2008 DHCD Phase1 by CCG

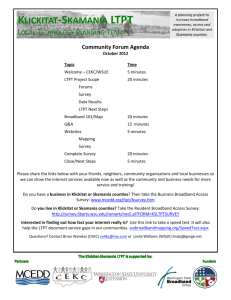

advertisement