Richard Ivey School of Business

advertisement

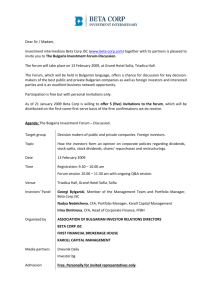

Eugene Bala Influence of Beta on the Price of Equity and the Cost Capital Summary Chapter 1: Introduction page 2 Chapter 2: Estimating the Cost of Capital page 4 Chapter 3: Beta Estimates page 6 Chapter 4: Managerial Implications page 13 Annexes SPSS output page 14 Data Sets page 22 03/08/16 Page: 1 Eugene Bala Influence of Beta on the Price of Equity and the Cost Capital Chapter 1 Introduction The Dow Jones industrial average, the world's most widely followed indicator of stock market health, broke through the 10,000 level for the first time on March 17, 1999. Some investors, mostly small-time players, attached great significance to the development. Ten thousand! That's a lot of zeros, which translates into a lot of wealth. The real significance of 10,000 is ' that's easy to say and has five digits instead of four' said financial analysts. Which investment is more profitable and which is riskier? A stock's expected return, its dividend yield plus expected price appreciation, is related to risk. Risk averse investors must be compensated with higher expected returns for bearing risk. One source of risk is the financial risk incurred by shareholders in a firm which has debt in its capital structure. Meeting its financial strategy for a firm is embarking only on projects that increase shareholder values. Thus, the expected rate of return on these projects should be equal or greater to the cost of capital. The company's cost of capital is directly related to its financial leverage and its impact on the cost of equity. Changes in interest rates, government spending, monetary policy, oil prices, foreign exchange rates and other macroeconomic factors affect all companies and the returns on all stock. Risk depends on exposure to macroeconomic events and can be measured as the sensitivity of a stock's return to fluctuations in returns on the market portfolio. Dominant practices in estimating companies' cost of capital are the WACC method. The CAPM model, which relies on beta estimates and the return on the market portfolio, is used in order to determine the cost of equity. Theory dictates that the return on market portfolio is an unobservable portfolio consisting of all risky assets, including human capital and other nontraded assets, in proportion to their importance in world wealth. Beta providers use a variety of stock market indices as proxies for the 03/08/16 Page: 2 Eugene Bala Influence of Beta on the Price of Equity and the Cost Capital market portfolio on the argument that stock markets trade claims on a sufficiently wide array of assets to be adequate surrogates for the unobservable market portfolio. How beta is estimated and how it impacts the cost of equity, respectively the cost of capital is critical for managers to understand. In the following sections of this paper it is presented the relationship between betas and the cost of capital, the regression model and assumptions allowing to estimate betas as well as two regressions for two different stocks and a subsequent analysis of the impact of using different indices as return on the market proxies on the value of the beta. Included to this document is a diskette containing the data sets that have been used for statistical analysis. 03/08/16 Page: 3 Eugene Bala Influence of Beta on the Price of Equity and the Cost Capital Chapter 2 Estimating the Cost of Capital The Weighted-Average Cost of Capital A standard method of expressing a company's cost of capital is the weightedaverage of the cost of individual resources of capital employed (WACC): WACC = (Wdebt x (1-t)Kdebt) + (Wpreferred x Kpreferred) + (Wequity x Kequity) (1) where : K = component cost of capital W = weight of each component as percent of total capital t = marginal corporate tax rate Finance theory offers several important observations when estimating a company's WACC. First, the capital costs appearing in the equation should be current costs reflecting current financial market conditions, not historical, sunk costs. In essence, the costs should equal the investors' anticipated internal rate of return on future cash flows associated with each form of capital. Second, the weights appearing in the equation should be market weights, not historical weights based on often arbitrary out-dated book values. Third, the cost of debt should be after corporate tax, reflecting