richard parry - Amazon Web Services

advertisement

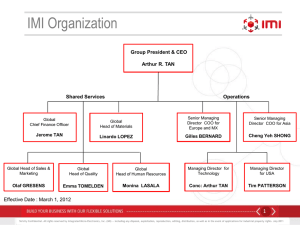

RICHARD PARRY MEng (Hons) Oxon; MSc. Sloan Fellow Address: Email: Phone: 47 Botsford Hill Road Newtown, CT 06470 rparry@me.com (203) 297-2919 SUMMARY A seasoned M&A consulting professional, with over thirteen years of consulting experience across the M&A lifecycle including Strategy, Business Valuation, M&A Capability, Due Diligence, and post deal performance improvement. Richard is a Sloan Fellow from the London Business School and an Oxford University Engineering, Economics, and Management graduate. PROFESSIONAL EXPERIENCE DELOITTE CONSULTING New York City, USA & London, England Senior Manager (One grade below Partner) 2006 – Present • Transferred to the New York office, with a promotion, to setup a new group modeled after the Deloitte M&A Strategy group in London and the PWC Group in New York. • Commercial and Vendor Due Diligence; provided both buy-side and sell-side reports, in a time compressed environment, to leading private equity clients into the key assumptions that underlie company valuation. • M&A Strategy; provided companies with new acquisition strategies and the names of priority targets to engage. • Business Valuation; provided companies with ‘fairness opinions’ and valuations of acquisition targets. • M&A Capability; provided companies with the organizational capability to conduct M&A utilizing a prepared acquirer approach to targeting available & off-market targets. • An example of putting all four of these skill sets to use in one engagement was a six month engagement that I lead, with Xerox in Europe and the U.S.A. During Phase 1, I helped Xerox define an acquisition strategy for their European Global Services business. During Phase 2, I designed and implemented an M&A Capability for Xerox in Europe that interfaces with the U.S. organization. During Phase 3, I visited prospective acquisition targets across Europe and conducted valuations of target companies. The culmination of the engagement was a successful presentation to the CFO of Xerox. MOUCHEL London, England Managing Consultant 2004 – 2005 • Managed change effort of ten National Health Service staff for two of the first Hospital Groups to adopt new working practices, part of ~£30Bn IT modernization project. • Provided the strategic and change management capability to setup a new not-for-profit business to conduct school inspections in the North of England. MARS & CO. Greenwich, Connecticut, USA Strategy Consultant 2000 – 2004 Suez – One of four most senior practitioners on a 2½ year post deal performance improvement program at Nalco chemical company. Purchased by Suez in 1999 for $4.1Bn and sold to private equity in 2003 for $4.4Bn. (EBITDA +48%, Revenue +19%). • Supervised four analysts whilst producing a middle-market strategy that found ways to achieve aggressive growth and profitability targets. • Supervised up to nine analysts and consultants to determine Nalco customer profitability Rescued project deadline and developed recommendations to realign sales force time to Page 1 of 2 RICHARD PARRY highly profitable and growing customer segments. Took analysis further to create a dynamic view of customer profitability over time. The CFO of Suez commended my work. • Interviewed board-level directors of major Nalco global paper customers to determine how the paper industry would buy its chemicals after a forecasted round of industry consolidation. Assessed the strategic impact on Nalco’s water treatment business. Pepsi / Bausch and Lomb / Red Lobster / Private Equity Clients • Lead a team to develop a detailed P&L financial model for Pepsi’s US operations. This model was successfully updated for three years. Presented recommendations on how to increase profitability to regional management. • Formulated a bundle pricing strategy and sales tool for Bausch and Lomb’s cataract surgery equipment and devices business. This increased both revenue and profitability. • Led a work stream for a three-month strategic audit of Red Lobster’s business. • Conducted due diligence for potential private equity firm investments at Logisticare and Freedom Medical for Summit Partners and a small New York private equity firm. DELOITTE CONSULTING & ACCENTURE Technology Consultant & Experienced Analyst • • • • Silicon Valley and New York USA 1998 - 2000 Won the San Francisco office’s Innovation Well Contest with award of time and team to develop an idea, which was well received by Venture Capitalists and Deloitte Ventures. Technical lead and supervisor for several Business-to-Business marketplace integration projects at Ventro. Billed $1/2M per month. Built EBusiness connection with Compaq and Dell at Southwestern Bell Corporation. Technical lead to determine pay increases for all staff - the first time that this was done on a global scale within Accenture; Developed Accenture’s Partner Internet portal. IMI PLC, (Former FTSE 100 Company) Seven Companies in England, Australia, Germany Manufacturing Engineer / Business Analyst / Scholarship Student 1992-1998 • • Attended a six month practical manufacturing technology course to give me the practical training to run a manufacturing plant. This culminated in the design and build of a CE certified computerized machine to pressure test aircraft fuel hoses. Manufacturing Engineer at The Birmingham Mint, IMI Marston, IMI Yorkshire Fittings, IMI Copper Refiners, and TIMET. Business Analyst at IMI Norgren & IMI Cornelius. EDUCATION LONDON BUSINESS SCHOOL Sloan Fellowship, Msc in General Management London, England 2005 - 2006 • London Business School’s premier full-time masters degree program for senior managers. Offered only at the London Business School, MIT, and Stanford. • ‘A’ average and distinctions in Strategy, ‘Managing People and Organizations’, Leadership, Corporate Turnarounds, and wrote thesis on the Debenhams LBO. • Studied the most advanced courses in Corporate Finance and Company Valuation. ST. JOHN’S COLLEGE, OXFORD UNIVERSITY Master of Engineering Science, Economics, and Management (Honors) Oxford, England 1996 PERSONAL U.S. AND U.K. CITIZENSHIP Page 2 of 2