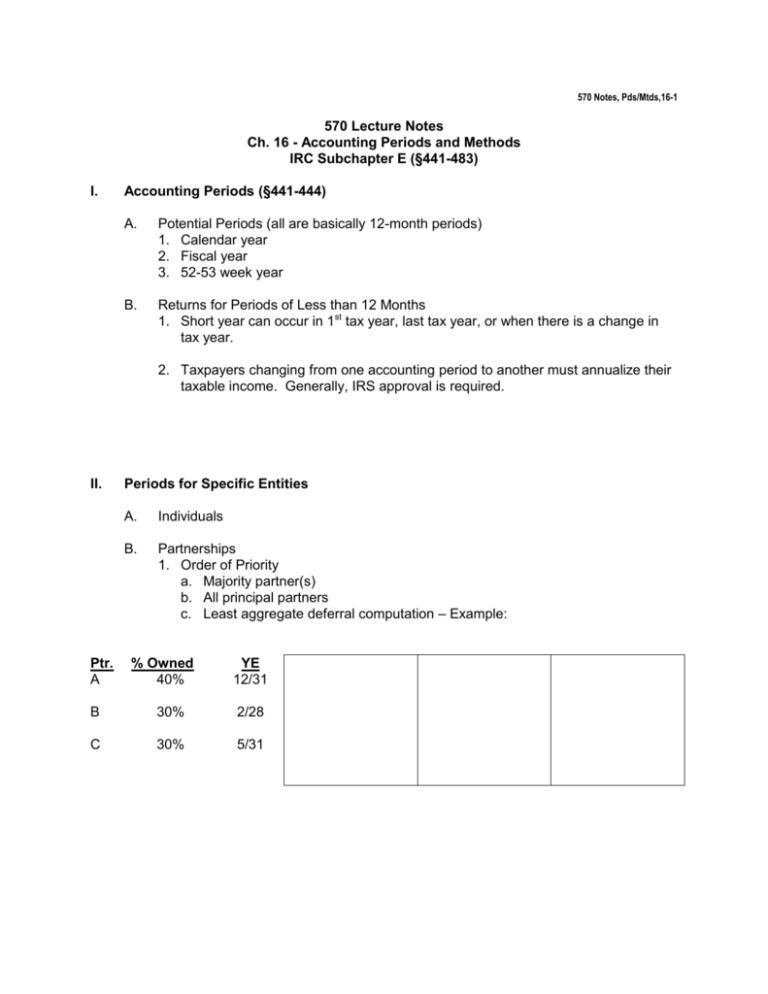

1. Order of Priority

a. Majority partner(s)

b. All principal partners

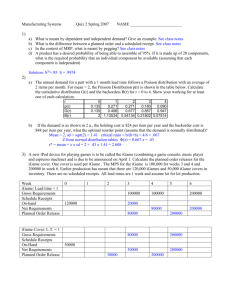

c. Least aggregate deferral computation – Example:

% Owned

40%

YE

12/31

B

30%

2/28

C

30%

5/31

570 Notes, Pds/Mtds,16-2

2.

Exceptions

a. Business Purpose (Natural business year)

Defn: A 2-month period in which > 25% of annual gross receipts received for

at least 3 consecutive years.

(Note: if more than one such 2-month period exists, the natural business

year is the period with the largest average.)

b. §444 election

1. Limit

2.

C.

Required deposit

partnership (not owners) deposits tax

does not earn interest

deposit = [Partnership Taxable Income x 36% x n/12], where n is # months

deferred

required only if deposit amount> $500

S Corporations

1. Calendar Year or 52/53 Week

2. Exceptions

business purpose (natural business year)

§444 election with required deposit

D.

C Corporations

E.

Personal Service Corporations

Defn: PSC is a corporation whose shareholder-employees provide personal

services (e.g., medical, legal, accounting, consulting, etc)

1. Calendar Year

2. Exceptions

business purpose (natural business year)

§444 election, but ONLY IF:

o the corporations pays the shareholder-employee’s salary during

the deferral period AND

o the salary for that period is at least proportionate to the salary

paid for the fiscal year.

Example: PSC has 10/31 year-end (a 2-month deferral). Its shareholderemployee was paid $60,000 in salary for the 11/1-10/31 fiscal year. PSC

must pay the shareholder-employee a salary of at least $10,000 ($60,000 x

2/12) in November and December.

570 Notes, Pds/Mtds,16-3

II.

Overall Accounting Methods (§446)

General rules:

taxable income must be determined under the method taxpayer regularly uses

for computing income in maintaining its books, provided it clearly reflects

income and is used consistently.

Same method used in determining revenues must be used for expenses.

A.

