ReportCS_1

advertisement

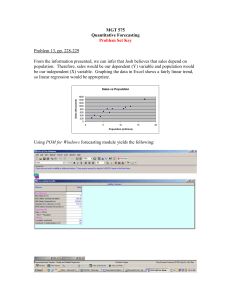

Problem: Questions at Aquatrix Corporation arose when a plant manager noticed that warehouse expenditures were shown to be higher than routine. Calls were made and our team of experts were tasked with the job of evaluating current forecasting techniques employed by the company. All that was received was six years of forecasting and sales data in which we separated and analyzed individually. TABLE1A shows each years current forecast, observed value, and the difference of the two which is the inaccuracy. After totaling out the forecasts observed for all six years and looking at the difference between them as a whole we can see that the only year which Aquatrix could not meet demand was 1981. This is peculiar as one would think forecasts would get progressively more accurate as time progressed. This was not the case for the Aquatrix Corporation from this perspective. Besides that miscalculation, it is noticed that the only year in which an acceptable amount of stock still on hand was in 1980. Now on the other hand after computing the Mean Average Deviation (MAD) and Mean Absolute Percentage Error (MAPE) it is observed that the values are more significant, as time went on the forecasts got better (See TABLE1B). Now that we have evaluated the current system of forecasting at Aquatrix Corporation it is our undertaking to implement a more efficient way to forecast. Implementation: As a result of plotting four years of prearranged data some uniformity in each of them is observed (See 1978-1981 Sales Graph). Each year the sales market for the merchandise has risen steadily with comparable trends each year. Eyeballing the graph the lowest sales occur on average in period five and the peak of sales occur in period nine. 1 Upon noting these observations our team decided to use two different forecasting methods to compare with the current model at Aquatrix. Since our forecast team has significant experience from prior work with moving average and exponential smoothing we chose to use them as our models to go against the existing Aquatrix methods. Initially we chose a MA3 forecast, which means that the average of the last three sales periods becomes our forecast for the fourth period. This is a very easy method to implement and is sometimes effective depending on the business. Dealing with a production company that has up and down sales numbers proved to be a hard task for the moving average model. Our numbers for one step ahead forecasts for 1981 turned out to be worse than the Aquatrix Corporation current model (See TABLE 2A and TABLE2B). As noted in the tables our MAD result was roughly four-thousand units inferior to the existing model and our MAPE was eight percent. Our first run was met unsuccessfully and we expect that our second choice of model would yield a better solution. It was now time to derive our exponential smoothing model. Using computer software implementation we were able to manipulate the data and get the MAPE down to a reasonable 10% and the MAD at approximately two-thousand units lower than the existing model (See TABLE 3A and 3B). This method although the gains were small proved to be the best current implemented method available to the Aquatrix Corporation. Results: Current methods at Aquatrix Corporation in the forecasting department proved to be in need of change. The first model chosen (MA3) showed to be unsuccessful as our numbers were worse than that of the existing implementation. Results were compiled in 2 TABLE 4 that show our comparison models to the Aquatrix model. As shown one can see that the exponential smoothing model that we implemented was 5% more efficient than the original model and 13% more efficient than our first choice. It is this model that we would recommend to the Aquatrix Corporation as the organization would save on roughly fifty-five thousand units per year of wasted product. This would save the corporation a vast amount of money that they could perhaps put towards even better forecasting models to save even more financial capital. 3