CHAPTER III

THEORY

The content of this chapter will focus on the relevant theories behind the demand

for hybrid electric vehicles. In the present study, the “demand for hybrid vehicles”

represents the sales of new passenger hybrid electric automobiles to consumers in the

United States. The justification for confining the study to new passenger car sales in the

United States is that the demand for commercial vehicles and used vehicles are subject to

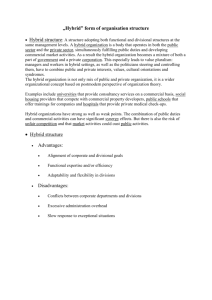

a different set of influences. This chapter will begin by providing a visual representation

of the determinants associated with the demand for hybrid vehicles. Next, it will present a

utility maximization model to explain the linear demand function for both hybrid vehicles

and gasoline vehicles. A final section will take the determinants of hybrid vehicles and

formulate them into the demand model.

15

16

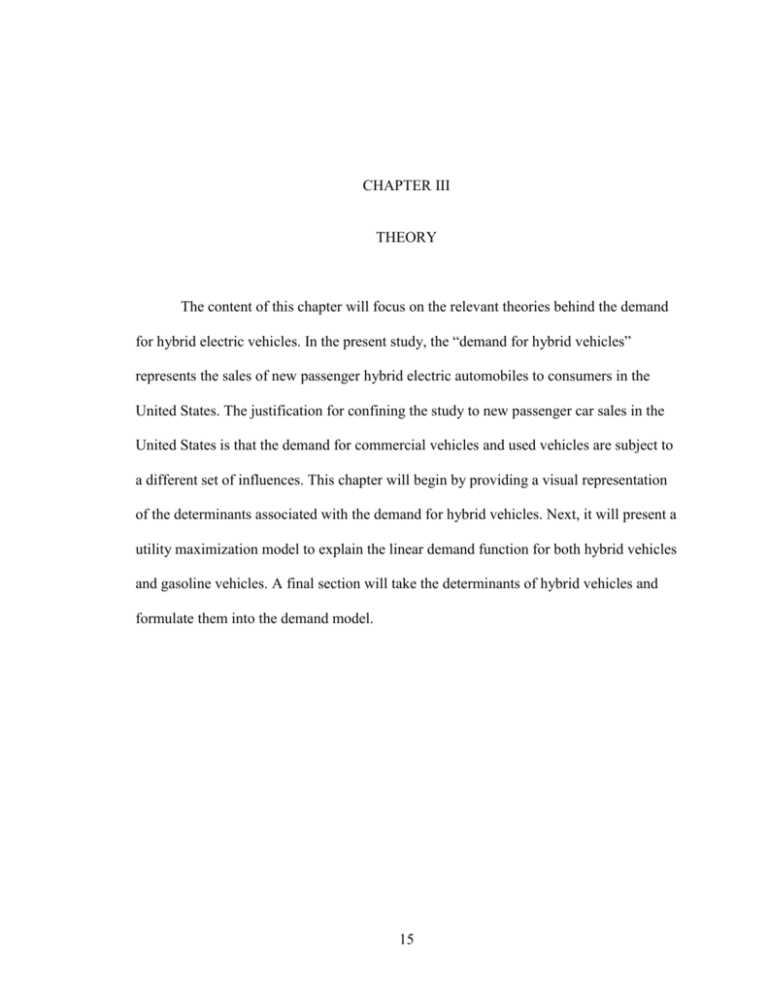

FIGURE 2.1

DETERMINANTS OF THE DEMAND FOR HYBRID ELECTRIC VEHICLES

Population

Consumer

Sentiment

Index

Time

(Month)

Fuel Price

Price of

Substitute

(gas vehicle)

Demand for

HEV’s

Season

Per Capita

Income

Price of

HEV

17

Utility Maximization Model

The theory of consumer demand, based on the concept of maximizing an

individual’s utility subject to a budget constraint, is one of the more highly developed

areas of economic analysis. This theory has been widely tested in empirical studies and

much recent work on the analysis of consumer behavior has been conducted within this

framework by using demand equations. To arrive at a demand equation expressing the

demand for hybrid cars as a function of own price, the price of its substitute and income,

a utility max problem must be stated.1

Equation 3.01 represents a general utility function modified for the current study:

Utility = U(X1, X2, Z)

(3.01)

In equation 3.01, X1 refers to the units of conventional gas vehicles consumed, X2

refers to the units of hybrid vehicles consumed, and Z is the Composite Numeraire Good.