Cash Receipts and Disbursements Method

1. Income recognized for the tax year in which cash or property is actually or

constructively received.

a. Exceptions for U.S. savings bonds (optional for discounts, required for

premiums) and OID bonds (required)

2. Expenses are generally deducted in the year paid. Prepaid expenses which

have a life > 1 year beyond the end of the year must be capitalized.

3. Restrictions on the use of cash method

a. Cash method cannot be used by businesses in which inventory is an "income

producing factor."

1. Exceptions:

- “qualifying taxpayers” (avg. gross receipts<$1m in last 3 years);

- “qualified small businesses” (avg. gross receipts < $10m in last 3 yrs &

either certain industry code or principal business is services or custom

work).

2. Hybrid method possible.

b. Cash method cannot be used by (exceptions for farmers):

1. C corporations with avg. gross receipts in last 3 years > $5million;

2. partnerships with C Corp partners & avg. gross receipts in last 3 years >

$5million;

3. tax shelters.

B.

Accrual Method

1. Income and expenses are both subject to:

a. all-events test

Defn: all events have occurred to establish the existence of the income or

expense and the amount can be determined with reasonable accuracy.

b. economic performance test (for deductions)

Defn: In general, services must have been performed to be deductible.

2. Exception for income received in advance.

a. General: Taxpayer must recognize income when cash is received.

b. Exceptions (deferral possible):

- Sales of inventory not shipped & gift certificates (maximum deferral is 2

yrs). Note – requires GAAP conformity.

- Service contracts (maximum deferral is 1 yr)

570 Notes, Pds/Mtds,16-4

C.

Change of Method (§481)

1. Must obtain IRS permission to change method.

2. Involves an adjustment to “catch-up”

Example: Change from the Cash to the Accrual Basis

A journal entry approach is helpful for illustrating the tax consequences of a change in methods.

To illustrate this approach, assume a C corporation’s average annual gross receipts for 2007

through 2009 exceeded $5,000,000. Therefore, effective January 1, 2010 the company was

required to change to the accrual method of accounting. On January 1, 2010 the company’s

cash basis and accrual basis accounts were as follows:

Cash Basis

Accrual Basis

Assets

Cash

$ 75,000

$ 75,000

Accounts receivable

0

125,000

Supplies

0

80,000

Equipment (net of depreciation)

400,000

400,000

Total

$475,000

$680,000

$

0

$ 31,000

Note payable

100,000

100,000

Stockholder’s equity

375,000

549,000

$475,000

$680,000

Liabilities and Stockholder’s Equity

Accrued expenses

Total

Journal Entry

Debit

Accounts receivable

$125,000

Supplies

$ 80,000

Credit

Accrued expenses

$ 31,000

§481Adjustment to income

$174,000

Note that the § 481 adjustment to income is the amount required to make the journal entry

balance after all of the asset and liability accounts have been adjusted.

Note also that as a voluntary change by the taxpayer the adjustment, generally, can be spread

over four years (i.e., $43,500 added to 2010 income and an equal amount added to 2011,

2012, and 2013 income).

570 Notes, Pds/Mtds,16-5

III.

Inventories (§471–475)

A.

Determination of Inventory Cost

1. Retailers use normal accounting procedures

2. Manufacturers must use full absorption costing (the uniform capitalization

rules apply to manufacturers with > $10million in gross receipts). Includes:

(a) Direct labor and materials

(b) Manufacturing overhead including factory repairs and maintenance, utilities,

rent, insurance, small tools, tax depreciation, factory administration and

officers' salaries related to production, taxes (other than income), quality

control and inspection, rework, scrap, spoilage, current and past service

costs of pension and profit-sharing plans, and service support.

IV.

B.

Cost flow assumptions

1. Normal rules used in accounting (LIFO, FIFO, average)

2. Retail method

3. Dollar-value LIFO

4. Restrictions on LIFO

C.

Cost departures (LCM)

1. Lower of cost or market (replacement cost) must be applied item-by-item.

2. Not available for LIFO.

Special Accounting Methods

A.

Installment Sales Method (§453)

1. Description: When any disposition of property for a gain occurs where at least

one payment is received after the taxable year of disposition, the installment sale

rules apply (i.e., the method is automatic, unless taxpayer elects out by reporting

entire gain in the year of sale). The income is reported proportionately over the

period payments are received.

Easy Example to remind you that you already know this: Asset with a basis of

$50,000 is sold for $90,000. Collection is $30,000/year for 3 years, with a

reasonable interest paid.

570 Notes, Pds/Mtds,16-6

2. Restrictions on installment method.

a. Not available for inventory, publicly-traded stock & securities, depreciation

recapture, & sales of depreciable property between related parties.