the benefits of the tax deductibility of interest. The Cost of Equity - the Capital Assets Pricing Model The presence of debt in a firm's capital structure has an impact on the risk borne by its shareholders. In the absence of debt, shareholders are subjected only to basic business or operating risk. This business risk is determined by factors such as the volatility of a firm's sales and its level of operating leverage. As compensation for incurring business risk, investors require a premium in excess of the return they could earn on a riskless security such as a Treasury bill. Thus, in the absence of financial leverage a stock's expected return can be thought of as the risk-free rate plus a premium for business risk: Expected return = Risk-free rate + Risk premium 03/08/16 (2) Page: 4 Eugene Bala Influence of Beta on the Price of Equity and the Cost Capital The risk premium consists of a premium for business risk and a premium for financial risk. Thus, the relation can be expressed as Expected return = Risk-free rate + Business risk premium + Financial risk premium (3) The capital assets pricing model (CAPM) is an idealised representation of the manner in which capital markets price securities and thereby determines expected returns. Since CAPM models the risk/expected return trade-off in the capital markets, it can be used to determine the impact of financial leverage on expected returns. In CAPM, systematic (or market-related) risk is the only risk relevant in the pricing of securities and the determination of expected returns. Systematic risk is measured by Beta. CAPM provides a measure of a stock's risk premium employing Beta, which facilitates the estimation of the stock's expected return. In general the return on the stock, which corresponds to the cost of equity in (1) and (2) can be expressed as : Rs = Rf + Beta ( Rm - Rf) (4) where : Rs = stock's expected return Rf = risk free rate Rm = return on the market 03/08/16 Page: 5 Eugene Bala Influence of Beta on the Price of Equity and the Cost Capital Chapter 3 Beta Estimates: Measuring Market Risk Regression model Finance theory calls for a forward-looking beta, one reflecting investors' uncertainty about the future cash flows to equity. Because forward-looking betas are unobservable, practitioners are forced to rely on proxies of various kinds. Most often this involves using beta estimates derived from historical data and published by such sources as Bloomberg and Standard & Poors. The usual methodology is to estimate beta as the slope coefficient of the market model of returns. The regression equation is: Rit = Alphai + Betai (Rmt) (5) where : Rit = return on stock i in time period (e.g. week, month) t. This is the dependent variable, as it is predicted by the variation of the independent variable. Rmt = return on the market portfolio in period t This is the independent variable as it used to make a prediction on the dependent variable. Alphai = regression constant for stock I (the intercept) Betai = beta for stock I (the slope) Sample size - Practical Compromises The use of this equation (5) to estimate beta relies on historical data. The data that has been downloaded from Datastream and subsequently analysed, represents the return on stock, respectively the return on the market portfolio. The time span used for estimating the beta is: 1. two year of weekly periods basis (104 paired values) and 2. five year of monthly periods basis (60 paired values) The names of the companies in each sample are presented in annexes. 03/08/16 Page: 6 Eugene Bala Influence of Beta on the Price of Equity and the Cost Capital One Null Hypothethis The null hypothethis is that there is no relationship between the market return, reflected by the index used as proxy, and the return on the stock i. Two regressions The regression equation (5) implies that the return on stock and the return on the market portfolio vary together, they are correlated. Some stocks are less affected by market fluctuations than others are. Investment managers talk about 'defensive' and 'aggressive' stocks. Defensive stocks are not very sensitive to market fluctuations and their betas are low. In contrast, aggressive stock amplify any market movement and their betas are high. To illustrate this relationship, two regressions have been built for : 1. the Walt Disney Company 2. the Unisys Corporation As proxies for the market have been retained: The Dow Jones - as