This study uses the Composite Numeraire Good to measure the worth of different goods

relative to one another. A numeraire is a good with a fixed price of one used to facilitate

the calculation of two goods when only the relative prices are relevant. Thus, Z is the

Numeraire Good and the price of Z, Pz, is equal to one dollar.

This function indicates that the utility an individual receives from consuming X1

and X2 depends on the quantities of X1 and X2 consumed. Furthermore, this utility

maximization function is subject to constraints as people are confined in what they can

1

A demand function is a representation of how quantity demanded depends on price, price of a

substitute, income, and preferences.

18

purchase based on their total disposable income (I). As a result of this, a budget

constraint equation is formed and defined as follows:

I = x1P1 + x2P2 + zPz

(3.02)

x1= Gas Cars

x2= Hybrid Cars

In this budget constraint equation, Px2 is the price of a hybrid vehicle and Px1 is

the price of a conventional gas substitute. For the purpose of this study, the direct utility

function derived by Deaton & Muellbauer2 will be used. The Umax problem may be

stated as follows:

b2 (x 1 - a 1 ) 2 b1 ( x2 a 2 ) 2 b(a1 x2 a2 x1 x1 x2 a1a2 )

Max (X1 , X 2 , Z) Z

2(b1b 2 b2 )

b1b2 b 2

(3.03)

Since Z is a Composite Numeraire Good, the price of Z (Pz) is equal to $1.

Therefore, the direct utility function is subject to:

I = x1P1 + x2P2 + Z

(3.04)

The constrained optimization problem can be formulated using the Lagrangian

multiplier method shown in equation 3.06. To assess the demand for hybrid vehicles, the

Lagrangian function is manipulated into equation 3.07.

L = U(X1 , X 2 , Z) + {I P1 x1 P2 x2 z}

2

(3.05)

Angus Deaton and John Muellbauer, Economics and Consumer Behavior, Cambridge University

Press, 1980.

19

Using the Cobb-Douglas Utility function (3.03) derived by Deaton and

Muellbauer3, a new Lagrangian function is formulated:

Max (X 1 , X 2 , Z, ) Z

b2 (x 1 - a 1 ) 2 b1 ( x 2 a 2 ) 2 b(a1 x 2 a 2 x1 x1 x 2 a1 a 2 )

2(b 1 b 2 b2 )

b1b2 b 2

{I P1 x1 P2 x 2 z}

(3.06)

The next step is to find the first-order conditions by taking the derivative of the

Lagrangian function with respect to the choice variables X1, X2, and the Lagrangian

multiplier (λ). The optimal amounts of X1 and X2 are obtained by setting the first-order

conditions equal to zero and solving for X1, X2 and λ.

1.

L 2b2 ( x1 a1 ) b(a2 x2 )

P1 0

x 1 2(b1b2 b 2 ) b1b2 b 2

(3.07)

2.

L 2b1 ( x2 a2 ) b(a1 x1 )

P2 0

x2 2(b1b2 b 2 ) b1b2 b 2

(3.08)

3.

L

1 0

Z

(3.09)

4.

L

I P1 x1 P2 x 2 z 0

(3.10)

In order to solve for the theoretical equation for the demand for hybrid vehicles,

X2 ( 1 ), equation 3.09, is substituted into equations 3.07 and 3.08. Therefore, equations

3.07 and 3.08 are simplified to:

3

Ibid.

20

1.

2b 2 ( x 1 a 1 ) 2b(a 2 x 2 )

P1 0

2(b1b 2 b 2 )

(3.11)

2.