3. General computations Required:

a. Contract Price = Selling Price - debt transferred to buyer

b. Gross profit percentage = Gross Profit/Contract Price

c. Annual income recognition = GP% times the collections of principal

Example: Suppose from the easy example that the $90,000 sales price is

$80,000 3-yr. note ($26,667/yr) & assumption of a $10,000 mortgage.

GP% = Gain / Cont. Pr. =

Yr

1

2

3

$ collected

GP %

GP Recog.

4. Special computations

a. Debt assumed by buyer exceeds seller's basis (plus selling expenses):

(1) excess added to contract price

(2) excess treated as cash received in year of sale

(3) net effect is a GP% of 100%

Example: Suppose from the easy example that the $90,000 sales price is

$30,000 3-yr note ($10k/yr) & assumption of a $60,000 mortgage.

Gain / Cont. Pr. =

40,000

= 100%

90,000 – 60,000 + 10,000

Yr

1

2

3

$ collected

10,000

10,000

10,000

Excess

10,000

GP %

100%

100%

100%

GP Recog.

20,000

10,000

10,000

b. All depreciation recapture must be recognized in year of disposition. GP%

must be adjusted to reflect recognition.

Example: Suppose from the easy example that the $40,000 gain consists of

$10,000 depreciation recapture under §1245.

GP% = Gain / Cont. Pr. =

Yr

1

2

3

$ collected

GP %

GP Recog.

c. Interest on the note must be reasonable (based on AFR), or we impute one.

Effect is simply reclassification of character of income to be recognized.

570 Notes, Pds/Mtds,16-7

B.

Long-Term Contracts (§460)

Defn: Contract that is not completed within the same taxable year in which it began.

1. Potential methods

a. Percentage of completion

b. Completed contract

2. Restrictions on completed contract. Available only for (i.e., default requires

percentage of completion):

a. Certain home construction contracts:

At least 80% of estimated costs are for dwelling units in buildings with no

more than 4 units.

b. 2-year construction projects by "small" contractors

(average gross receipts < $10M)

3. Special Provisions

a. Percentage of Completion - can ignore income recognition if <10% complete

at year-end.

b. Percentage of Completion Look-Back Rule

1. Potential interest payment/receipt applies to construction projects that

exceed 2 years and are > $1M.

2. In the year of completion, we must recalculate the profit and related

taxes to actual.

570 Notes, Pds/Mtds,16-8

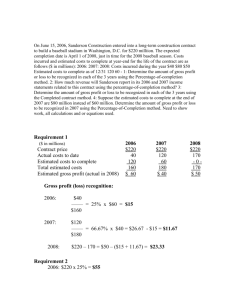

Example: Percentage of Completion Method

Contract started in 2008 and was completed in 2010

Contract price

Estimated total cost at beginning

Estimated costs changed in 2009 to

Actual cost incurred:

2008 =

$ 250,000

2009 =

$1,000,000

2010 =

$ 250,000

$1,600,000

$1,000,000

$1,500,000

Percentage of Completion Profit

Formula:

Revenue this year – Costs this year = Profit this year,

where Revenue = [(Total Contract x % complete to date) – Prior Years’ Revenue]

2008

2009

2010

=

=

[$1,600,000 X $250,000/$1,000,000] - $250,000

$400,000 - $250,000 =

(You may have learned to recognize profits, which are computed as:

[$600,000 est. profit X $250,000/$1,000,000])

=

=

{[$1,600,000 X $1,250,000/$1,500,000] - $400,000} - $1,000,000

$1,333,333 - $400,000 - $1,000,000 =

(Continuing with profit method:

{[$100,000 est. profit x $1,250,000/$1,500,000] - $150,000})

=

=

{($1,600,000 X $1,500,000/$1,500,000) - $1,333,333} - $250,000

$266,667 - $250,000 =

Total profit = $150,000 - $66,667 + $16,667 =

$150,000

(66,667)

16,667

$100,000

Look-back Profits for Each Year

2008 $1,600,000 X ($250,000/$1,500,000) - $250,000 =

2009 $1,600,000 X ($1,000,000/$1,500,000) - $1,000,000 =

2010 $1,600,000 X ($250,000/$1,500,000) - $250,000 =

$16,667

$66,667

$16,667

Thus, the taxpayer will receive interest on the difference in tax on $150,000 reported in 2008

and the tax on the corrected income, $16,667. The interest will be calculated as though the

company loaned the government the tax when it filed its 2008 return and the government repaid

the loan when the 2010 return was filed. For 2009, the taxpayer is deemed to have borrowed

the tax on $133,334 ($66,667 + $66,667) for one year, assuming the $66,667 loss reported in

2009 was offset against other income. No interest is due or receivable with respect to 2010

taxes because the difference between the actual and estimated profit is adjusted in that year.