the Walt Disney Company is one of the 30 largest companies (blue chips) listed on the NYSE. The Standard & Poors 500 index has been retained as proxy for the market portfolio. First regression The SPSS output is presented in Annexe 1 to 4. For monthly observations of the return on the Walt Disney Company' stock. The null hypothethis has been rejected as Signif F < 0.05. The correlation coefficient is .59 if Dow Jones is the independent variable. The correlation coefficient is .53 if S&P500 is the independent variable. That indicates a strong correlation between the return on the market and the return on stock. Furthermore, the value of Sig T < 0.05 shows that the independent variable, which is the market return, is significant. The predictive power of the regression is .35 (Dow Jones), respectively .28 (S&P) Therefore the regression is considered to be significant. 03/08/16 Page: 7 Eugene Bala Influence of Beta on the Price of Equity and the Cost Capital If Dow Jones represents the proxy of the market return then the regression equation is: Rt = -.086434 + 1.073218 * Rmt (6) Beta = 1.07 Exhibit 1 : Normal P-P Plot of DISNEY 1.00 Expected Cum Prob .75 .50 .25 0.00 0.00 .25 .50 .75 1.00 Observed Cum Prob and is graphically represented in Exhibit 1. If the S&P 500 represents the proxy of the market return then the regression equation is : Rt = -.204710 + 1.022262 * Rmt (7) Beta = 1.02 For weekly observations of the return on the Walt Disney Company' stock: The null hypothethis has been rejected as Signif F < 0.05. The correlation coefficient is .49 if Dow Jones is the independent variable. The correlation coefficient is .47 if S&P500 is the independent variable. That indicates a strong correlation between the return on the market and the return on stock. Furthermore, the value of Sig T < 0.05 shows that the independent variable, which is the market return, is significant. The predictive power of the regression is .24 (Dow Jones), respectively .22 (S&P) 03/08/16 Page: 8 Eugene Bala Influence of Beta on the Price of Equity and the Cost Capital Therefore the regression is considered to be significant. If Dow Jones represents the proxy of the market return then the regression equation is: Rt = .130378 + .853764 * Rmt (8) Beta = .85 and is graphically represented in Exhibit 2. Exhibit 2: Normal P-P Plot of DISNEY 1.00 Expected Cum Prob .75 .50 .25 0.00 0.00 .25 .50 .75 1.00 Observed Cum Prob If the S&P 500 represents the proxy of the market return then the regression equation is : Rt = .030570 + .826095 * Rmt (9) Beta = .83 Second regression The SPSS output is presented in Annexe 5 and 6. For monthly observations of the return on the Unisys Corporation' stock. The null hypothethis has been rejected as Signif F < 0.05. The correlation coefficient is .53 with S&P500 as independent variable. 03/08/16 Page: 9 Eugene Bala Influence of Beta on the Price of Equity and the Cost Capital That indicates a strong correlation between the return on the market and the return on stock. Furthermore, the value of Sig T < 0.05 shows that the independent variable, which is the market return, is significant. The predictive power of the regression is .28 (S&P) Therefore the regression is considered to be significant. Exhibit 3: Normal P-P Plot of UNISYS 1.00 .75 Expected Cum Prob .50 .25 0.00 0.00 .25 .50 .75 1.00 Observed Cum Prob The regression equation is : Rt = -1.435103 + 2.381546 * Rmt (10) Beta = 2.38 and is graphically represented in Exhibit 3. For weekly observations of the return on the Unisys Corporation' stock: The null hypothethis has been rejected as Signif F < 0.05. The correlation coefficient is .48 with S&P500 as independent variable. 03/08/16 Page: 10 Eugene Bala Influence of Beta on the Price of Equity and the Cost Capital That indicates a strong correlation between the return on the market and the return on stock. Furthermore, the value of Sig T < 0.05 shows that the independent variable, which is the market return, is significant. The predictive power of the regression is .23 (S&P) Therefore the regression is considered to be significant. The regression equation is : Rt = 1.169138 + 1.313846 * Rmt (11) Beta = 1.31 and is graphically represented in Exhibit 4. Exhibit 4:Normal P-P Plot of UNISYS 1.00 .75 Expected Cum Prob .50 .25 0.00 0.00 .25 .50 .75 1.00 Observed Cum Prob 03/08/16 Page: 11 Eugene Bala Influence of Beta on the Price of Equity and the Cost Capital Beta estimates The