2b1 (x 2 a 2 ) 2b(a 1 x 1 )

P2 0

2(b1b 2 b 2 )

(3.12)

After more algebraic simplification, the equations become as follows:

1. 2b2 x1 2b2 a1 2ba2 2bx2 2(b1b2 b 2 ) P1

(3.13)

2. 2b1 x 2 2b1a 2 2ba 1 2bx 1 2(b1b 2 b 2 ) P2

(3.14)

The next step is to multiply b to equation 3.13 and b2 to equation 3.14 in order to arrive at

a theoretical equation for hybrid cars and their conventional gas substitutes.

1. 2b2 bx1 2bb2 a1 2b 2 a2 2b 2 x2 2b(b1b2 b 2 ) P1

(3.15)

2. 2b1b2 x2 2b1b2 a2 2bb2 a1 2bb2 x1 2b2 (b1b2 b 2 ) P2

(3.16)

The next step is to add these two equations (3.15 and 3.16) to each other in order to

simplify the equation.

2b2 bx1 2bb2 a1 2b 2 a2 2b 2 x2 2b(b1b2 b 2 ) P1

+

2b1b2 x2 2b1b2 a2 2bb2 a1 2bb2 x1 2b2 (b1b2 b 2 ) P2

21

= 2b 2 a2 2b 2 x2 2b1b2 x2 2 b1b2 a2 2b(b1b2 b 2 ) P1 2b2 (b1b2 b 2 ) P2

(3.17)

After more algebraic simplification:

= 2 x2 (b1b2 b 2 ) 2b 2 a2 2 b1b2 a2 2b(b1b2 b 2 ) P1 2b2 (b1b2 b 2 ) P2

= x2

2b(b1b2 b 2 ) P1 2b2 (b1b2 b 2 ) P2

2(b1b2 b 2 )

2 b1b2 a 2 2b 2 a 2

2(b1b2 b 2 )

(3.18)

(3.19)

Therefore, the final theoretical equation for measuring the demand for hybrid vehicles

with respect to the price of a hybrid vehicle and its conventional gas substitute is:

x2 b P1 b2 P2 a2

(3.20)

Or

x2 a2 b P1 b2 P2

(3.21)

22

Variables that Affect the Demand for Hybrid Vehicles

As a result of the variables, the equation for the demand for gasoline-electric

hybrid vehicles will be as follows:

Sales of Conventional Gas Cars = β0 + β1*PSUB - β2*PGAS + β3*PHYB + β4*INC +

β5*CSI + β6*POP + β7*SEASON + β8*TIME + µ

(3.22)

Sales of Hybrid Cars = β0 + β1*PHYB + β2*PGAS + β3*PSUB + β4*INC + β5*CSI +

β6*POP + β7*SEASON + β8*TIME + µ

(3.23)

Many factors potentially affect the demand for hybrid automobiles by consumers

in the United States. This study seeks to determine these factors and distinguish whether

gasoline-electric hybrid cars are a worthy substitute for conventional gasoline fueled cars

in the consumer automotive market. The study will also examine the effects of rising fuel

prices and the price of a hybrid vehicle on the sales of conventional gasoline-powered

vehicles. The following section discusses what these factors are and how they could

potentially impact the demand for hybrid vehicles.

The most significant reason for choosing a hybrid vehicle is to increase fuel

efficiency. Similar to Carlson’s study, the price of gasoline will have an affect on the

demand for automobiles.4 As the average US retail fuel price increases (as is occurring

and is expected to occur in future years), people will purchase vehicles which consume

Rodney L. Carlson, “Seemingly Unrelated Regression and the Demand for Automobiles of

Different Sizes, 1965-75: A Disaggregate Approach,” Journal of Business, vol. 51, no. 2, 1978

4

23

less gasoline. 5 Thus, fuel price will have a negative affect on the sales of gas cars and a

positive affect on hybrid sales.

