Chapter 5: The Statement of Cash Flow

advertisement

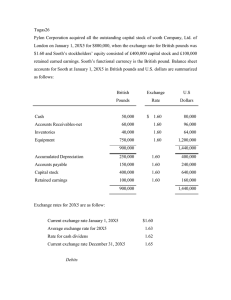

Chapter 5: The Statement of Cash Flow Assignment 5-7 RANGLER PAPER COMPANY Statement of Cash Flow Year Ended 31 December 20x5 (in ‘000’s) Net cash inflows (outflows) from operating activities: Net earnings ......................................................................................... Adjustments Depreciation .................................................................................. Net increase in working capital ................................................... Net cash inflow (outflow) from operating activities ........................... Cash inflows (outflows) from investing activities: Cash invested in restricted construction fund ............................ Disposal of operational asset for cash (at book value) ............. Net cash inflow (outflow) from investing activities ............................ Cash inflows (outflows) from financing activities: Paid cash dividend ....................................................................... Borrowed on long-term note ........................................................ Payment of bonds payable........................................................... Net cash inflow (outflow) from financing activities ............................ Net increase (decrease) in cash ......................................................... Beginning cash balance, 1 January 20x5 .......................................... Ending cash balance, 31 December 20x5 ......................................... $103 20 ( 3)* $120 (60) 12 (48) (10) 25 (97) *Changes in current items: Assets Increase in Inventory ...... $-14 $+5 Increase in Prepaids ....... -3 Decrease in Receivables +7 Decrease in Rent receivable +2 Net........................................... $-8 Overall (-8 + (+5)) ................ $-3 Liabilities Increase in Accounts payable (82) (10) 62 $52 Assignment 5-8 Note: The assignment asks only for the total cash flow from each category, so a formal statement and/or appropriate presentation of operating activities is not required. DENTON CORPORATION Statement of Cash Flow For the year ended 31 December 20x5 Operations: Net earnings ............................................................................ $690,000 Less: Increase in inventory................................................... (80,000) Gain on sale of long-term investment ....................... ( 35,000) Plus: Depreciation expense*............................................... 250,000 Amortization of patent ................................................ 10,000 Increase in accounts payable .................................... 105,000 Net cash from operations ....................................................... $940,000 Financing activities: Bank loan................................................................................. 325,000 Proceeds on issuance of shares ............................................ 220,000 Dividends ................................................................................. ( 240,000) Net cash from financing ............................................................... 305,000 Investing activities: Proceeds on sale of long-term investment............................ 135,000 Proceeds on sale of equipment ............................................. 150,000 Purchase of plant assets** ...................................................(1,100,000) Net cash for investing ................................................................... ( Change in cash.............................................................................. Opening cash ($100 + $0) ........................................................... Closing cash ($230 + $300) ........................................................ $ 815,000) 430,000 100,000 530,000 Assumed: short-term bank debt is not an overdraft and thus is not included in the cash definition. * Accumulated Depreciation 20x5 ........................................... $450,000 Accumulated depreciation on equipment sold ..................... + 250,000 Less: Accunulated depreciation 20x4 ................................... - 450,000 Depreciation expense ............................................................. $ 250,000 ** Equipment 20x5 ..................................................................... $1,700,000 Cost of equipment sold........................................................... 400,000 Less: equipment 20x4 ............................................................ - 1,000,000 Purchase of equipment............................................................ $1,100,000 Assignment 5-18 Requirement 1 BXX Products Limitied Statement of Cash Flow Year ended 31 December 20x1 Cash flows from operating activities: Net earnings .........................................................................................$128,000 Adjustments for non-cash items: Depreciation expense ...................................................................... 24,000 Loss on sale of capital assets ......................................................... 2,000 154,000 Changes in net working capital: Increase in accounts receivable ..................................................... (15,000) Decrease in inventories................................................................... 7,000 Increase in accounts payable ......................................................... 14,000 Increase in wages payable .............................................................. 8,000 Decrease in tax payable .................................................................. (5,000) Net cash flows from operating ............................................................ $163,000 Cash flows used for investing activities: Sale of capital assets ...................................................................... 15,000 Purchase of capital assets ..............................................................(125,000) Purchase of land .............................................................................. (45,000) Net cash flows used for investing ....................................................... (155,000) Cash flows used for financing activities: Borrowing on long-term mortgage .................................................. 30,000 Cash from issuance of common shares ........................................ 50,000 Payments on long-term debt ........................................................... (54,000) Dividends paid ................................................................................. (36,000) Net cash flows used for financing....................................................... (10,000) Net decrease in cash ........................................................................... (2,000) Cash balance 1 January ..................................................................... 43,000 Cash balance 31 December (to balance) .......................................... $41,000 Requirement 2 BXX Products Limitied Statement of Cash Flow Year ended 31 December 20x1 Cash flows from operating activities: Net earnings .........................................................................................$128,000 Adjustments: Depreciation expense ...................................................................... 24,000 Loss on sale of capital assets ......................................................... 2,000 Income tax expense ......................................................................... 17,000 Interest expense .............................................................................. 4,000 175,000 Changes in net working capital: Increase in accounts receivable ..................................................... (15,000) Decrease in inventories................................................................... 7,000 Increase in accounts payable ......................................................... 14,000 Increase in wages payable .............................................................. 8,000 Cash paid for income tax ($17,000 + $5,000) ................................. (22,000) Net cash flows from operating ............................................................ $167,000 Cash flows used for investing activities: Sale of capital assets ...................................................................... 15,000 Purchase of capital assets ..............................................................(125,000) Purchase of land .............................................................................. (45,000) Net cash flows used for investing ....................................................... (155,000) Cash flows used for financing activities: Borrowing on long-term mortgage .................................................. 30,000 Cash from issuance of common shares ........................................ 50,000 Payments on long-term debt ........................................................... (54,000) Dividends paid ................................................................................. (36,000) Interest paid ..................................................................................... (4,000) Net cash flows used for financing....................................................... (14,000) Net decrease in cash ........................................................................... (2,000) Cash balance 1 January ..................................................................... 43,000 Cash balance 31 December (to balance) .......................................... $41,000 Assignment 5-29 BOOLE, INC Statement of Cash Flow Year ended 31 December 20x5 Operating activities Net earnings ........................................................................ $790,000 Plus (less): non-cash charges Depreciation .................................................................. 250,000a Gain on sale of investment .......................................... ( 35,000) 1,005,000 Changes in working capital: Inventory increase......................................................... (80,000) Accounts payable and accrued liabilities decrease ... ( 5,000) $920,000 Investing activities Sale of building ................................................................... 350,000 Purchase of plant assets .................................................... (1,190,000)b Sale of long-term investments ........................................... 135,000 (705,000) Financing activities Dividends paid..................................................................... (340,000)c Issuance of common shares .............................................. 220,000 Net increase in cash and cash equivalents ............................ (120,000) $95,000d Computations: a Depreciation expense = $250,000 because accumulated depreciation did not change during the year and the building disposal caused accumulated depreciation to decrease $250,000. b Plant asset increase = $700,000 = plant asset purchases in 20x5 + $110,000 acquisition through debt - $600,000 cost of building sold Plant asset purchases in 20x5 = $1,190,000 c Retained earnings increase = $290,000 = $790,000 earnings - Dividends declared Dividends declared = $500,000 Dividends payable increase = $160,000 Dividends paid = $340,000 ($500,000 - $160,000) d Change in cash ................................................................. $120,000 dr Change in short-term investments ................................... 300,000 dr Change in bank overdraft.................................................. (325,000) cr $95,000 dr