different values resulting from the use of different return on the market proxies (Table 1) indicates that : When using Dow Jones as return on the market proxy for a company which is in the Dow Jones' pool the value of beta is above 1, as for an aggressive stock. When using S&P500 as return on the market proxy for a company which is in the Dow Jones' pool the value of beta is under 1, as for a defensive stock. As a result, it is possible to assess the variability of the return on the stock by comparing with a larger population of companies by using the S&P 500. In this case the Walt Disney Company seems to be a defensive stock when compared to the overall market. When compared to its specific pool of 'blue chip' companies the same stock appears to be slightly aggressive because the companies in the Dow Jones pool are less riskier than those in the overall market and perform differently. When using weekly observations vs monthly observations the value of betas for both companies are smaller as they may introduce some irrelevant information, like unchanged return on stock and/or the market portfolio. Nevertheless it increases the size of the sample and thus , the reliability of the estimate. Table 1 Company Market Index Walt Disney Dow Jones Company S&P500 Unisys Corp. S&P500 Beta Monthly obs. 1.07 .85 2.38 Weekly obs. 1.02 .83 1.31 Dow Jones vs S&P 500 In the light of the results obtained previously, it seems that each of the two companies come from a different population of companies more or less risky. In order to assess whether these assumption is true the following test of means has been made : Two samples each of 30 companies have been established : - one contains all the blue chips companies in the Dow Jones' pool - the second one contains other companies in the S&P 500 pool. 03/08/16 Page: 12 Eugene Bala Influence of Beta on the Price of Equity and the Cost Capital The null hypothethis : the companies in both samples come from the same population. Instead of doing a regression for each company in the samples, beta estimates from the Bloomberg provider have been considered. If the null hypothesis is correct then all these companies should respond more or less in the same manner to the variations of the return on the market portfolio. As the SPSS output for a t-test for independent samples in Annexe 7 indicates, the 2-Tail Sig < 0.05, thus the null hypothesis is rejected. In other words, the two samples do not come from the same population. However, the 30 companies in the Dow Jones pool have been taken out, without replacement, from the S&P 500 pool when the second sample has been created picking all other company excepting a 'blue chips'. 03/08/16 Page: 13 Eugene Bala Influence of Beta on the Price of Equity and the Cost Capital Chapter 4 Implications for Managers When using the CPAM model beta estimates directly influence the magnitude of the company's cost of equity and indirectly, as indicated in the previous sections, the cost of capital. Bigger the beta harder the company has to 'work' for the money that it gets from investors and pay a premium for the risk that they have taken. Firms recognise a certain ambiguity in any cost number and are willing to live with approximation. Nevertheless it is critical for managers to understand what underlies beta estimates and, as a result, use the most appropriate value that several providers may offer. In addition to relying on historical data, use of this equation (5) to estimate beta requires a number of practical compromises, each of which can materially affect the results. 1. Increasing the number of time periods used in the estimation may improve the statistical reliability of the estimate but risks the inclusion of stale, irrelevant information. 2. Shortening the observation period from monthly to weekly or daily increases the size of the sample but may yield observations that are not normally distributed and may introduce unwanted random noise. 