In keeping with the findings of Cragg and Uhler’s study, disposable income will

have an affect on automobile sales.6 Income, the money that is received as a result of the

normal business activities of an individual, puts a constraint on the consumers’

purchasing power. As disposable income increases, purchasing power increases and

results in more acquisitions. Therefore, an individual’s income is needed to depict the

total sales of hybrid and conventional gas cars.

In accordance with Cragg and Uhler’s study, the price of a vehicle will influence

a consumer’s decision to purchase a vehicle.7 All consumers have certain preferences

which determine an individuals set of indifference curves. The slope of these indifference

curves measures the consumer’s marginal rate of substitution (MRS) between two goods

which is the maximum amount of a good that a consumer is willing to give up in order to

obtain one additional unit of another good.8 As automobiles are goods with high prices,

consumers will maximize utility. Thus, as the price of the car model decreases,

consumers will be more inclined to buy causing total sales for the model to increase.

Energy Information Administration, “Short-Term Energy and Summer Fuels Outlook”,

Available From http://www.eia.doe.gov/emeu/steo/pub/contents.html,, Accessed on December, 18, 2005.

5

John G Cragg and Russell S. Uhler, “The demand for Automobiles,” The Canadian Journal of

Economics, Volume 3, No. 3, Aug., 1970, 386-406.

6

7

8

Ibid.

Robert S. Pindyck and Daniel L. Rubinfeld, Microeconomics (Upper Saddle River, New Jersey:

Pearson Prentice Hall, 2005) 63-89

24

Compliant with Berry, Levinsohn, and Pakes’ study, the price of a substitute will

also have a large affect on the demand for a new automobile.9 In this case, the price of a

conventional gas car will affect a consumer’s decision of whether or not to purchase a

hybrid car with similar specifications and size and vice versa. As the price of a hybrid car

increases, ceteris paribus, fewer people will purchase it and therefore purchase the

conventional gas car. This percent change is examined to determine the relationship of

the hybrid as a substitute for gasoline cars.

This study uses consumer confidence as a factor that affects the sales of all

consumer goods.10 If consumers feel that the US economy will grow in the near future,

they will save less now and thus be more inclined to purchase more goods. A high

consumer confidence will increase the demand for new vehicles, whether a hybrid or a

conventional gas car.

Consistent with Carlson’s study, the population of the United States will also

affect the demand for automobiles.11 If the amount of people able to drive increases so

too should the amount of car sales. The season and month in which the analysis is being

conducted will also affect the total sales for cars. This study will use dummy variables to

asses these factors.

Equations 3.22 and 3.23 represent a set of two demand equations for related

products. In the following chapter, the data used in this study will be explored in greater

Steven Berry, James Levinsohn, and Ariel Pakes, “Differentiated Products Demand Systems

from a Combination of Micro and Macro Data: The New Car Market” Journal of Political Economy, vol.

112, no. 1, 2004

9

10

Consumer confidence measures how consumers feel about the United States economy.

Rodney L. Carlson, “Seemingly Unrelated Regression and the Demand for Automobiles of

Different Sizes, 1965-75: A Disaggregate Approach,” Journal of Business, vol. 51, no. 2, 1978

11

25

detail using empirical analysis. To test these variables, an ordinary least squares

regression model will be used. In this regression, the coefficient on the Price of Hybrid

Car (β3) will determine whether hybrid cars are a substitute for conventional gasoline

fueled cars.

The elasticity’s between these variable will also show whether hybrid vehicles are

a worthy substitute for regular gasoline automobiles. The assumption implicit in most

studies is that the supply of new cars is perfectly elastic at a price exogenously fixed by

the manufacturer. In estimating the equation as a demand relationship, purchases (or

sales) is used as the dependent variable and all of the factors that affect the sales of a

vehicle are the independent variables. In order to arrive at a measure of the elasticity of

demand for automobiles, it is necessary to take into account the factors which influence

the intensity of demand. It is recognized that correlations between certain variables used

in the study will exist and this problem will be fixed in Chapter Five.