Apes With Wings Pty Ltd & Anor v St Kilda Arts and Events Company

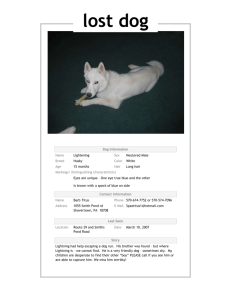

advertisement