3. Choice of the market index. Beta providers use a variety of stock market indices as proxies for the market portfolio on the argument that stock markets trade claims on a sufficiently wide array of assets to be adequate surrogates for the unobservable market portfolio. Part of the Dow Jones index's appeal is its simplicity: it includes 30 of the biggest corporate names on the planet, such as McDonalds's Corp., Walt Disney, IBM, Wal-Mart Stores Inc., but they represent only 20 percent of US market's total value. A much broader measure is the Standard $ Poors 500, whose stocks represent about 79 per cent of the market value. Therefore it is better that the betas should be estimated taking into account the S&P 500 indice as proxy for the return on the market portfolio. Also managers must be aware of the impact that the time interval of observations have on the value of beta, as indicated in table 1, and accordingly adjust it. 03/08/16 Page: 14 Eugene Bala Influence of Beta on the Price of Equity and the Cost Capital Annexes 1 SPSS Output for The Walt Disney Company Monthly Observations - Dow Mean Std Dev Label DIS 1.544 7.346 DOWJM 1.520 4.047 N of Cases = 60 Variable(s) Entered on Step Number 1.. DOWJM Multiple R .59122 R Square .34954 Adjusted R Square Standard Error .33832 5.97532 Analysis of Variance DF Sum of Squares Regression Residual F= Mean Square 1 1112.81831 1112.81831 58 2070.85798 35.70445 31.16750 Signif F = .0000 ------------------ Variables in the Equation -----------------Variable DOWJM (Constant) B SE B Beta 1.073218 .192237 -.086434 .824874 .591218 03/08/16 T Sig T 5.583 .0000 -.105 .9169 Page: 15 Eugene Bala Influence of Beta on the Price of Equity and the Cost Capital Annexes 2 SPSS Output for The Walt Disney Company Monthly Observations - S&P500 Mean Std Dev Label DIS 1.544 7.346 SP500M 1.711 3.805 N of Cases = 60 Multiple R .52951 R Square .28038 Adjusted R Square .26797 Standard Error 6.28495 Analysis of Variance DF Sum of Squares Regression Residual F= Mean Square 1 892.64334 892.64334 58 2291.03295 39.50057 22.59824 Signif F = .0000 ------------------ Variables in the Equation -----------------Variable B SE B SP500M 1.022262 .215043 (Constant) -.204710 .890921 Beta .529510 03/08/16 T Sig T 4.754 .0000 -.230 .8191 Page: 16 Eugene Bala Influence of Beta on the Price of Equity and the Cost Capital Annexes 3 SPSS Output for The Walt Disney Company Weekly Observations - Dow Mean Std Dev Label DIS .389 4.352 DOWJW .303 2.485 N of Cases = 104 Multiple R .48747 R Square .23762 Adjusted R Square .23015 Standard Error 3.81816 Analysis of Variance DF Sum of Squares Mean Square Regression 1 463.47481 463.47481 Residual 102 1486.99241 14.57836 F= 31.79198 Signif F = .0000 ------------------ Variables in the Equation -----------------Variable B SE B DOWJW .853764 .151419 (Constant) .130378 .377204 Beta .487465 T Sig T 5.638 .0000 .346 .7303 03/08/16 Page: 17 Eugene Bala Influence of Beta on the Price of Equity and the Cost Capital Annexes 4 SPSS Output for The Walt Disney Company Weekly Observations - S&P500 Mean Std Dev Label DIS .389 4.352 SP500W .434 2.453 Multiple R .46564 R Square .21682 Adjusted R Square .20915 Standard Error 3.86989 Analysis of Variance DF Regression Residual F= Sum of Squares 1 422.90689 102 28.23882 Mean Square 422.90689 1527.56034 14.97608 Signif F = .0000 ------------------ Variables in the Equation -----------------Variable B SE B SP500W .826095 .155456 (Constant) .030570 .385427 Beta .465643 T Sig T 5.314 .0000 .079 .9369 03/08/16 Page: 18 Eugene Bala Influence of Beta on the Price of Equity and the Cost Capital Annexes 5 SPSS Output for The Unisys Corp. Monthly Observations - S&P500 Mean Std Dev Label UIS 2.640 16.021 SP500M 1.711 3.805 Multiple R .56560 R Square .31990 Adjusted R Square .30818 Standard Error 13.32592 Analysis of Variance DF Sum of Squares Regression Residual F= Mean Square 1 4844.74897 4844.74897 58 10299.65243 177.58021 27.28203 Signif F = .0000 ------------------ Variables in the Equation -----------------Variable SP500M (Constant) B SE B 2.381546 .455954 -1.435103 1.889012 Beta .565600 03/08/16 T Sig T 5.223 .0000 -.760 .4505 Page: 19 Eugene Bala Influence of Beta on the Price of Equity and the Cost Capital Annexes 6 SPSS Output for The Unisys Corp. Weekly Observations - S&P500 Mean Std Dev Label UIS 1.756 6.732 SP500W .446 2.462 Multiple R .48043 R Square .23081 Adjusted R Square .22320 Standard Error 5.93328 Analysis of Variance DF Regression Residual F= Sum of Squares Mean Square 1 1066.94360 1066.94360 101 3555.57954 35.20376 30.30766 Signif F = .0000 ------------------ Variables in the Equation -----------------Variable B SE B SP500W 1.313846 .238654 (Constant) 1.169138 .594247 Beta .480431 T Sig T 5.505 .0000 1.967 .0519 03/08/16 Page: 20 Eugene Bala Influence of Beta on the Price of Equity and the Cost Capital Annexes 7 SPSS Output for the Test of Means t-tests for Independent