(2) Investment Policy

advertisement

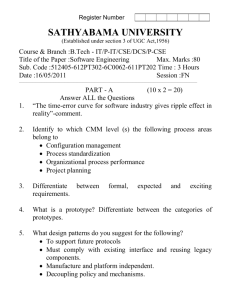

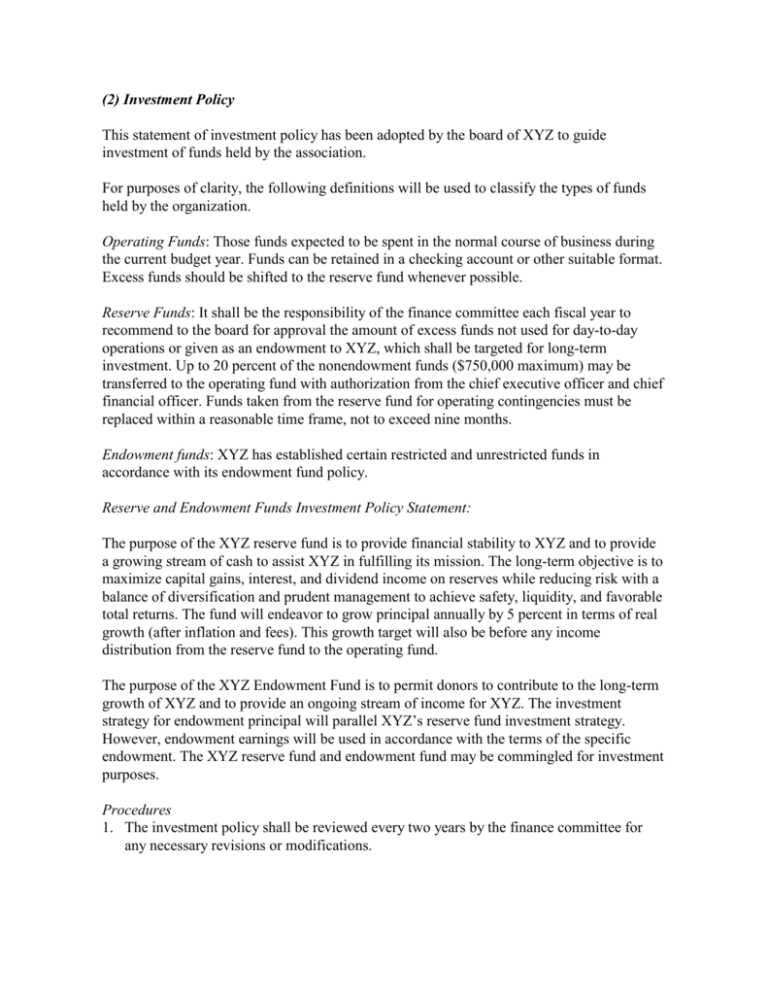

(2) Investment Policy This statement of investment policy has been adopted by the board of XYZ to guide investment of funds held by the association. For purposes of clarity, the following definitions will be used to classify the types of funds held by the organization. Operating Funds: Those funds expected to be spent in the normal course of business during the current budget year. Funds can be retained in a checking account or other suitable format. Excess funds should be shifted to the reserve fund whenever possible. Reserve Funds: It shall be the responsibility of the finance committee each fiscal year to recommend to the board for approval the amount of excess funds not used for day-to-day operations or given as an endowment to XYZ, which shall be targeted for long-term investment. Up to 20 percent of the nonendowment funds ($750,000 maximum) may be transferred to the operating fund with authorization from the chief executive officer and chief financial officer. Funds taken from the reserve fund for operating contingencies must be replaced within a reasonable time frame, not to exceed nine months. Endowment funds: XYZ has established certain restricted and unrestricted funds in accordance with its endowment fund policy. Reserve and Endowment Funds Investment Policy Statement: The purpose of the XYZ reserve fund is to provide financial stability to XYZ and to provide a growing stream of cash to assist XYZ in fulfilling its mission. The long-term objective is to maximize capital gains, interest, and dividend income on reserves while reducing risk with a balance of diversification and prudent management to achieve safety, liquidity, and favorable total returns. The fund will endeavor to grow principal annually by 5 percent in terms of real growth (after inflation and fees). This growth target will also be before any income distribution from the reserve fund to the operating fund. The purpose of the XYZ Endowment Fund is to permit donors to contribute to the long-term growth of XYZ and to provide an ongoing stream of income for XYZ. The investment strategy for endowment principal will parallel XYZ’s reserve fund investment strategy. However, endowment earnings will be used in accordance with the terms of the specific endowment. The XYZ reserve fund and endowment fund may be commingled for investment purposes. Procedures 1. The investment policy shall be reviewed every two years by the finance committee for any necessary revisions or modifications. 2. The investment advisory service shall be evaluated every three years. The following procedures shall be followed to engage a new or replace a current registered investment advisor: a) The finance committee will seek bids, review proposals, and recommend the hiring or replacing of an investment advisor and concurrently; b) The finance committee will make a final recommendation to the board. Investment Objectives The primary objectives should be to provide a balance between capital appreciation, preservation of capital, and current income. This is a long-term goal designed to maximize returns without undue risk. 1. The account’s total return should, over a 5 year moving time period, meet or exceed a balanced index of 60 percent S&P 500 and 40 percent Lehman Brothers Corporate/Government Intermediate Index. 2. The portfolio should be invested to minimize the likelihood of low or negative total returns. 