District of Columbia Tax Requirements

advertisement

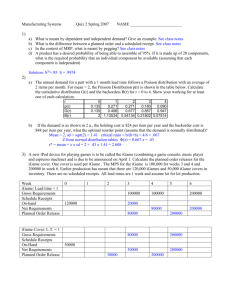

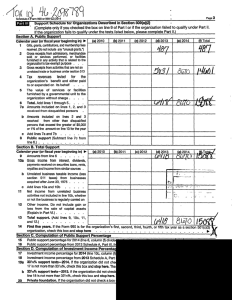

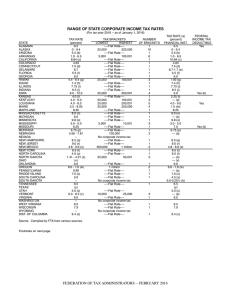

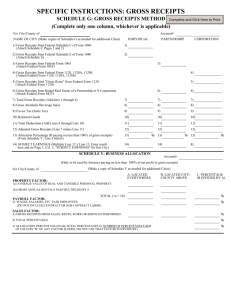

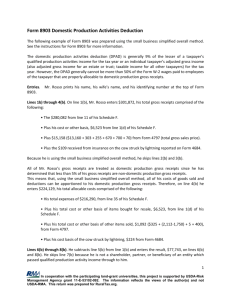

District of Columbia Tax Requirements Susan T. Edlavitch Venable LLP Washington, D.C. Direct Dial: (202) 344-8518 stedlavitch@venable.com February 13, 2013 ©2013 DC Tax Requirements • Combined Business Tax Registration. o Initial registration with DC Department of Regulatory and Consumer Affairs (DRCA). o Form-500 provides information on ownership, location and type of business, which is needed to make a determination of an employing unit’s liability to pay unemployment taxes. o Form FR-500 can be filed on-line. • Business License Application and Registration: http://dcra.dc.gov/DC/DCRA/For+Business/Just+ Starting+Your+Business%3F General Business Taxes • Business Income Taxes o Corporate Franchise Tax o Unincorporated Business Franchise Tax o Pub. L. No. 86-272 Safe Harbor: State cannot tax out-of-state entity if “mere solicitation of orders” for sale of TPP and orders are approved and fulfilled from outside the state. • Sales & Use Taxes • Other Business Taxes • Payroll Taxes Corporate Franchise Tax • Tax on net income of corporations having DC “nexus”. • “Nexus” means engaging in a trade, business or profession in DC. • Tax Rate: 9.975% of taxable income. • $250 minimum tax if $1 M gross receipts or less; $1,000 minimum tax if over $1 M gross receipts. • Form D-20 Annual Return. Unincorporated Business Franchise Tax • Tax on net income of unincorporated business having DC “nexus” with gross receipts > $12,000/year. • Sole proprietorship, partnership, LLC, joint venture, etc. • Tax Rate: 9.975% of taxable income. • Taxable income after 30% salary allowance and $5,000 exemption. • $250 minimum tax if $1 M gross receipts or less; $1,000 minimum tax if over $1 M gross receipts. • Form D-30 Annual Return. • DC resident Form D-40 excludes allocable share of previously taxed income from unincorporated business. Sales & Use Taxes • Sales tax on all tangible personal property (TPP) and certain selected services sold or rented to businesses or individuals at retail in DC. • 5-Tier Rate Structure: TPP and certain selected services (6%); liquor off-premises (10%), restaurant meals and liquor onpremises (10%); hotels (14.5%); commercial lot parking (18%). • Exemptions: Groceries, medications & residential utility service. • Use tax is imposed at same rate on purchases outside DC and then brought into DC to be used, stored or consumed, if purchaser has not paid sale tax to another jurisdiction. • Sales & Use Tax Returns must be filed monthly (Form FR-800M, quarterly (FR-800Q) and annually for Oct. 1 through Sept. 30 (FR-800A). Other Business Taxes • Personal Property Tax: Tax on TPP used or held in storage for business purposes or held for rent to 3rd parties, subject to $225,000 exclusion (Form FP-31). • Economic Interest Tax: 2.9% of consideration or FMV if transfer of (a) 80% of corporate assets consisting of DC real property or (b) more than 50% controlling interest. • Gross Receipts Tax: Certain businesses, such as utilities, toll telecommunications, cable TV, etc. • Tax on Special Events: Auctions, shows, expositions, etc. Payroll Taxes • DC income tax withholding. • DC Unemployment Compensation Tax o Taxes payable for first $9,000 of gross wages paid to each employee annually o Newly liable employer pays at rate of 2.7% or average rate paid by all employers during preceding year, whichever is higher. • Employer Withholding Tax Return Form FR-900 must be filed monthly, quarterly or annually, depending on how employer reports. IRS Circular 230 Disclosure: Taxpayers are urged to consult their own tax advisors. This presentation is not intended as tax advice for a particular taxpayer and cannot be used for the purpose of (a) avoiding penalties that may be imposed on any taxpayer, or (b) promoting, marketing or recommending to another party any matter addressed herein. End Susan T. Edlavitch Venable LLP Washington, D.C. Direct Dial: (202) 344-8518 stedlavitch@venable.com February 13, 2013 ©2013