Samples of INDEX Number Variable of Cases Mean SD SE of Mean ----------------------------------------------------------------------BETA INDEX 1 30 .9480 INDEX 2 30 1.2527 .315 .294 .058 .054 ----------------------------------------------------------------------Mean Difference = -.3047 Levene's Test for Equality of Variances: F= .012 P= .912 t-test for Equality of Means Variances t-value df 2-Tail Sig 95% SE of Diff CI for Diff ------------------------------------------------------------------------------Equal -3.87 58 .000 .079 (-.462, -.147) Unequal -3.87 57.72 .000 .079 (-.462, -.147) ------------------------------------------------------------------------------- 03/08/16 Page: 21 Eugene Bala Influence of Beta on the Price of Equity and the Cost Capital Annexe 8 betadjm.sav Field Description month sp500m dowjm mcd dis chv xon gm genel uk intc aap dd pg ko ip wmt utx cat s ald ek goodyear mrk hwp mmm mo jnj c t axp ba jpm Standard & Poors monthly Dow Jones monthly McDonald's Corporation The Walt Disney Co. Chevron Corp. Exxon Corp. General Motors Corp. General Electric Co. Union Carbide Corp. Intel Business Machines Corp. Alcoa Inc. Du Pont de Nemours Procter & Gamble Co. Coca-Cola Co. International Paper Co. Wal-Mart Stores Inc. United Technologies Corp. Caterpillar Inc. Sears, Roebuck $ Co. Allied Signal Inc. Eastman Kodak Co. Goodyear Tire & Rubber Co. Merck & Co., Inc. Hewlett-Packard Co. Minnesota Mining & MFG Co. Philip Morris Companies Inc. Johnson & Johnson Citigroup Inc. AT&T Corp. American Express Co. Boeing Co. JP Morgan & Co. 03/08/16 Page: 22 Eugene Bala Influence of Beta on the Price of Equity and the Cost Capital Annexe 9 betadjw.sav Field Description week sp500m dowjw mcd dis chv xon gm genel uk intc aap dd pg ko ip wmt utx cat s ald ek goodyear mrk hwp mmm mo jnj c t axp ba jpm Standard & Poors weekly Dow Jones weekly McDonald's Corporation The Walt Disney Co. Chevron Corp. Exxon Corp. General Motors Corp. General Electric Co. Union Carbide Corp. Intel Business Machines Corp. Alcoa Inc. Du Pont de Nemours Procter & Gamble Co. Coca-Cola Co. International Paper Co. Wal-Mart Stores Inc. United Technologies Corp. Caterpillar Inc. Sears, Roebuck $ Co. Allied Signal Inc. Eastman Kodak Co. Goodyear Tire & Rubber Co. Merck & Co., Inc. Hewlett-Packard Co. Minnesota Mining & MFG Co. Philip Morris Companies Inc. Johnson & Johnson Citigroup Inc. AT&T Corp. American Express Co. Boeing Co. JP Morgan & Co. 03/08/16 Page: 23 Eugene Bala Influence of Beta on the Price of Equity and the Cost Capital Annexe 10 betasp500m.sav Field month sp500m amr ntrs luv mar jcp mas fmy hon lnc uis bc cs cof ccl cd ctx cen cha cmb cb ci csco ccu cl jci rnb pkn dg ccr see Description Standard & Poors monthly AMR Corp. Northern Trust Southwest Air Mariott Intl JC Penney Co. Masco Corp. Fred Mayer Inc. Honeywell Inc. Lincoln Natl. Corp. Unisys Corp. Brunswick Corp. Cabletron System Cap One Finl. Carnival Corp. Cendant Corp. Centex Corp. Ceridian Corp. Champion Intl. Chase Manhattan Corp. Chubb Corp. Cigna Corp. Cisco Systems. Clear Channel Colgate Palmolive Johnson Controls Republic NY Corp. Perkin-Elmer Dollar General Countrywide Cred. Sealed Air Corp. 03/08/16 Page: 24 Eugene Bala Influence of Beta on the Price of Equity and the Cost Capital Annexe 11 betasp500w.sav Field week sp500m amr ntrs luv mar jcp mas fmy hon lnc uis bc cs cof ccl cd ctx cen cha cmb cb ci csco ccu cl jci rnb pkn dg ccr see Description Standard & Poors weekly AMR Corp. Northern Trust Southwest Air Mariott Intl JC Penney Co. Masco Corp. Fred Mayer Inc. Honeywell Inc. Lincoln Natl. Corp. Unisys Corp. Brunswick Corp. Cabletron System Cap One Finl. Carnival Corp. Cendant Corp. Centex Corp. Ceridian Corp. Champion Intl. Chase Manhattan Corp. Chubb Corp. Cigna Corp. Cisco Systems. Clear Channel Colgate Palmolive Johnson Controls Republic NY Corp. Perkin-Elmer Dollar General Countrywide Cred. Sealed Air Corp. 03/08/16 Page: 25 Eugene Bala Influence of Beta on the Price of Equity and the Cost Capital Annexe 11 Beta30.sav Field Description Cny Name of the company Index 1- Dow Jones pool 2- S&P 500 pool Beta beta provided by Bloomberg 03/08/16 Page: 26 Eugene Bala Influence of Beta on the Price of Equity and the Cost Capital Annexe 12 References R Giammarino 'Fundamentals of Corporate Finance' R Bruner, K M Eades, R S Harris, R Higgins 'Best Practices in Estimating the Cost of Capital: Survey and Synthesis' 03/08/16 Page: 27