3. XYZ anticipates a need of some income from this portfolio each year to meet its operating budget. The investment advisor shall be notified each budget year of the amount of investment income included in its budget. The long-term goal is to reinvest income generated by the reserve fund. Investment Guidelines XYZ recognizes that risk, volatility, and the possibility of loss in purchasing power are present to some degree in all types of investment vehicles. While high levels of risk are to be avoided, the assumption of some risk is warranted in order to allow the investment advisor the opportunity to achieve satisfactory long-term results consistent with the objectives of XYZ. Target Asset Mix The board will leave the asset allocation to the investment advisor’s discretion within a target range of 60 percent equity and 40 percent fixed income (see target mix below). Advisors will have no limitation on moving out of investments and into money market or cash if deemed necessary by the market conditions. Target Asset Mix Asset Class Cash & Equivalent Equity Fixed Income Minimum Weight 0% 40% 20% Target Weight 0% 60% 40% Maximum Weight 30% 65% 50% Target of Asset 1. Equity securities include common stocks, preferred stocks, convertible securities including debentures, and may be selected from the New York, American, and Regional Stock Exchanges and over-the-counter markets. The equity portfolio should be well diversified to avoid undue exposure to any single economic sector, industry group, or individual security. 2. Fixed-income securities may be comprised of obligations of the United States Government and its agencies, corporate bonds and notes, convertible bonds, mortgagebacked securities, and asset-backed securities. High yield bonds are inappropriate for this portfolio. All debt instruments must carry investment grade credit rating of Moody’s A3 or S&P A or better. The maximum maturity per security should not exceed 12 years. 3. Cash and equivalents may be invested in commercial paper, repurchase agreements, U.S. Treasury Bills, money market funds, and certificates of deposit or money market preferred. Certificates of deposit from U.S. banks having at least $250 million in capital, surplus and undivided profit accounts, but no more than $250,000 at any eligible bank. 4. Other Assets: The investment advisor is prohibited from investing in commodities, unregistered letter stock, foreign securities other than those listed on the NYSE, warrants, purchase of equity securities on margin, selling short, real estate mortgages, all options and futures, or other specialized investment activities. No client assets should be invested in speculative securities or companies whose principal lines of business include manufacture of tobacco products. 5. Investments not specifically addressed by this statement are forbidden without the written consent of the finance committee. Performance XYZ’s reserve fund will be evaluated quarterly. Returns will be compared to the following: 1. An index comprised of the S&P 500 index (60 percent) and the Lehman Corporate & Government Intermediate Index (40 percent) or other appropriate benchmarks. The fixed income indices and the equity portion of the portfolio may be compared to the equity indices separately if deemed appropriate. Reporting The following procedures shall be followed in reporting investment performance: 1. The investment performance of the reserve funds and endowment funds may be commingled for reporting purposes. 2. The portfolio performance will be measured against the objectives stated above and the investment advisor will also be evaluated against a universe of his peers. All returns are to be reported on a gross and net return basis. The net basis excludes investment fees and expenses. 3. The data shall be presented for the latest quarter, year-to-date, annually, and since inception. 4. The report will be given to the finance and administrative affairs committee quarterly and to the board semiannually.

![[Date] [Policyholder Name] [Policyholder address] Re: [XYZ](http://s3.studylib.net/store/data/008312458_1-644e3a63f85b8da415bf082babcf4126-300x300.png)

![waiver of all claims [form]](http://s3.studylib.net/store/data/006992518_1-099c1f53a611c6c0d62e397e1d1c660f-300x300.png)